Medicare is a Medicare Part A hospital policy as well as a Part B medical coverage program. To help fund supplemental insurance, called Medi-Gap or Medicare supplement insurance, not available to all individuals in Medicare. This coverage is provided by private insurance companies and covers things that Medicare does not cover: copays or insurance when a person visits another country.

Medigap policies are diverse and most comprehensive available through Plan F, covering all coinsurance and deductibles. However, plans F & C will no longer cover deductibles for new Medicare beneficiaries.

Most people believe in Medicare Advantage plans as a form of insurance because they're free. It's not true. When enrolled in Medicare Advantage, it's your responsibility to cover the Medicare portion of the cost. Unfortunately, there aren't any free Medicare plans.

Medicare Advantage companies pay the private companies who provide the insurance to cover the cost of medical care based on health care costs and other factors. However, Medicare's Advantage plan does have no minimum premium costs. Medicare Advantage companies advertise plans attractively so they attract enrollees for them.

Medicare Advantage offers many other advantages a Medicare supplement does not provide. This includes vision and dental health coverage for the elderly, prescriptions, insurance coverage, and more.

However this further benefit may cause problems with paying for services. Many recipients are disappointed that they're paying more in advance to utilize these additional benefits.

Even though Medicare is a health insurance program, the patients receive extremely high premiums. When you exceed this limit you must bear 100% of the costs. Some of the pros of Medicare include: Health Insurance Coverage for People Who Need It Medicare is the single largest health insurance program in the U.S. providing hospital insurance (Medicare Part A) and medical insurance (Medicare Part B) coverage to more than 60 million Americans

The Medicare benefits plan is certainly worthwhile. You can decide on what insurance will be best for you or your budget. It depends on where you're located, health care needs, budget, and preferences. For many people, Medicare Advantage may prove an excellent financial choice.

If you don't get regularly checked at a GP or doctor visits you'll probably get much worse off of a treatment plan. If there are serious problems with health, then investment may fail. Medicare is great until your insurance provider stops providing it.

