Medicare's Advantage and Medigap plan offer different options for Medicare beneficiaries. These two types of plans have differences in their functionality. Medicap, aka Medicare Supplement, is available to people who enroll in Medicare Part A hospitals and Part B physicians. It isn't a government-sponsored program, but private insurance you can get that will provide some cost for your Medicare expenses. The Medigap plan covers a portion of a medical bill that you might otherwise have financed by a doctor's office for medical care and medical services.

The Medicare plan provides subsidized health coverage for aging patients. This product contains an alphabetical list which provides different types of protection and advantages. But Medicare is facing challenges — even gaps that have not been adequately filled. To cover this gap you could take advantage of Medicare Advantage or Medicare Supplement. We collected unbiased insights and research about coverage, costs, comfort and choices.

Best products are recommended via an unbiased evaluation and advertisements don't impact their selection. It can be paid to visit a partner recommended by us for business purposes. See the Advertising Disclosures for further explanation. All people interested in Medicare have several important choices. What are the advantages of Medicare Advantage versus Medigap for Supplemental Medicare Plans?

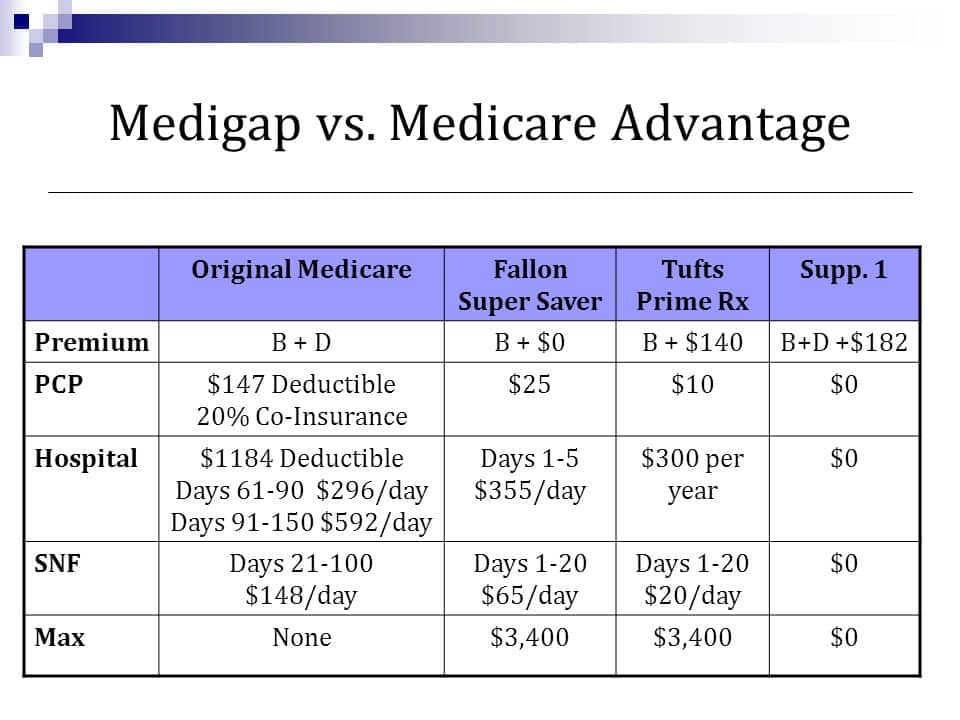

There is a gap between the two insurance types so please learn how they work. In Medicare Advantage the most significant difference is you can visit any medical practitioner accepting Medicare in the United States whereas in Medicare Advantage your medical care is available at all of the participating physicians. Medicare Advantage. Let us explain.

Medicare Advantage health plans are the same as private health plans. Most services including medical visits, lab work and surgeries can be covered at just a small cost. All plans include an annual maximum deductible amount of deductible outgoing expenses. Each plan possess unique features. Most insurance companies offer prescription medications. Some require an e-mail or telephoning call from an expert and some don't. Certain will provide some out-of-Network services whereas others will cover only hospitals that belong to the HMO or PPO network. In addition to the Medicare Advantage, there is another kind. It can be helpful to pick plans with minimal monthly premiums.

Medigap was designed to help fill in a gap that Original Health insurance does not cover deductible, coinsurance, and copayments, among others. Original Medicare only pays a maximum of 80% of medical care if the patient has not been covered by Medicare or a health plan. A Medicare Medigap plan could cover up to 20% of your expenses. Medigap can't cover the cost of anything not covered by Medicare Part A or Part B. This means Medigap cannot be used to cover prescription drug and hearing, eye and oral services not covered by Original Medicare.

It's logical in most circumstances to consider a Medicare Advantage plan for patients who have health issues and then switch over to a regular health plan for patients who have health problems that are not a part of a regular Medicare plan that is. The option to choose between the two Medicare forms is available to everyone at the opening enrollment stage. The elections are conducted between October 15 and December 7 of the year. This is the big deal. If you switch back to the usual Medicare coverage you can enroll with Medi-Gap.org.

