When an individual enrolls with Original Medicare, the insurance company cannot reject their eligibility unless it is due to an illness that's preexisting. Likewise, Medicare Advantage (MA) plans cannot refuse to accept applications from people who qualify for Part B and have end-stage kidney disease if they are eligible. However, if your medical condition is not deemed to be predominant, your Medigap benefits may be delayed for as much as six months. The wait period for Medicare Part B Medicare Supplement is known as the wait period for Medicare. The wait is effective for six months.

The Medicare Supplement is provided as part of your health insurance policy. If you do not receive medical care within six months, then you may be covered under a supplementary policy. The symptomatic list for cancers and cardiovascular disease is asthma. The department has said nearly 50% of people with underlying conditions have pre-existing illnesses. How do I find suitable medical coverage? In a few simple steps. The onset and severity of preexisting health conditions can hinder the application and approval process.

If you maintained six or more months of prior creditable coverage, the Medicare Supplement provider may not impose a waiting period but must cover all your preexisting medical conditions when the policy becomes effective. However, if you did not have creditable coverage more than 63 days before getting a Medicare Supplement plan, then the Medigap company can impose a waiting period.

Tell me how Medigap can refuse treatment if there's a medical problem that has lasted for a long time. Medigap's policies handle preexisting conditions a little differently. Medigap plans are the best way for you to avoid any problems that may arise. You will be approved no matter the state in which you reside. That does not mean you have any immediate coverage. Tell me the answer.

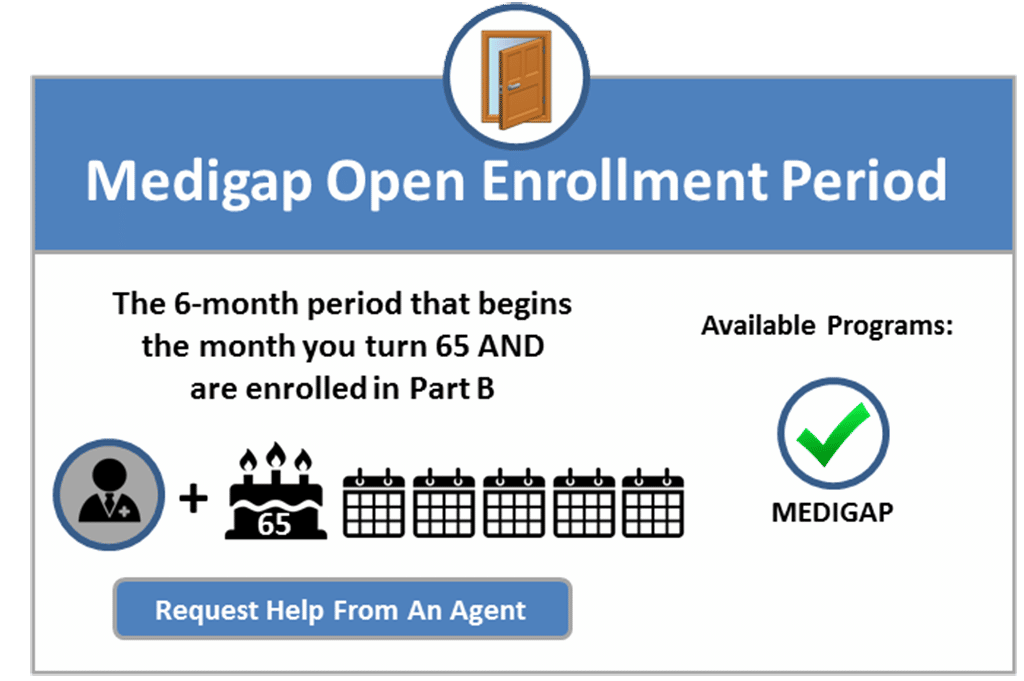

If you miss this open enrollment period and decide to purchase a Medigap plan, you may be denied coverage or charged a higher premium for a supplemental plan. However, if you have supplemental insurance through another provider after the initial enrollment period has passed, you may qualify for a special enrollment period.

