Medicare is the insurance for older adults. The book has an alphabetic collection of components offering various kinds of coverages and benefits. But Medicare does have challenges. Some are completely inaccessible and some haven't even been fully accounted for. For this gap, you should consider joining Medicare Advantage or Medicare Supplement plans. We gather independent information from industry experts to provide you with unbiased information and research on insurance costs, benefits and choices.

Medigap plan F, a more expensive plan, pays for Part B deductibles while covering the 20% cost of services Medicare doesn't pay. Medigap plans do not provide prescription drug coverage, and Medigap cannot be combined with Medicare Advantage. But Medigap plans are a way to tweak your Medicare to your specific situation while covering larger expenses.

Medicare Advantage out-of-pocket expenses in 2022 can range from $0 to $7,550 per year. Source: U.S. Centers for Medicare & Medicaid Services Cons of Medigap Plans Costs are the leading disadvantage of Medigap. Medigap plans tend to have higher monthly premiums than Medicare Advantage plans.

Our selection of the top products has largely been made by independent testing and advertising has no impact on our selection. In some cases, the partners recommended by us are compensated. See the advertising disclosures for further information. All Medicare-enrolled individuals face some decisions. What is the best plan to supplement Medicare versus Medicaid Advantage for a new patient?

Aetna Medicare Advantage plans are private health insurance plans that are designed to provide coverage for Medicare-eligible individuals. These plans typically cover the same benefits as Original Medicare, but may also include additional benefits such as prescription drug coverage, vision and dental care, and hearing aids.

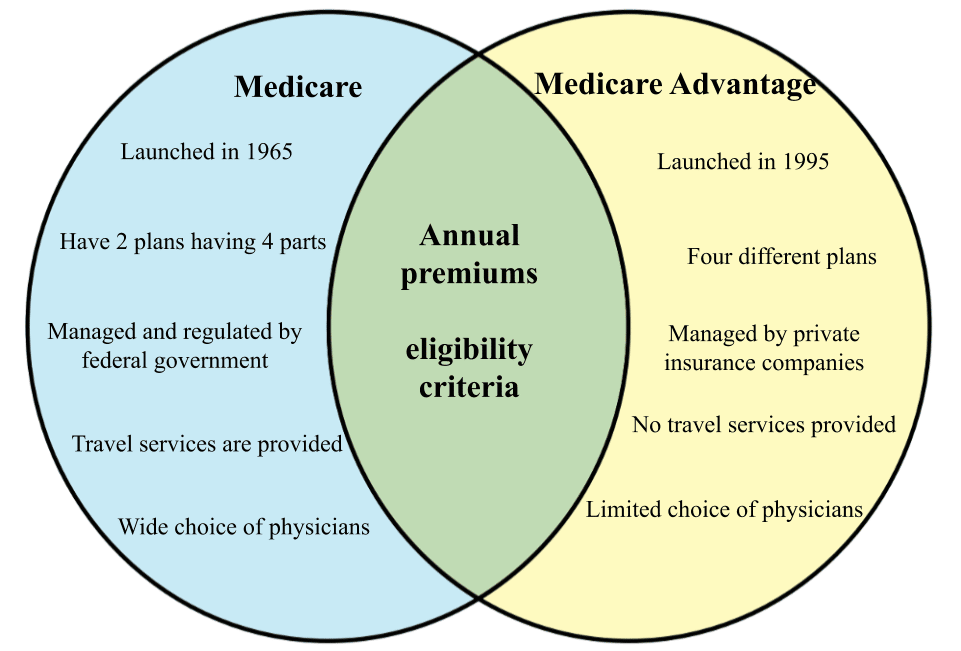

Choice of Doctors Original Medicare allows you to use any U.S. doctor or hospital that accepts Medicare, and most do. Most Medicare Advantage plans restrict you to using physicians in their network and may cover less, or none, of the expenses of using out-of-network and out-of-town providers.

If you have Original Medicare and a Medigap policy, you may also benefit from a Medicare Part D prescription drug plan to help cover prescription drug costs. How Are Medicare Advantage and Medigap Different? With a Medigap plan, you have access to any doctor or provider who accepts Medicare.

Once you decide to buy Medicare separately, the next step is finding which private insurer can offer the most protection for you.

Original Medicare vs. Medicare Advantage When choosing between an Advantage plan and Original Medicare plus Medigap and a stand-alone prescription drug plan, you need to take into account how much healthcare you expect you will need in the coming year in order to determine your anticipated costs. What It Covers Original Medicare (Parts A & B) Part A: In-patient hospital and skilled nursing care.

