Medigap plan is an affordable health insurance plan that helps to pay for some of the health expenses Medicare does not cover. Some Medigap Plans also provide coverage for health care which Original Medicare does not cover, like health care if you travel abroad in the United States. If you have Medicare or have purchased Medigap, Medicare can pay a portion of this approved amount. Your Mediga plan will also pay you for your portion.

You can get Medicare supplement plans if you already qualify under Part B or Part B. Your open enrollment period starts on the day you turn 67. During this Medicare Supplement Open Enrollment Period you will have no option to withdraw your insurance due to any prior health conditions. Some countries do not offer underwritten insurance coverage for people under age 65 whose eligibility is based purely on age.Some states offer a Medicare program for the younger age group based on a variety of reasons. Medicare Supplement coverage gives you access to a doctor who accepts Medicare patients. The Anthem Health Care Plan includes all the coinsurance coverage for Part A and Part B.

Plans F covers a medical deductible and some co-payments. Per state regulations plan F can only be used for individuals who have been enrolled into Medicare after January 1, 2020. The Innovative - F is also available in several states.

Plan N pays for the co-insurance for the Medicare Part A. You may have a deductible and copayment but have a reduced premium. Select and InnovativeN may exist in different locations.

Plan G covers any expenses that are not covered by Original Medicare except the Part B deductible. Select G and Innovation G are available in certain countries.

Plan A represents the best basic Medigap plan, allowing for low premiums. In addition, the supplemental Medicare program has no Part A deductible.

Part D plans are not covered under Medicare Supplement plans. In addition, Medicare Supplement plans do not cover dental and vision protection, but there are dental and vision insurance options available to residents of Wisconsin, California, Connecticut, Florida, and Kentucky. California and Kentucky provide innovative Medicare Supplements with vision and hearing benefits.

