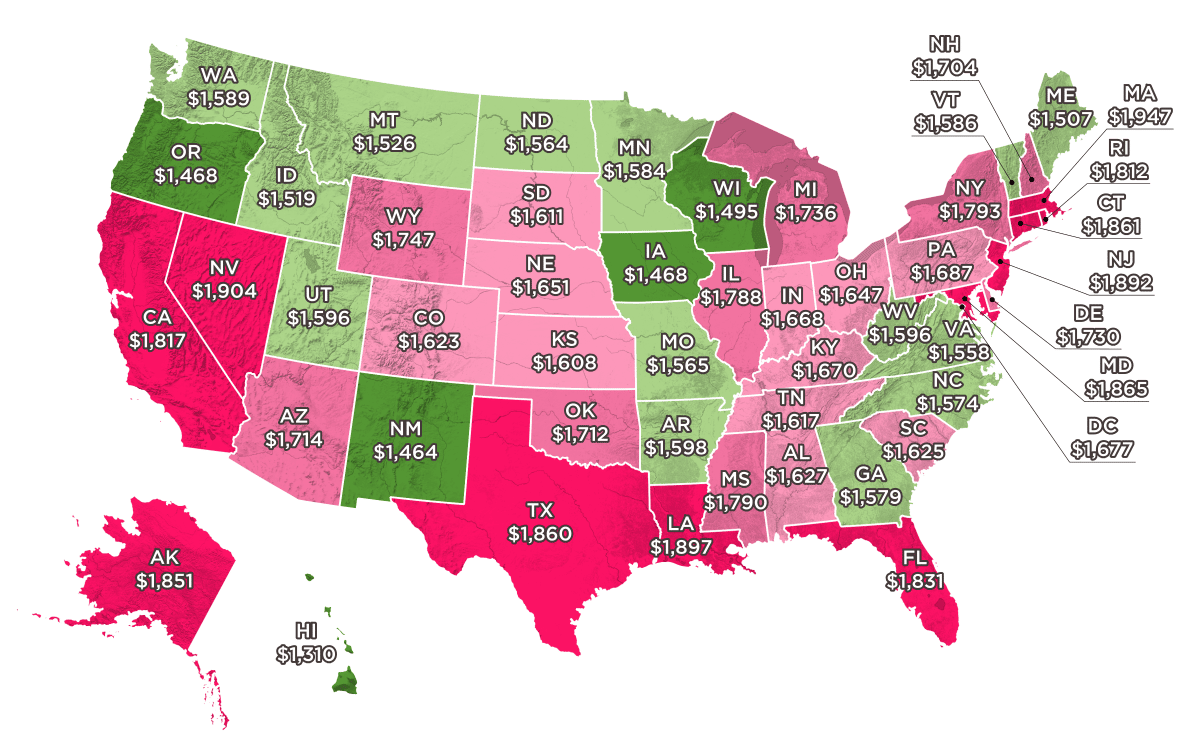

In addition Medicare Supplement (Medicap) premium varies between states. Although benefits can be standardized, Medicare is varying in cost in states. Find Medicare plans in 3 Simple Steps. We can help with the right health care plans today. The costs of obtaining Medicare coverage may vary depending on the country's situation or its coverage type. Prices policies differ by region, and the cost of living also affects prices. Here is a list of the ten highest cost states for Medigap plans nationwide.

What are Medicare Supplement insurance plans? Find your local plan immediately! If you have already signed up or have already qualified under Medicare, you may consider purchasing Medicare Supplement insurance. Medicare Supplements (also called Medigaps) are a private insurance company that helps with the out-of-pocket expenses of Medicare Part A or Part B, like deductibles, copays and coverage.

This list the different Medigap plan types available to 63 year-old non-smokers in North Carolina. Medigap plan types Monthly Premium Price Range. Medigap plan A – the main advantages offered under the Medigap plan without additional costs. $75 - $116. Medigap plans B provide basic health care plus coverage for the deductible. 1313. $ 307.

Medigap plans are low priced and cover the majority of Medigap benefits. $10-6340$. Medigap Plans G offer maximum coverage for newly enrolled Medicare. Available in some locations with standard plans and high deductible plans. 95 – 33. High-deductible medical insurance plans: $30-69.75.

Some Medicare Supplement insurance plans offer community-based coverage. There's no age limit in premium payments for each individual member. Pricing is sometimes called no age rating or age-based. Aged e-newsletters. Prime prices depend upon the age of the purchase. The younger population typically pays a higher premium than the older population.

Pricing is also known as entry-age ratings. Age-advanced. Premium rates are determined according to age and cost will rise with age. Some states require specific prices for Medicare supplement coverage, therefore not all have the corresponding pricing options.

Medicap is billed by Medicare as being about $200 per month, industry experts say. The new plans help address gaps in original Medicare coverage. Medigp can assist you in the payment of all deductible and coinsurance costs that arise. Medigap Supplemental coverage may cover: Medigap plans are governed by private insurance providers which Medicare reimburses.

