Josh Dickinson | You can get additional coverage through Medicare if you have an supplemental policy that covers your medical expenses. Private insurer Medicap sells insurance policies but is tightly regulated by state and federal governments as well. These plans are available to Medicare-assigned individuals under Part A or Part B and are not available to Medicare-eligible individuals. Medigap plans cover deductibles and deductibles, and other fees that Medicare does not cover.

MedigAP plans, also known as Medicare Supplements, are offered by private companies that pay some costs for health care services that are not covered under original Medicare. Certain Medigap plan options may also offer coverage for medical costs or other expenses which Original Medicare cannot cover. So you'll get some reimbursement on Medigap.

Medigap Medicare Supplemental insurance that fills gaps and is marketed privately; the government provides them with the funds. Original Medicare provides some, if not all, of the costs of covered healthcare services. Medicaid Supplements (Medicaids) can provide coverage to some of these remaining medical care needs.

For Medicare For Medicare Shop for Plans Member Resources Eligibility & Enrollment Find a Doctor Find a Doctor Log in to myCigna Compare Medicare Supplement Insurance Plans Plans that help pay deductibles, copays, and coinsurance—out-of-pocket costs Original Medicare doesn't cover.

From day 21-100, you are responsible for coinsurance, or a portion of the cost (unless you have a Medicare Supplement insurance plan that covers it). Hospice Care Coinsurance or Copayment Medicare pays all but very limited copayment/coinsurance for outpatient drugs and inpatient respite care. A copayment is the amount you pay for each medical service.

For non-emergency services covered by Medicare, you must use a hospital in our Select hospital network to receive full benefits. Medicare Advantage Plans Include dental, vision, and/or hearing coverage, and most also cover prescription drugs. Can change and do not offer guaranteed lifetime coverage once you've enrolled.

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

If you are already on Medicare Supplement plans, you may be referred to Medicare Supplement. You can open enrollment for 6 months from when you reach age 62. During the open enrollment period of the Medicare Supplement, you cannot get any coverage for any prior medical condition. Not all states permit insurance for health coverage, and some states offer plans for those under age 65. Medicare Supplement insurance gives you access to all doctors who treat Medicare patients. Anthem's Medicare Supplement plan covers Part B- 100% coinsurance.

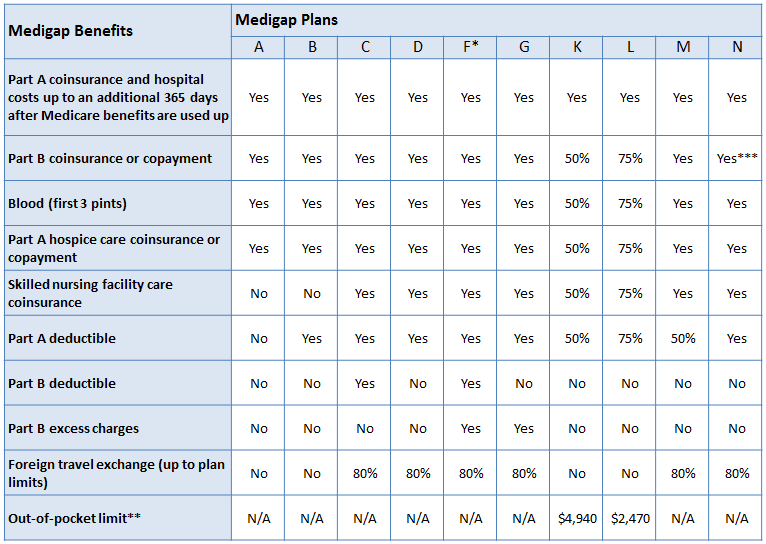

Plans FS covers deductibles and a few copayments or coinsurance. The Plan F program will be offered to people who have commenced their Medicare eligibility by January 1, 2020. In some states, selects and innovation-F will also be offered.

The program helps pay the Medicare co-insurance cost of Part A. You are responsible for any deductible or copayments; however, your premium is lower each month. The selection of innovative N can be obtained in some jurisdictions.

Plan g covers all costs of any type that are not deductible under Original Medicare, except Medicare Part B deductibles. Select or innovative Gs are available across several countries.

Plan A is one of the simplest Medigap plans with the lowest cost. In most cases, this is the one plan that does not include deductibles.

Medicare Supplement plans don’t include meds and you can purchase a Part D plan for a fee if you are eligible. A Medicare Supplement plan doesn't even offer dental and vision coverage. However, you can choose to buy the dental and vision protections for a premium in California. California and Kentucky offer Medicare Supplements with innovative vision and hearing protection.

The Medicare Supplement is the most common plan, but not the most. Tell me the difference between these options.

Anthem Blue Cross Life and Health Insurance Company (Anthem) has contracted with the Centers for Medicare & Medicaid Services (CMS) to offer the Medicare Prescription Drug Plans (PDPs) noted above or herein. Anthem is the state-licensed, risk-bearing entity offering these plans. Anthem has retained the services of its related companies and authorized.

There's one disadvantage with Medigap plans: high monthly premiums. It is necessary to find various plans. There is a minimum requirement for prescription insurance (available under Plan D).

For your Medigap policy. You pay this monthly premium in addition to the monthly Part B premium that you pay to Medicare. A Medigap policy only covers one person. If you and your spouse both want Medigap coverage, you'll each have to buy separate policies. You can buy a Medigap policy from any insurance company that's licensed in your state to sell one.

It may be less than the actual amount a doctor or supplier charges. Medicare pays part of this amount and you're responsible for the difference. for covered health care costs. Then, your Medigap insurance company pays its share. 9 things to know about Medigap policies You must have Medicare Part A and Part B. A Medigap policy is different from a Medicare Advantage Plan.

Medigap plans are priced at $118 monthly, but certain kinds of Medigap plans tend to have much fewer enrollees than other kinds. These enrollment differences affect the average annual premium paid by Medigap beneficiaries.

What's the difference between a Medicare and Medicaid program? When it comes to medical bills, Medicare Advantage may be the best alternative to Medicare. But for patients suffering from serious medical problems, Medigap may be the better option.