Idaho's Medicare Supplement policy is now amended. Idaho's legislature recently voted to expand options and consumer protection to Idaho seniors. The State Insurance Commissioners' Office has announced that a temporary rule on Medicare Supplement Policy has been approved by Governor Little. The bill is expected to go into effect April 22 2023. The proposal was negotiated as necessary. IDAPA 1804.10 was released in November 2013 as the Admin Bulletin Volume 21-11 and has two major modifications effective on February 28, 2020:

Although Medicare is a state program, states can use various rules to comply with basic Medicare requirements. Most countries have implemented regulations that ease seniors' ability to modify Medigap plans. This article highlights individual Medicare regulations and their respective countries. Find a good plan today.

On the other hand, broader guaranteed issue policies could result in some beneficiaries waiting until they have a serious health problem before purchasing Medigap coverage, which would likely increase premiums for all Medigap policyholders. A different approach altogether would be to minimize the need for supplemental coverage in Medicare by adding an out-of-pocket limit to traditional Medicare.

One in four people under conventional Medicare (25 percent) were covered under private health insurance in 2015, called Medigap. The report provides an overview of the enrollment process for Medigap, and analyzes consumer protection based on state and national law.

Plans must comply with federal regulations restricting how they operate. Most states now require Medigap Plans to provide a higher level of protection than federal regulations deem necessary. Medigap Plans have varying operations in the various states.

Guaranteed Issue Right is protection for the Medicare participants in some cases. Those rights prohibit insurers from refusing to provide certain benefits to a Medicare / Medicaid / Medica / Medicaid / Medicaid beneficiary who meets specific requirements. The beneficiaries of the guaranteed rights should follow MACRA when determining a plan for the benefits they are pursuing. Only people who had Medicare Part A prior to January 1, 2020 could apply for Medicare Supplements. Similar Open Enrollment Periods and guarantee rights allow for enrollment on a Medicaid Medigap plan without under-writing health questions. Those receiving Medicaid before January 1, 2020 are required to follow MACRA during open enrollment periods.

The most convenient time to purchase a Medigap plan is during an Open Register period of six months with Medigap. In many cases, it's easier to find cheaper and more options. During that period you may purchase any medical insurance offered in your state unless your medical conditions have been severe. Typically, this period starts from your last month of life when your age is 55. This information is not rescinded nor re-used. Once you've finished your enrollment, you may have no chance of buying any insurance from Medigap. It is possible to get one for less money, as the price is influenced by previous or current medical problems.

Medicare Medigap Plan is nationally uniform. In addition to California, the United Kingdom offers different kinds of Medigap plans. The state includes Minnesota, Wisconsin and Massachusetts. Instead of a typical letter plan, they offer greater flexibility with regards to coverage. Wisconsin has 3 customized Medigap plans. In Wisconsin, three different plans are available: How does a doctor choose a Medicare plan? Massachusetts has three Medicare options.

Several different states regulate Medicare. These rules cover yearly birthday rules, guaranteed rights for issues of insurance, disability coverage obligations and exorbitants. Almost 60% of the people enrolled on Medicare are in states with state-specific regulations. The regulation gives the public more choices about the Medicare Supplements policy than the initial enrollment process.

When you enroll in Medicap you will find that some plans cover excess charges while some don' t. This can determine whether the person enrolling in the policy is successful or not. Under the following states, policy owners are not obligated to incur excessive charges because these cannot be tolerated.

Some countries allow insurance companies to adjust their Medigap policies without a health underwriter's question. How do I find my Medicare plans? California allows you to switch to any carrier no matter what your present plans are. Louisiana requires you to be on the same carrier.

The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. for the year. Foreign travel emergency coverage with Medigap policies has a lifetime limit of $50,000. Find out before you go Before you travel outside the U.S.

If you had creditable coverage for two months before you purchased a Medigap, your policy could only impose a four month waiting period, instead of six months. If you had six or more months of prior creditable coverage, Medigap insurers must cover your prior medical conditions immediately. Keep in mind that you cannot use creditable coverage to reduce your pre-existing waiting period if you had a break in coverage of more than 63 days.

Medigap insurance companies usually have medical underwriting permission in order to decide if a claim is accepted or not. But you may purchase any of the insurance policies offered by Medigap at a similar price as for people with good health. Please find out where it is:

If someone has a Plan F or G with high deductible, and they change to a different Medicare Supplement Plan F or G with high deductible during the annual guaranteed issue (Birthday Rule), does their deductible start over? Maybe.

