Medicare Supplement insurance plans are offered by private insurers. It addresses gaps in Medicare's original policy, like copayment, coinsurance, deductibles, etc. Plans F have the maximum coverage of any Medigap plan, and if you don't qualify for Medicare on Dec. 31, 2019, no one can use Plans F. If you qualify for Medicare, it's significantly costlier than its alternatives. If you cannot purchase Plan F, you may purchase another Medigap plan with the same coverage.

Currently, the Medicare Supplement Plan F enrollment has expired for eligible individuals. Currently you have the option of staying on Plan F. Or you can compare your choices and change your plan. Medicare Supplement Plans F are standardized Medigap plans that help you pay for the out-of-pocket expenses not covered by Medicare Part A. Standardized means the plans were designed to give you the same benefit no matter how you buy, except in the case of an unused plan.

Medicare Supplement Plan F originally aimed to be a comprehensive of the 10 standard Medicare Supplement Plans. Plan F is available to people enrolled into Medicare prior to January 1, 2020. Any person who is eligible to receive Medicare before January 1, 2020 is not allowed to enroll under Plan F.

Plan F is popular in many ways. Plan F was most comprehensive in its scope. Because most people simply need more coverage than possible, Plan F provides a quick and affordable choice. Knowing you'll have the most coverage is the most important thing to know, as it isn't something you could have done for a higher level protection. The popularity of Plan F has helped in decreasing the overall market price.

The better plans are offered by insurance carriers, the cheaper their prices will become as the competition becomes stronger. Although Plan F is typically the most expensive due to coverage, the ratio of coverage and cost tends to be good because there are so many insurers available.

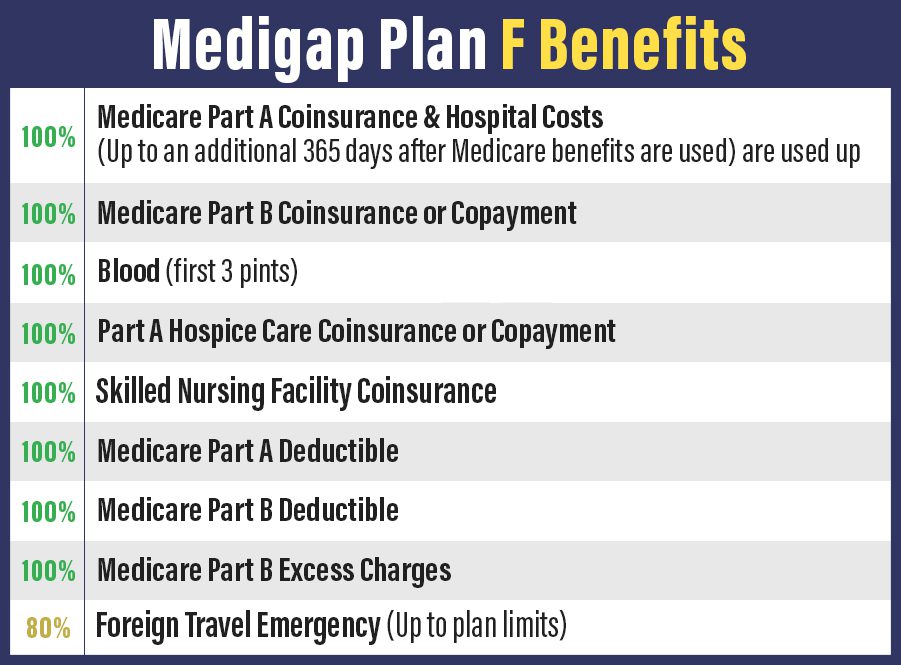

This is Medicare.gov's coverage for part A health care coinsurance and hospital fees for the first year following Medicare withdrawal. Adeductible. I've never done it before. Part A - Hospice insurance and copayments. Co-insurance and co-payments. Part B deductibility is available here. Since 2020 all Medicare users can purchase any plan that includes remuneration, this protection is available for patients with Medicare plans A and B. Part B – excess charges (when providers can charge more than Medicare approved amounts). Dedicated care and assurance. Blood transfusions.

Even though this plan might make sense if you were planning to buy Medigram Plan F, you have to keep a couple general rules in your mind while shopping. Generally, a plan will vary according to where a consumer is in the country and it therefore helps to compare costs to find out which is the best possible price. It also has to do with your personal preferences. It would also make sense to have Plan A instead of Plan B if your plan is cheaper.

Medigap plans do not cover any deductibles for a medical condition, Medicare Part A and Part B. Unless you are enrolled in the Medicare Advantage Plan, your premium will never be reimbursed for any co-insurance.