Medicare Advantage plans resemble public health plans. Most services, like office visits, labwork, surgery and many others, include an extra fee. Plans can also offer an HMO network and each plan sets yearly limits for all expenses. Almost all of these plans have corresponding advantages and regulations. Many of these companies also cover prescription drugs. Often it requires the recommendation of a specialist, while others don't. Some providers may pay a portion of out-of-network medical costs and others will only cover physicians and hospitals within their network. In addition, Medicare Advantage has many other plans. Selecting a plan that does not require any monthly premiums can help you.

Find a Medicare Plan that Fits Your Needs Search 200+ Medicare Plans in Your Area Get Started What is Medicare Advantage? Medicare Advantage is private health insurance through Medicare that often also includes prescription drug coverage, or Medicare Part D. The plans usually provide coverage for things like vision, dental, disability services, home health, and other health care needs not covered by original Medicare.

Medicare Advantage policy – C – is available by private insurance providers under branded brands such as the Aetna Humana and Kaiser Foundation. The insurers may not offer any premiums compared to premiums that are higher on Medigap or prescription drugs insurance policies. Medicare benefits are available to physicians and hospitals as well if the plan provides prescription medication and certain services that are not covered by a Medicare benefit. In 2021, 42 percent of Medicare beneficiaries would consider a health care plan. Many Medicare Advantage Plans operate in the form of health care organizations or preferred provider groups (PPOs).

Medigasp will only help fill gaps in Medicare's coinsurance, copayment and deductibles. Medicare only covers most Medicare coverage for services like doctor appointments and medical care in outpatients. Medigap plans are available to cover the gap of 20% you're paying. Medigap cannot reimburse Medicare Part A and Part B services unless covered by a Medicare Part D policy. It's not valid to cover medical prescription medications or the hearing, vision and dentistry treatment Original Medicare does not provide.

About 58% of Medicare beneficiaries who are over 65 have Medicare Advantage Part A and Part B, which covers hospital and doctor care. About 81% of Americans have supplemented their Medicare Supplement insurance by Medicaid or employer-sponsored insurance and 48 million are also paying for the same prescription drug program. Medicare supplements and medical coverage are not affiliated or approved by the federal Medicare system. Despite being cheaper than most, it is an excellent alternative for most users.

I recommend putting aside money and getting Medicare if you have a serious medical condition and want to have treatment at a hospital. It's even possible for people in the open enrollment phase to choose a Medicare Advantage plan. The annual elections season takes place every October 15th - Dec 7th every year. Let me know a couple of things. Depending on whether a Medicare participant switches to a Medicare-sponsored plan or a Medicare plan that has been purchased in the past two years.

At age 65, it can become difficult to determine the dates of registration for your child to attend college in order to be eligible. Check eligibility first. To avoid penalties and gaps, the Medicare Part A Medicare Part B program is geared toward physicians and patients who have completed medical school at least once a year and have been diagnosed before. If you currently have Social Security, you can enroll immediately if there is no other option available online or via fax.

Medicare is a replacement for Original Medicare. Sold by private insurers they cover all of Original Medicare's coverage but offer additional benefits for something Medicare does not. In addition, prescription drugs and vision protection may also be offered in this package. Medicare benefits are available only to individuals with Medicare Part A and Part B medical coverage. Upon enrollment, your Medicare Advantage plans will replace your Medicare Part A and Part B plans.

Almost every Medicare Advantage program offers the possibility of 0 %. Baethke says that if you join a health plan that charges premiums you must pay these costs each monthly. Medicare Part B coinsurance and its deductibles have risen from $126 to $2926. When these conditions have been met your Medicare Advantage Copay is generally 20 percent the Medicare deductible for most services and products, like durable medicine equipment like diabetes management devices or.

Medicare Advantage Plans offer many of the benefits that Original Medicare provides, but offer additional protection to items that aren't covered by Original Medicare. The company said it will even provide transport to doctors’ appointments and Adult Daycare Services. “Plans are able to tailor the benefits package in advance to the needs of people who have chronic health problems”. Currently, Cigna provides free vaccination services to Medicare Advantage users.

Once you're on Medicare you can choose the coverage for your prescription drugs. If you have not yet signed up for Part D insurance and have not purchased prescription coverage before then you may have to pay for it. 11.11. If you qualify for creditable medical insurance, this means that you can receive medical benefits at a rate of at least 5%. Medicare provides the standard coverage. When you are eligible for Medicare, drug insurance is usually retained.

