In 2015, 1.4 million people were covered under the Medicare Supplemental Insurance Plan, which includes supplemental health insurance that can cover their deductible. The brief provides information about the benefits of Medigap enrollments and analyzes consumer protections in federal laws and federal regulations that affect beneficiaries' participation in Medigap.

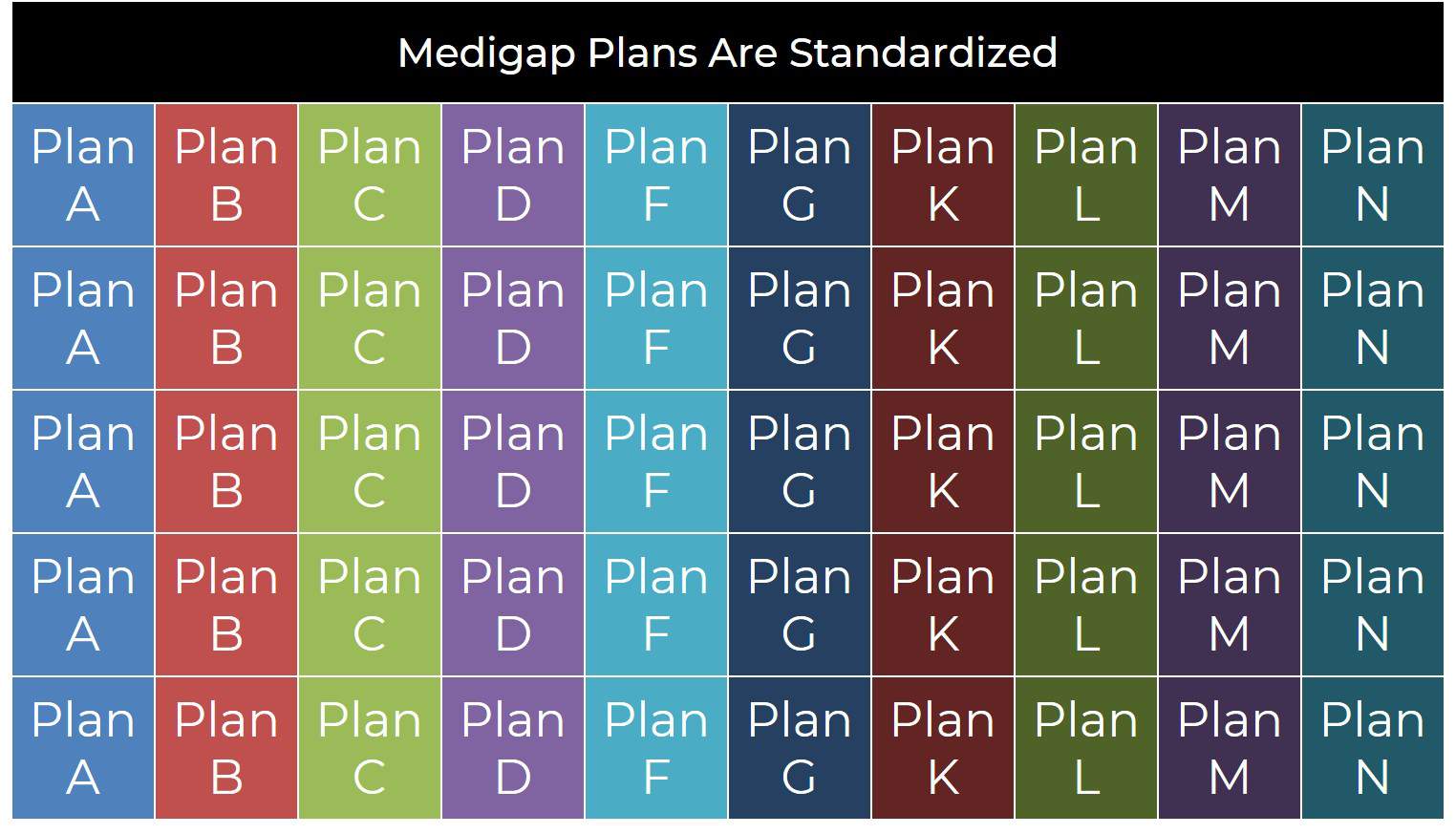

Each Medigap policy should adhere to federal law and state regulations aimed at ensuring your protection if you are enrolled in Medicaid or Medicare. The insurers have only to offer standard policies identified by letters in many states. Each policy offers the same fundamental features, but some have additional benefits that allow you to choose which one suits you best.

