Medicare Supplement Plan letters have letters A–N and all plans cover the gap that Medicare presents. Use the following table to compare Medicare Supplements plans. The comparison of Medicare Supplement plan is very simple. Medicare Supplement plans and Medicaid plans are similar. The Medigap Plans Comparison Chart of CMS is updated each year though the majority of the Medicare plans have no change in benefit. Medigap plans offer higher rates and coverage. Others will also be cheaper due to you agreeing with Medicare to fill some gaps for you.

With the 10 different Medicare Supplement Plans offered by each state, the majority of customers wonder which would be the better. What's wrong with everyone's interpretations? Does this offer any advantages? Costing? And another thing? How can I choose a suitable Medicare supplement plan? With free online plan comparisons, it is possible to see how many different types of insurance policies they offer as well as how much the plan will be.

elementor-template id="1705"]

This page provides basic information about Medicare Supplement Insurance. Medicare Supplement Insurance covers only one individual. When the spouse has a Medicare Supplement, they need a separate policy. In most cases, companies are prohibited from changing plans with Medigap plans. Medigap plans are standardized to guarantee their renewal, and health insurers cannot revoke your health insurance policy in the event of a health problem. Medigap does not offer prescription medicines. Medigap policy does not cover receptive drugs. This is necessary if you want prescription medicines under Part D. You cannot use Medigap for Medicare benefits.

When comparing Medicare Supplement costs, make sure the plans you select are uniform. Every company has its rates but the cost of the plan is the same wherever your purchase is placed. Similar happens with other Medigap plans. So the price comparison of the policies is simple. We typically check the most expensive carrier on the market. We then decide whether the home discount is applicable. We also examine rates and increases for low-price carriers. Lastly, we look at financial rating. There are several top A / B+ companies in the market that are very good companies, so there isn't much reason for choosing a firm with a higher rating.

elementor-template id="1686"]

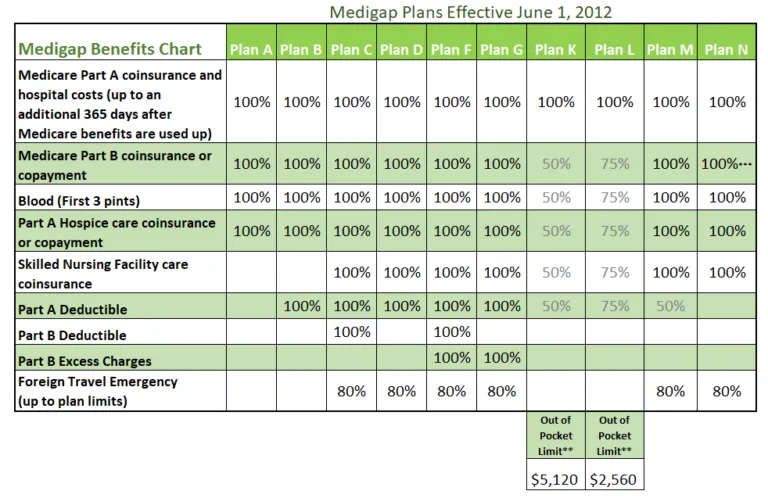

Learning the difference between health insurance plans is quite straightforward. Medicare publishes an annual brochure with an informational comparison chart of Medicare Supplement plans comparisons. Comparisons of health benefits for Medicare & Medicaid are provided by Medicare.com. This Medicare Supplement comparison map reveals which benefits each program covers. *Medicigap Plans F are sometimes offered on high-deductible plans. When you opt to have a high-deductible policy, you will need to pay Medicare deductibles (deductibles) until 2022 before your insurance pays anything.

