The ACA introduced an additional Medicare surtax on higher-income individuals from December 2013. The additional Medicare tax imposes an additional 0.5 percent tax in addition to the 1.45 percent employee taxes. Employers do not have to match that amount and employees pay all additional taxes on their own. It will depend on how much you pay and what tax filings you file. What Happens to your Income Tax Bill? You only pay 0.2 percent of your income tax on earnings more than $200,000.

During the same tax year, the couple also received $50,000 in investment income, bringing their MAGI to $275,000. The net investment income tax threshold for married couples filing jointly is $250,000. The couple is required to pay 3.8% tax on the lesser of the excess MAGI ($25,000) or the total amount of investment income ($50,000). In this case, the couple would owe a net investment income tax of $950 (3.8% x $25,000).

Social Security taxes do not have any wage limits on Medicare taxes. For the year 2022 there's no Social Security levy on income exceeding $137k. But you will continue to pay the same tax rate for Medicare, no matter your income.

Medicare taxes are collected automatically on your earnings to provide health insurance for Medicare Part A seniors and disabled people. Each employee pays 1.45% of their income to the employer. Higher-income earners pay a smaller percentage, while self-employed individuals pay taxes for quarterly reports.

Medicare taxes were originally introduced to cover taxable income from the taxable year. Since Medicare taxes are $283 billion annually, more seniors are eligible for medical care. Most American employees pay Medicare taxes for their salaries. This tax is incorporated under an underwriting provision of fica.

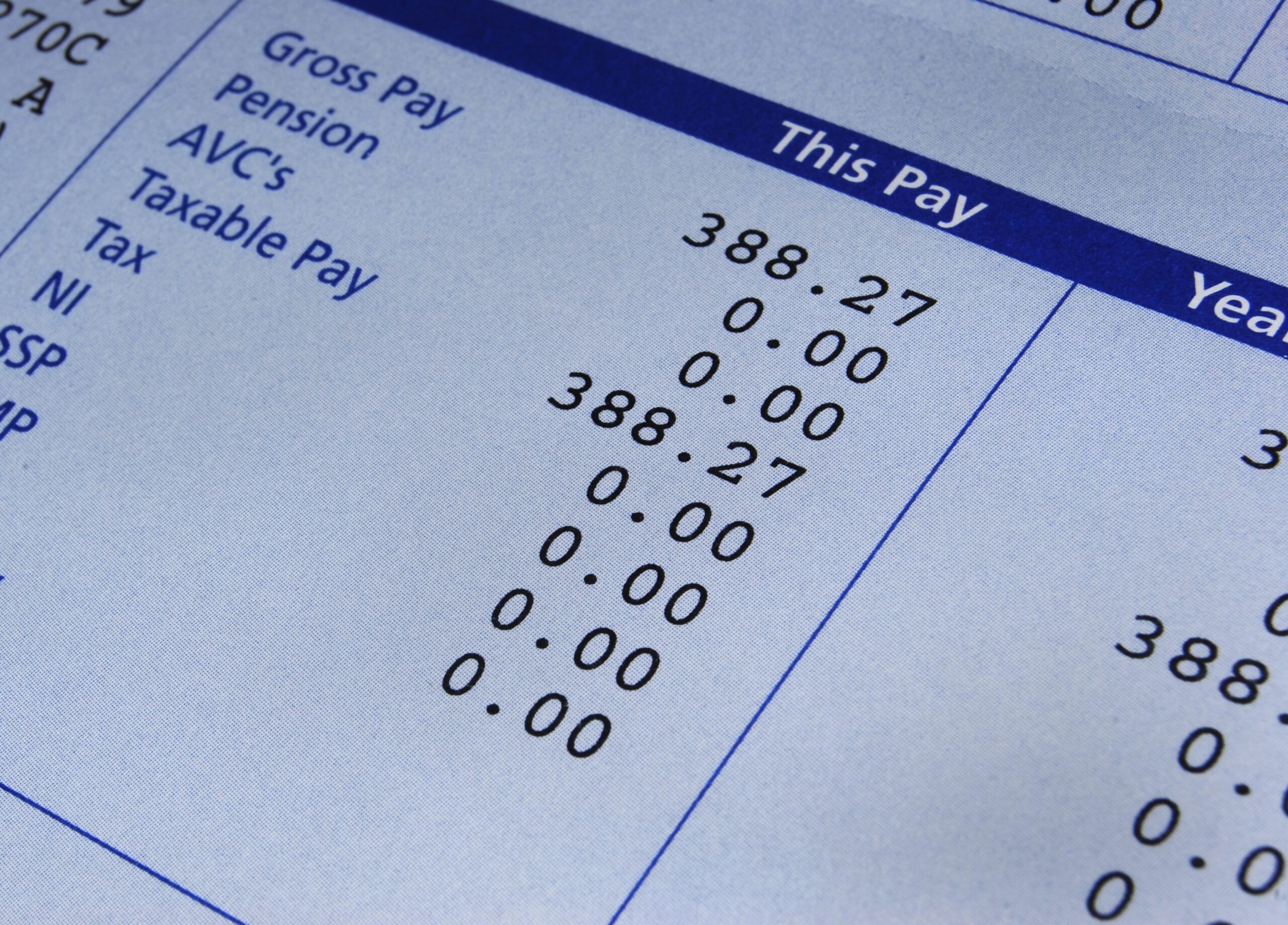

When viewed in an employer's paycheck, Medicare tax is considered a separate deduction from the Social Security tax. Medicare tax is a law that aims at tackling an economic and social problem affecting many people.

