The health insurance programs Medigap and Medicare Advantage offer additional benefits. Obviously both types of plans work in wildly different ways and do not work together. Medicare supplements are only offered to people who have signed up for Original Medicare Part A Hospitalization and Part B doctor/outpatient care. The program is not administered by the government but is privately owned and covers some of your costs for traditional Medicare. Medigap plans cover up to 20 percent of your Part A deductible for medical care.

The Medicare Advantage and Medigap programs offer two very different types of insurance, and they cannot both be combined. Tell me the best insurance plan you need and why. Get free online maps to any location Immediately! If a patient goes without health insurance for a month or even a year after turning 66 he will have coverage for the remainder of Medicare. Although Medicare Part B and Part D pay for many of its expenses, they cannot cover all the medical costs.

Medicare is a free health plan available to older Americans. The book contains alphabetical pieces which offer different kinds of benefits and coverage. However, the government still faces some challenges. To fill this gap, consider obtaining Medicare Advantage and the Supplemental Plan. Our expert analysis has collected unbiased information from leading experts about coverage, cost, convenience and choice.

The best product is reviewed independently and advertisers never influence our selections. It may cost money to visit a partner recommended by us. Please see our advertisement disclosures. Everyone who wants to enroll in Medicare has many options to consider. What'll help me re-evaluate Medicare Advantage?

Medicare Advantage plans are similar to private health care. Most services, including doctor's visits, laboratory visits and surgery, can be covered with a small fee. Plans can provide a network of HMOs and PPOs and every plan limits annual out-of-pocket expense per employee. Several plans offer different advantages and regulations. Almost all of them offer prescription coverage. Some need to consult the specialist.

Depending on the provider and its location some will pay for outpatient care and some will only be provided by physicians and other health services within the HMO and PPO networks. There may also be another Medicare Advantage plan. It's important that you choose plans which offer low or minimal annual premiums.

The Medicaid Advantage plan is a replacement for original Medicare coverage. The company offers private insurance. A MA plan gives you parts B and A, but in the majority you also have part D. You will receive additional services including dental, hearing and vision. Medicare Advantage plans provide health care services similar to the Original Medicare — including medical care visits, lab test visits, etc. But you'll have to remain connected to networks or request referrals before the plan pays the costs. Original Medicare lets you see any doctor accepted.

Medicare Advantage programs can replace the Medicare program. Sold via private insurers this plan covers all aspects of the original Medicare coverage and can offer additional services unless Medicare is not included in the program. In addition, there is prescription medicine coverage and hearing, dental, or eye care services available. You can buy a Medicare Advantage plan by enrolling in Medicare Part A hospital coverage as well as Medicare Part B healthcare coverage. When you enroll, Medicare Advantage plans replace Part A and Part B insurance.

Some 66% of all Medicare beneficiaries have Medicare coverage from Part A to Part B, which covers hospitals, physicians, and other services. The Medicare program is funded by the federal government through the Medicare Advantage Program. The program is funded by the Medicare Advantage Plan and is available at no extra cost in most states. Medicare supplement insurance or Medigas plans don't have any direct connection or support with government programs. It might be the cheaper solution, though there are advantages.

Medicare Advantage provides the right and affordable option for people who have low medical expenses. Medigap is deemed to be more effective in managing a serious medical condition that requires costly care and treatment. Talking to an insurance agent is an essential step for determining what insurance policy best serves your needs. If you aren't allowed to have the Medicare Advantage or Medigap simultaneously, you have to carefully select to get the coverage you need to get the right treatment.

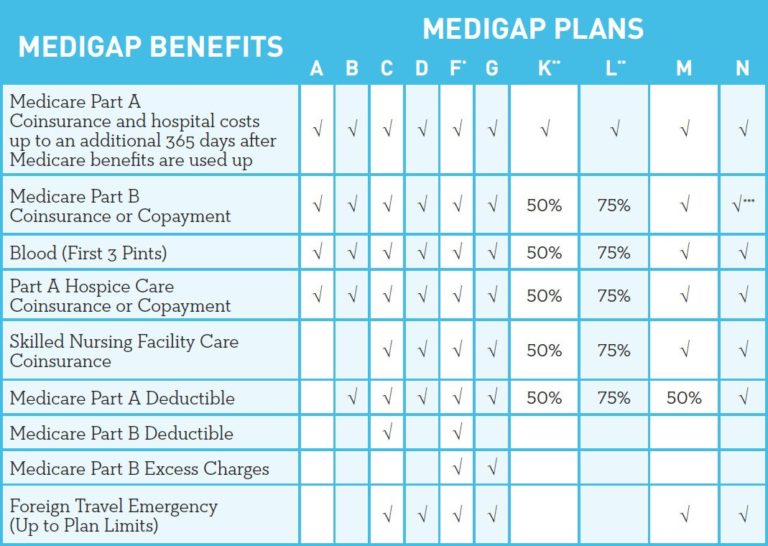

Medicare Supplement plans (also called Medigap plans) are offered by private insurance companies to cover unused Medicare. Almost 45% of those who had Medicare coverage in 2018 had the benefit. Medicare Supplement plans covered a portion of the cost of services approved. In addition to the standard coverage and coinsurance, a number are bundled with the MediGp plans that include a number of other types - from maternity plans to medical plans.