It's hard to calculate the health expenses in retirement since you have to decide if your expenses are minimal or enormous. Although traditional Medicare provides excellent basic coverage it only covers 80% of hospital and doctor expenses. The remaining 20 per cent is largely the responsibility of the individual and unlike the ACA coverage, the amount the insured can pay cannot be exceeded. Tell us what the reason for a heart bypass procedure is.

Medicare Advantage is a viable, cost-effective option for people with limited medical costs. In some cases however, Medigap can be helpful in treating serious medical conditions with high medical expenses. Consult a licensed insurance representative about your health problems and find a suitable option that works. As you can't combine Medicaid and Medicare, you have to pick carefully to ensure proper coverage for each case.

Medicare Supplements make your expenses less costly. I like that you don’t have any worries that you owe money every time that you visit the doctor, hospital or doctor. You may visit any doctor anywhere you wish in America. Similarly in Arizona, you could travel into Minnesota and visit the Mayo Clinic. Sadly, Jacobson says it can help reduce pain in patients who have weakened immune systems.

Recent analysis from The Common Wealth Fund looks at Medigap plans that offer nontraditional services that cannot be covered under Original Medicare. “We found only 3% of plans offer these services, compared with 5% for those who have not. Many Americans do not realize there's a plan similar in benefits to Medicare. The government faces trade-offs regarding policies that encourage / discourage such benefits.

The average annual premium of a Medicare Supplement plan can vary from $150 to roughly $200 depending upon the state and the insurers. As with most Medicare Advantage Plans, you can shop for the cheapest options available for 62 years if the elderly are eligible for Medicare Supplement Plans G and N. We are exploring the ways to improve private coverage and health care for individuals.

Medigap and Medicare Advantage offer different services depending upon the health requirements of the individual. The Medigap plan provides supplemental health protection for people on Original Medicare, except those who do not require prescriptions. The Medicare Advantage plan offers the same coverage as Original Medicare as well as additional health care benefits.

Medicare Supplements are often known as Medigaps or Medis. Private companies provide coverage that helps to fill gaps in Medicare Original Medicare coverage. In 2018, 32% of Medicare patients were covered by SSPP-approved Medicare Supplement plans roughly 11m of them. Medigap plans offer standardized coverage and help pay for things such as deductibles, coinsurance, or co-payments.

Original Medicare includes Parts A (hospital insurance) and Part B (medical insurance), according to the previous paragraph. This coverage can be supplemented using Medicare Part D standalone drug plans or the Medigap supplementary insurance program. When you enroll in Medicare, you must buy the supplemental insurance on your own.

Medigap is private coverage offered by insurers and brokers, but not on medicaid.gov. Plans A, B, C, D, F, G, K – LM & N all feature different uniform coverage levels. Plans F and G have a higher deductible option in some states as well. Some plans also provide medical assistance when abroad. This coverage is standard, and the Medigap Policy is not rated accordingly. The insurance company will offer consumers the best rates for each letter plan by simply selecting a more attractive offer. Medigap plans sold to Medicare patients have been denied Part C deductibles starting January 1.

Medicare Advantage plans generally cover Medicare Part B (hospital insurance) or Medicare Part B (Medicare insurance). Enrollment is only possible for some periods. Specifically, you may be eligible for, or switching to, Medicare Advantage plans without drug coverage over three time periods.

With Medigapp you are allowed to receive the services of any physician accepting Medicare. You may also be limited in choosing a doctor or medical provider with a Medicare Advantage program. Legally, there is no Medicare benefit for Medigap coverage. You might also change your plan.

It is important for people to consider the health benefits of Medicare and Medigap compared to the financial conditions and health situation. Before choosing a Medicare Advantage plan you will need to compare the different Medicare programs. Expanding.

Medigap will reimburse you for the costs of implementing your original Medicare plan. It is possible that Medigap has a great medical advantage for you. It's easier to go to the best medical provider accepting Medicare. Unless the doctor does not have a Medicare Advantage plan, or you do not wish to change providers, they can recommend Medigap. It allows a physician to see anyone accepting Medicare. While your health insurance premium is usually more expensive than Medicare Advantage, the Medigap system can help reduce your out-of-pocket expenses in your case.

The biggest downside to Medicare Advantage programs is that they limit you in choosing doctors and hospital providers. Medicare Advantage plans depend on network health services a medical practitioner that isn't part of your network typically charges a premium. In the US, Medicare is similar in terms of coverage, but Medicare Advantage plans are restricted in certain areas. If you relocate to the other state, it may be necessary for you to change plans. Medicare benefits offer a wide variety but aren't available in all areas.