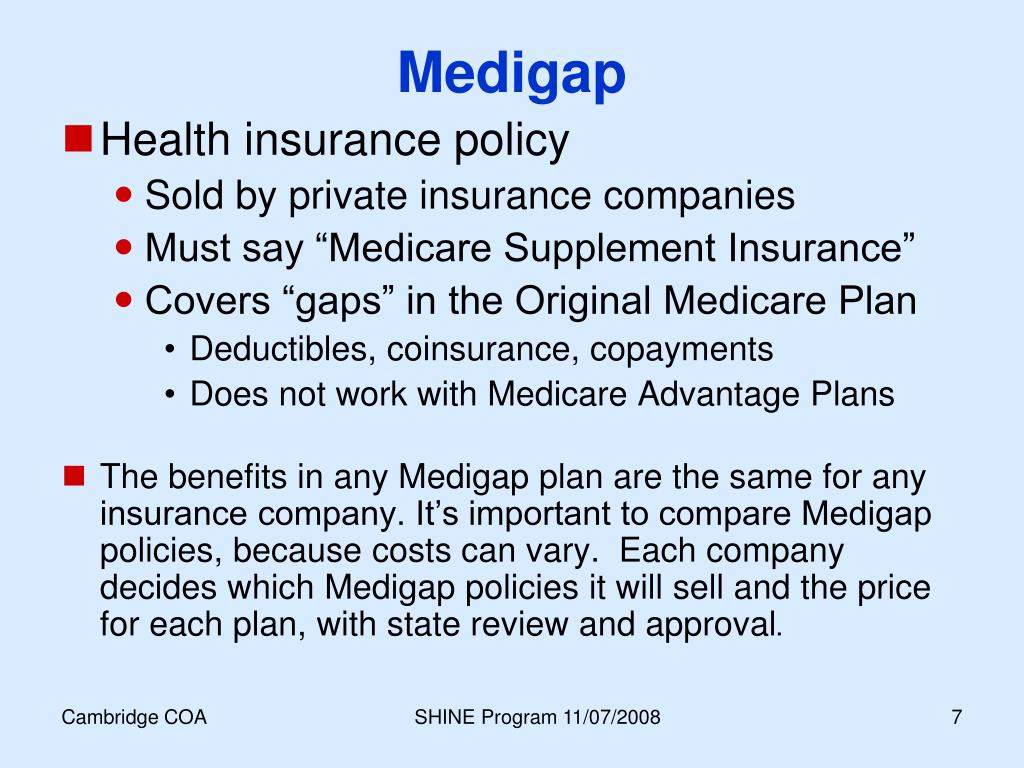

If you have Medicare Part A or B, Medigap plans are designed to cover coverage gaps. The Medicare plan is provided by private insurers and is designed to provide assistance for you with your own medical bills without any extra cost. Medigap plans can also be standard. All standard plans can be found at your local store.

The First Enrollment period provides a limited window to enroll in Medicare when the eligibility criteria have changed. After completing Medicare Part A or Part B, your plan may have supplemental plans such as Medigap. Best time for buying Medigap policies is the period that begins on day one of each month if a person reaches age 62 and is enrolled in Part B or older. If you are not enrolled in a Medicare program after that period, you may not qualify for Medicare Part B The various states handle the situation separately, though there is sometimes a longer period to enroll.

However, some companies—like Humana—also offer additional benefits. Take some time to consider the differences is in the companies, the quality of service and the price. What isn't covered by Medicare Supplement insurance plans? Generally, these plans don't cover long-term care (like care in a nursing home), vision or dental care, hearing aids, private duty nursing or prescription drugs.

What's Medicare Supplement Insurance (Medigap)? Search Search Print this page. Left navigation How Medicare works with other insurance Retiree insurance What's Medicare Supplement Insurance (Medigap)? Medigap costs Medigap & Medicare Advantage Plans Medigap & Medicare drug coverage (Part D) Illegal Medigap practices Find a Medigap policy When can I buy Medigap? How to compare Medigap policies Medigap & travel What's Medicare Supplement Insurance (Medigap).

The 2 year limit does not apply to fraud. Rates are subject to change. Any change will apply to all members of the same class insured under your plan who reside in your state. can provide peace of mind by helping with some of these costs. Shop and apply for an AARP Medicare Supplement Insurance Plan Shop Now How do Medicare Supplement insurance plans work with Original Medicare? Medicare Supplement plans work alongside your Original Medicare coverage to help cover some of the costs you would otherwise have to pay on your own.

You can get either Medicare supplemental plans or Medicare ACA plans, but not both. Here's the difference in terms to assist with choosing.

Coverage Options Prescriptions, Providers & Benefits Medicare Cost Basics More about Medicare Articles and Special Topics Types of Plans Overview of Plans Medicare Advantage Plans Medicare Supplement Insurance Medicare Prescription Drug Plans Special Needs Plans FAQ Medicare FAQ Glossary Medicare Enrollment When to Enroll How to Enroll Changing Plans Working Past 65 Get Your Free Medicare Guide Learn more about how Medicare works, coverage options and when to enroll.

Medicare Supplements is a private insurance program designed to help pay deductible and copayment fees.

Medigap policies differ significantly from Medicare Advantage and Medigap. The plans offer Medicare benefits, while the Medikap coverage provides supplemental Medicare benefits. Payments to Medicare or health insurance plans if deemed necessary to provide health care coverage.

You pay the private insurance company a monthly premium for your Medigap plan in addition to the monthly Part B premium you pay to Medicare. A Medigap plan only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap plan from any insurance company that's licensed in your state to sell one.

Medigap benefits are limited. There must be various types of plans. There is no prescription coverage.

Medicare pays part of this amount and you're responsible for the difference. for covered health care costs. Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan.

Medicare Supplement F is a fully integrated Medicare Supplement Plan and has been recognized as a good Medicare Supplement Plan. Upon payment of the Medicare Part I premium, this option provides 100% of your coverage. Medigap Plan F includes deductibles and insurance coverage for Medicare Part B, as well as Medicare Part C.