The best Medicare Supplement companies are listed below to help you find the best Medicare Supplement policy. Our comprehensive coverage information is available for all of our clients from the beginning to the end to help them understand their options and get the most out of Medicare. How do I get Medicare plans in just three steps? The factors that determine our choice are Consumer Reports, the Am Best rating, Standard and Poor (S&P) ratings as well as the companies' number year market.

Medicare is an attractive option for senior citizens. Medicare is considered the most effective medical program for 65-plus. It can only handle certain tasks. You might also need additional health insurance (known as Medigap) for your medical expenses as you get older.

Among the main downsides to Medicare Supplements are upfront expenses. Typically over time you can expect less cost of treatment with Medigap compared to Medicare Advantage or original Medicare (parts A and Part B).

Nevertheless, Medicare Supplement plans require higher monthly payments than HealthCare and you must still take out the Original Medicare Part D premium. In order to get the best possible care with Medigap the costs are significantly less than other types of coverage. In order to get a long-term return on investment, you have to pay an additional monthly fee that might cause confusion for some consumers.

Medicare supplemental, or Medigap, is a private insurance program that provides financial support to cover the cost of a service that is not included in Part A or Part B. The secondary coverage program is available exclusively with Original Medicare not any other private insurance plans, standalone plans or Medicare Advantage plans. Medigap Plans usually do not provide prescriptions and may require an additional Medicare supplement from your health care plan. Medigap plans have different benefits – they differ from a Medicare Advantage plan.

How much coverage you get with your Medicare Advantage plan depends upon your specific healthcare requirements. Medicare Advantage is intended to replace Original Medicare in terms of coverage as well as additional benefits including prescription drug coverage. Medigap plans have also been sold to borrowers who qualify to get Medicare Original coverage. Medigap provides standard coverage with assistance in covering deductibles and deductible costs. Unlike other health plans, Medigap does not offer prescription drugs.

Plan FS GC and plan n are the most commonly used Medicare supplements. Medicare Supplement Plan F offers Medicare beneficiaries full medical coverage once Original Medicare pays the remaining amount. Medicare Supplement Plang provides 100% coverage for medical expenses incurred in a yearly Medicare Part C. In general, Medicare Supplement plan N is considered a paid plan which tends to be cheaper for beneficiaries who do not require medical care regularly but are requesting urgent medical services.

Medicare Advantage Plans serve as an alternative to traditional Medicare, providing the same coverage as prescription drug coverage. Similarly, Medicare Supplement plans are sold to those on original health insurance to reduce their gaps.

Medigapping provides standardized coverage to all Medicare recipients nationwide and helps pay for things like deductibles and coinsurance. The coverage of these plans can be easily changed and prices vary depending upon the service providers. Medigap policy does not cover prescription drugs.

Open enrollment in the most popular plans usually lasts longer. It begins automatically the 1 year following you are 62 years or over. You will receive the “favored rate” for this period regardless of your condition. Registration during a certain time may be required for “normally priced” rates. Your application may be rejected if Medigap is not in full enrollment. Despite the exception, you can still enroll under Medigap while not incurring hefty penalties.

In most areas, the discount is 7%. As a company, Manhattan Life only offers 5 Medicare Supplement plan options (Medicare Supplement Plan A, Plan C, Plan F, Plan G, and Plan N). Manhattan Life offers a relaxed underwriting process, allowing those with more health issues access to a Medicare Supplement policy.

Medicare originals cover most – but not all – the costs of approved health-care services. After completing a deductable payment period, you will be liable to pay the cost. There will never be another limit on the amount paid for insurance. Medigap addresses a number of potential cost-based shortcomings in Original Medicare — and offers peace of mind for patients. To enroll in Medigap plans, you should have Medicare Part B. So get ready to shop Medigap!

Medicare pays just 80 percent to 80 percent of your hospital care. Medigap helps to prevent unexpected expense. Senior citizens should consider Medigap programs for the following reasons:

At more than 170 years old, Manhattan Life is one of the longest continuously operating companies in the U.S. 17 Manhattan Life sells 5 Medicare Supplement Insurance plans, including the popular Plan F, Plan C and Plan G. The company also sells a variety of other insurance products, including a dental, vision and hearing package that can be paired with a Medigap plan to give you some extra benefits that Original Medicare (Medicare Part A and Part B).

The company offers typical Medigap plans and policies bundling dental, vision, and hearing coverage. One of their best assets is an easy-to-use mobile app for customers to track their claims history and payments. Blue Cross Blue Shield Pros: Blue Cross Blue Shield Cons: Customizable Medicare Supplement options can bundle additional benefits into your policy for an extra monthly fee.

The insurance companies are responsible for which plan types they sell, what they charge and whether to include extra perks, as well as providing customer service. Each company has different strengths and weaknesses. Best Medicare Supplement Insurance companies NerdWallet compares Medigap supplemental health insurance companies' performance in terms of plan choices, member satisfaction, prices, extra perks, service area and more.

