The Medigrap supplement is a Medicare supplement that fills gaps in and is sold through private corporations. Original Medicare covers the full cost of the medical services and supplies provided to covered persons. Medicaid Supplement Insurance policies are available to pay a portion of med insurance's remaining health care expenditures including: Some Medicaid plans also cover services that Medicare cannot provide.

In 2021, Medicare celebrated 57 years of providing coverage. It became a law in 1965 and was offered as an option in 1964. At the same time, 19 million people benefited from the Medicare program. 61 million people were registered for this year's program. The Medicare program is only available to individuals ages 62 and older. Over the years other parts are also introduced. Coverage was extended in the past to include persons under the age of 65 with a certain type and severity of disability.

Medicare Supplements have been in operation since 1970. To enhance consumer safety, the federal government launched the voluntary Medicare benefit program that allows Medicare recipients to cover gaps.

1. 2020 Medigap plans are cancelled for a period of three years. The legislation was passed in 2015 that prohibits the sale of the Medigap program to the public that covers supplemental deductibles for Medicare and Medicaid.

Some of our patients have no Medicaid or QMB coverage, and may need Medigap insurance. Around 80% of the population purchases Medigap insurance. From 31 July 1992, the Medigap policy was uniform across the US.

Congress passed the bill H.R. 2 on April 14, 2015, which will eliminate plans that cover the part B deductible for new Medicare beneficiaries starting Jan. 1st, 2020. Those who enroll in to Medicare after Jan. 1st, 2020 will not be able to purchase plans F or C; however, those people who enrolled onto Medicare prior to Jan. 1st, 2020 will still be able to purchase plans F or C.

Consumer representatives at both the national and the State level report that Medicare beneficiaries have become knowledgeable about the 10 standardized plans and are comfortable choosing among them.

People who have this kind of coverage when they become eligible for Medicare can generally keep that coverage without paying a penalty, if they decide to enroll in Medicare prescription drug coverage later. , and you may pay more if you join a drug plan later.

The law expanded Medicare and established a new part: Medicare Part D . Part D is prescription drug coverage. Before Part D, Medicare didn't include this coverage. Part D officially took effect in 2006. The addition of free preventive services in 2010 In 2010, former President Barack Obama signed the Affordable Care Act into law.

The law made numerous changes to healthcare in America, including some to Medicare. The law added Medicare coverage for preventive care and health screenings and made these services free for Medicare enrollees. The law also reduced the out-of-pocket costs of using Medicare Part D.

Medigap plays in supplementing Medicare coverage. The Medigap market changed dramatically with the passage of the Omnibus Budget Reconciliation Act (OBRA) of 1990.

A Medicare Advantage Prescription Drug Plan, also known as Medicare Part C, is a type of Medicare plan that includes both medical and prescription drug coverage in one plan. These plans are offered by private insurance companies that are contracted with Medicare.

During the first three years of implementation of standardization policies, insurers offered less Medigap coverage. Almost every company exiting the markets had low market share in part due to the lack of cost savings of scale for marketing, claims processing and regulations relating to insurance products (MacCormack 1996 – 1995). Respondent surveys by all six state insurers show that carrier numbers and the overall industry share have remained stable for several years.

A recent Health Care Financial Review report from 2001 showed that 5.3 million of the Medicare beneficiaries under 65 had qualified for disability. The disabled population accounts for 13 % of Medicare beneficiaries but constitutes only 1% for Medicare beneficiaries. This is due in part to the fact that a person who is over 65 will not qualify for a 6-month open enrollment period.

The ability of insurance companies to impose pre-existing condition exclusions has been severely constricted since the enactment of a federal law called “HIPAA.” Under HIPAA, if an individual had health insurance coverage for a period of at least 6 months prior to their initial open enrollment period for Medicare, no pre-existing condition exclusion may be imposed.