Yeah. Not only do Medicare-eligible seniors have the option to upgrade their Medicare to Medigap.

A Medicare Advantage plan is probably a better option if the premium is higher and it protects you from high costs. The Medicare plan plus Medigap usually gives you greater flexibility in the places in which the patient will be provided with medical services.

Medicare Advantage provides additional protection to patients on the Medigap plan, although they are not covered. In addition, Medicare Advantage Plans have a similar level of coverage as Original Medicare but have extra advantages like prescription drug coverage, dental services and hearing and wellness services.

Medicare benefits are typically cheaper upfront compared to medgap plans. Currently the average daily premium on Medicare is $15 per person.

Medicare Supplement plans are easier for you to budget. “A lot of people like cost-sharing and it makes it easier for them to pay for medical care if they are hospitalized or have to go to a hospital. The doctors can be seen anywhere in the nation they want. If you live in Arizona, you may need to fly to Minneapolis to visit Mayo Clinic. Jacobson said these benefits are usually more important in people that suffer from illness.

A recent study by the Commonwealth Fund examines Medigap plans that offer services not included in the original Medicare plan. Research shows there's very little coverage for these benefits. Most people do not realise there's a plan available with similar advantages as the Medicare Advantage. At a federal level, policies enabling or discouraged this benefit are largely a tradeoff.

Medigap will simply cover gaps that Medicare isn’t covered: co-insurance, a payment or a deductible. Medicare covers 80% of all medical expenses for outpatient and GP care. Medigap plans may provide for the 20% gaps you're required to cover in your pocket. Medigap will no longer pay for things Medicare Part A or B doesn't. Medigap will not be available for medical care that Original Medicare is not covered for.

In most states your monthly insurance premium can range anywhere from $150 to about $200, according to insurers. Just as in the case of the Medicare Advantage plan, the 65-year-olds can save about $840 a year with the Medicare Supplement Plan G or $647 a year on the plan N. Jacobson continues to look in the right direction for a more efficient and equitable health insurance system, he added.

Medigap and Medicare Advantage plans offer different advantages depending upon the type and quality of health needs for you. Medigap plans offer additional coverage to Medicare users, but they exclude prescription drugs. Medicare Advantage plan offers similar coverage to Original Medicare plus other benefits, such as prescription drugs, vision care, and dental care.

The Medigap program gives you access to all the health care providers accepted by Medicare. In contrast to a Medicare-based health benefit plan, you may find less choice for your doctor. In practice there is no Medicare coverage for the Medicare Advantage Plan. You can choose between two types.

Medicare and Medicaid Advantage programs offer various options for the most suitable circumstances. You should always review Medicare plans carefully so you get the best possible coverage if you're uncertain of what you need. How do Medicare Advantage and Medigap compare? You should also take care of your health. You will receive a comprehensive Medicare plan to prepare for a good life.

It is possible for people of all backgrounds or financial situations to get Medicare and Medicaid coverage. You should compare your choices before buying a health benefit plan to the one that best suits you.

Private insurance companies offer Medicare Advantage plans that Medicare approves, and they bundle together Part A hospital coverage, Part B doctor and outpatient services, and usually Part D prescription drug coverage into one package. If you decide to get coverage through a Medicare Advantage plan, you'll still have to enroll in Medicare Parts A and B, including paying the premiums for Part A, if you don't qualify for it free, and Part B.

Choosing Traditional Medicare Plus a Medigap Plan As noted above, Original Medicare comprises Part A (hospital insurance) and Part B (medical insurance). You can supplement this coverage with a stand-alone Medicare Part D prescription drug plan and a Medigap supplemental insurance plan.

If you're considering disenrollment from your Medicare Advantage plan and picking up a Medigap plan, contact the local office of your State Health Insurance Assistance Program . At the end of the day, the decision often comes down to whether you can afford a Medigap plan, as they can be more expensive.

Legally, you cannot have Medigap coverage with a Medicare Advantage plan. However, you may be able to switch between the two plans. Biggest Differences Between Medicare Advantage and Medigap Medicare Advantage and Medigap plans can provide different options to best suit your circumstances. You should compare Medicare plans carefully to make sure you're getting the best coverage for your particular financial situation and health care needs.

If you have a Medicare Advantage plan, you aren't allowed to enroll in a Medigap insurance plan unless you're also switching your Medicare Advantage plan back to Original Medicare. If you want to enroll in Original Medicare and buy a Medigap policy, you'll need to contact your Medicare Advantage plan and ask if you can disenroll from it.

A Medicare Advantage plan may be a better choice if it has an out-of-pocket maximum that protects you from huge bills. Regular Medicare plus a Medigap insurance plan generally allows you more choice in where you receive your care.