Rated as an A company by AM Best and S&P, Cigna has proven itself a worthy Medicare insurance company. As a Medicare Supplement insurance company, Cigna offers all of the top Medigap plans and a spectacular dental, vision, and hearing plan option for Medicare beneficiaries. Cigna also provides spousal and household discounts in many states nationwide.

Find Medicare Plans in 3 Easy Steps We can help find the right Medicare plans for you today We assess several elements for a Medicare Supplement insurance company to be one of the best. Factoring into our choices for the top companies are consumer reports, AM Best rating, Standard and Poor (S&P) rating, and the company's number of years in the market.

Plans are insured and offered through separate Blue Cross and Blue Shield companies. Medicare Advantage and Prescription Drug Plans are offered by a Medicare Advantage organization and/or Part D plan sponsor with a Medicare contract. Enrollment in these plans depends on the plan's contract renewal with Medicare.

Plus, you receive various policy options when using Mutual of Omaha as a Medicare insurance company. Aside from Medicare Supplement plans, Mutual of Omaha offers Medicare Part D prescription drug plans , dental coverage, and long-term care insurance – to name a few of their products.

Costs Premium All Medigap plans require that you continue to pay your Part B premium and a separate premium for Medigap coverage. Deductible Some plans have deductibles. Copays A copayment may apply to specific services. Coinsurance The percentage of coinsurance varies depending on plan.

Anthem offers extra perks for a variety of fitness, health and wellness products and services. Cons Only a few Medigap plan types are available, although they are the most popular ones. Medigap policies are available in only about one-third of states. Anthem spends more on overhead and less on member benefits than other major Medigap insurers.

This applies to Medicare coverage throughout the country , save for a few states. In some ways, Medicare Supplement plans are simple: Unlike Medicare Advantage plans, Medigap plans don't make any coverage decisions. You can see any doctor or hospital that accepts Medicare. Medicare Supplement plans pay the specified share of your medical bills that Medicare doesn't pay, including deductibles and copays.

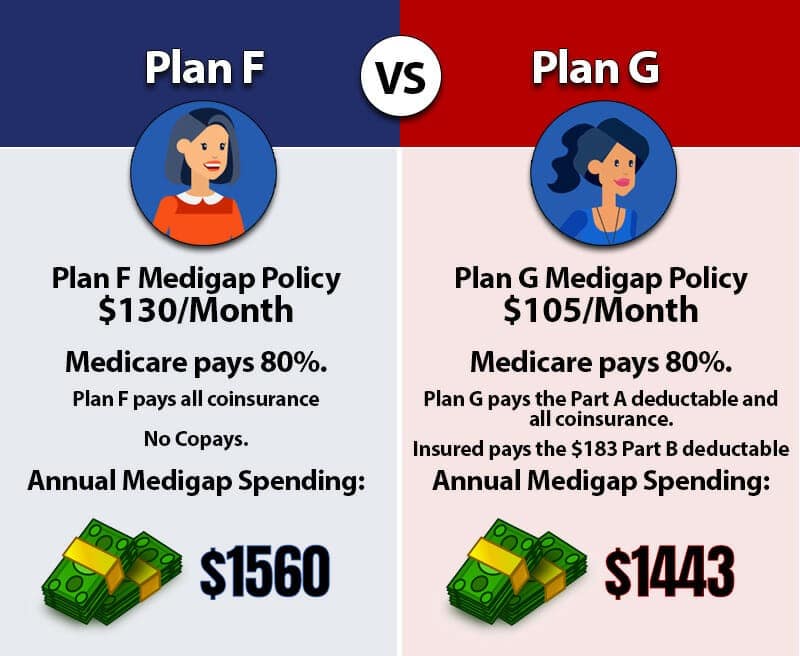

Medicare Supplement Plan F is the most comprehensive Medigap option available, providing beneficiaries with 100% coverage of Medicare-covered medical expenses after Original Medicare pays its portion. Medicare Supplement Plan G leaves beneficiaries responsible only for their annual Medicare Part B deductible, after which the plan provides 100% coverage on all Medicare-covered medical expenses.

hen you're set to start Medigap shopping! Ten Medigap insurance plans are each assigned a letter of the alphabet (although Wisconsin, Minnesota, and Massachusetts do things slightly differently). Each Medigap plan is standardized, which means, for example, the basic benefits you receive under Medigap Plan G are the same in Kentucky as in California.

Despite plans F, the most widely known plan Medigap is the second best known insurance. Approximately 57% of Medigram plan beneficiaries enroll in an F plan.

There are several disadvantages to the Medgap plan: higher monthly rates. Try various kinds of plans. No prescription coverage for the insurance (available under the plan D).

The plan F, Plan G, and Plan N are the most common. I'll show you some of the reasons why most patients choose Medicare Supplements.

Find Cheap Medicare Plans in Your Area Currently insured? Find Plans Medicare Supplement policies, also called Medigap, can prevent unexpected medical bills. Without a Medigap plan, Original Medicare policyholders will find tracking deductibles can be cumbersome and paying for regular medical treatment out of pocket can be expensive.