You can buy a Medigap policy from any insurance company that's licensed in your state to sell one. It's important to compare Medigap policies since the costs can vary between plans offered by different companies for exactly the same coverage, and may go up as you get older. Some states limit Medigap premium costs.

The Medicare Prescription Drug Improvement and Modernization Act changed the way Medigap policies treated drugs. Depending on the plan, some could keep their old policies while others took the option to purchase new coverage. Those that had to buy new insurance had protection from rising premiums.

Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S. jurisdiction. Healthline Media does not recommend or endorse any third parties that may transact the business of insurance.

With a Medigap guarantee issue right, a person can buy a Medigap Plan A, B, C, F, K, or L that's sold by any insurance company in their state. In addition, the insurance company cannot deny or raise the premium due to past or current health conditions.

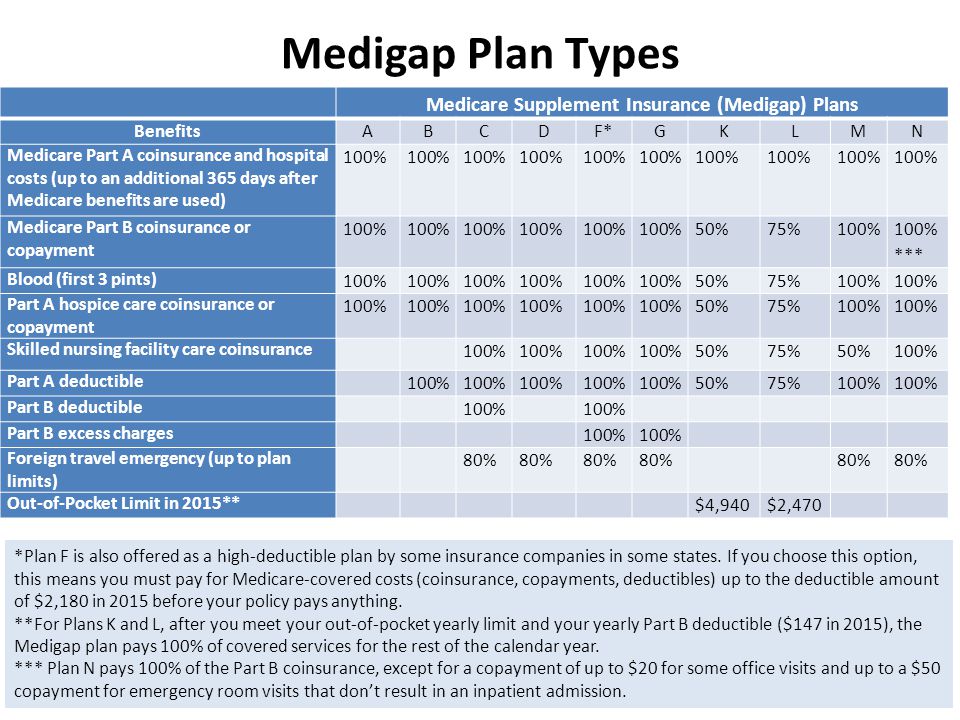

Products available Edit Medigap offerings have been standardized by the Centers for Medicare and Medicaid Services (CMS) into ten different plans, labeled A through N, sold and administered by private companies. Each Medigap plan offers a different combination of benefits.

Due to lack of availability and high prices, seniors often paid three times as much for coverage as younger people. When Did Medicare Advantage Plans Start? Medicare Advantage plans are private plans that date back to 1966. Medicare Advantage plans were higher-risk contracts; the policies agreed to take responsibility for their members' health costs.

Traditional Medicare, preferred by most beneficiaries, has not been improved in years, yet private Medicare Advantage plans have been repeatedly bolstered. It's time to build a better Medicare for all those who rely on it now, and will in the future.

A Medigap policy differs from Medicare Advantage plans. This plan offers Medicare benefits and a Medicare Medigap plan only supplements your original Medicare coverage. Payment for health coverage to Medicare and other health insurance providers and health plans.