There are a number of Medicare Supplement insurance programs that consumers have found to be a little confusing. But everybody's interpretation of the plan varies from person to person. What are your benefits? Costs. Is this another thing? How does one compare different insurance plans in different areas of America? With a free internet comparison of plans, it will be easy and affordable for you to understand what each plan covers.

Each Medicare Supplement Insurance policy must be governed by federal laws and must be clearly marked by Medicare Supplement Insurance. Insurance brokers may sell you standardized policies identified by letters. All policies are similar in basic terms but others offer additional benefits to make it easy to pick a policy to meet your specific needs.

Medigap policies in Minnesota are standardized in other states. Each insurer chooses which Medigap policy to market, though the law may affect which ones. The insurance company who sells Medigap insurance policies.

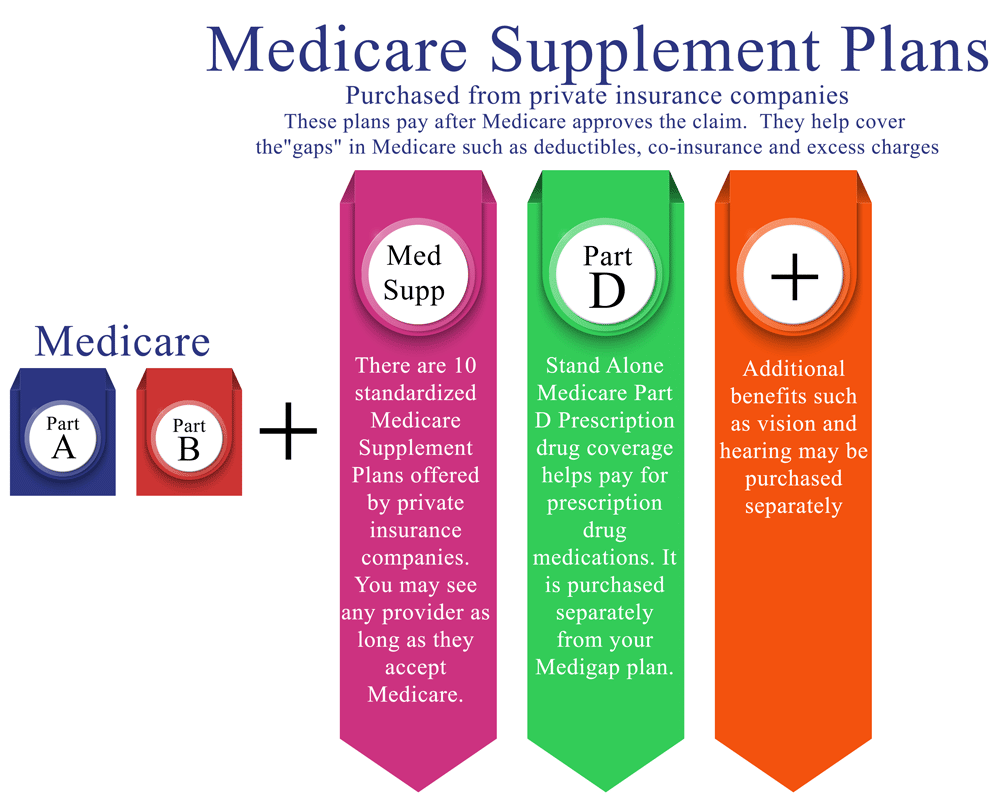

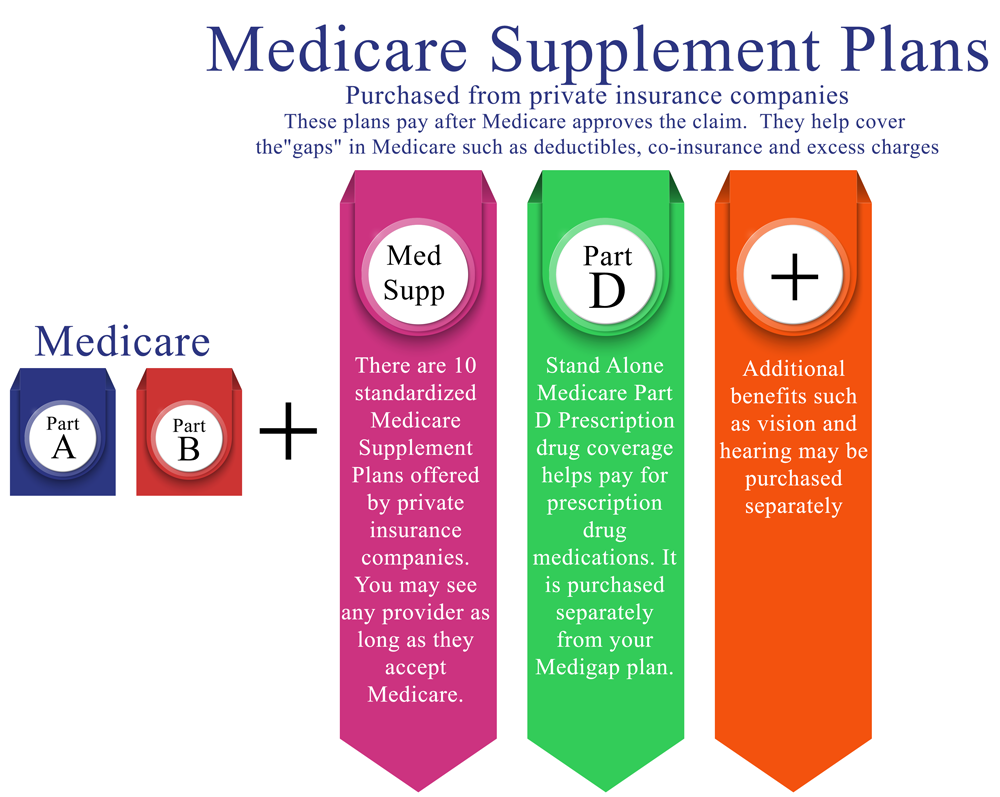

In the absence of an employer-sponsored Medicare Part B (Original Medicare) plan, Medigap may be necessary in some circumstances.The Medigap plan has been sold to private insurers that offer assistance in paying your premiums. Medigap is standardized, but some plans are not yet available.

The initial enrollment period is a short period during which you can enroll in Medicare Part A if you are already enrolled. Once you have joined Part B or Medicare you have the option to select another coverage option from approved private insurance companies.

