Medigap plan has been federalized and standardized. Companies have to adhere to our Medigap policy below. A Plan G is a Plan G regardless of the insurance provider you are using. Similarly, plans N in different companies are like those in another company. Plan Standardization makes comparing plans quick and easy. However, premium rates are definitely nonexistent despite benefits being uniform. The premium of an exact same plan is 30-50% depending on the insurer you choose. The best plan will depend primarily upon its pricing.

The average American senior can choose between 12 Medicare supplement plan options by 2023. Our simple chart will help review all the options you can find for a Medigap plan more quickly than ever. How Should I Look at a Medicare Plan?

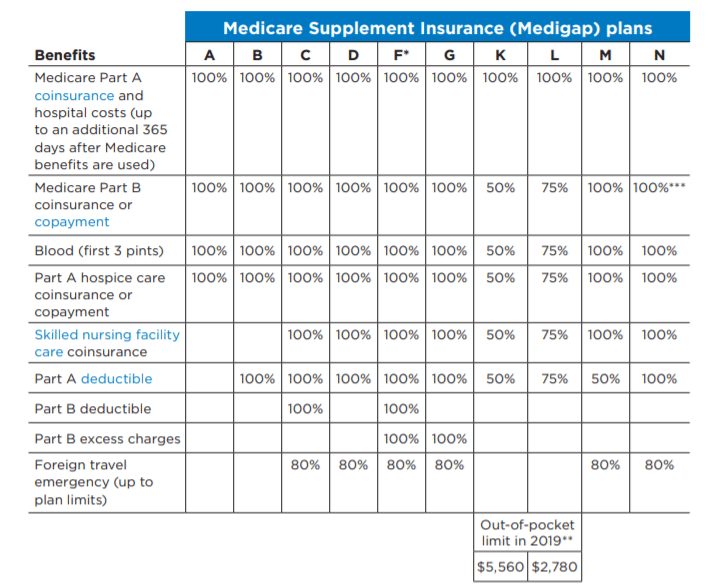

The following diagram reflects all twelve Medicare plans covered by Original Medicare after Medicare paid a small percentage of the cost. Do not confuse Medicare Part B plans with Medicare Part B. Original Medicare consists of Part A which includes hospitalization and Medicare Part A which covers outpatient physician visits. Medicare Plans A and B provide additional protection for Medicare coverage left in place. If your Medigap is a Medicare-compliant insurance plan you have coverage for all of the hospitals that provide Medicare to their patients. A medical practitioner will refuse a prescription for a Medigap plan.

Navigating the Medigaps maximum deductible (MOOP) limit is often confusing. A key point to keep in mind is that Medigap Plan K and Plan L are cost share programs. This means that your plan covers every benefit it provides with a set amount set to help seniors avoid paying over that set limit: The Centers for Medicare & Medicaid Services (CMS) developed the United States Per Capita Costs (USPCC) estimates to calculate these increases in Medicare & Medigap plan K and L have a maximum octane (MOP) cap for 2022 at $6940 and $3470. Estimations on OOP in 2023 are derived from Medicare data released by CMS of the U.S. PCC.

There is no perfect Medigap plan available. A specific Medigap plan may be useful - a specific plan that covers what suits your needs and has premiums that match your budget. Medigap plans are among the most popular SSI's. 45 percent of Medigap beneficiaries participate in their own plans F.1. Plans F cover standardized Medicare cost-sharing costs than other Medicare plans available. Plans F cover 9 standard Medigap benefit categories a company offers. Plan F premiums averaged $87.17 per month for 2018, 2022.2. Medigap Plans G are the second most popular Medigap plans that have rapidly exploded in popularity.

Medigap is available for enrollment throughout the entire year. However, if your Medicare Supplement opens enrollments, you will find the best time to enroll for medgap plans. In such an application, the company will not give you insurance. You will receive the Medigap plan you choose. If you are still in Medigap and want to continue enrolling after your enrollment date then the Medigap plan is available for you. Generally speaking, though, you must answer underwritten medical questions. This may result in higher premium rates because of the already present conditions.

All Medigap policies are subject to Federal laws and must contain clearly identifiable health insurance. Insurance companies can only give you standardized policies labelled with letters across the country. The policy has similar fundamental features and some offer other advantages to suit a person's needs. In Massachusetts, Minnesota and Wisconsin Medigap policies are standardized differently. Depending on what state law affects a policy the company sells if it sells Medigap policies or not. Insurance firms offering Medigap plans.

