With 10 different Medicare Supplements Plans available across most states, consumers often ask what is best. It's not just anyone who knows what is the most suitable solution. Are these good? What are the costs? Do we need another thing? How do I choose the most appropriate Medicare Supplement Plan? With a free comparison website, you can find out how much a plan is covered for – and how much it's worth – from independent companies.

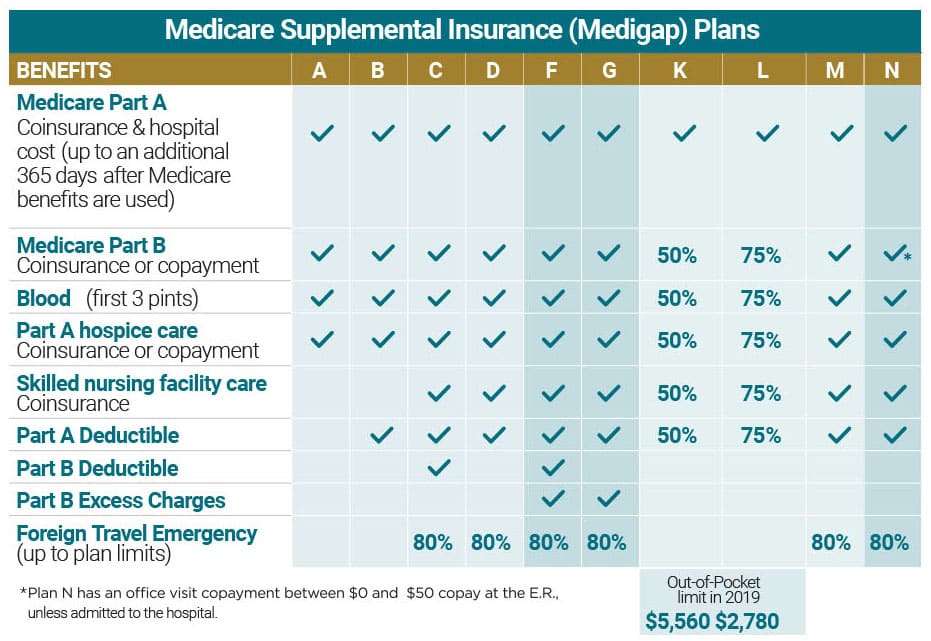

The majority of senior citizen plans will be able to use twelve different Medicaid plans by 2023. We have compiled a quick comparison table of all Medigap plans so you can compare their benefits easily. Find your Medicare plan today.

For example, a Physician's Visit. Coinsurance is the percent of the Medicare approved amount that you have to pay after you pay the deductible for Part A and/or Part B. Blood (first 3 pints) First 3 pints per calendar year. Medicare Part B Deductible The annual deductible, an amount you pay before Medicare benefits will kick in to cover physician services.

The following table lists the coverage of all twelve Medicare benefits after obtaining a reimbursement. Make it clear to patients that Medigap plans are not Medicare Part B or A.

Original Medicare includes Medicare Part A inpatient hospitals and Medicare Part B inpatient physicians visits. Medigap Plans A and B provide additional coverage for costs Original Medicare leaves behind. Whatever your medical insurance plan is, you can access it at any medical facility in any state or country accepting Original Medicare. A physician who accepts Medicare won’t stop taking your insurance unless it’s a company that you’ve chosen.

Explore benefits and costs and find plans that may be available where you live. Read more Medigap Plan F vs. Plan G | Compare Medicare Supplement Plans Medigap Plan F offers the most comprehensive coverage of any Medigap plan, but Plan G offers almost as many benefits. Learn more. Read more Medicare Supplement Plan F vs. Plan N 2022

The average cost of Medicare Supplement plans is $339 monthly in 2024. Nevertheless, rates vary widely from roughly $50 to over $400 monthly and in some areas of the United States the rate is around $70 to $500. Selecting a Medicare Supplement Plan will give you the best coverage and the coverage you want most of the time. For example, if you need nursing services the cost will be fully covered under Medicare Plan G and the Medigap plan K will cover the costs.

This number includes two high-deductible plan versions; Medigap High Deductible Plan F and High Deductible Plan G. Each lettered plan covers the core policy benefits and different levels of additional benefits. When comparing Medigap plans, it is essential to consider what each covers and how it aligns with your healthcare needs.

Every Medicare plan has been governed by federal laws that protect the consumer, including requiring a clearly identified "Medicare Supplement Insurance." Most insurers sell standardized policies with a lettering. Each policy offers the same basic benefits but some offer other benefits.

You're free to select the one to suit your needs. Medigrap policy is standardized differently in Michigan, Minnesota and Wisconsin. All insurance companies decide how many Medigap policies they wish to buy, but some states determine which one is offered. Assurance companies selling Medigap policies.

A Medicare-accepting doctor can never turn you away because of the carrier you choose for your Medigap plan. Medigap Cost Comparison Chart for 2023 When choosing a Medigap policy, price is likely at the forefront of your mind. Each Medigap plan requires a monthly premium.

