You can switch to Medicare Supplement plans or switch to Medigap at anytime. We suggest changing the MediGap plan and/or enrolling a different policy only when there is enrollment protection referred to as a guaranteed issue. This can help reduce medical costs. You may be considered enrolled for Medigam for a temporary period if your insurance policy does not change. But many Medigap enrollee benefits can vary depending on location. The state now allows for the modification of its Medigap plan every year, while other states are not giving the same flexibility.

Medicare is often confusing like any large, complex system. The health care system can sometimes be tricky to understand. What can be confusing is whether a patient may qualify as a Medigap patient. The rules for a Medicare Supplement insurance program are different. We will explain the difference.

One in three Medicare beneficiaries buys Medicare Supplement plans, commonly called Medigram policies, because it fills the gap left by Medicare Part A and Part B.2. Web site for Medicare. The shift of the policy towards Medicaid.” Healthcare.gov.

Medigap has an enrollment period of six months. The term starts on July 30 after a beneficiary turns 65. During these months you can enroll in any 10 standard plans without medical underwriting. A health insurer cannot reject you or charge you more in the absence of a condition that you already had. Medicare beneficiaries can change their supplements anytime. In consequence, a request may be rejected without the permission of a person switching from a designated Open Enrollment period. An application can also have medical underwriting.

Consumer protection is now available through a new guaranteed issue rights system. While the increased access can give you greater flexibility, regulations can be very different in different states. According to your state laws, you are likely to be eligible for switching between a Medigap plan or switching between two insurers to gain more coverage or, in some cases, switching between Medicare Advantage and Medicare Medigap. In 2022 12 states will have a guaranteed year-round Medigap program and will offer more enrollment options.

If your insurance is not covered by Medigap, you can still apply and receive a refund – whichever occurs first after you receive a payment from Medigagap. Some pre-existing conditions may cause plans to become too costly to use or not be available. Because the medical underwriter will evaluate and decide how much money you should be spending on the plan. It is generally advisable to enroll in Medigap at age 66 in your first Medigap enrollment period and to keep the plan long-term.

If you decide to enroll into a Medigap program, you should apply during the Medigap Open Enrollment Period of six months. Your Medicare Part B open enrollment period is six months that begins on the same date. During your 6-month Open enrollment period, Medigap is available without any medical insurance, and is required.

If you buy the first Medigap insurance plan before switching to an alternative insurance plan it is not necessary to wait.

If your Medigap plan does not meet the criteria for a full Medicare or Medigap eligibility test, you may be eligible for a Medicare supplemental payment plan. This means that insurers will no longer refuse you coverage based on your health or underlying medical condition.

You can switch back to Original Medicare and get the same Medicare Supplement plan you had before making the change (you have guaranteed-issue rights to the Medigap plan) if the same insurance company still sells your former plan. If your former Medigap policy is no longer sold, you may be able to choose a different plan with guaranteed issue.

If you choose not to get Medicare Part B right away, then your Medigap Open Enrollment Period may also be delayed and will start automatically once you're at least 65 and have Part B. Your health status when enrolling in a Medigap plan can play an important role in which Medigap plan you choose, and your age at the time may determine how much you pay for it.

What Are Guaranteed-Issue Rights? The main way to avoid medical underwriting is if you have a Medicare Supplement insurance guaranteed-issue right . Some guaranteed-issue rights occur when: Your Medigap insurance company went bankrupt or ended your policy through no fault of your own. Your Medigap insurance company committed fraud and you are canceling your policy. You leave your current Medigap insurer because the company misled you.

Keep in mind that if you enrolled in your Medigap policy before 1992, your plan may not be guaranteed renewable and may cost more than the standardized plans currently available. If your Medigap insurance company decides not to renew your policy, you'll have a guaranteed-issue right to enroll in a different Medigap plan.

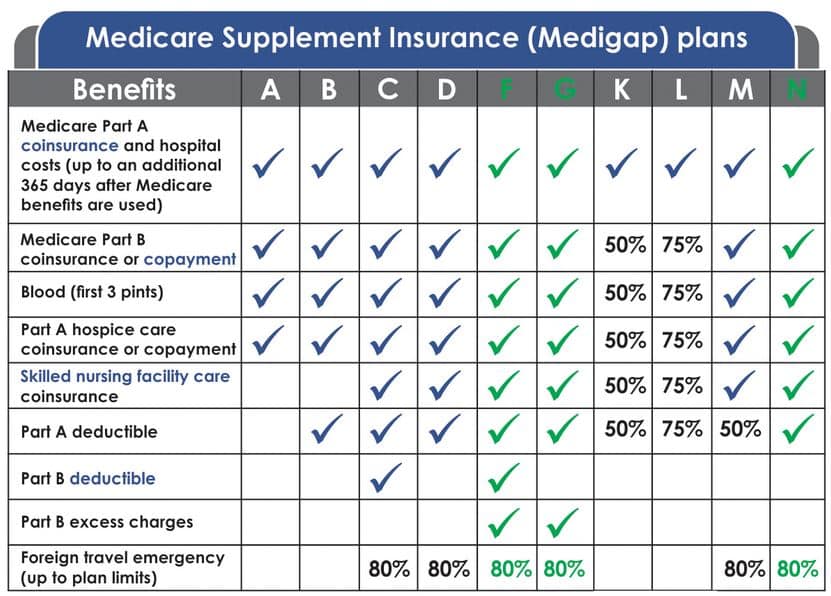

Periods Original Medicare Videos Medicare Supplement Medigap Plans Medigap Plan F Medigap Plan G Medigap Plan N High Deductible Plan F High Deductible Plan G Medigap Plan A Medigap Plan B Medigap Plan C Medigap Plan D Medigap Plan K Medigap Plan L Medigap Plan M Medigap Eligibility Medigap Coverage Medigap Enrollment Periods Medicare Supplement.

The company may then decide to raise the costs of your policy or deny you coverage outright. You have a Medicare Advantage plan and switch to Original Medicare with Medigap Medigap and Medicare Advantage ( Medicare Part C ) plans don't work together.

I'm joining a Medicare Advantage Plan Get more information about how Medigap works with Medicare Advantage Plans. How to switch Medigap policies Call the new insurance company and arrange to apply for your new Medigap policy.

You've been enrolled in a Medicare Supplement insurance plan for fewer than six months. Your insurance company may agree to sell you a new policy with the same basic benefits, but you may have to wait up to six months before the new plan covers any pre-existing health conditions.

There are several situations when you might have guaranteed-issue rights. Here are a few of them: You signed up for a Medicare Advantage plan for the first time, and decided you want to drop the plan and buy a Medicare Supplement insurance plan instead.

Medigap plans, however, are sold by private insurance companies. You must shop for these plans, and a licensed insurance agent can help you pick the one that offers you the best coverage at the best rates. Medicare Supplement plans carry letters to designate the benefits each type of plan offers.

We and the licensed agents that may call you are not connected with or endorsed by the U.S. Government or the federal Medicare program. Medicare has neither reviewed nor endorsed the information contained on this website.

eHealth and Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program.

In federal law you have a six-month open enrollment period that commences the day you're 65 years old. During this open enrollment period, Medigap companies must sell you a policy at the best available rate no matter the condition.

This happens during the 30 days immediately after their birthday without a medical screening or a new waiting period. The new policy must have the same or fewer benefits than the old policy. An Alphabet of Medigap Policies Across the nation, there is a confusing array of 10 Medigap policies offering different levels of coverage.