Medicap is the only insurance option available on Medicare and offers extra benefits. But both plans have different functions, they're not compatible. Medicare Supplement Insurance is available only for individuals with Medicare Part A Hospitalization and Part B Doctor and Outpatient services. There is no government program, but private insurance available that covers the cost of traditional Medicare. MediGap provides a 20 percent copayment for physicians or outpatients.

Medicare offers health benefits that are bundled for seniors. This package contains an alphabetic assortment of components containing various kinds of coverage and benefits. Nonetheless, Medicare presents challenges—and there are some problems which just are not covered. For this purpose, consider enrolling in Medicare Advantage plans. We gathered unbiased insights and research about coverage, cost, convenience and choices.

Our review system recommends the most suitable products, so advertisers don't influence our selections. You can get compensation for visiting a partner you recommend. Please see advertisement Disclosure for further details. Anyone interested in Medicare needs some serious considerations. How does Medicare Advantage help improve health care coverage?

If it isn't available, you can buy another Medigap policy. The Medigap policy can no longer have prescription drug coverage even if you had it before, but you may be able to join a Medicare Drug Plan (Part D) Part D adds prescription drug coverage to: Original Medicare Some Medicare Cost Plans Some Medicare Private-Fee-for-Service Plans Medicare Medical Savings Account Plans These plans are offered by insuranceWhat's the difference between Medicare Advantage and Medigap?

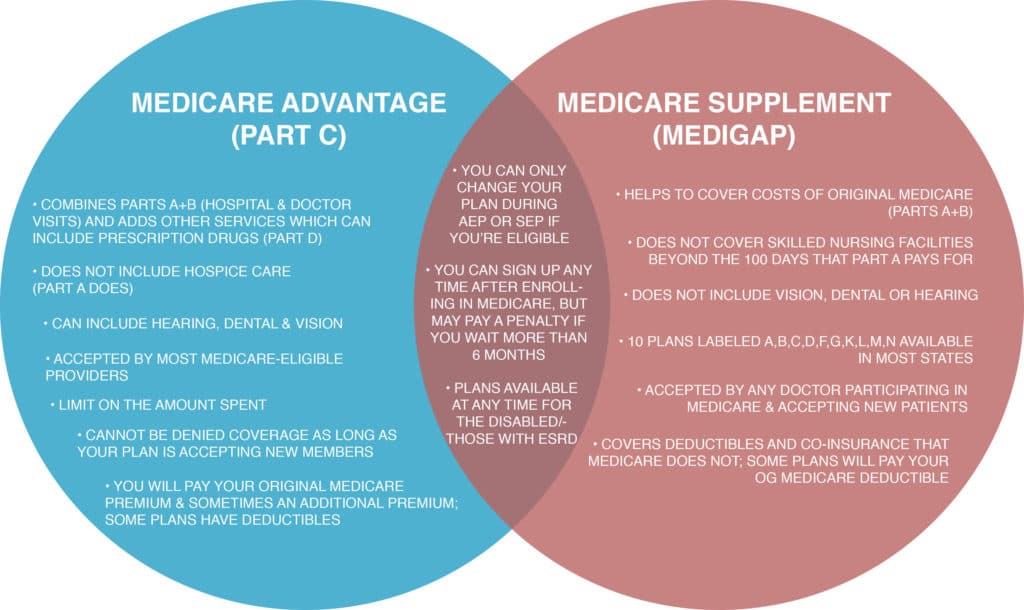

There are only two kinds of insurance, you must learn the basic structure of each. The biggest difference between Medigap and Medicare Advantage is that you have free access to doctors that offer Medicare while Medicare Advantage allows patients to receive care through their network of medical providers. Tell me the important part.

Medicare Advantage health plans have the same characteristics as private health insurance. Some services like office visits, labwork, and surgery will be covered by a small fee. Plans can also offer networks with HMOs or PPOs and all plans have annual limits for total expenses. Depending on the plan the benefit is different, and the regulations vary. Some pharmacies cover prescription drugs. Occasionally, s/he requires a referral from a health care expert, but some don't. Some doctors will charge for outpatient medical expenses while others will cover only the medical providers who belong to the PPO or HMO networks. There are other Medicare Advantage plan types. A low-interest plan is important for reducing your premiums.

If you go to an out-of-network doctor, the visit might not be covered or you might have a higher copayment. Most Medicare Advantage plans include prescription drug coverage. Those without are designed for enrollees who have drug coverage from a previous or present employer or another source. You won't have to buy a separate Part D. Keep in mind If you enroll in a Medicare Advantage plan.

Availability of plans Medicare - Affinity - Unlimited network of providers $ 0-Premium. Preauthorized medical services must be approved for HMO or special needs. Can it be moved/travelled with plans? Maybe, with the Medicare benefits. Extra coverage such as dental, vision and sound care: Cap on out-of-pocket costs There are no caps on Medicare, however medspa plans cover most out-of-pocket expenses. Medigapro's Plan K is capped at a minimum of $2,500 per participant. The eponymous title "Atlas" (, " A. ") is the name of an oxen-like shaped, shaped shape of the rock that resembles that of a rock.

The Medicare Advantage (Part C) plan is sold to consumers by companies like Aetna HealthCare Foundation or Humana HealthCare Foundation. They may not pay premiums or be higher compared to significant premiums on MediGap and prescription drugs insurance. Advantage plans provide health care services to patients and usually provide prescription drugs coverage as part of a package of services not regulated by Medicare. In 2025, 45% of Medicare recipients will opt out of the plan. The Medicare Advantage plan operates as an HMO/preferential provider organization.