Excess costs are $6620 in 2022 $3310 in 2022 * Plans F et G also offer high deductible plans in some states. If you want Medicare coverage, you need to pay for co-payments and other expenses as long as it exceeds 249 in 2022. The Medicare plans are unavailable to those who have been newly approved for Medicare before January 1, 2020. **The yearly limits of Medicare and the Part B deduction can be increased by up to 50% for Plans K or L.

Because of Plan F's enrollment requirements, no new enrollees will be allowed into the popular Plan. Which are the most affordable Medicare plans available in the United States after the first day of 2019? Plan G has the identical advantages to Plan F, except the Medicare Part B deductible does not exist. Part C deductibles will cost $256 per year by 2023. The costs are relatively minimal when compared with other types of Medicare out-of-pocket coinsurance or deductibles. Generally, the plan's monthly cost is less than plan F, which almost totally reduces Part B deductibility.

Medigap Plan B checks that box, with coverage for three types of out-of-pocket Medicare costs that Medicare beneficiaries may be more likely to face that can add up quickly: Medicare Part A deductible Medicare Part A coinsurance Medicare Part B coinsurance Having those three areas covered means you will likely avoid some of the biggest potential Medicare charges you could face.

Contrary to other conventional health insurance plans, where the policies vary between providers, Medicare Supplement Plans have standardized benefits for all companies. This means the United Health Insurance program G is the same in coverage as the plan G offered by Aestna. However, prices may fluctuate between different companies since all providers have different pricing structures. This factor must include company financial strength and historical rates rises. Some companies offer cheap price points but increase the rate of their customers with age.

From day 21-100, you are responsible for coinsurance, or a portion of the cost (unless you have a Medicare Supplement insurance plan that covers it). Hospice Care Coinsurance or Copayment Medicare pays all but very limited copayment/coinsurance for outpatient drugs and inpatient respite care. A copayment is the amount you pay for each medical service.

Plans F and G are the most common Medigap Plans. The Plan F plan is available to Medicare eligible patients only until 2020, but due to its broad benefits, approximately 46% of Medicare Supplement beneficiaries choose the plan. Plan G accounts for 27% of the market and is the preferred option for new Medicare applicants.

The Medicare Supplement program currently costs around $139 per month in 2023. Although the cost range is very broad, due primarily to the wide array of services offered and price factors such as age and location. Many of those on Supplement plans can earn as much as $600 monthly while others pay as much as $500.

The cost of medical care that some health plans offer is medical emergencies from abroad or medical care from other states outside the United States of America. The Medigap plan covers 85% of travel emergencies in the US. Two of these plans provide coverage for international medical needs with fewer monthly premiums than some other type of Medigap plan offering these services. Additionally, this program provides coverage on Medicare Part B excess expenses, making it possible for patients to view more health care services within the United States.

Medicare Supplement insurance plans are offered by private insurance companies. It also means plan availability or premiums might vary. Average premium cost on Medicare Supplement Insurance plans was $167.16 a month. Medigap plans can differ in price among their different types of plans in a variety of ways. Medigap offers many different types of standard coverage; plans that offer more benefit are also liable for lower premiums. Your age, gender, smoking status, health, location and the time you applied can affect your Medigap plan costs.

The Medicare Supplement Insurance Plans Listed Below provide a list of the top Medicare Supplement plans that meet the requirements of the customer. This may be an indication that Medicare supplement programs are standardized and approved by all federal agencies except Massachusetts, Minnesota and Wisconsin. This means that the coverage of every policy remains consistent regardless of the place of purchase. Medigap Plan C offered by Company 2 in New York provides similar benefits to Medigap plan C offered by Company 2 in California.

You can sign up for Medigap anytime throughout the year. Open enrollment for Medicare Supplement plans can be completed at any time. In some cases, a carrier cannot give you coverage despite your application being approved in advance. You are entitled to any Medigap program you want. You can also opt out of the Medigap Open enrollment period later in life and enroll in another program later. In some states, it is necessary to ask health-related questions. It's possible to get denied premiums if you have preexisting conditions.

When you select Medigap you'll most likely consider cost. Almost all Medigram plans have a monthly premium. Your premiums will vary according to many different factors. The most important factor that determines Medigap premiums is the letters on the plans letter. It shows you your insurance coverage levels. Despite the higher coverage offered by Medigap plans, the most expensive options are cheaper. Below is a comparison of Medigap monthly premium samples for the below demographic - non-smokers who live in FL (33634 zipcode).

There are not many different options for Medigaps that work for you. Is this ok? Medigap plans may be suited to you if they are affordable and provide coverage that suits your needs. The Medigap program represents the cheapest Medicare Supplement insurance. Approximately 46 per cent are enrolled in Plan F2. Plan F covers all Medicare costs in full. Plans are available in a wide range of forms. The average Plan F premium in 2020 is $87.56 monthly. The plan is a two-fold popular Medigap Plan that is gaining popularity rapidly.

If you compare Medigap plans, they will vary by monthly cost and premium amount. If you've received Original Medicare or Medigap coverage you're still required to pay these costs. Medical insurance costs vary from company to company. Certain plans include copayments and deductibles, while others require seniors to pay only a copayment and the deductible to receive coverage. Some examples can be found in Medicare Plan F and Plan C. However, first-dollar insurance does not exist anymore for new patients with Medicare.