How do I buy my insurance at a discount for my age of 60? The latest information is from Sept. 25, 2021 9:59 p.m. American seniors under 60 may be eligible under Medicare for the first time if disability is incurred. Several states require disability benefits to last a year before you qualify for Medicare. If you are eligible for Medicare you can also join Medigp and receive additional insurance protection. There was much confusion over the issue due to federal or state legislation and this article was created in an effort to separate the state Medigap for U6465 from the U6465.

States with Medigap protections if you're younger than 65 While the federal government doesn't require private companies to make Medicare supplement insurance available to disabled beneficiaries under 65, 35 states have regulations directing insurers to make at least one type of policy available to select groups of younger Medicare recipients.

Some states guarantee that applicants under 65 will have access to at least one Medigap plan, whereas other states do not. States with mandated Medigap coverage options for those under 65 According to a report by the Kaiser Family Foundation, there are 30 states that require insurers to offer at least one Medigap plan to qualifying Medicare beneficiaries under 65.

These plans are probably becoming D and G because of the 2020 Medigap changes. Oklahoma : Most of Oklahoma's Medigap insurers have decided to offer Plan A as their option for beneficiaries under the age of 65, but Globe Life & Accident offers Plan B, and United American Insurance offers Plan B and high-deductible Plan F.

The eligibility for Medicare for those who are eligible to be covered under Medicare varies based on state of living. Medicare supplement plans or Medigaps pay a deductible or copayment and pay other outsourced costs. If someone is over 60 or a year old, the policy is available at the most competitive rates — for example within six months of completing the Part B. Roadblocks for the younger person. The federal government does not provide a program that protects people from kidney failure or other impairment. There state safeguards that are triggered.

This is a period when Medicare beneficiaries under the age of 65 can enroll in a Medigap policy without having to go through medical underwriting. For policies obtained during this period, insurance companies cannot deny you coverage or force you to pay a higher premium due to any past or current health conditions.

You may qualify for additional state protections too. Keep in mind Even if you can't buy a Medigap policy before age 65, you might consider enrolling in a Medicare Advantage plan , an alternative to original Medicare. Medicare officials must approve each plan, and they must cover everything that Medicare Part A and Part B cover, albeit with different deductibles and copayments.

One quarter of all Medicare patients had Medicare Supplemental Health Insurance in 2015 (also called Medigap). The report provides an overview of Medigap enrolling and analyzes federal and state regulations that could have an adverse impact on beneficiaries' eligibility for Medigap.

If you're under 65, you might not be able to buy the Medigap policy you want, or any Medigap policy, until you turn 65. However, some states require Medigap insurance companies to sell you a Medigap policy, even if you're under 65. If you're able to buy one, it may cost you more. I have group health coverage through an employer or union.

Unlike Medicare, Medicare does not provide maternity insurance coverage to a person who cannot qualify for the program because of disabilities. Aside from the federal guidelines on pricing, a company will have to charge significantly more to cover people under 65 than for people under 60. Some firms charge hundreds more for a single person under the age of 59. Even in the most difficult circumstances, the insurer may impose pre-existing conditions of up to six months on an applicant who didn’t have continuous medical coverage prior to enrollment.

As you might imagine, collecting data about Medigap in 66 states is very difficult. The whole information is contained here but please read further and find even deeper data. We're going to try our best to keep these pages updated regularly, however if you are aware of state laws not reflected here, please add a reference here to your comments 🙂 In most states, the insurance industry has to provide an individual with a Medicare supplement before turning 55. If the state doesnt appear, it is unlikely we will see any under 65 protections.

Yet the states with laws requiring Medigap availability don't have blanket protections for all disabilities that can qualify a patient for early Medicare. Some require offering Medigap policies only to those without end-stage renal disease. Others mandate the inverse, saying only people with kidney failure must be offered Medigap.

Medigap offers standard Medicare-based coverage which supplements the Medicare-covered coverage that Medicare does not provide. The deductible is covered through a policy not included in Medicare. Those who qualify for Medicare at the age of 65 may apply for Medicare without any medical condition, but typically have several Medigap plans on offer to them. This cannot be said of those over age 65.

Almost all states are currently introducing Medicaid coverage to the ages of 65-65. Some states allow insurance companies to offer MediGap plans as guaranteed. Some states offer price guidelines for finding a good affordable program. These regulations vary drastically between the states outlined above.

Things to Consider Some Medigap plans cover foreign travel emergency services. Once you are enrolled in a plan, it renews every year as long as you pay your premium and the plan is available. Initial Enrollment Period The Initial Enrollment Period is a limited window of time when you can enroll in Original Medicare (Part A and/or Part B) when you are first eligible.

You can no longer buy meds at 65 unless you turn 65. However some states require Medigram companies to sell your policy even if the age is less than 65. If you can afford it, the costs could be higher.

Federal law should be extended to grant consumer protections to all Medicare beneficiaries, not just those over age 65. Further, all states should follow states like Kansas where beneficiaries under age 65 are given the opportunity to purchase plans at rates comparable to their counterparts aged 65 and older.