This results in incredibly large price variation in the insurance market. Two insurance companies can charge very different premiums for identical coverage. The greater coverage a health insurer offers, the greater the premium will increase.

There are many different factors which influence the cost of Medicare. Some states are using community rating methods for pricing their plans. It does not affect the premium cost of enrollment for female or male enrollees. All people under 65 receive the same amount of protection under this plan. Medigap premiums tend to be high throughout the board within states with community ratings. In addition many states listed are very expensive for living. California, New Jersey and Rhode Island are all among the most expensive states to live with.

In 2022 supplemental insurance premiums were approximately $150 a year or $1800 annually. Several factors can affect the Medigap cost, such as the age or place of residence. Rachel Christian: Rachel Christian is author and researcher for the RetirementGuide website. She is devoted to life insurance and retirement topics. Rachel is an Associate Member in Financial Planning Education.

Medicaid helps many low-income people on Medicare with their Medicare premiums and cost-sharing requirements, and may also cover some benefits that are not covered by Medicare, such as dental services and long-term services and supports.

How an insurer rates its policies can directly influence how much it costs. In some insurance companies, age does not affect premium rates. Some companies may increase your insurance rates each year. Bob Glaze, a registered insurance expert, describes how aging affects Medigap cost.

Depending on how older you are in the past the cost is dependent upon the policy. The monthly premiums increase with age. Depending on age you can find a more affordable policy if you are eligible to receive Medicare. But with time, this option can get you a lot more cost-effective option. Inflation or other factors can cause premium increases. Keep it at the risk that it will never happen to you. It takes time to think about things that you haven't thought of before. Make it ok. Get Medicare advice the best way for you.

It varies by how old you have been during your initial purchasing period. Premium rates are low in the youth group. But the prices are likely to remain stable with age. For instance Amy purchased an age-rated policy in her 60s and paid $12 per month. Bob begins coverage at 73 and pays $170 a month on similar policies. Amy will not receive more premiums when her age reaches a certain limit. It is almost guaranteed from your date of issue but cost can gradually increase with inflation.

Medigap Plan Costs in California It should be no surprise to see California Medigap plans on this list. Medicare beneficiaries enrolling in a Medicare Supplement plan can expect to spend close to $163 each month for a Medigap plan. In California, the biggest Medigap perk is the birthday rule. California's Medicare Supplement birthday rule allows beneficiaries to change Medigap policies during.

If you do not qualify for Medicaid and you want to stay in traditional Medicare, you could try to switch to a less expensive Medigap policy. Your options will vary based on your state, however, so it can be helpful to work with an agent you trust. 4. Another option could be to enroll in a Medicare Advantage plan.

With Plan L, you pay 25%. High-deductible plans require you to meet a deductible of $2,490 in 2022 before the Medigap policy pays for anything. » MORE: Compare Medicare Supplement Insurance plans Medigap cost comparison chart Here are the price ranges for each Medigap plan type available.

Your options will vary based on your state, however, so it can be helpful to work with an agent you trust. 4. Another option could be to enroll in a Medicare Advantage plan. Medicare Advantage plans provide all benefits covered under Medicare Part A and Part B. A few details: - Medicare Advantage plans.

Medicare Advantage plans provide all benefits covered under Medicare Part A and Part B, but often have lower cost-sharing requirements than traditional Medicare.

Medicare Supplement Medigap Plans Medigap Plan F Medigap Plan G Medigap Plan N High Deductible Plan F High Deductible Plan G Medigap Plan A Medigap Plan B Medigap Plan C Medigap Plan D Medigap Plan K Medigap Plan L Medigap Plan M Medigap Eligibility Medigap Coverage Medigap Enrollment Periods Medicare Supplement Videos Medigap by Carrier Medicare Part C Medicare.

Medigas'disadvantages include high monthly premium fees. The difficulty in navigating various plans. There is no prescription drug insurance for the patient.

Are there any medical advice available? Medigap policies supplement original Medicare coverage and cover additional cost of care. Medigap gives you more flexibility and offers a wider network of providers that are comparable to others. Having travel coverage that Original Medicare cannot provide is the most important option.

Pay a bit more to cover medical expenses, so people who need more medical services will make bigger payments. Medigap plans can be more costly than Medicare Advantage, however, it can help you cover your medical expenses better.

Deductible, copayment, coinsurance etc... Medicare Supplement plan G costs a 65-year-old $13.46 a month while Medicare Plan F costs $89.95 - $188.93 monthly. It's free to check Medicare Supplemental Price online.

Medigap policies can be priced or "rated" in 3 ways: Community-rated (also called “no age-rated”) How it's priced Generally the same monthly premium is charged to everyone who has the Medigap policy, regardless of age. What this pricing may mean for you Your premium isn't based on your age.