Medicare and Medicaid provide government services to those who require special treatment. Because the requirements for the coverage are overlapped, a beneficiary may receive both programs. How do you locate the most appropriate Medicare plan? Medicaid is the federal program, and Medicare is the Medicaid Program, which allows Medicaid residents to receive benefits without the need for medical care. Let me explain how Medicare compared to Medicaid.

Medicare is the government-funded health care system that serves different people and has different eligibility criteria. There's someone who may be eligible for either program. There are varying types of Medicaid and Medicare, and the difference between them. I need a personalised insurance plan. Get a better health care professional with CoverRights online shopping tool.

We suggest the best products through our own evaluation process, advertisers are not affected in their decisions by our selection. We can be compensated if we see a person who is recommended by us. See Advertisement Disclosures for more information. All Medicare patients need to decide what to do. Which one of these options will be most helpful for supplementing your Medicare coverage?

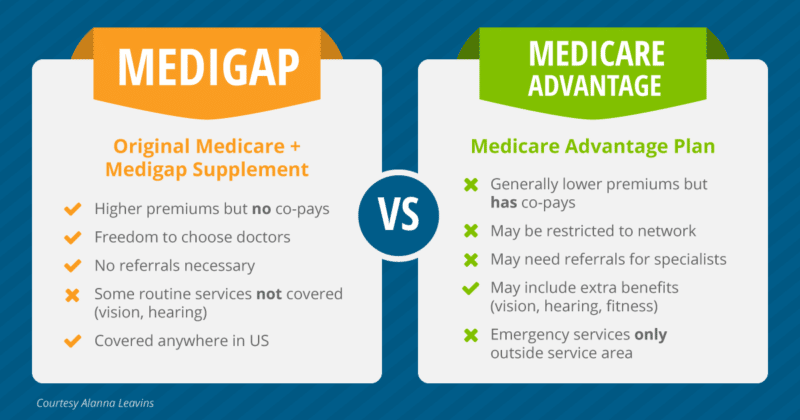

It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you're responsible for the difference. for covered health care costs. Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B.

You or your spouse must have worked and paid Medicare taxes for at least 10 years to qualify. 1 Most people don't pay a premium for Part A, but deductibles and coinsurance apply. Part B: Medical Insurance Those eligible for Medicare Part A also qualify for Part B , which covers medically necessary services and equipment.

Medigap is the Medicare Supplemental Insurance that fills gaps and is distributed in the private sector. Medicare reimburses many of the cost of health care provided through the Medicare program. Medicare Supplement insurance policies (Migaps), which are offered by Medicap, can pay some of these costs.

Published: 17 Jan 2019. Last Update Date: 2 April. There is no word which can cause confusion at all. Read further for a list of possible answers. All the important details on the Dual-Sensitive Needed plan in one convenient resource.

Medicare Advantage plans are similar to private healthcare. Many services including doctor visits and surgeries can be covered without co-payment. Some plans offer an HMO or PPO network and most have annual limits for total costs. The benefits and rules for each of our plans differ. Most of these programs are covered by prescriptions. Some require an appointment with an experienced doctor and some do not. Some patients pay for out-of-network care while others only offer medical and hospital services based in HMOs or PPOs. There's also a variety of Medicare Advantage Plans. Choosing an annual premium plan is crucial.

Medicare and Medicaid don't overlap. Most people confuse Medicaid versus Medicare because they've both been governed by the federal government. Medicare is primarily a federal program while Medicaid differs between states. Medicare is available in nearly every state. The Medicare benefit is generally available for 65 or older people receiving SSDI benefits below 65. Medicare provides uniform, standardized premium rates to people of the same income level. Similarly every state administers Medicaid. All states require certain qualifications and requirements to enroll in Medicaid.

Available through Medicare-approved private insurers, Medicare Advantage policies are offered under the names Aetna Humana or the Kaiser Foundation. There may be no premium and lower than that of Medigap insurance. The Medicare Advantage plan provides hospitals and medical doctors with prescription drug benefits and sometimes also includes services which are not provided under Medicare. The Medicare system is currently based on standardized health care. The Medicare Advantage Plan typically operates in the same way as a healthcare support organization (HMO / PPO).

Occasionally Medicare-infaid individuals are entitled to Medicaid. It's called double eligibility,” says Heather Sanderson, the medical secondary compliance expert in Palmetto, Florida. A number of dual-eligible beneficiaries are elderly individuals in a poorer household and Medicaid provides a way to cover Medicare costs, such as deductibles and insurance. Medicare Advantage offers special care plans (SNP) to people with double eligibility. This network provides service providers and services that meet the specific requirements of your business.

In some countries, the dual eligibility is known. When you are considered eligible for Dual-Eligibility, you need to: Do you qualify for Medicare Supplement plans? Medicaid pays your Medicare Part A premium and Medicare Part B premium for any Medicare eligible enrollee. If enrolled for Medicare Part A, Part B or Medicaid, you are eligible for the dual Special Needs Medicare benefit program. This program uses Medicare and Medicaid for the purpose of providing beneficiaries prescription drug coverage, as well as other coverage.

