Our selections of top products are reviewed through an independent review process, with no advertisements influencing our selection. We might be compensated for the visit of the partner that we recommend. Please see the advertising disclosure. Medigap Plans are private insurance programs that sell private policies separate from Medicare. Medicare Supplement plans cover costs of coverage that aren’t reimbursed under Original Medicare. These may involve prescription visits, eye and dental treatment and other procedures. The best Medicare supplements providers are available at a competitive rate and have streamlined websites and intuitive interfaces.

Medicare is sold to private insurers but Medicare coverage is administered through the government. In other words, Medigap plan G provides the same Medicare benefits no matter who the insurer is. Most states have a set of 10 standard Medigap Plans. The insurer has the responsibility for the plan type, the cost and if there are a number of other benefits and also provides customers with support services. Each business possesses a unique strength and a unique weakness.

The Medicare Supplement plan is a primary insurance plan after Medicare pays a part of the amount for a period. The Medigap program is indicated in varying letters A through N. Medicare Supplements offers a range of health plans and a number of high deductible health insurance plans for the enrollment in Medicare. In each carrier, the benefits of the letter program are essentially the same. In fact, these three most popular Medicare supplement programs have high benefits. These plans are popular because the coverage, affordable costs and availability are factors that helps customers achieve overall satisfaction. This section will show how Medicare Supplement benefits can help you get your coverage.

Medicare Supplement Plans N are the best affordable options in our list of best Medicare Supplement plans. But that will also bring additional incurred expenses for you personally. Medicare Supplement N consists of Part A deductible and Part B 20 % coinsurance. Medicare plan N requires you to pay a small copay when you visit a hospital or a physician. In addition, you may incur excess charges on these plans for any state in which you receive treatment. This charge can be quite uncommon even in states that permit it. Medigap Plan N requires $20 in coinsurance for doctors & $50 in emergency visits.

Medicare Supplement Plan G allows you to manage your medical expenses without requiring a deductible. You will then receive full Medicare medical reimbursement. Currently Medicare Part B deductible is $2,500 or more. Your only medical expenses will cover all your costs outside your monthly premium. Because of the relatively low outlay, Medicare Supplement plans G are the best Medicare Supplement plans available until 2020. As a result of Medicare Supplement Plan F enrollment regulations, Plan G has quickly become the most used Medigram option. Medicare Supplement Plan G is a good option when:

Original Medicare only covers about 80 percent of your healthcare expenses. Medigap plan helps you control your expenses. Senior people may consider Medigap plans to the following extent.

Whenever you are considering Medigap, it is important to ask what providers' policies are. Insurance companies have age limits in a number of jurisdictions and the older the better the pay. Nonetheless, some insurers like UnitedHealth's AARP employ community-driven approach. Depending upon age, the premiums may be identical. Remember even community subsidies can still go up from their annual level, depending primarily upon the inflation factor. Insurance firms are regulated to use community ratings on insurance companies for assessing their customers' insurance coverage.

Please watch your calendar when you are approaching your Medicare eligibility period. Your open enrollment for Medicare starts on the day of your 66th birthday. If a user decides to enroll in Medigap during a free enrollment period, you may incur an unforeseen late fee. There are a few exceptions, of course, which will be described more fully later.

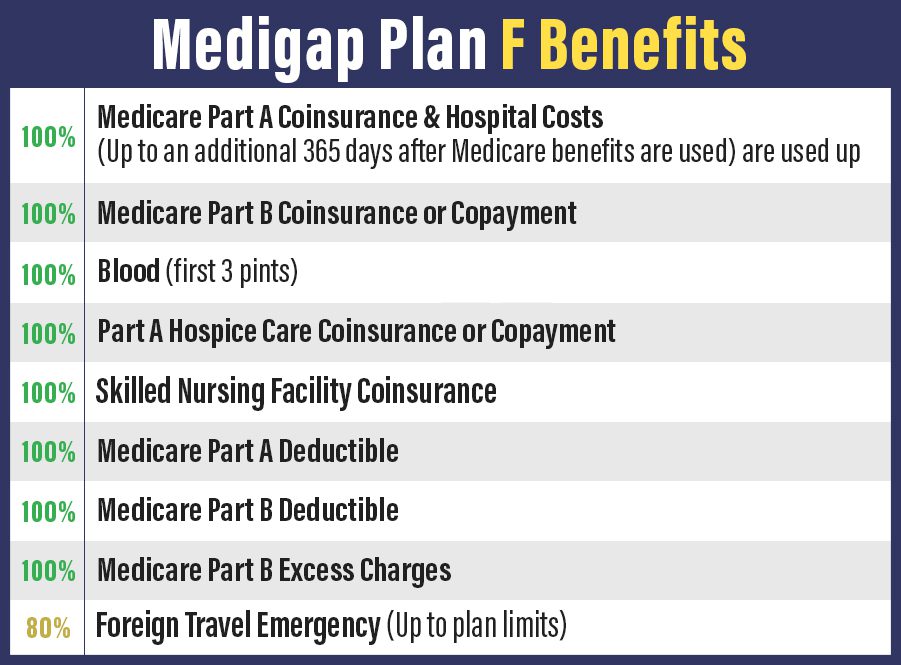

Plan F is the most used Medigas program. Plans are available for Medicare only if eligible before 2020 and due to comprehensive benefits, around 49% of all Medicare Supplement enrollers are using them.