When buying a Medigap policy, the best times of the year are the 6-month period beginning the first day of the month in which you turn 65 or older and enroll. After the period the ability to buy the Medigap policy is limited. Depending on how you treat the situation, each state has its own open enrollment period.

Medicare Supplement Plan F offers the most comprehensive Medigap plan and thus is the ideal Medicare Supplement plan. All insurance options are guaranteed until Medicare has paid a percentage. Medigap Plan F provides coverage for Part B deductibles and other premiums.

Medicare Supplement Insurance (Medigap) plans, including what they cover, how much Read Article Find Aetna Medicare Supplement Plans in Texas Aetna offers Medicare Supplement plans in Texas, including popular Plans F, G and N. Learn about Aetna Read Article Health Insurance Medicare Enrollment Guide Medicare Overview Medicaid Prescription Drug Coverage VA Benefits and Resources Retirement Retirement Social Security Taxes and Financial Abuse.

This can help many beneficiaries enjoy some peace of mind with a simple plan that has everything they need and nothing they don't. Visit centurymedicare.com Plan N: Best Medicare Supplement Plan for Cost Cost is always important when shopping for health insurance, and some consumers will even place it as their top priority. High-deductible Plan G and high-deductible Plan F are typically the two lowest-cost Medigap plans available.

Plans are insured and offered through separate Blue Cross and Blue Shield companies. Medicare Advantage and Prescription Drug Plans are offered by a Medicare Advantage organization and/or Part D plan sponsor with a Medicare contract.

