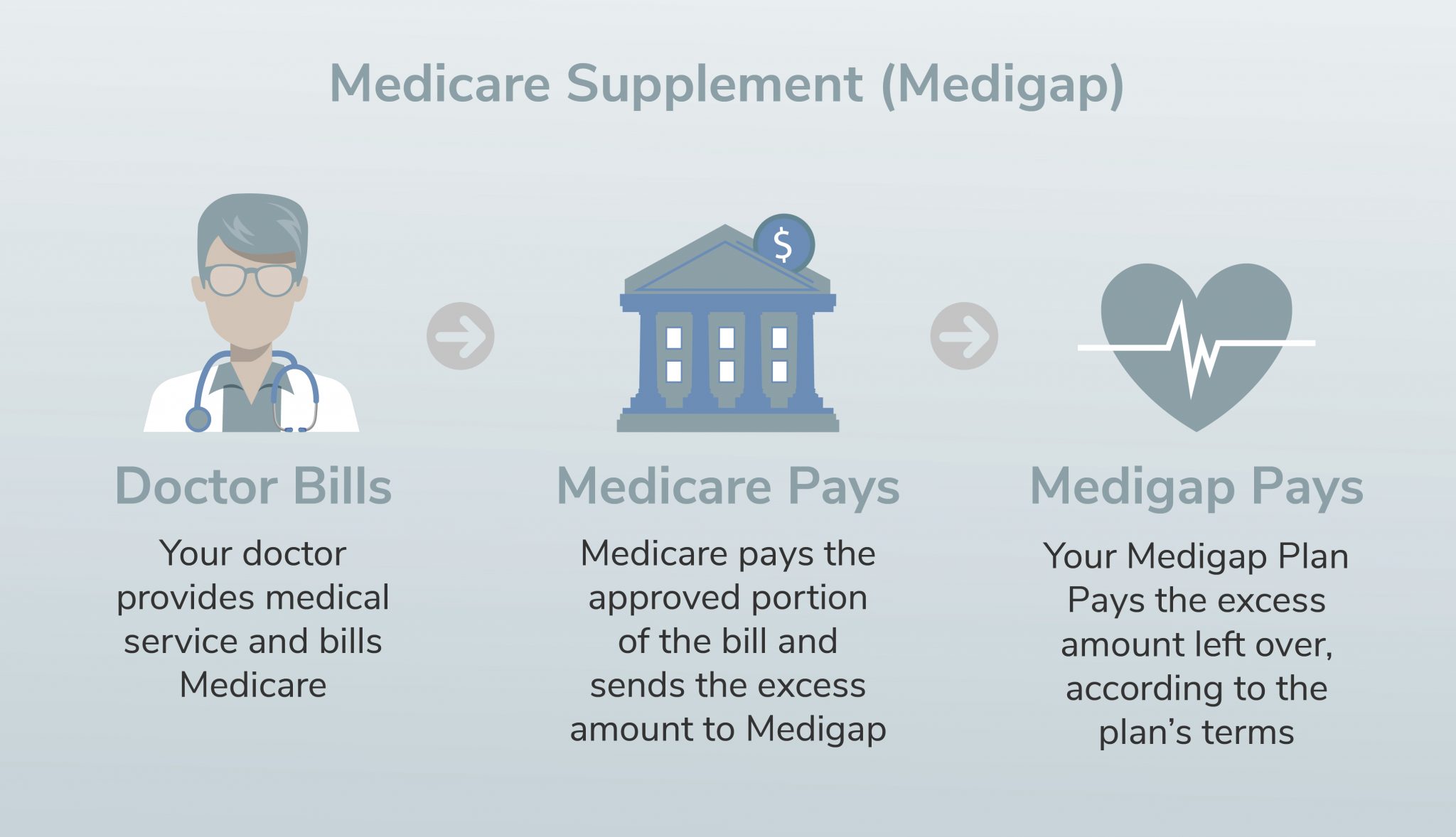

Medicap plans or other Medicap supplement plans sold through private firms can provide some health-care costs that Original Medicare can't afford, such as copayments, coinsurance and deductibles. Some Medicare plans also cover services that Original Medicare does not cover. So your Medigap plan gets paid.

Medicap is a Medicare Supplemental Insurance plan that fills gaps and is offered by private corporations. Medicare covers most of a portion of the cost of covered care. Medicaid Supplement Insurance (Medicigape) policies may help pay if there are unforeseen health care needs for a client.

You may join your Medicare Supplement Plan unless you have Original Medicare Part a and Part B. Your open enrollment period lasts six months from your 65th birthday. During this Medicare Supplement open enrollment period there is no possibility of re-entrying a program if your current condition is present.