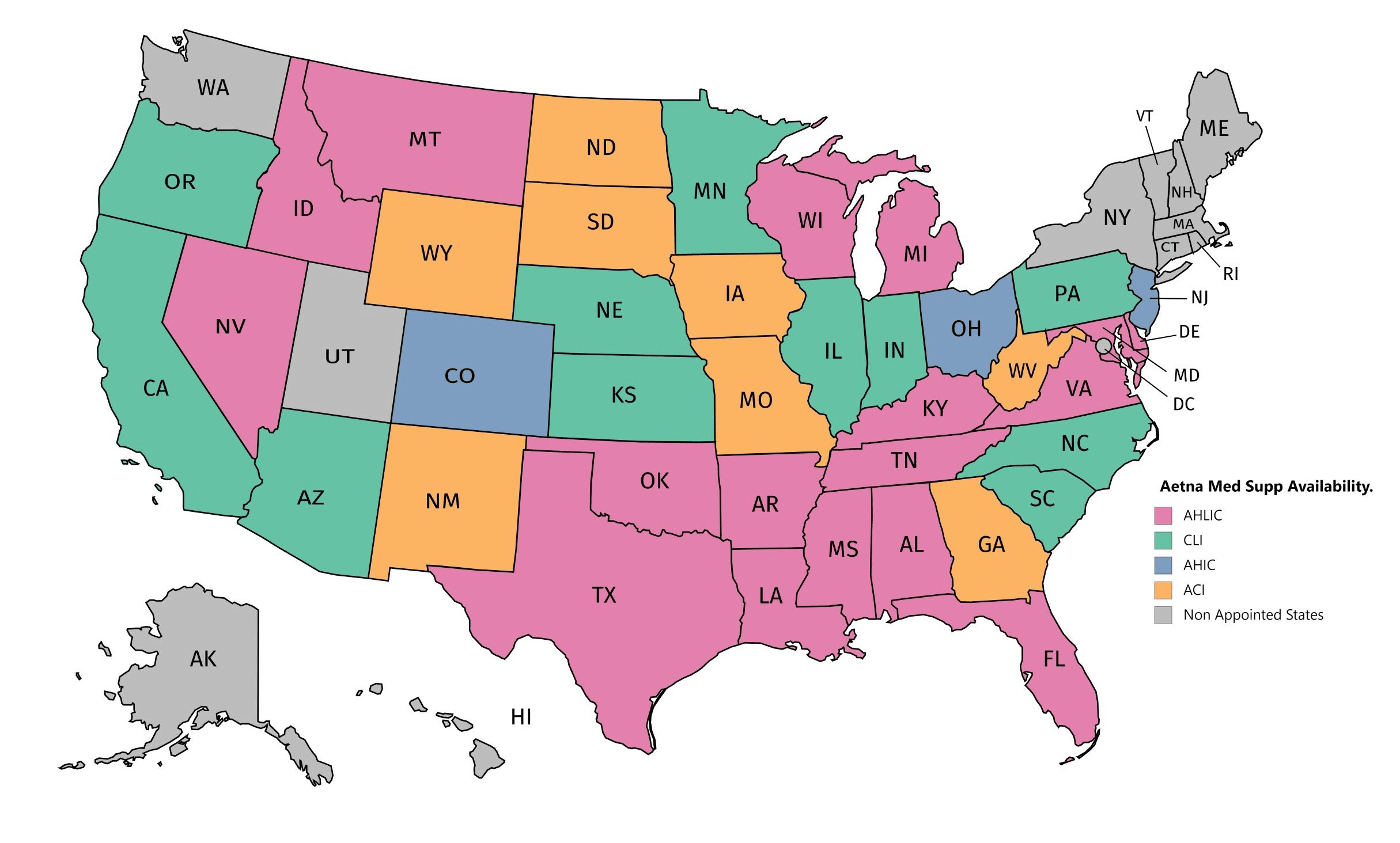

The following states require insurance companies to offer at least one type of Medicare Supplement plan before you turn 65 (U65). If you do not see your state on this list, then we have no record of Under65 protections. If your state does not offer under 65 Medigap protections, you may be better off enrolling in Medicare Advantage which treats everyone the same regardless of age.

These state requirements can have a big impact on Medigap applicants under 65. For example, if you live in California and have Medicare coverage due to ESRD, a Medigap insurance company is not legally required to offer you a Medigap plan. The state only protects applicants under 65 with a qualifying disability.

During that time you can buy any Medigap policy sold in your state, even if you have health problems. This period automatically starts the first month you have Medicare Part B (Medical Insurance) Part B covers certain doctors' services, outpatient care, medical supplies, and preventive services.

After this enrollment period, your option to buy a Medigap policy may be limited and it may cost more. Some states have additional open enrollment periods. I'm under 65. Federal law doesn't require insurance companies to sell Medigap policies to people under 65.

Medigap plans are standard across all the states thereby providing the same benefits. Except Wisconsin, Minnesota and Massachusetts. Plans from such states can also have options different from Medigap Plans from the ones available elsewhere.

Oregon and California were the first to have a Medigawap Birthday. The federal government announced that it would be the fifth state to adopt birthday restrictions on Medicare Supplemental coverage. These States include Illinois, Louisiana, and Nevada. The rules and regulations around birthdays vary across the 4 countries.

Medicare Supplements (Medicaids) premiums vary by state for each state. However, Medicare's costs are different from those in other states. There are several different factors behind some states having higher cost Medicare.

In California there are no persons older with terminal renal disease. Insurance providers should offer plans AB, C, D and G. The insurance provider must offer if the insurer provides plan K if not plan L unless he possesses an older person. Delaware. Suitable for those who have kidney failure. Georgia: The premium for the under-65s should not exceed the maximum and the premium variation shall not have a high impact on the health or safety of the beneficiary if the benefit was provided under 65 or more years. Despite the restrictions, Georgia rates are generally higher.