One quarter of Medicare patients had private insurance a year ago known as Medicare Advantage. The program provides for deductible coverage and cost share protection. This article gives a summary of Medigap enrollment and analyzes federal law and state regulations that may have a positive impact on beneficiaries accessing Medigap.

Riaz Ali CEO, Saeidan. RAIZA ALI CEO, Saeidan A few Medigap plans provide non traditional benefits like vision, dental, and hearing care. As enrollment for Medicare increases, policymakers must weigh the benefits and disadvantages.

Medigap's policy is subject to federal and state regulations aimed at protecting you and must be clearly identified as "Medicare Supplement insurance." Insurance companies can provide you with only the standard policies that can easily be found on the letterhead. Each insurance plan is similar in terms of basic, but some offer additional benefits, so you'll be sure to decide if that policy is the correct choice. Medigap policy is the standard in Wisconsin, Minnesota and New Hampshire. All the insurance companies choose which Medigap plans they sell, although certain state regulations affect which ones they are offered. Companies selling Medigam policy:

The exclusive cost is $6620 for 2022. $3310 for 2022 * Plans F & G have high-deductible plans in some states as well. If you want a plan that covers your own Medicare-covered costs, you must pay it in full by 2022. Plan F is not available to individuals who are currently receiving Medicare on or after January 1, 2020. ** If you meet both the annual out-of-pocket and part B deductibles, the Medicare benefits will be paid.

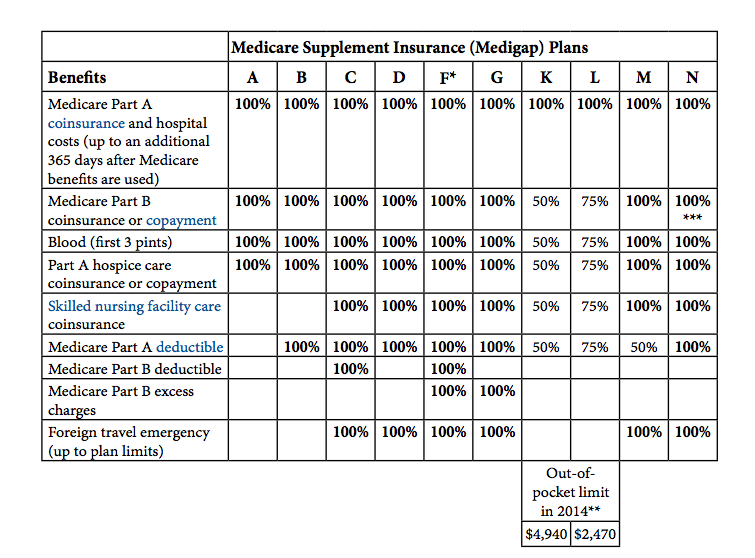

The table below lists a list of the benefits that medspa covers. the plan covers 100% of this benefit. the policy doesn't cover that benefit 0%. the plan covers those percentages if the person has a disability.

The choice to enroll in Medicare Advantage is difficult. This report highlights the additional ways Medicare and Medicaid differ from the MA, as the access to additional medical services in MA has grown. Beneficiaries will have to decide on costs and access based on incomplete and inaccurate medical information. The decision about the use of Medicare Advantage and Medigap plans is complicated by how they were designed and funded.

Medicare Supplement Insurance, also known as “Medigap” insurance, provides supplemental health insurance coverage for Medicare beneficiaries. Individuals in traditional Medicare may want to obtain Medicare Supplement (“Medigap”) insurance because Medicare often covers less than the total cost of the beneficiary's health care.

Medigap (Medicare Supplement) If you are enrolled in Medicare Part A and B (Original Medicare), Medigap plans can help fill the coverage gaps in Medicare Part A and Part B. Medigap plans are sold by private insurance companies and are designed to assist you with out-of-pocket costs (e.g., deductibles, copays and coinsurance) not covered by Parts A and B. These plans are available in all 50 states and can vary in premiums and enrollment eligibility.

These data include the number of policyholders as of December 31, 2016 for each state, insurance company, and type of plan sold. The number of covered lives represent a snapshot of enrollment at that time, rather than average enrollment over the course of the year.

Guaranteed issue means that an insurance company is required to sell a policy and may not force an individual to prove “insurability” by making the person pass an insurance physical examination.

Impact on Beneficiary Decision-Making Choosing whether to enroll in traditional Medicare, with or without a Medigap plan, or to enroll in a Medicare Advantage (MA) plan is complicated. This analysis highlights another way that traditional Medicare with Medigap diverges from MA, as access to additional benefits such as dental, vision, and hearing in MA is growing.

The Medicare program that Americans know and cherish has been allowed to wither. Traditional Medicare, preferred by most beneficiaries, has not been improved in years, yet private Medicare Advantage plans have been repeatedly bolstered. It's time to build a better Medicare for all those who rely on it now, and will in the future.

Medigap policies are standardized; Medigap policies comply with federal laws designed to protect people. In some instances insurance companies will offer a standardized policy that has recognizable letters in many states.

Medigaps help pay certain Medicare costs, including deductibles, coinsurance , and copays. Medigaps do not help pay for Medicare premiums. All policies must offer the following basic benefits: Hospital coinsurance coverage 365 additional days of full hospital coverage Full or partial coverage for the 20% coinsurance for provider charges and other Part B services.

In 1990, Omnibus Budget Reconciliation (OBA) was held. Generally, the bill requires the sale of new Medicare coverage under a new plan that is branded Plan A through J.

Additional benefits are: Part A Skilled Nursing Facility Coinsurance for Days 21-100; Part A Hospital Deductible; Part B Deductible; Part B Charges above the Medicare Approved Amount (if provider does not accept assignment); Foreign Travel Emergency Coverage; At-Home Recovery (Home Health Aid Services); Preventive Medical Care. Policies B through L vary considerably.

Medigap plans have been classified by CMS as being available to a total of ten private companies. Each Medigap program has its own unique benefits. The coverage offered will roughly match the premiums.

Coinsurance The percentage of coinsurance varies depending on plan. Limits and Considerations Limits Most of the time, Medigap coverage has no network limitations and is available anywhere that Medicare is accepted.

The advantages to Medigap are: Higher monthly payment rates. It's difficult to navigate various types of plans. Unlike most insurance plans, you don't have prescription insurance.

Know More: Dentists That Accept Medicare