Buying Medigap is very much about understanding the time and method of the purchase process. Let's break down each situation in which purchasing policies affect your situation. And you'll know everything you want to know before enrolling in your plan.

From 1966 until 1965 the Medicare program was designed for a limited amount of retirees' health care. Original Medicare consists of two parts: Part A, hospitals coverage and Part B, physicians and medical services. Medicare covers only specific services and costs are split among the insurers. When it comes to getting Medicare, you have 3 main options: You can buy the supplemental policy Medicare is not covering, or you can get Medicare through Medicare by purchasing it. Medigap plans are available from private insurers and are identified by capital letters - B, C, F, and G.

It is possible for a doctor to enroll for a MediGap plan once they are enrolled in Medicare Part B. Typically two times a year are required for eligibility, without medical underwriting of a predetermined number of health problems. If you miss your initial six-month enrollment window, insurers typically require health insurance, so the policy will not be provided. With time you may switch to the plan according to the rate you have paid or different levels, and be cautious in this. Don't stop taking insurance on any current plan until you find a suitable replacement plan.

The health care insurance company uses medical underwriting to determine whether they have an eligible policy. Unless you have an underwriting guarantee, the company won't sell you an alternative plan besides your OEP. In some states, a policy called Medicare Select is available. 4. They only provide healthcare options to members of a group of insurance companies.

You've turned 65 and enrolled in Part B. In this "initial enrollment period," you have 6 months to select and enroll in a Medigap policy. You are older than 65 and losing employer coverage. Once you enroll in Medicare Part B, you'll have 6 months to buy a Medigap policy.

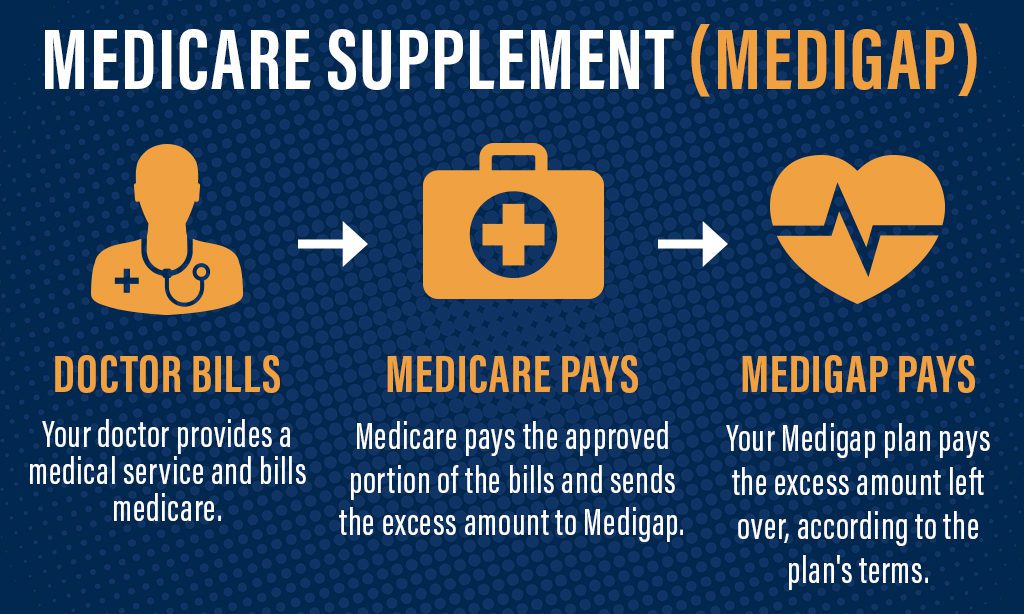

For Medicare Part A and Part B (Original Medicare), Medigap Plans can assist in closing the gap between Medicare Part A and Part B coverage. Medigap Plans are available through private insurance companies and are designed to provide a solution to avoid unnecessary expenses. Medigap plans are common, but some standardized options may be unavailable to you locally.