One in four Medicare recipients have private insurance to pay for deductibles and other costs. This article provides a comprehensive look at Medigap enrollment and analyses consumer protections under federal laws affecting beneficiaries and implementing Medigap.

Medicare Advantage may help. If you qualify for Medicare before age 65 but can't get a Medigap policy in your state, you may be able to sign up for a Medicare Advantage plan after signing up for parts A and B. Until recently, people with end-stage renal disease couldn't enroll in Medicare Advantage plans. But those rules changed in 2021.

I want to buy Medicare supplements and have them for the same amount but with different benefits for you. When you get Medigap policies at other dates, insurance carriers will either decline you or charge more for the same.

Unless you bought a Medigap policy before you needed it, you'd miss your open enrollment period entirely. Outside open enrollment If you apply for Medigap coverage after your open enrollment period, there's no guarantee that an insurance company will sell you a Medigap policy if you don't meet the medical underwriting requirements, unless you're eligible due to one of the situations below.

Even when you enroll on Medigap, there may be pre-existing condition waiting periods to be met. There seems to be an inconsistency in our minds. Tell me a little about that. However, you cannot be denied enrollment during your Medigap first enrollment period. Do not worry about it.

Some Medicare Supplement plans may charge you a higher premium, however, and you may have to wait up to 6 months before the policy will cover costs related to your pre-existing condition. If you have had continuous and creditable coverage for your condition through another form of insurance for 6 months prior to your purchase of a Medigap policy, this waiting period may be waived.

How do you prevent the delay? Examples of credible coverage are the following: Contact a previous insurance provider for a report to see if they are rated “credible”. How can we avoid Medigap waiting period?

In some cases, the Medigap insurance company can refuse to cover your out-of-pocket costs Out-of-pocket costs Health or prescription drug costs that you must pay on your own because they aren't covered by Medicare or other insurance.

Different companies may have lower prices or easier enrollment guidelines. So while one company may deny coverage for your preexisting condition, a broker can guide you to others that won't. Medicare Supplement helps pay expenses Medicare doesn't cover.

r up to 365 days after Medicare benefits are used up. If you are in a pre-existing condition waiting period and you are hospitalized for a car accident, which is not a pre-existing condition for you, your Medicare Supplement insurance plan may cover your hospital coinsurance. However, for example, if you are in a pre-existing condition waiting period and you are hospitalized for an asthma-related health problem and asthma is a pre-existing condition for you, you may have to pay your hospital coinsurance out-of-pocket.

If you missed a prepayment period for OEP, you could be underwritten by your physician. You could also choose some alternatives. Option to enroll in Medigap for a missed initial term:

What Pre-Existing Conditions Are Not Covered by Medicare Supplements? The pre-existing conditions that cause denial for a Medicare Supplement plan vary by carrier. However, some individuals won't qualify for Medigap because of chronic issues. Some examples of pre-existing conditions that can disqualify Medicare beneficiaries for Medigap plans include the following.

You might be able to avoid or shorten the pre-existing condition waiting period if you had at least six months of creditable coverage before applying for the Medicare Supplement insurance plan. Creditable coverage could be individual health insurance, group health insurance (such as from an employer), TRICARE (military retiree benefits), and more.

Does Medications cover the cost of Medigap treatment? That would mean Medigap is not covered under any insurance. Medigap insurance is offered to those who apply during your Medigap open enrollment period.

Most forms of health coverage count as creditable. Here's how this works: your pre-existing condition waiting period is reduced by one month for each month you were enrolled in creditable coverage prior to purchasing a Medigap. If you had creditable coverage for two months before you purchased a Medigap, your policy could only impose a four month waiting period, instead of six months.

Those who qualify under Medicare Supplement Insurance are entitled to 30 days to register each calendar year. During the period you may purchase Medigap policy without any medical underwriting or wait time.

It can't be changed or repeated. After this enrollment period, you may not be able to buy a Medigap policy. If you're able to buy one, it may cost more due to past or present health problems. During open enrollment Medigap insurance companies are generally allowed to use medical underwriting to decide whether to accept your application and how much to charge you for the Medigap policy.