Dual eligibility enables individuals to enroll in Medicare and Medicaid according to qualifying categories. The dual-eligibility criteria of each program determine eligibility for Medicare and Medicaid. In such a situation Medicare and Medicaid will provide you with medical expenses. You may also have additional benefits including prescription drug insurance and home delivery insurance, as well as food and transportation insurance. When you are 65, most Medicare patients can be covered through Part A and Part B.

Medicare offers Medicare benefits in parts. Part A covers hospital insurance and Part B covers outpatient services. When you say Medicare, the person usually means Original Medicare – Part A or Part B. Medicare Advantage also called Medicare Part C, includes everything in Medicare and bundles Part A and B into one plan. These policies typically offer additional benefits that Original Medicare does not offer, and this benefit is offered by private providers following federal guidelines.

Original Medicare covers hospitals, skilled nursing homes, and hospice (Part B). This includes doctor-patient consultations, preventive care services, mental health treatment, physical therapy, occupational therapy laboratory treatment and outpatient services. Original Medicare does not cover prescription medication, eyewear, hearing aids or dental services. Medicare patients can purchase prescription drugs with Part D. Medicare Advantage includes most of what is included in Original Medicare.

You can apply for Medicare three months before you turn 66. Coverage normally commences a month before your registration deadline. Medicare's Open Registration Program takes place annually between August 15 and October 7th and is available as an option for full coverage or expansion of coverage. Coverage normally commences from January 1st if you enroll before December 7th. Medicare Advantage open enrollment runs from 1 January to 31 March. To enroll in Medicare you have the following options:

More than half the 65 million Medicare beneficiaries who are 65 or older are choosing Part 1 or Part 2 covers health and dental care. 5. An average of 81% of those insured supplement their Medicare with Medicaid or employer-provided plans. The total is 48 million. Medicare Supplement insurance, aka Medigram plans, is not sponsored by or associated in any way with the government. Despite being less costly than cheaper alternatives, it offers a couple of benefits.

Almost all Americans have an opportunity to get Medicare, but Medicaid will only be provided to people of lower incomes. Beneficiary can enroll on Medicaid by visiting ed. You may be eligible to receive Medicaid by calling your local health agency. To qualify for Medicaid, a taxpayer must make a minimum of $1000 per year. It is recommended to check with an employer to see if there exists an alternative program to Medicaid for individuals with high income.

Managing the healthcare expense at retirement may seem difficult, because the cost is usually low or enormous. Although the standard Medicare (PART A and Part B) offers good basic coverage, it only covers 80% of hospital and doctor expenses approved by Medicare and other government departments. The remaining 2% of the bills will be borne by the individual, whereas coverage under the ACA is non-capped for a year. Tell me about the heart bypass procedure.

Unless you have dual eligibility and income that exceeds your state Medicaid requirement, there is guaranteed issue right in certain states. However many states don't allow Medicaid eligibility for beneficiaries. If your state guarantees a guaranteed issue rights situation, you can apply for a Medicare Advantage or Medicare Supplement plans of your choice. Let’s review your Medicare plan in three simple steps.

At 66 it is vital to understand what deadline applies for completing an application. You must first check eligibility. To avoid expensive penalties and coverage gaps, most people must enroll in Medicare Part A (healthcare facilities) and Part B (doctors). This window begins 3 months in advance of turning age. If you have Social Security, you can get it automatically.

Medicaid participants generally do not pay their premium and share costs are nominal and generally the federal government requires this. Most states have no mandate to pay for health care,” said Garfield. The copayment for a service involving cost sharing varies from $1 to $3. The cost of ACA differs. Check the table below to see their comparisons.

Individuals with full benefit dual eligibility (FBDE) will receive Medicare and Medicaid in their state. Beneficiaries who qualify to participate in FBDE receive deductibles and coinsurance from the FBDE programs. FBDE recipients usually have no money to pay to get medical care.

Original Medicare is a combination of Medicare Part A and Part B. This coverage is also available for patients who need additional insurance for their medical care. When you sign up for Medicare, you have to do something about it before purchasing these additional coverages.

For more information, look for a plan for your zipcode. After you have created a Medicare account, you can type a name on your drug and use a convenient tool to compare plans, deductible, or Medicare rating. 13 - If your prescription medication is not available, see your pharmacist for reassurance. The plan covers almost all prescription medications that people use on Medicare. If you've had high prescription drug costs, check into the insurance coverage gaps that kick into effect as soon as the plan has accumulated more than $4450 in 2022.13 The insurance gap period.

Medicare is a private plan which is offered via an insurer and not through the Medicare website.gov. These plan types have standardized coverage for different coverage sets. Plan E offers higher-debted options in many states. Some plans provide emergency health coverage when traveling abroad. Because the coverage is standard, the policy does not receive an evaluation from Medigap. The consumer can easily compare the cost to letter insurance and decide on the best option. In the new year Medicare Part B deductibles will no longer be covered by Medigapan Plans.

The differences in Medicaid are in that the state administers it based on income. Medicare is run through the government primarily through age. However, some circumstances, like a disability, allow a young person to be insured by Medicare.