Medigap combines health benefits and Medicare Supplement Insurance to cover the gaps. Medicare provides coverage for a number of services and supplies. Medicare Supplement Insurance (Medigap) policies are available in a number of ways that can help you pay for some remaining health care needs, such as:

Medigap insurance is a solid retirement income plan. Medicare is the first coverage, but Medicare is supplemented by the Medigap Program. Is there an effective link between Medicaid and Medicare? There are 4 major things that you should learn.

Medicare in Spain is a federal health program that helps people with disabilities pay their own medical bills in most circumstances. This plan is also designed for the treatment of disabled persons under the age of 65. Medicare Supplemental Insurance can help pay for some of the extra expenses Medicare cannot pay. As Medicare supplement insurance covers some gaps in Medicare coverage, this is sometimes called Medigap coverage.

Unless you'd like to move somewhere else, you should check your Medicare plan before moving. If Medicare is your original coverage, it is generally permissible for Medicare Supplements to remain. The exceptions include deductibles and other premium perks if you own a Medicare Select plan. When you're using a Medicare Medicaid plan, make sure it has access to your new zipcode. The plan must be replaced when it doesn't work out, and the plan will be discontinued. You can change to another Medicare Advantage plan or to original Medicare if you move.

Find out how you can pay Medicare supplement costs without the need to buy insurance. These options may assist you in your financial needs.

Medicare is open to people under 65 who have disabilities and are under 65. This free enrollment right is only applicable in Medicare Supplement Plan A. Note: People enrolled in a disability program can also enroll in Medicare.

Medicare Supplements Insurance premiums are payable according to instructions given by the insurance companies that sold you this program. Medicare Supplement insurance is offered by Private Insurance Company and can assist in paying for the costs incurred by claiming services covered through Part A and Part B.

Usually, Medigaps pay part or the whole remaining cost once Original Medicare pays first.MediGap covers deductibles, coinsurance, or copayments. Medigaps may cover medical expenses that Medicare doesn't cover as a whole such as travel insurance.

Advantages of Medigap plan include higher monthly premium. It involves understanding different types of plans. No insurance (which comes under Plan D)

Medicare pays part of this amount and you're responsible for the difference. for covered health care costs. Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan.

If you have had at least 6 months of continuous prior creditable coverage, the Medigap insurance company can't make you wait before it covers your pre-existing condition. Many types of health care coverage can count as creditable coverage for Medigap policies, but they'll only count if your break in coverage was no more than 63 days.

Considering a Medicare Plan? Get online quotes for affordable health insurance I'm Looking for: Health Insurance Medicare Provide a Valid ZipCode See Plans Considering a Medicare Plan? Get online quotes for affordable health insurance I'm Looking for: Health Insurance.

Surplus line insurance Title insurance Travel Extended warranties & service contracts Medicare Complaints & appeals File a complaint How to appeal a health insurance denial How a small pharmacy can appeal a reimbursement decision Find companies & agents Fraud Report insurance fraud in Washington state Criminal Investigations Unit (CIU).

The Centers for Medicare and Medicaid Services (CMS) publishes the Medicare & You handbook that describes Medicare coverages and health plan options. CMS mails the handbook to Medicare beneficiaries each year. You can also get a book by calling 800-MEDICARE ((847)577-8574).

NEW! The Sale of Individual Market Policies to Medicare Beneficiaries Under 65 Losing Coverage Due to High Risk Pool Closures The bulletin below sets forth circumstances under which the Secretary has determined that issuers may sell individual market health insurance policies to certain Medicare beneficiaries under age 65 who lose state high risk pool coverage.

If you're able to buy one, it may cost you more. I have group health coverage through an employer or union. If you have group health coverage through an employer or union because either you or your spouse is currently working, you may want to wait to enroll in Part B.

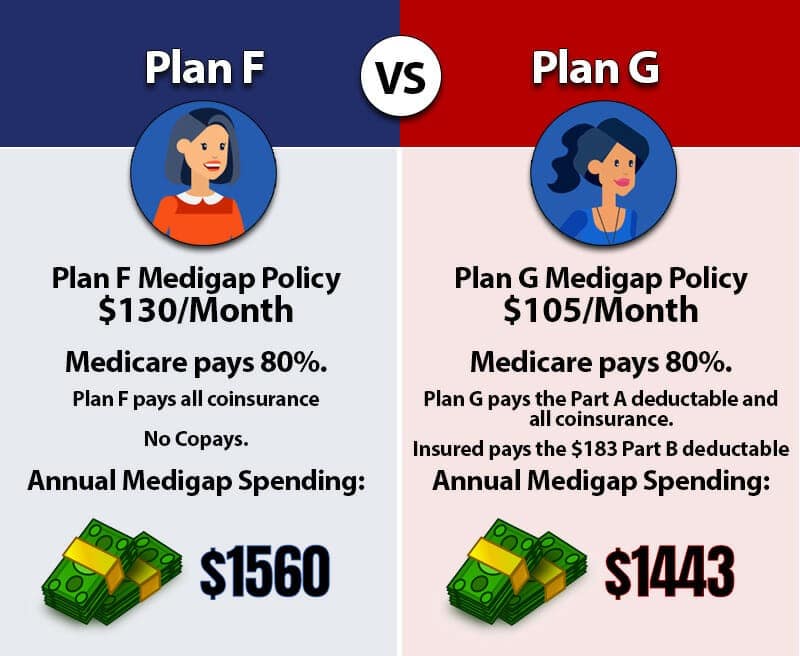

With Medicare as primary, the Medigap plan backs it up as a secondary payer. Medicare pays, in most cases, 80% of the Medicare-approved costs (after the Medicare deductibles), and the Medigap plan pays, with most plans, the other 20% and some combination of the deductibles. Medigap Plan F pays both of the Medicare deductibles and the remaining 20%, thereby filling in all the “ gaps” in Medicare and being full coverage.

Acting as a representative of Medicare or a government agency. Selling you a Medicare supplement policy that duplicates Medicare benefits or health insurance coverage you already have. An agent is required to review and compare your other health coverages.