In Massachusetts, Minnesota & Wisconsin Medigap policies are standardized in different ways. All insurers determine the type of coverage they wish to sell and states may also have their policies regulated by law. Insurance providers selling medap insurance:

The extra charge is $6620 and $3310 for 2022. The F and E plans also include high deductibles in ten states. The policy will cover Medicare-covered expenses (coinsurance, copays and deductibles) until 2021 and the policy pays nothing until 2024. Plans C and F are not available to people whose Medicare benefits lapsed after Jan 1. 2020. ** For plans K and L, after you exceed your deductibles and your annual Part B deductible, the Medicare benefit increases.

A detailed breakdown of the benefits covered by Medicare can be seen here. The Medigap policy covers only after you have paid the premium, except Medigap policies also pay the benefits for.

In addition to paying the Part B deductible, new Medicare customers will not have the option to purchase a Medicare plan. This means plan F and B have been discontinued for all new Medicare users beginning January 1. If your insurance is not available in January 2020, your coverage may be withdrawn. In some cases, a patient who is not currently enrolled can apply and get subsidized through Medicare.

We used data from the National Association of Insurance Commissioners (NAIC) Medicare Supplement Insurance files for our analysis of Medigap enrollment by plan type and by state. These data include the number of policyholders as of December 31, 2016 for each state, insurance company, and type of plan sold.

Medigap policies are standardized Every Medigap policy must follow federal and state laws designed to protect you, and it must be clearly identified as "Medicare Supplement Insurance." Insurance companies can sell you only a standardized policy identified in most states by letters. All policies offer the same basic benefits The health care items or services covered under a health insurance plan.

Medicare Advantage plan, such as a Medicare HMO or PPO. Roughly two-thirds of Medicare beneficiaries are in traditional Medicare, and most have some form of supplemental health insurance coverage because Medicare's benefit design includes substantial cost-sharing requirements, with no limit on out-of-pocket spending. Medicare requires a Part A deductible for hospitalizations ($1,340 in 2018).

Register Medigaps are health insurance policies that offer standardized benefits to work with Original Medicare (not with Medicare Advantage ). They are sold by private insurance companies. If you have a Medigap , it pays part or all of certain remaining costs after Original Medicare pays first. Medigaps may cover outstanding deductibles, coinsurance , and copayments.

Medigaps help pay certain Medicare costs, including deductibles, coinsurance , and copays. Medigaps do not help pay for Medicare premiums. All policies must offer the following basic benefits: Hospital coinsurance coverage 365 additional days of full hospital coverage Full or partial coverage for the 20% coinsurance for provider charges.

QMB program benefits include: Payment of Medicare premiums. Payment of Medicare annual deductibles. Payment of Medicare coinsurance amounts. Thus individuals who qualify for the QMB program generally also do not need.

Part B coinsurance or copayment 50% 75% *** Blood (first 3 pints) 50% 75% Part A hospice care coinsurance or copayment 50% 75% Skilled nursing facility care coinsurance 50% 75% Part A deductible 50% 75% 50% Part B deductible Part B excess charge If you have Original Medicare, and the amount a doctor or other health care provider.

However, there is a basic benefit package, known as the “core benefit” plan, which must be allowed in all states and which must be offered by any company which sells Medigap insurance. Although individual Medigap policies have been standardized since 1992, some seniors are still covered by previously issued non-standardized plans.

The Medigama markets changed significantly with OBRA 1990. This legislation requires all new Medigap products to meet one of the following criteria:

Medigap policy is standardized All Medigap policies have corresponding Federal law and must have a clear label "Medicaid Supplement Insurance." The insurance company will sell you one standard insurance policy identified by the letter.

Additional benefits are: Part A Skilled Nursing Facility Coinsurance for Days 21-100; Part A Hospital Deductible; Part B Deductible; Part B Charges above the Medicare Approved Amount (if provider does not accept assignment); Foreign Travel Emergency Coverage; At-Home Recovery (Home Health Aid Services); Preventive Medical Care. Policies B through L vary considerably.

Medigap plans are grouped under ten separate categories by the CMS. Medigap plans have various benefits. The amount covered will roughly correspond to the premiums paid.

The insurance company must continue to renew the discontinued Medigap policy each year you wish to keep it. See the Medigap Plan Benefits Chart for plans purchased between July 31, 1992, and May 31, 2010 for more information on your Medigap policy's coverage.

A person buying an updated standard policy will have just one Medigap Policy. This policy will be removed from the standard plan. This protects customers from costly duplicate insurance policies. The 12 standardized benefits plans labeled A to L.