A prior or pre-existing condition is a condition or illness you were diagnosed with or were treated for before new health care coverage began. The wait time for your Medigap coverage to start is called a pre-existing condition waiting period . You can avoid such waiting periods if you buy your policy when you have a guaranteed issue right.

The federal law for the combination and reinsurance of employers is very different from that for Medicare.

Voluntary group cancellations mean removing your coverage for the group. In some cases the coverage of groups is higher versus the Medicare program. Having a group terminated may improve your wallet. In general, choosing to stop having medical insurance doesn't necessarily mean you can't expect unexpected situations to happen. Your location could, however, be excluded under these regulations. It's possible for you to switch from employer insurance to Medicaid with this guarantee if you reside in one of the following states. How do I find a Medicare Plan?

Oregon and California had Medigagap birth rules. The new Medicare Supplements Act is aimed to protect Medicare's beneficiaries from being deemed disabled. The state includes California, Illinois, Louisiana and Nevada. In all four states, rules governing birthday celebration have varied.

Medigap plans are standard across many states meaning there are similar benefits. There are only two exceptions - Wisconsin, Minnesota, and Boston.

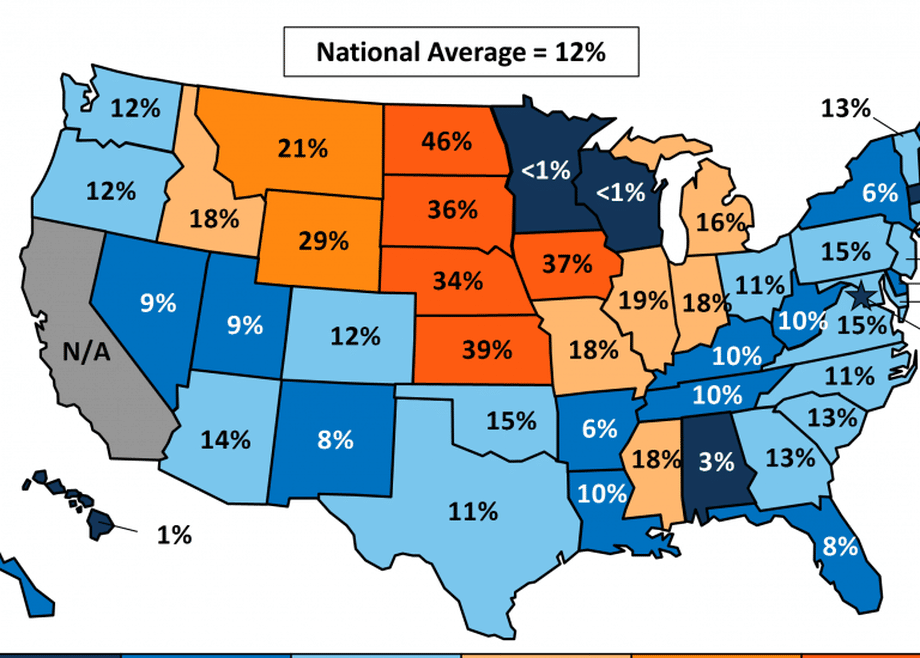

These data include the number of policyholders as of December 31, 2016 for each state, insurance company, and type of plan sold. The number of covered lives represent a snapshot of enrollment at that time, rather than average enrollment over the course of the year. This analysis used data from 49 states and the District of Columbia excluding California because only a small share of companies.

Mediga states vary. Several state legislatures have introduced legislation to allow seniors to switch to Medigap programs and to allow people under 65 to join Medigap programs. In the US and CT, Medigap plans are guaranteed year-round.

Does my insurance agent receive a commission for selling me a Medicare Supplement policy? Idaho Medicare Supplement rules permit insurance companies to pay commission to agents for the sale of Medicare Supplement policies. The rule ensures commissions are paid regardless of the age of the policyholder, guaranteed issue status of the policyholder, or any other such bases.

The Medigap plan is standard across the country. The Medigap plan is offered in three states. This includes Wisconsin, Massachusetts and Minnesota. Unlike traditional letters, these states offer better coverage options.

Find out before you go Before you travel outside the U.S., talk with your Medigap plan or insurance agent to get more information about your Medigap coverage while traveling. For more information Find a Medigap policy. Call your State Health Insurance Assistance Program (SHIP) . Call your State Insurance Department.