Medicare taxes are 1.45% on employees' salaries. Medicare also relates primarily to the taxation of employers. You have to take 1.45% off employees salary and contribute the same.

Medicare accounts for 29% of the FICA taxes. All proceeds going to Social Security taxes. Let's suppose Medicare employees earn up to $1000 per month. Can you stop paying Medicare taxes on employees with incomes above $1000? Donate a total of $14.50.

In contrast to Social Security's salary basis, Medicare wages are subject to taxes. Keep Medicare taxes refunded regardless of how much money the employee earns. As part of your overall payroll taxes, the federal government requires employers to collect the FICA (Federal Insurance Contributions Act) tax.

Form 941 is due on April 30, July 31, October 31, and January 31. You may be able to report your tax deposits on a yearly basis if you receive a written notice from the IRS. To report annually, file Form 944 , Employer's Annual Federal Tax Return. Include Medicare taxable wages and how much tax you withheld from each employee's pay on Form W-2.

All taxable wages are governed by Medicare Taxes. There are many forms of income like salaries, overtime pay, paid holidays, tips and bonuses. It's not possible to limit the taxes on your income as you're entitled to Medicare tax on your entire income.

Unlike the Social Security taxable income, the income is paid in cash only on your first $175,000. Some pretax deductions may be withdrawn as part of the Medicare wages. Pre-tax payments for insurance coverage are not included in the tax.

Are Medicare premiums tax deductible? According to H&R Block, you might be able to deduct certain Medicare premiums in some limited situations. Ask a tax specialist to see if you qualify. What is the Medicare employee tax? The IRS (Internal Revenue Service) levies a federal tax to fund Medicare.

The Medicare tax rate is 1.45% of your taxable income for employees. There is an “Additional Medicare Tax†that may apply if your income is more than $200,000 per year, according to the IRS.

There are four parts of the Medicare program: hospital insurance, medical insurance, Medicare Advantage plans, and prescription drug coverage. Recipients of Medicare coverage obtain benefits like inpatient hospital care, outpatient care, and medications. The Medicare tax rate is 1.45% of an employee's wages. Again, Medicare is an employer and employee tax.

Employers whose employees have not followed the rules of the federal income taxation system are liable to civil and criminal sanctions. If your income tax is not withheld, check with your employer for errors. If you've overpaid your tax bill, you could face annual penalties if you don't pay.

If a company has a Medicare deduction on its payroll, that means they are able to meet payroll obligations as an employee. It is an employee-owned Medicare hospital insurance tax that helps seniors and disabled individuals pay taxes. The FICA tax includes two separate taxes. Social Security taxes fund Social Security benefits and the Medicare tax goes to pay for the Medicare Hospital Insurance (HI) that you'll get when you're a senior. Medicare tax pays for Part A of the Medicare program, which includes hospital insurance for individuals age 65 or older and people who have certain disabilities or medical conditions.

Medicare currently has a 1% income tax rate that takes a deduction from your paycheck. The employer matches your contribution with a payment of 14.5 %. For self-employment you may be eligible for the Medicare part of your tax bill at an estimated 2.9%. Fact check - Our fact-checking process begins with checking every source for authenticity and relevance.

Afterwards, we check facts through original reports from these sources or confirm facts through experts. To ensure complete transparency our source list is clearly identified. Citing: Turner, Thomas (2022 May 20). If your income means you're subject to the Additional Medicare Tax, your Medicare tax rate is 2.35%. However, this Medicare surtax only applies to your income in excess of $200,000. If you make $250,000 a year, you'll pay a 1.45% Medicare tax on the first $200,000, and 2.35% on the remaining $50,000.

Medicare taxes help fund hospitals trust fund. This is the second trust fund that pays for Medicare. The HI trust fund provides Medicare Part A services such as maternity care, home care, home health and hospice care. This fund is mainly aimed at managing Medicare.

A third Supplementary Medical Insurance trust is funded through a federal grant and the income from a trust investment. It covers Medicare Part B benefits and Part D prescriptions. The trust fund covers the administrative and enforcement costs related to Medicare fraud.

Funds are used for the provisions of the ACA, including providing health insurance tax credits , to make health insurance more affordable for more than 9 million people. What's the current Medicare tax rate? In 2022, the Medicare tax rate is 1.45%.

This is the amount you'll see come out of your paycheck, and it's matched with an additional 1.45% contribution from your employer for a total of 2.9% contributed on your behalf.

You must pay Medicare tax on your earnings at 2.8 per cent. These are covered by the self-employment tax. The self-employment taxable income tax covers your 15.3 percent tax rate on taxable income, which includes the Social Security tax. But it’s okay to have an escape.

How does one calculate an income tax using Schedule SE of the IRS Form 104? Your self-employed tax is deductible by your employer if you pay more than a half-time amount to your tax bill. What are the benefits of working in the field of personal taxation?

CMS announced the existence of two trusts that pay for the Medicare program. In addition to Medicare taxes, one company used other income sources to pay Medicare Part A hospitals insurance. Another trust fund called the Medicare Part B and Part D fund provides Medicare Part B (medical insurance) benefits through Medicare. The rest goes into the Medicare Part D program.