Expensive charges: $6620 in 2019 $3310 in 2020 * Plans F or G offer high deductible options in some states. If you have Medicare coverage in 2020, then deductibles will go up to $ 245 to $390 before you can claim anything. Plan B is not available to those who have been recently eligible for Medicare from January 1. ** For plan K and L, the plan will automatically be reimbursed to meet your annual deductible.

The following diagram presents a few key information regarding Medigap policy benefits. The plan covers 100% of the benefit (the policy is unable to cover that benefit). The plan is covered by that percentage. N. A. Not applicable. The Medigap policy only covers once your premium has come up unless a Medigap policy also pays the entire premium.

Medicare Supplemental Insurance is offered through private insurance companies. The price of the plan is influenced by availability. Medicare Supplement Insurance plan premiums in 2022 average $121.26 per month.2. The average cost for Medigap plans will vary greatly depending on their plan type. Several different Medigap plans provide standardized benefits, meaning plans which have more benefits can provide lower premiums. The amount of money you spend for Medigap may also be an issue, depending on how much it costs.

If you compare each Medigap plan, you'll find that average monthly costs and premiums differ. If you had Original Medicare and Medigap coverage you would still have to pay for it. Medigap insurance costs vary. Many plans require copayments and deductibles while other plans like Medicare supplement plan F require seniors to pay deductibles before coverage kicks in. Examples of these include the plans Medigap C and F. Currently Medicare's First-dollar insurance does not include any deductibles.

When choosing Medigagap policies, prices will probably come first. Medicap plans have monthly premiums. Your premium varies based upon a number of variables. Ensure the plan letters determine your Medigap Premium. The letters indicate the insurance coverage you receive. It's not surprising that MediGagap plans that offer most comprehensive coverage costs more than other types. Below is a table which shows the sample monthly Medigap premiums in the following demographics:

This number covers the two most deductible plans: Medigap High Deductible Plan F and High Deductible Plan C. Each lettered plan covers the core benefits and different levels. The benefits of Medigram plans are based on how they are covered as well as the type of coverage they are designed for you. Depending on plan, you will need insurance to cover deductible costs, coinsurance, and other expenses.

Once the annual deductible is met, the plan pays 100% of covered services for the rest of the year. The high-deductible Plan F is not available to new beneficiaries who became eligible for Medicare on or after January 1, 2020. 2 Plan K has an out-of-pocket yearly limit of $6,620 in 2022.

The Top 10 List Medigap Coverage Chart The Medigap plans are Federally-standardized. All companies must follow the Medigap coverage chart below. In other words, a Plan G is a Plan G, no matter what insurance company you use to provide the coverage. Likewise, a Plan N with one company is the same as a Plan N with another company. Because of the plan standardization, it is very easy to compare plans in a straight-forward way.

Medicare plans F or C are not available to any person wishing to apply to Medicare before January 1, 2020. If the plan is not in effect until 2020, you'll have to maintain that one. If you have opted for Medicare after 2020, then you can buy Plan F or Plan C after January 1, 2020 if either is accessible wherever you reside.

Medicare supplemental coverage plans (sometimes called Medigap) offer insurance coverage that complements your Medicare Part A - B coverage and helps cover certain Medicare coinsurance deductible costs. What is the most important statistic in health-insurance?

Seniors can use these policies with Medicare-accepting practitioners nationwide, just like the standardized Medigap plans in other states. Find Medicare Plans in 3 Easy Steps We can help find the right Medicare plans for you today How to Compare Medicare Medigap Plans for 2023 Comparing Medigap plans is a reasonably simple but critical task when enrolling in coverage.

Plans F and G have higher premiums for certain states. You must pay all Medicare deductibles up to $2490 per year before your policy pays.

Medigap's average premium rate for all plans is $18 monthly. Some Medigap plans have much smaller enrollers.

Medicare Part B premium (and IRMAA, if applicable) Medicare Part A premium (if applicable) Medigap plan premium Medicare Part B Deductible – All Medigap plans except Medigap Plan C and Plan F Copayments – Not applicable on all plans Coinsurance – Not applicable on all plans Medigap insurance cost varies by plan.