Not all countries provide underwriting for healthcare plans. Some states provide plans for people under 65 who may not qualify for Medicare for a medical reason other than a disability. Medicare Supplement insurance gives you access to all medical facilities that accept Medicare patients. Anthem offers supplemental insurance policies covering 100% of Part A and Part B coinsurance.

Medicare Advantage Plans provide an alternative to traditional Medicare with similar health coverage but with additional benefits including prescription drug coverage. Meanwhile, private insurers provide Medicare Supplement plans to individuals who enroll in original Medicare to cover the gaps that exist in the coverage.

Medigap provides nationwide standardized coverage for a large number of people who are unable or unwilling to take maternity insurance. Since coverage is standard the monthly premium rates vary from provider to provider. The MediGap policy does not cover prescription drugs.

The enrollment procedure is simple in Medigap plans. Those prescription drugs are usually purchased through an agent and are delivered direct from a carrier,” he said. The open enrollment period is not annually and you may apply at anytime. The Medigap plan can be ordered during an extended open enrollment period of six months for an average of six months. The period begins the day after you start having Medicare Part B for age 55 and above. Medigap insurance is offered for all states and residents during the current time. Follow these steps to purchase Medigap plans:

It will vary depending on how many people are enrolled in Medicare and Medicaid Advantage plans. Medicare Advantage is an alternative to Original Medicare and provides the same coverage but additional benefits, including prescription medication protection (Part D). In addition, Medigap insurance is sold to people enrolled in Original Medicare to fill in gaps. Medigap provides standard coverage and helps pay deductibles, insurance, and premiums. Unlike most drug plans, Medigap covers no prescription medications.

The most commonly used Medicare Supplement Plan is Plan N. Medicare Supplement plan F provides beneficiaries full coverage for Medicare-covered medical costs once original Medicare reimburses a percentage. Medicare Supplemental Plan G only covers Medicare Part C yearly deductibles after the plan is able to cover 99% of Medicare coverage. Finally, Medicare Supplement plan N is an arranged plan that is more economical to administer as a payment option.

Generally speaking, Medicare is a government-sponsored insurance plan designed to provide reassurance that Medicare doesn't cover the full cost of the health care. The secondary insurance policy is available only with the Original Medicare program. Medicare Part D does not generally provide prescription coverage, and you may want to enroll in one of these Medicare Advantage plans. Unlike Medicare Advantage Part C Medicare Medicap has no similar benefits to Part B.

If the Medicare Advantage plan is approved, it will not cover Medicare Advantage plans. The insurer can delay a claim for six months if there is no coverage for your condition. If you re-enroll for Medicare Part B coverage before 62, you should enroll as soon as your Medicare Part C enrollment begins. Medigap policy is invalid unless your status and your medical coverage changes.

Medicare plans don't provide prescription drugs coverage, though you can purchase part-D insurance plans to help cover medication expenses. Unlike Medicare Supplement plans, Anthem provides you with additional dental care and vision coverage within the United States. In addition, California, Kentucky and Nevada offer innovative Medicare Supplements that include eye and hearing support.

People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, if they decide to enroll in Medicare prescription drug coverage later. , and you may pay more if you join a drug plan later. If you buy Medigap and a Medicare drug plan from the same company, you may need to make 2 separate premium payments.

The cost of medical supplements is dependent on the company and plan chosen and a few carriers do not all offer their plans. Medigap policies have been determined from individual insurers that sell them. Companies determine pricing on premiums in three ways. Medigap insurance is bought through a private insurance company that pays the company monthly premiums directly.

Medicare pays part of this amount and you're responsible for the difference. for covered health care costs. Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan.

The Medicare Supplement program helps to reduce health care costs that cannot be paid by original Medicare. All patients in Medicare should be aware that their health insurance coverage is likely to be very high. Some Medicare Supplement plans provide insurance to certain services that the original Medicare does not cover.

A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap plan from any insurance company that's licensed in your state to sell one. Any standardized Medigap plan is guaranteed renewable even if you have health problems.

The plans and what they cover are standardized by the federal government. General features of Medicare Supplement insurance plans Medicare Supplement insurance plans work with Original Medicare (Parts A & B) to help with out-of-pocket costs not covered by Parts A and B. The following are also true about Medicare Supplement insurance plans: Predictable costs help you stay ahead of unexpected out-of-pocket expenses.

Medigap Some types of insurance aren't Medigap plans, they include: Medicare Advantage Plans (like an HMO, PPO, or Private Fee-for-Service Plan) Medicare Prescription Drug Plans Medicaid A joint federal and state program that helps with medical costs for some people with limited income and resources. Medicaid programs vary from state to state, but most health care costs are covered if you qualify for both Medicare and Medicaid.