If you have a Medicare Advantage Plan or a Part D prescription drug plan, none of your copays or coinsurance costs for these plans will be covered by your Medigap plan. What Is Medicare Supplement Plan F? Plan F is simply one of the Medigap policies that is available and is currently the most popular plan. There is nothing unique about Plan F, but it is notably the most comprehensive plan available.

Medigap supplement Plan F, the most popular supplemental plan that helps retirees cover medical costs that Medicare doesn't pay. Retirees already in Plan F by year's end will be allowed to stay. Almost 60% of the 14 million people who have Medicare supplement insurance are in Plan F, according to CSG Actuarial research. Known as “first-dollar coverage” because people don't have to worry about costs the moment they walk into a doctor's office or hospital, or use a lab, Plan F is the most expensive of the Medicare supplemental plans.

The purpose of this site is the solicitation of insurance. Contact may be made by an insurance agent/producer or insurance company. eHealth and Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. We offer plans from a number of insurance companies. Download The FREE Medicare Guide Enter your email Invalid email address Get Guide Products Products Find Plans Medicare Part A & B (Original Medicare) Medicare Advantage.

What Will Replace Medicare Plan F? No plan completely replaces Medicare Part F, but the closest available is Medicare Supplement Plan G. Like Plan F, Plan G covers 100% of many benefits, including : Part A coinsurance and hospital costs Part B copays/coinsurance (not deductibles) Three initial pints of blood Part A hospice Skilled nursing facility Part A deductible Part B excess charges Plan G also covers 80% of foreign travel emergency healthcare after you meet a $250 yearly deductible.

That amount from 2020 to 2021 was 2.5%, which makes the 2022 deductible for Plans F, G, and J $2,490. For the standard Plan F , monthly premium rates are set by the individual private insurance companies. Costs vary based on your age, gender, tobacco use, state of residence, and how the plan is rated . Both the standard and high-deductible plans include a $250 annual deductible for foreign travel emergency healthcare coverage.

Are Medicare Plan F Rates Changing? There are two types of Plan F coverage options: a standard option that requires a monthly premium, just like any other Medicare supplement insurance plan. The other option is a high-deductible plan with a lower monthly premium. With the high-deductible Plan F option , you must pay your entire deductible amount before the plan will cover any associated healthcare costs.

Upon joining a Medicare Supplement Plan F you may continue that plan. After you enroll in Medicare Supplement Plans, you have guaranteed renewal protection until you pay the premium. It is possible to cancel your plan without paying your premiums or changing your plans. When you become eligible for Medicare earlier this year and decide on a delay in coverage, then the plan will remain available to all eligible patients. The late enrollment penalties for part A or Part B may be imposed by you, and the premiums are added.

Plan F is the most comprehensive and affordable Medicare Supplemental Plan in the US. The best-known plan covers 100% of all the benefits offered under the plan. In the United States, Medicare Supplement Plan E was discontinued in 2015 for everyone who became eligible for Medicare after January 1. However, Plan F is still offered by those previously covered by that plan. If you haven't been eligible for Medicare since Jan. 1, 2020 and have opted not to get covered, you can enroll in Plan F.

Part B coinsurance or copayment. Part B deductible. (Since 2020, new Medicare members can't buy any plan that covers the Part B deductible. However, this coverage is available for Medicare beneficiaries currently enrolled in Medigap Plan C and Plan F.) Part B excess charges (if a provider is permitted to charge more than Medicare's approved amount and does so).

Limits on Medigap Coverage Medigap plans only cover out-of-pocket costs associated with Original Medicare (Medicare Part A and Part B). If you have a Medicare Advantage Plan or a Part D prescription drug plan, none of your copays or coinsurance costs for these plans will be covered by your Medigap plan.

What Medigap Plan F covers Here's what Medigap Plan F covers, according to Medicare.gov : Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. Part A deductible. Part A hospice care coinsurance or copayment. Part B coinsurance or copayment. Part B deductible. (Since 2020, new Medicare members can't buy any plan that covers the Part B deductible.

Medicare Supplement plans that pay the Medicare Part B deductible will no longer be sold to those newly eligible. This change is part of the Medicare Access and CHIP Reauthorization Act of 2015 (MACRA). If you already have Medicare Supplement Plan F (or Plan C, which also covers the Part B deductible), you can generally keep it.

Medicare Supplement Plan F will be eliminated on January 1, 2020. If your current plans do not work, don't worry. You have unlimited options for the duration of your plan. However, you cannot get a new health care plan until your first day in the country.

Do Medicare Supplements insurance programs have the option for the future of Medicare? Unfortunately, Plan F cannot be used for new Medicare recipients beginning after January 1, 2020. These changes affect Medicare Supplement plan deductibles (Plan F and Plan C).