Comparisons for Medigap Plans below are comparisons to each plan side-by-side. This will give you a clear picture of which has the greatest benefit, but which covers less. Plan A and Plan G have the most benefit benefits as discussed above, leaving you with a relatively modest amount of costs to pay. The following list shows all the different Medicare supplements and offers an overview for comparison. But this would be covered by 20% of the costs Medicare cannot provide to the inpatients. The Medigap Plan has some important benefits.

elementor-template id="1652"]

Other excellent features include a Medicare policy that lets a person see anyone if the insurance company has a Medicare plan. Thousands of services are offered in the US. It is simple to get meds from a Medigap plan. As long as your medical provider is on Medicare, you may also accept your Medicare supplement. Many people find these things confusing because Medicare Advantage Plans are different and require network usage. If your original Medicare plan is active, then you are allowed to visit a doctor with your Medicare membership.

Plan E and Plan C are the two most common Medigap plans. In this Medigap comparison chart Plan F covers every gap in Medicare. Plans G are very similar so they are popular among customers. When looking at Plans F and G together you will notice that Plan G is only different: Part B deductible. In case you compare annual premiums for plan G and your premium savings over a Part B deductible, then enrolling in Plan G would be appropriate. Plan G has gained popularity over Plan F as plans are not accessible to all Medicare enrollings.

A new enrollment restriction on plans F is in effect and new participants cannot enroll under this popular plan. Can anyone find an affordable Medicare plan? Plan G has a similar benefit to plan F except that they cannot pay Medicare Part A deductible. Part B deductible will be $233 annually for 2018-19. It's therefore relatively inexpensive compared to other types of insurance. The premium for the monthly plan is generally lower compared with the Plan F premium and may cancel a Part C refundable expense in some cases.

elementor-template id="1728"]

According to the chart above, one of the most important Medicare plans in America offers exceptional health insurance. Plans F offers coverage of all the benefits provided by this type of insurance. Plan members receive little or no medical costs because their Medigap plan takes over most everything not covered by original Medicare. Approximately 50% of Medigap beneficiaries participate, however the plan has one drawback. Those who are currently eligible for the Medicare plan can still be eligible.

Medical Care expenses covered by Medicare supplemental insurance are the travel and emergency care incurred outside the United States. It has six Medigap plans that cover 80% of your travel emergency expenses. The two are Plan M and Plan N which cover urgent care but typically provide low monthly premiums over all Medigap Plans. These plans also cover Medicare Part B excise rates, which gives members access to a larger variety of doctors throughout the country.

In some states the Medicare Supplement can be offered in three types. This may be classified in community ratings issue-age rating and reached age. Typically age-related programs in many states are the least expensive. In some countries, issue-aged ratings are the lowest. Keep in mind that any Medigap policy with an age rating still reflects rate hikes resulting from inflation in health insurance premiums. Find out what's going on with that blog here.

Costs are very important when the purchase of healthcare insurance, and they're even a major priority for many consumers. Plan G and Plan F are typically the cheapest plans for MediGAP customers. All plans have deductible amounts before Medigap coverage begins. The maximum deductible for high-deductible plans G and F is $2490. In return for the lower monthly premiums you're expected to pay for the benefits until 2022.

Only Medicare beneficiaries first eligible for Medicare by 2019 can purchase Plans C and F. Check marks indicate benefits are 100%. Part A coinsurance and hospital coverage (up to another 30 days after Medicare eligibility) Coinsurance or copayment 50% 75% Blood (1st 2 pints) 50% 75% Part A hospice copayment or coinsurance 50% 75% Skilled.

elementor-template id="1768"]

Often recipients just want an inexpensive Medigap program, but not thrills. Medigap Plan B checks this box by offering three options if any of your medical expenses are significantly more expensive. This may allow many beneficiaries to feel reassured by a straightforward plan that contains everything they need.

Find Medicare supplements in your local area at Medicare.gov. Please type your ZIP code, and sex and tobacco usage into the box below to get the most accurate quote. Once you select a program with Medigap, the searcher displays all the local companies that are available.

Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and a copayment of up to $50 for emergency room visits that don't lead to inpatient admission.

UnitedHealthcare gives users information and tools to make finding and understanding your plans easier.

This website is not connected with the federal government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.