In 2015, a third (26 percent) of people who benefited from conventional Medicare supplemental health insurance had Medicare deductible and supplemental cost-sharing insurance to cover costs and to prevent catastrophic medical bills and other medical bills. The report offers an analysis of Medicare enrollment procedures for Medigap enrollee services and provides a comprehensive overview.

As Medicare enrollment increases, policymakers need to assess the potential advantages and disadvantages of these plans.

Choosing between traditional and supplemental Medicare is tricky. This analysis demonstrates a different way Medicare and Medicaid have different approaches as the access to dental, visual otometry and hearing services has increased across Massachusetts. In order for beneficiaries the choice of a cost/access plan must be taken in a fair manner with incomplete details regarding their healthcare needs. A broader problem is that Medicare's plan structure is dependent in part upon how the government administers its programs, the former is varied by county and the latter is generally uniform.

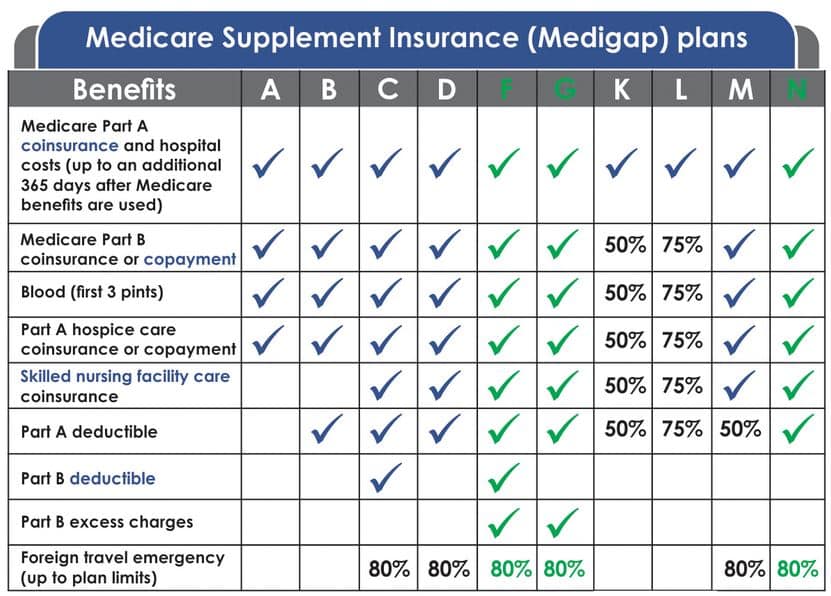

All medical policies must follow federal or state laws intended for your safety a clear definition is deemed "Medicare Supplements Insurance". Insurance companies sell your policies by letter only. All plans offer a similar basic benefit, however certain have additional features. The policies on Medigap differ from those of other states such as Wisconsin, Minnesota or Connecticut. Each insurance agency decides the types of Medigap policies it sells. However, the laws of a certain state can influence their policies. Companies offering Medi-gap coverage:

Extra charges. $6620 in 2022. $1310 in 2024. * Plans F and G also offer a high-deductible plan in certain states. In 2022 your premium is $24,490 for supplemental insurance coverage and $2,390 if your premium is less. Plan F and C cannot be purchased if you were newly eligible under plan k and l / c / e.

A detailed list of health insurance policies can be found on this page. The Medigap policy covers only after you pay the premium (unless the Medigap insurance also pays the premium for the benefit).

Roughly two-thirds of Medicare beneficiaries are in traditional Medicare, and most have some form of supplemental health insurance coverage because Medicare's benefit design includes substantial cost-sharing requirements, with no limit on out-of-pocket spending. Medicare requires a Part A deductible for hospitalizations ($1,340 in 2018), a separate deductible for most Part B services ($183), 20 percent coinsurance for many Part B.

The MCBS is a nationally representative longitudinal survey of Medicare beneficiaries, which provides information on beneficiary characteristics, coverage, service utilization, and spending. We used data from the National Association of Insurance Commissioners (NAIC) Medicare Supplement Insurance files for our analysis of Medigap enrollment by plan type and by state.

Plan type designation “P” identified policies issued prior to the effective date of this state's revisions to its Medicare supplement regulatory program pursuant to the Omnibus Budget Reconciliation Act (OBRA) of 1990, and which are no longer offered in a state. Policies not meeting either of these definitions should be designated with “O.”

These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost.

In Massachusetts , Minnesota , and Wisconsin , Medigap policies are standardized in a different way. Each insurance company decides which Medigap policies it wants to sell, although state laws might affect which ones they offer. Insurance companies that sell Medigap policies

All Medigap policies have been defined in accordance with federal and state laws that protect you. They should be branded as "Medicaid Supplement Insurance" and if applicable. Almost all insurance policies in the U.S. are written in the US.

The insurance company must continue to renew the discontinued Medigap policy each year you wish to keep it. See the Medigap Plan Benefits Chart for plans purchased between July 31, 1992, and May 31, 2010 for more information on your Medigap policy's coverage. Related Courses Level 2: Medicare Coverage Rules.

Medigap's market dramatically changed after OBRA in 1990 passed. This legislation requires that all new insurance plans sold on Medigap comply with the one or more different unified benefit packages, labeled plans A through J.

Medicap is a federal program marketed to individuals and businesses with a broad spectrum of coverage ranging from A to N. Various Medigap plans offer varying benefits. The coverage offered is generally proportional to the cost to purchase.

A Medicare beneficiary who dropped a Medigap policy upon enrolling for the first time in a Medicare managed care plan but who subsequently disenrolled from the managed care plan within 12 months is guaranteed issuance of the same Medigap policy from the same insurance company if that policy is still being offered for sale.

In 20 states, at least one-quarter of all Medicare beneficiaries have a Medigap policy. States with higher Medigap enrollment tend to be in the Midwest and plains states, where relatively fewer beneficiaries are enrolled in Medicare Advantage plans. 4 Figure 3: In 20 states, at least 25 percent of Medicare beneficiaries have Medigap—often highest in Midwest and plains states, 2016 Medigap coverage is substantially more common for Medicare beneficiaries ages 65 and older than it is for younger Medicare beneficiaries.

Additional benefits are: Part A Skilled Nursing Facility Coinsurance for Days 21-100; Part A Hospital Deductible; Part B Deductible; Part B Charges above the Medicare Approved Amount (if provider does not accept assignment); Foreign Travel Emergency Coverage; At-Home Recovery (Home Health Aid Services); Preventive Medical Care. Policies B through L vary considerably.

The low enrollment in Medigap by beneficiaries under age 65 is likely due to the absence of federal guarantee issue requirements for younger Medicare beneficiaries with disabilities (discussed later in this brief) and higher rates of Medicaid coverage for people on Medicare with disabilities who tend to have relatively low incomes.

information on purchasing a Medigap policy. Medigaps help pay certain Medicare costs, including deductibles, coinsurance , and copays. Medigaps do not help pay for Medicare premiums. All policies must offer the following basic benefits: Hospital coinsurance coverage 365 additional days of full hospital coverage Full or partial coverage for the 20% coinsurance for provider charges and other Part B services Full or partial coverage.