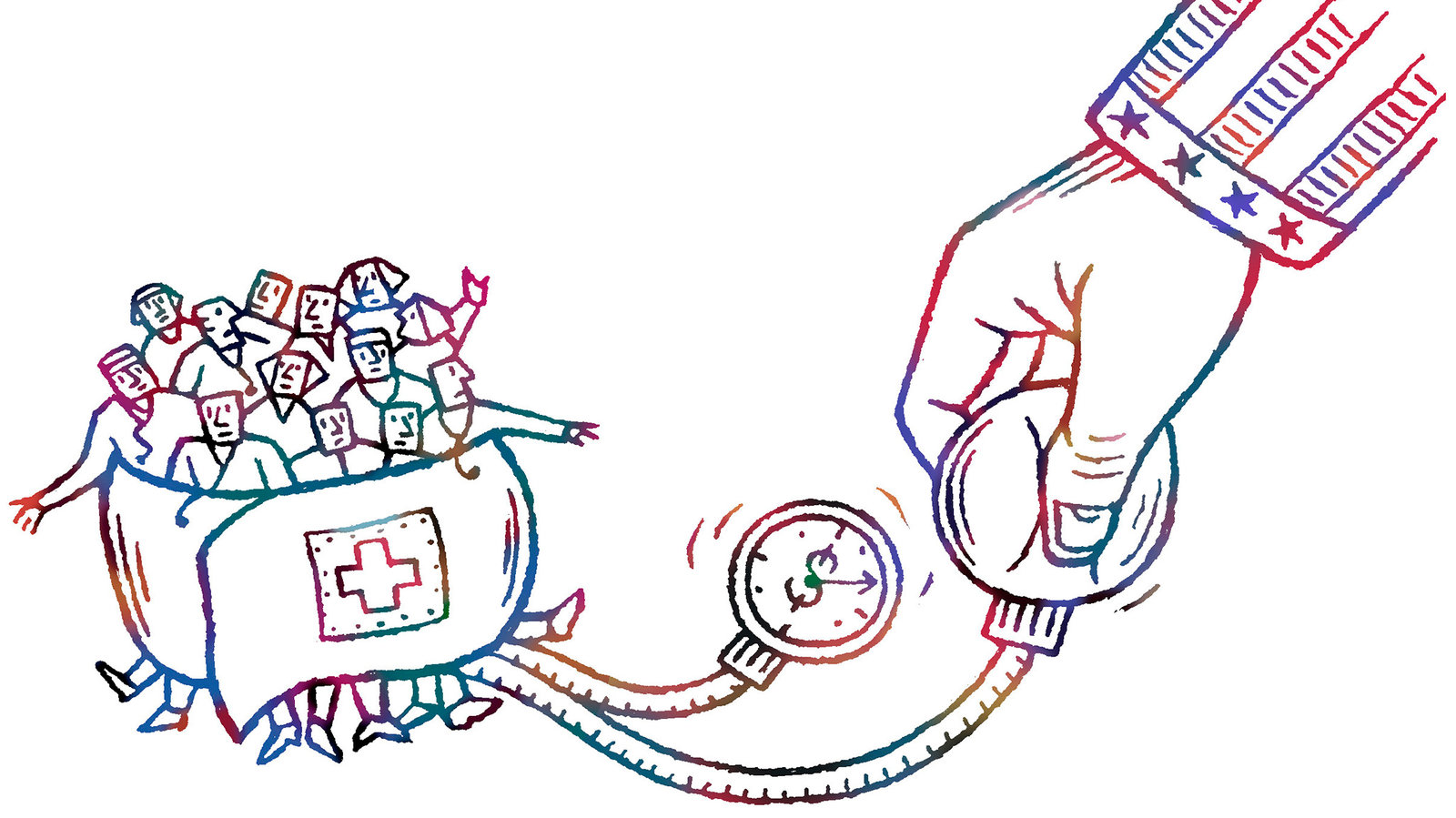

The Medicare Advantage Plan cherrypicks patients by analyzing all of the copay details on each plan that is considered if there's a Medicare benefit plan. To show a good example of the types of copays you will find here are details of in-network services offered by a popular Medicare benefit plan from Humana. This non-exhaustive list is a good one. Over the last 40 years, the Dartmouth group has documented extensive geographic variation in Medicare spending that is unexplained by demographics, income, or disease severity.

In addition, Medicare offers you zero premiums, but unexpected out-of-pocket costs are unlikely to pay you any money for an early recovery period if you become sick. Use the health care data that is available to monitor costs, improve quality, and reduce waste, and recommend that Accountable Care Organizations be provided with this data as they work to control costs and improve patient outcomes.

Medicare Advantage plans are designed to offer a complete alternative to Medicare. The private insurer offers such plans by partnering with Medicare for Part - B benefits and sometimes for Part - D prescription drugs. Many insurances offer services which Original Medicare does not include, like vision, hearing, and dental services. Selling such an idea requires demonstrating that it in fact will save money. You must join Medicare Part A and Part B before getting into the Medicare Advantage Program.

The insurer pays an agreed amount every month for Medicare Advantage coverage. This includes nearly all caregivers, although it is true that it can be hard to find caregivers in some parts of the country who are accepting new Medicare patients.

Some of those advertisements claim to have a comprehensive health insurance policy. Medicare Advantage plans might offer prescription coverage, eye, dental and hearing aid care. Yet there are also reports of people criticising this plan. How can Medicare benefits be used to reduce costs? Is Medicare the right option if we don't have a Medicare benefit? Medicare Advantage is a non-issue and not always the worst plan.

But these aren't perfect for all of us. We want to find out what's wrong with the plans' seemingly untrue reputation.

The reviews published on this blog are honest and are independent of advertisers. Learn how we review products, and learn about advertising disclosures and how we earn money. Medicare Advantage Plans or MA plans may seem attractive. Typically Medicare Part A (hospital and dental coverage) combine together. This plan covers all of the Medicare services and some have additional coverage such as dental, hearing and vision.

They can be purchased from a company approved by Medicare. It would expand Medicare coverage to include dental, vision and long-term nursing home care.