It's logical for a person to consider utilizing the Medicare Benefits program while they are healthy and then switch back to normal Medicare when he develops a health condition that needs care at the hospital outside the neighborhood. Currently, switching between these Medicare forms and the Medicare Advantage plan is possible to all participants during the open enrollment time frame. All year the elections are conducted in the year October 15th to December 7th. I think we have caught something important. In some instances you won't get Medigap insurance.

It may be challenging figuring out how much health care you're gonna have in retirement because you don't know when you will be able to cover it all. While traditional Medicare offers good basics coverage, it only covers around 80 % of the costs approved by it for hospitals, physicians, and medical procedures. The remainder of the bill is personal responsibility and unlike coverage through the ACA there is no cap to the maximum amount of dollars paid for coverage each year. Give me a good reason to have heart bypass surgery.

The monthly premium for the Medicare Supplement is estimated to be $150 or $200, depending on the country you reside in and the insurance company you are using. Just as Medicare is good for shopping - 65-year-of-age people will have the opportunity to save up to $840 per year on the Medicare Supplement Plan, or $648 per year for the plan N in a state where the lowest-cost is the most common. “We continue to explore ways to improve the efficiency of private insurance programs and health coverage,” she said.

Medigap and Medicare Advantage plans provide many different benefits, depending upon health care needs. Medigap plans provide additional coverage for Medicare users who do not currently have a prescription drug plan. Similarly, Medicare Advantage plans offer similar insurance benefits to original Medicare, as well as additional benefits such as prescriptions and vision.

After registering with Medicare you have to decide on the Part D prescription medication program to get covered. If you do not have Part D insurance and want to purchase drugs later you might have been penalized permanently. You can avoid the penalty, however, by using insurance that pays more than Medicare's typical prescription coverage and can be billed for more than the cost of an employee if a prescription is paid. If you have this sort of drug protection in Medicare you can usually maintain it.

Many health care plans offer no additional premium and you should consider your options carefully. Baethke says the fee for Medicare Part B plans is paid in a monthly installment of roughly $165. Medicare Part B has co-insurance and the deductible is $226, Medicare.gov states, and once they meet their requirements, your premiums in Medicare Advantage typically are 10% of the Medicare-approved amount for most services and products, like durable medical equipment like glucose.

Some 59.8 percent chose the Original Medicare Part A and Part B coverage that covers hospital, doctor services and medical treatments. Some 81% of them supplement their health insurance with Medicare Supplement insurance, Medicaid or employer-sponsored insurance, while 48 million also purchase standalone health insurance. Medicare Supplement Insurance / Medicare - Medicap Plans is a federal government sponsored program. While it's a cheaper choice it's got some benefits.

Medicare supplement plans help you reduce the need for healthcare expenses. According to Jacobson, cost-sharing has helped to make it easy for people to get care without worrying that they owe money every time they visit their doctor. It's possible to go anywhere you wish. “I've seen almost every doctor.”. For instance in Arizona, you could fly to Minnesota and see the Mayo Clinic. Jacobson says the benefit is more important for those who are sick.

Medicare supplements (commonly called Medigap Plans) can be purchased through private health plans as they fill gaps in Medicare eligibility. Approximately 11 million people have access to the benefits offered by Medicare Supplement programs if they are eligible to receive a Medicare supplement. The Medigap program offers specialized coverage and helps with costs such as deductibles and co-insurance.

Whether you are applying through Medigap or other insurance companies after submitting an application is not guaranteed. Insurance companies have the right to:

Advantage Plans provide Medicare benefits similar to original Medicare with coverage for services not included in Original Medicare. Among those plans, supplemental benefits are provided by Aeroflow Healthcare. Plan owners are free to customize the package of benefits offered for chronic illnesses. For example, Cigna has introduced a vaccine delivery option for all Medicare beneficiaries with CP19.

In general, a Medicare benefit plan will cover you if you are also eligible for Medicare Part A (Health care and other health coverage) or Part B (Medicare and other health benefits) or live in the services. Enrolments may last for some periods. You can join or move to Medicare Advantage plans in a three-year window period.

Medicare originals include Part A (hospital insurances) and Part B (medical insurances). This coverage may be supplemented through a Medicare Part D prescription drug plan. If you are enrolled in Medicare and are enrolled in Parts A and B, you must take the necessary steps to obtain these additional policies.

It's not your only option to know what the Medigap and Medicare Advantages are. Only a third of people are "very happy" with making the right Medicare decision, according to the latest report by healthcare consulting agency Sage Growth Partners. Lets go over these:

Medicap insurance or Medicare Supplement Insurance can cover certain out-of-pocket expenses, like coinsurance or deductible fees. Medigap plan customers receive a monthly premium ranging from $199 to $299 depending upon their age or location. As well as your Part B and Part D prescription drugs, you pay yearly premiums. Medigap plans are standardized, meaning the same benefits are available to all Medigap Plan G policies by a specific insurer. Prices and reputation are important.

Medicare Advantage offers an alternative to Original Health Insurance which includes Part B and Part C coverages (generally Part D and sometimes extra benefits such as dental and vision coverage). Medicare Advantage can only be bought by private insurers with contracts for government services.