The initial registration period is a short window of time during which the eligibility period is limited. When you enroll in Part B of Medicare Part A, you have the opportunity to choose another insurance option. A Medigram plan may cost more if you have more than one policy that will last six months. The period of six months begins on the first day of the month when a resident turns 65 or older. After this point you are restricted in buying the policy. In some states the enrollment period for certain courses can extend.

Medicaid Supplement insurance provides supplemental health insurance for seniors that private companies provide as an alternative to Medicare. The costs are mainly out-of-pocket expenses including copay fees. The Medigapro policy will work exclusively with Original Medicare. If you want a Medicare Part A or Part B health plan you need a Part A and Part B plan.

It's important to consider your health conditions when you're 65. Steve Feinschreiber, vice president for financial products for Fidelity Financial Solutions shares the following advice when shopping for a Medigap insurance product:

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year.

If you have had at least 6 months of continuous prior creditable coverage, the Medigap insurance company can't make you wait before it covers your pre-existing condition. Many types of health care coverage can count as creditable coverage for Medigap policies.

If possible, wait until your Medigap Open Enrollment Period to buy a policy when it's guaranteed to be issued. 6 Another tip in getting the most out of supplemental coverage for seniors on Medicare is working with HealthMarkets. We can help you identify the Medicare Supplement plan that best fits your healthcare needs and budget with no obligation to enroll.

Medigap policies are designed to work only with Original Medicare. So, you must be enrolled in both Medicare Part A and Part B to buy a Medigap plan.¹ There are eight Medicare Supplement Insurance plans for new enrollees, which are represented by letters: A, B, D, G, K, L, M, and N. There are also two plans (C & F) that are available only to people who were eligible for Medicare before January 1, 2020.

Coverage Options Prescriptions, Providers & Benefits Medicare Cost Basics More about Medicare Articles and Special Topics Types of Plans Overview of Plans Medicare Advantage Plans Medicare Supplement Insurance Medicare Prescription Drug Plans Special Needs Plans FAQ Medicare FAQ Glossary Medicare Enrollment When to Enroll How to Enroll Changing Plans Working Past 65 Get Your.

Medicare Supplement Insurance plans to ensure you opt for the right choice for you. 4 These are some of the reasons you would want to delay Medicare Part B enrollment if you have health insurance through an employer or union: 4 In most cases, group health insurance based on current employment is often similar to Medicare Part B coverage. You won't have to pay for Part B benefits before you really need them.

Since costs vary between companies, contact more than one insurance company that sells Medigap policies in your state. Before you contact any insurance companies, figure out if one of these applies: You're in your Medigap open enrollment period. You have a guaranteed issue right. Step 4 – Buy the Medigap policy . Once you decide on the insurance company and the Medigap policy you want, you should apply.

AARP/United Health Care are among the best Medicare supplement companies and offer AARP endorsement and health insurance products. Aetna offers supplementary coverage as well. The firm has a "Best A" rating on Amazon.com.

The average cost to a medical supplement is $155 each month through 2018. Cost, however, depends primarily on two things: the policy chosen and the pricing structure within your state. Firstly, the plans differ in their price since every policy is different from one another and has different benefits.

Medicare Supplements is a type of health care coverage provided under Medicare Part B. Medicare Supplement insurance covers the gap in Medicare's medical costs. Medicare supplementation can offer different benefits to compensate for healthcare costs.

UnitedHealthcare offers the best health care coverage in its area and offers the most affordable Medicare Supplement plans in the industry. The standard Medicare Supplement plan benefit remains the same, no matter what insurers. AARP Medicare Supplement Insurance Plans by United Healthcare also offer several distinct features.

Aside from Medicare Part B premiums your Medicare pays monthly premiums on Medigap. Since the Medigap Plans offer diverse levels of coverage, the premium varies according. Premium rates on different plans are different for companies. Other factors determine the cost and amount of the Medicare supplemental coverage.