WebMD Connect to Health is an internet-based tool allowing you to locate health information. When purchasing a service, WebMD can charge you a fee. WebMD does not endorse the products, services, or treatments mentioned here. Learn how Medicare Advantage differs from Medicare and how best to choose a Medicare plan if you need it. Medicare Advantage and Medigap will provide a way for people to cover medical bills. Medicare Advantage combines with Medigap and provides coverage for more coverage, but there are significant differences.

Having done all that you need for life has made you happy. How to protect yourself against unexpected health and medical expenses that may easily consume your money once you are 65? Medicare does not cover your health coverage after 65. Medicare Part A covers 80% of outpatient hospital care and 85% of medical supplies. The 20% not included in Medicare will be able to be bought by private insurers.

All of our reviews are independent, and advertisers never influence our choices. You might be reimbursed by the companies we suggest. See Advertisement Disclosures for details. Almost everyone interested in Medicare will need to make several important choices. Which is a Better Option for Medicare Advantage than Medigap for Supplementing Your Original Medicare Plans?

Medicare Advantage Health Plan has the same features as private healthcare. Most services, including office visits, laboratory procedures, and many others, come with a modest co-payment. Plans can provide a network with an HMO/PO plan and most plans limit total costs annually. There are different plans that have different benefits. Most insurance companies sell prescription drugs. Many people require referrals to specialists while other people don't. Some may pay some out-of-network services and others may just cover physicians and hospitals that are within the HMO or PPO networks. There are many more Medicare Advantage plan types available. It's critical to pick out an insurance policy that offers a low annual premium.

Medigap or Medicare Supplement Insurance is a Medicare supplement program that replaces Medicare coverage in areas you don't know about. Medigap plans typically do not cover eye care, long-term care or home care. These can also be helpful in specific kinds of protection, such as health insurance for trips and frequent medical emergencies. The Plan N Medigap provides foreign and hospital visits, as well as emergency visit expenses, which cost $50. Medigap plans F and E cover the 20% service charge Medicare does not provide. Medigap does not offer medical coverage, so Medigap is not affiliated with Medicare Advantage.

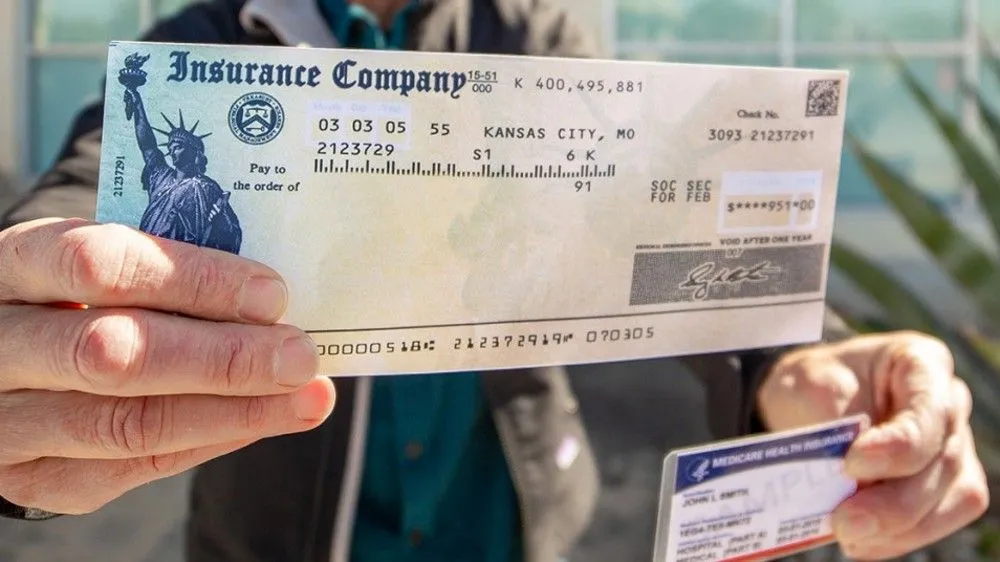

Each insurance program must be in conformance with federal and state laws that protect you, and should clearly be called Medicare Supplement Insurance. Most states require standardized plans for insurance that have letter. Most policy types have similar basic advantages, and some also provide additional benefits so that you can choose the policy which best suits you. In Wisconsin, Medigap policies are standardized differently. The insurer decides on what policy they want sold and state regulations can determine what they sell. Insurance company selling Medicare insurance:

Extra charge 661 in 2020. 3310 in 2020 * Plans F or G have high-deductible plans. If you opt out of a Medicare plan you have to cover Medicare-covered costs (Coinsurance and Co-payments) up to 24990 before you pay any policy premium. Plan B is not available if a person has previously been approved to receive a Medicare supplement on or after December 1, 2020.

Once you enroll with Medicare one major decision can be made about securing Part D prescription drug coverage. If he or she doesn't get Medicare coverage or buys drug insurance at the end of the year you could lose all of your benefits permanently.11. You may avoid this penalty by purchasing the creditable prescription drug coverage, which is prescription drug coverage from an employer. You'd need a prescription drug coverage that costs about twice the standard prescription drug premium in most cases. Typically you will have drug coverage if you qualify for Medicare.

Medicare Supplement plan costs average $63/month for 2022. The rates are, however, varying between $40 and $400 a month. The ideal Medicare Supplement plan will depend upon the insurance policy that offers the most coverage options for you as a person. When considering your needs for medical care and need additional assistance in travel emergencies, consider how much coverage the different health plans offer. Using Medicare Part A plans will protect you from high costs of healthcare. Tell me your surgery is coming..

Medicare Advantage plans are sold to the public from private insurance companies that are Medicare-regulated under branded names. The premiums are lower for Medigap policies compared with the premiums. Medicare Advantage policies also cover physicians and usually cover prescription drugs and services without Medicare coverage. In 2021, a majority will opt for the same health care system as current health. Most Medicare Advantage plans operate in the manner of HMOs, preferred provider organizations, or PPOs.

Medicare Supplement plans are standardized, unlike traditional health plans in which policy differences are between providers. The benefit of a given plan letter is the same. The Medicare Supplement Plan G will be similar to the Plan G offered by Aetna. The rates will vary however since the companies will use their own pricing structure. Then, take into account their current financial strength, as well as rates that have gone up. Many firms offer low rates and increase rates more rapidly if you get older.

Plan G is among the best known Medigap programs available. Plans F only offer eligibility to Medicare beneficiaries if the program has not yet expired in 2019. However, due to their comprehensive benefits, approximately 49% of Medicare supplement beneficiaries choose them. Plan G holds 22 % of the business and is the most popular option for those with new Medicare coverage.

Medicare Advantage insurance is a public health program under Medicare which usually covers prescription drugs or Medicare Part D. Typically these plans cover services including vision, dental, disability services, home health services or other medical services which were not covered by original Medicare. All of the benefits are provided under the Medicare Advantage plan and can be combined with the other Medicare Advantage benefits. The cost of insurance varies depending upon your specific insurer.

A federal government website managed and paid for by the U.S. Centers for Medicare & Medicaid Services. Medigap plans usually don't cover vision, hearing, long-term care or at-home care. However, they're useful for specific types of coverage, such as health insurance while traveling or frequent emergency care. For instance, under Medigap plan N, foreign emergencies and hospital visits are covered, while emergency visits cost $50.