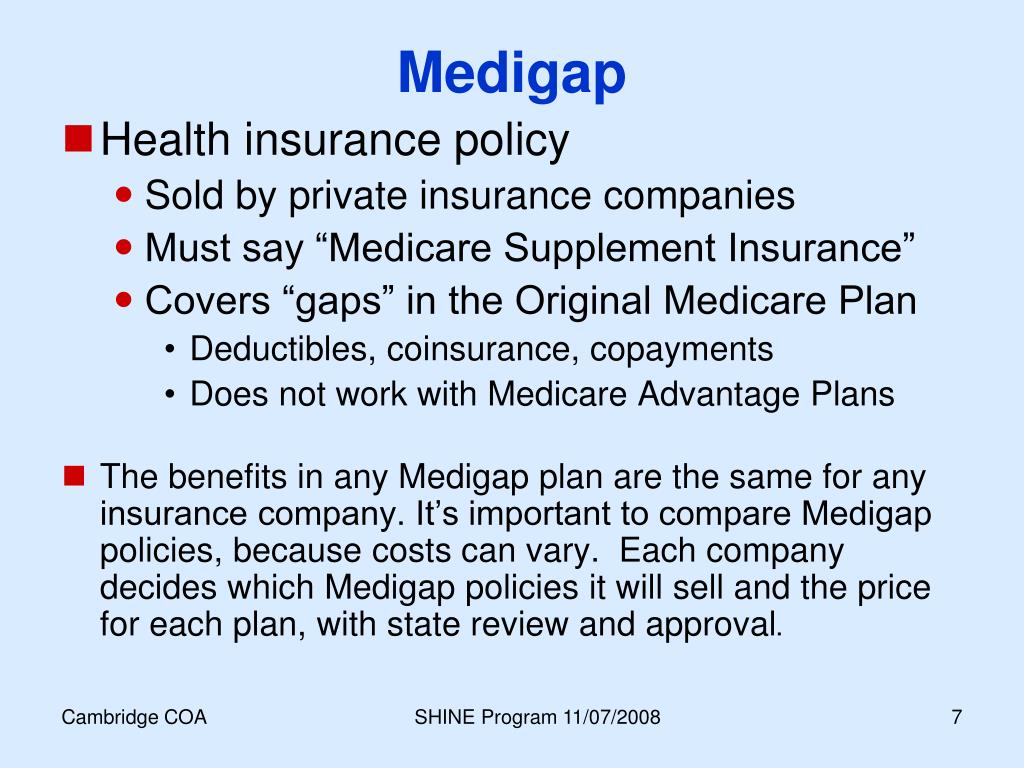

Medicare Medigap offers supplemental insurance coverage. Depending on the type of policy, the Medigap policy is designed to provide greater coverage for routine services that Medicare does cover and may even cover a portion of the expenses that Medicare does not cover - including medical treatment and vision insurance. Medigap is designed to reimburse you from the cost you paid directly. This plan comes from a private insurance company, so make a little comparison shop for a package that fits you. The lettered plans from the different companies have the same benefit.1.

En espaol | It is best to purchase Medigap Insurance during a period when the policy is in effect without any insurance company refusing coverage or charges for the coverage. They are possible to vary based on the age and place in life.

Medicare was created in 1965 and covers only some portion of retirees' health care. Original Medicare consists of two sections: Part A, hospital coverage, and Part B, physicians and outpatients. Only certain services are included and the cost is shared between Medicare and you. If you are ready to enroll in Medicare, you may decide on the following 3 choices - paying Medicare's cost or buying additional insurance. Medicare.gov or a Medicare Supplemental Policy. MediGap is offered by private insurance providers and is characterized through capital letters: a, B, C - D - A, K - L.

The Medigap program provides additional protection for the expense you do not currently have under Medicare. Medicare Advantage Plans are private alternatives to government programs of health care. Most of these plans have been established to replace all of the service offered on Original Medicare with additional services such as prevention services within a pre selected network of doctors and medical centers. Medigap plans are likely to offer better choice choices than Medicare Advantage if your health provider accepts Medicare.