Medicare Supplement Plan F is a comprehensive Medigap plan and is considered to be a good Medicare Supplement policy. All of the benefits will be covered by your original Medicare plan unless you pay your part. Medicare Part C coinsurance is included.

So, for example, Medigap Plan G has the same Medicare benefits regardless of which insurance company you choose. In most states, there are 10 standardized Medigap plan types. The insurance companies are responsible for which plan types they sell, what they charge and whether to include extra perks, as well as providing customer service.

Our licensed insurance agents are interested in pairing you with the best coverage for your needs rather than prioritizing a particular insurance company. What is the next best Medicare Supplement plan after Medigap Plan F is discontinued? For those newly Medicare-eligible, the next most comprehensive Medicare Supplement plan is Medigap Plan G.

Medicare Advantage plans serve as a substitute for Original Medicare, providing the same coverage plus additional benefits like prescription drugs coverage (Part D). Meanwhile, Medigap plans are sold by private insurance companies to people enrolled in Original Medicare to help fill the gaps of that coverage. Medigap plans provide standardized coverage and help pay for things like deductibles, coinsurance and copays.

only after you've paid the deductible The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. (unless the Medigap policy also pays the deductible). Compare Medigap Plans Medigap Benefits Plan A Plan B Plan C Plan D Plan F Plan G Plan K Plan L Plan M Plan N Part A coinsurance and hospital costs up to an additional.

If you're unhappy with your Advantage plan and switch back to a Medicare Original Plan (which you can do within 12 months of enrolling in the Medicare Advantage plan), you then become eligible for Medicare Supplement insurance. When Can I Buy a Medicare Supplement Plan? When it comes to Medicare eligibility , you can buy a Medicare Supplement policy beginning on the first day of the month you turn 65.

Anthem's optional dental and vision coverage add-ons are rare among competitors. It offers only a few Medigap plan types, though, and serves relatively few states. Pros Anthem offers several tiers of dental and vision coverage to mix and match with Medigap plans.

ure you receive the most complete coverage possible. What Are the Top Medicare Supplement Plans? Medicare Supplement (Medigap) plans pay secondary, meaning after Original Medicare pays its portion. Each Medigap plan is identified by a different letter, A through N.

This option supplies you with 100% coverage after Original Medicare pays its portion. Medigap Plan F covers the Medicare Part A and Part B deductibles and coinsurance. While on Medicare Supplement Plan F, you will never spend a dime on any Medicare-covered medical services outside your monthly premium.

Best cheap Medicare Supplement plan: Plan K If you are interested in the cheapest Medigap policy that still provides some coverage on top of Original Medicare, you may want to look into Plan K. Plan K is significantly different from many other Medigap policies since it provides only 50% coverage for Medicare Part B coinsurance, blood, Part A hospice, skilled nursing and the Part A deductible.

A person enrolled in Original Medicare who wants prescription drug coverage must purchase a separate Medicare Part D plan in addition to any Medicare Supplement plan. What is the most popular Medicare Supplement plan? Plan F, Plan G and Plan N are the most popular types of Medicare Supplement plans.

Due to these enrollment restrictions, Plan G is becoming the most popular Medicare Supplement plan type for new Medicare enrollees, as it covers the most Medicare costs of any Medigap plan type that's available to all beneficiaries.

Medicare Supplement Plan G's premium Are looking for catastrophic coverage If you enrolled in Original Medicare before 2020, you are only eligible for Medigap High Deductible Plan F. Those who sign up for Original Medicare in 2020 or later are only eligible for High Deductible Plan G.

A person enrolled in Original Medicare who wants prescription drug coverage needs to purchase a separate Medicare Part D plan in addition to any Medicare Supplement plan. Meanwhile, Medicare Advantage policies are only standardized in that they must provide the same benefits of Original Medicare, as the plans serve as a direct substitute.

Services: 15 States. Medigap offers: A, F, G, and N. Plan availability differs based on location. In some locations Anthem provides additional coverage at cost sharing for services not provided in standard Medigap plans. Anthem extras packages include the expense of tooth cleaning, dental treatments and eye examinations. Anthem is the 2nd biggest health insurer in America. Medicare Supplement Insurance is offered through the Blue Cross Blue Shield Collective as well as individually. In comparison, Anthem provides additional dental and vision coverage as a free option.