Find Cheap Medicare Plans in Your Area Currently insured? Find Plans Medicare Supplement policies, also called Medigap, can prevent unexpected medical bills. Without a Medigap plan, Original Medicare policyholders will find tracking deductibles can be cumbersome and paying for regular medical treatment out of pocket can be expensive.

This plan covers the same benefits as the standard Medicare Supplement Plan G but offers a lower monthly premium due to its higher deductible. Find Medicare Plans in 3 Easy Steps We can help find the right Medicare plans for you today Remember that Medicare Supplement High Deductible Plan G comes with the same higher deductible as High Deductible Medicare Supplement Plan F, which is $2,490 in 2022.

FAQs Is Medicare Supplement Plan F the best Medicare Supplement plan? Medigap Plan F is considered one of the best Medicare Supplement plans because it provides the most comprehensive coverage. With Supplement plans, the best choice for one individual may not be the best plan for another person.

n general, policies with more comprehensive coverage for deductibles and care will have higher monthly premiums. View more Plan A Plan B Plan C Plan D Plan F Plan G Plan K Plan L Plan M Plan N Medicare Part A coinsurance Medicare Part B coinsurance 50% 75% Blood (3 pints) 50% 75% Part A hospice care coinsurance 50% 75% Skilled nursing facility.

It is no secret that the Supplement plans come with the most affordable monthly premiums. Depending on your state, high-deductible Medicare Supplement Plan F or Plan G will cost anywhere from $40-$80 each month. However, when you look at overall spending with the high-deductible Medicare Supplement plans.

Full Coverage Car Insurance Liability-Only Car Insurance Free Car Insurance Quotes Best Car Insurance Companies Cheapest Car Insurance Health Insurance Quotes Travel Credit Cards Medicare Find Plans 4 Best Medicare Supplement Plans for 2022 4 Best Medicare Supplement Plans for 2022 by Stephanie Guinan Reviewed by licensed agent Brandy Law updated Aug 30, 2022 Plan G is the most comprehensive Medigap policy in 2022, but it's also one of the more expensive Medicare Supplement plans, averaging $190 per month.

Medigap enrollment is available year-round for Medicare beneficiaries. The only stipulation for admission to a policy is the need to answer underwriting health questions in most states. Medigap Plan Comparison in Massachusetts, Minnesota.

Supplement (Medigap) plans available to most Medicare beneficiaries in 2022. Our easy-to-read Medigap plan comparison chart makes reviewing these plans easier than ever.

High deductible G is available to individuals who are new to Medicare on or after 1/1/2020. People new to Medicare are those who turn 65 on or after January 1, 2020, and those who first become eligible for Medicare benefits due to age, disability or ESRD on or after January 1, 2020. Effective January 1, 2023, the annual deductible amount for these three plans is $2,700.

Compare Plans Select which Medicare plans you would like to compare in your area. Get Quote Compare rates side by side with plans & carriers available in your area. Sources: Medicare FAQ is dedicated to providing you with authentic and trustworthy Medicare information.

Medigap Plans Medigap Plan F Medigap Plan G Medigap Plan N High Deductible Plan F High Deductible Plan G Medigap Plan A Medigap Plan B Medigap Plan C Medigap Plan D Medigap Plan K Medigap Plan L Medigap Eligibility Choosing Medigap Policy Medigap FAQs It's free and no obligation!

These increases in the limits are based on estimates of the United States Per Capita Costs (USPCC) of the Medicare program developed by the Centers for Medicare & Medicaid Services (CMS). Calculation of the OOP Annual Limits: The annual OOP limits are determined in accordance with section 1882(w)(2) of the Social Security Act.

Your best Medicare Supplement plan should match your cost and coverage. The most comprehensive insurance plans with deductibles have higher monthly premiums. See more Plan B. Plan C. Plan D. Plan E. Plan K. Plan L. Plan M. N. Price quotes for policies are from a sample of quotes from women in the age group of 65 and over. Depending on location and gender rates may be different. Plan G can be beneficial to people who want to have a low health bill that'll be around $990 per month. You'll get a little comfort knowing there's no medical emergency.