Parts B and A of Medicare cover basic insurance and Part C provides optional prescription drugs you can buy from private providers. Part C or Medicare Advantage replaces government-provided coverage and private coverage. If you choose Part C, you won't need Medigap coverage. If your Medicare plan includes Part D and you are wishing to get Medicare Part D you have many other things to learn. All letters represent corresponding levels and coverage standards. The most popular Medigap plan is F or G.5.

This plan may be replaced with Plan F in popular use because it offers virtually the same coverage except for reimbursement of parts of the deductible - a feature which is no longer included in most Medicare plan offerings. Average Plan G costs more than Plan F. However, cost varies widely depending on zipcode, gender, and cigarettes and increases with age. Medigap Plan G provides almost identical coverage as the famous Plan F. It will be retired from the program on January 1, 2020.

The most detailed program was a popular choice over the years. The median price per month for the most widely used Medigap F plans is approximately 326.65 USD. Plans for F will be discontinued for newly eligible Medicare beneficiaries. People with Plan F already can get this and those with no Medigap plan can still have Plan F if they wish.

After enrolled in Medicare Part B, a patient can get into the Medigap plan. It's normal to get into Medicare for two periods. If a person misses their first 6-month enrollment period, insurance companies usually require health underwriting, which means a denied claim could be made or you could be required to pay heftier premiums. As time passes, you can switch plans according to costs. Make sure the premium on the existing plans doesn’t stop when the new plans accept you.

There are disadvantages to Medigap Plans such as a higher monthly premium. Having to manage different plan types. Insurance for prescription drugs is not provided by the Plan C program.

Medigap plans cover the cost of Original Medicare. Medigap plans can save you time by paying less for health care expenses. Although this does not need anything to be done it will definitely benefit you.

You also have a guaranteed right to buy most Medigap policies within 63 days of losing certain types of health coverage, including private group health insurance and a Medigap policy or Medicare Advantage plan that ends its coverage. You also have this fresh window if you joined a Medicare Advantage plan when you first became eligible for Medicare and dropped out within the first 12 months.

Be sure to contact Medigap insurers in your state to learn if they will sell you a Medigap policy outside protected enrollment periods. Cancelling a Medigap policy You have the right to review a new Medigap policy for the first 30 days. You can cancel it within that time for a full refund if it does not meet your needs. After the first 30 days, you can cancel your policy at any time.

Under federal law, you're guaranteed the right to buy a Medigap policy during a six-month open enrollment period that begins the month you turn 65 and join Medicare.

Medigaps may cover outstanding deductibles, coinsurance , and copayments. Medigaps may also cover health care costs that Medicare does not cover at all, like care received when travelling abroad. Remember, Medigaps only work with Original Medicare.

So the Ottos decided to buy Medigap insurance to cover health care costs that Medicare does not. Medicare and Medigap Since its introduction in 1965, Medicare was designed to cover only a portion of a retiree's health care needs.

Additional benefits are: Part A Skilled Nursing Facility Coinsurance for Days 21-100; Part A Hospital Deductible; Part B Deductible; Part B Charges above the Medicare Approved Amount (if provider does not accept assignment); Foreign Travel Emergency Coverage; At-Home Recovery (Home Health Aid Services); Preventive Medical Care.

Payment of Medicare coinsurance amounts. Thus individuals who qualify for the QMB program generally also do not need, and should not pay for, Medicare Supplement Insurance. The qualifying income figures change in April each year. Contact the Department of Social Services office in your area to find out more about Title 19 and QMB eligibility and enrollment.

If you have had at least 6 months of continuous prior creditable coverage, the Medigap insurance company can't make you wait before it covers your pre-existing condition. Many types of health care coverage can count as creditable coverage for Medigap policies, but they'll only count if your break in coverage was no more than 63 days. I have other insurance.

Original Medicare covers a large portion but not a majority of the costs associated with health care coverage. Medicare Supplement Insurance (Medicare Cap) policies can pay some of those remaining healthcare fees such as Copays. Coinsurances.com.

Medigap was designed to fill gaps that Original Medicaid does not provide for — co-insurance, copayments, or deductibles. Original Medicaid coverage covers only 80% of medical costs if you have an outside doctor or hospitalization.