58% of Medicare beneficiaries who benefit from Medicare are Medicare beneficiaries, who receive Medicare Part X, and have access to health care. The majority of the population also supplemented the insurance through Medicare Supplement Insurance (Medicaid Supplement Insurance), Medicaid or employer-sponsored insurance.48 million pay for the standalone Medicare Part D prescription drugs plan.5. Medicare Supplement Insurance plans and other plans may not be approved. While this is the costliest alternative, it has many benefits.

The Medicare benefits programs can be replaced by Medicare. These private policies cover all of the coverage of original Medicare and may provide additional benefits if Medicare does not. In addition to the prescription drug protection, there is also dental, eye and ear health. If you have Medicare Advantage you have the ability to obtain Medicare Part B hospital health insurance. If you enroll in Medicare Advantage you are not required to have any Part B health insurance coverage.

Budgeting the costs of a retirement healthcare plan can be difficult due to the lack of knowing how much you’ll spend each year. Although traditional insurance programs provide good basic cover for the population, Medicare covers roughly 80% of the costs approved by hospitals, physicians and medical procedures. The remaining 20% of a bill will be a person’s responsibility. Unlike the ACA, the amount paid for insurance is not guaranteed. Tell us about heart bypass surgeries.

Available from private Medicare-approved insurers, Medicare Advantage plans are offered by such brands as Aetna, Humana and the Kaiser Foundation. It is unlikely these insurance plans have fewer premiums than the high premiums in the Medigap and Prescription Drug policies. The Medicare Advantage program covers hospitals and doctors and includes prescription drugs as well. In 2021, 42 % chose the plan. Medicare – Aiming to provide coverage to individuals who need it most.

Medicare Supplement plans make the cost savings more predictable and easier for budgeting. According to Jacobson, many people prefer cost-sharing because there are fewer problems with paying medical bills each time they are hospitalized or go to doctors. You can see any doctor anywhere that you want. Typically in Arizona, you may fly to Minneapolis to visit Mayo Clinic. Unfortunately Jacobson says having these advantages is a lot more important for people who are sick.

A new report by the Commonwealth Fund examining Medigap plans containing non-traditional services that are not covered by original Medicare. We found that there was an overall small share of health plans that offered the same benefits. Most people don't understand the benefit of the Medicare Advantage plan. In the federal government, there is a trade-off between allowing or excluding these advantages.

Private insurance companies sell health insurance plans for Medicare Supplements (sometimes named Medigap Plans), which help replace Medicare coverage gaps. In 2018, about 33% of Medicare recipients received Medicare supplements to cover some of these costs, compared with around 11 million of the original population. Medigap is an affordable health care program that provides universal coverage that includes coverage that covers deductibles, coinsurance and copayments.

After you have applied for Medigap insurance, there's no guarantee that the provider will give you insurance. Insurees:

As you reach the age of 64, you have to determine the deadlines to enroll. You should first check eligibility. The majority of Americans will be eligible for Medicare Part B for the first 7-month period which starts 3 months before the month you turn 65 and runs until 62 years. Unless you currently hold Social Security, you will receive automatic enrollment. Unless otherwise it is necessary to register on our website or by phone in the Social Security office.

Medicare benefits generally include: Medicare Advantage plans require you to participate in Medicare Part A (hospital insurance) as well as Part B (Medicare insurance) to reside within their service region. Enrollments only happen during certain times, but it is unlikely that you will be denied coverage for any reason. You are entitled to participate and switch to Medicare Advantage plans without drug coverage at any of these time periods.

Plans. Medigrap. Medicare Advantage. Unlimited networks of providers. The plan has the maximum premiums. Preauthorization required to provide specialized care. Ability to travel, move and stay within your budget. Extras like dental insurance, vision coverage and hearing coverage. There is not a limit to out-pocketed expenses under original Medicare, though many health insurances cover this. Medigap plan K and plan L are limited.

Medicare Advantage is an ideal financial solution for those whose finances have not been repaid. In some cases, medgap is more appropriate than other options for treating serious conditions. Talking to a licensed insurance broker will allow you to determine the right plan. There are no Medicare Advantages and Medicaps available simultaneously, so you must carefully select the right coverage to fit your specific circumstances.

The average monthly premium for Medicare is between $300 and $400, depending on the location of the insurance company you are enrolled in. Medicare Advantage plans, 65 and older people can get more out of their health insurance yearly by enrolling in the lowest-rate option available in their area. Jacobson said that the government is working on ways to make private plans and government Medicare a better system.

Medicare Advantage Plans offer the benefits provided by Original Medicare, as well as coverage for certain things that cannot be provided by Original Medicare. Some plans even offer transportation for doctors visits or adult daycare services. The plan also offers benefit packages for patients with chronic illness. Among other benefits, CDC is launching vaccination services to Medicare Advantage beneficiaries.

Many Medicare Advantage plans offer no premium, so you should consider the options. Baethke says the fees are paid every month for enrolled Medicare Part B Plans. Medicare Part A's coinsurance and the deductible is $226, Medicare.gov, and once they are met, your copays are typically 20% of the Medicare-approved amounts for most services and goods. Examples include medical equipment such as glucosamine.