What's the best way to get supplemental insurance coverage if you have health problems or are unable for a specific reason? For medigap eligibility, you must have Medicare Part B, Part D or Part. In Colorado, you have 12 Medigap plans including two deductible plan plans. Medicare is helping pay the majority of health costs in Denver for Medicare users. Nevertheless, the costs of the co-paying or the tax return remain yours. It is possible that these fees will increase quickly. Generally, Medigap is an extra coverage that helps reduce or eliminate some of the costs Original Medicare does not cover.

The Medicare Supplemental Insurance Plan is the most effective in Colorado compared to other states. Our quote service is free to all carriers. This is not a sale call. Private information protected if required. Get help with your planning by calling 877-282-0510 (TY711). Get help from 1-800-272-0510. Whether a Medicare applicant is eligible to enroll in a health insurance program for Medicare, Medicaid or an alternative health care program, Medicareenrollment.com offers a free consultation to Medicare enrollees.

elementor-template id="1705"]

Medicare Supplement Plans can address the gaps left by Original Medicare (Part a/B). If you have Medicare Supplement coverage you have access to a doctor who accepts Original Medicare. MediGap provides an effective way of getting medical help. In addition, you will get high-quality care for the time you want. Let us describe Medicare Supplement plan in Colorado. Compare Medicare Plans Find Colorado's best Medicare plans!

How do Medigap plan providers compare to Colorado? These include Medicare Supplement Plan EXMedicare Supplement Plan F is the largest Medicare Supplement. This policy includes the full cost of Original Medicare deductible, coinsurance and payments and provides no additional cost for the Medicare services. Medicare Supplement Plan Gx if you turn 65 in the next few years, it could be the largest supplement that your Medicare provider will offer. This also has the most popularity. You may think Medicare Supplement Plans F is.. . ' The NXMedicarial Supplemental Program is a member of the ten standard Medigap plans.

elementor-template id="1686"]

If you have been in the country for 5 years, you must apply for the Original Medicare program for Medicare Supplement Plans. The open enrollment period for Medicare Supplements typically starts the day your Part B starts being activated and lasts six months. In the first six months of this term, your Medicare Supplement plans will be eligible for insurance underwritten. If you aren't enrolled for the insurance plan during this period, you may continue to apply to cover it. Depending on what is the health policy you want to do it might get rejected if you aren't answering all the questions.

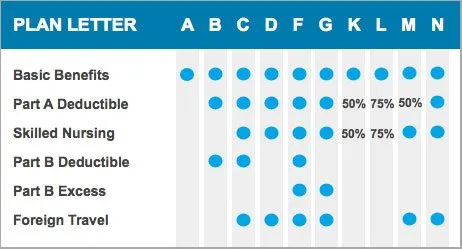

The Federal government has worked on an agreement to create standard Medicare Supplemental Insurance policies. Insurance companies have to clearly define a plan as a Medicare Supplement insurance plan. Medicap policies must have the standard letter codes A to N. All letters of plan offer the same benefits no matter who offers them. All rates have differences. That means that AARP plans F offer the same health insurance cover as AARP plans. The letter plans allow comparisons to the HMO and PPO coverage offered by the Advantage program.

elementor-template id="1652"]

This table shows an overview of the benefits offered by every standard program. Medicare plans F offer a higher deductible option. Depending on the plan, you must pay Medicare coverage costs at least $2,240 before the payment period. Medicare plan N pays 80% Part C coinsurance with no additional costs for office visits and up to 50% of hospital admission for inpatient visits. After meeting a minimum monthly limit and deductible yearly, Medicare will pay for all of its benefits during the remainder of the fiscal year.

If you qualify before 65 you can get a Medicare Supplement plan. All carriers offering Medicare Supplement programs for older adults must offer one plan to people younger than 65. Monthly premium prices are usually higher for older individuals compared with older adults because of the higher rates relating to disability. Some older Medicare patients who have not yet reached 65 should start enrolling in an Advantage plan and then switching over to supplemental Medicare plans.

The state of Colorado has 12 Medicare Supplements. Each Medigap Plan is numbered by a different letter, "N" to " A. The best Medicare Supplement Plans in Colorado are Medigap Plan A, Plan G, and Plan NP. These three plan options are among the top choices throughout the nation primarily as a result Medicare supplement standardization requires the same letter for every Medigap plan enrollee. Therefore, you don't have to tell the provider whether your plan accepts it or not.

elementor-template id="1728"]

Only Medicare Part D plans that offer prescription protection are available in Colorado. In some instances prescription coverage starts at as low a dollar per day. When you start receiving your Medicare benefits, your prescription medications should be included. Once you have completed enrollment with Medicare, you must wait until the next open enrollment period. EOPI begins January 1st and runs until January 31st. Enrolled or switching plans?

We reviewed a number of reputable Medigap insurers in Colorado. We have 5 stars and the rating is impartial. The underlying equation for evaluating an entrepreneur's years is a. M. XA Premium is an annual fee paid to a policyholder in exchange for coverage. The Premium is generally repaid monthly. Medicare covers a total of 4 different types of premiums. & taxes. Currently the formula does not include rate increase statistics.

In general, you'll get the best deal on Medicare supplement insurance if you buy the plan as soon as you qualify and enroll in Parts A and C. Medigap opens enrollment on the day you turn 66. In some cases insurance companies cannot accept a new application for medical services. Contact an insurer for information about the enrollment period for Medigapp plans. Make your application and decide how soon your policy starts.

Approximately 55 percent of Colorado's Medicare recipients use Original Medicare. So the patient has Part A (hospital health plan) or Part B (medic insurance). The best period for Medicare Supplement Insurance is during your Medicare Open Enrollment period, which generally starts at age 65 and is enrolled in Medicare Part B and runs for full six months.

elementor-template id="1768"]

Coinsurance is a percentage of your total payment to the government for a health-related service. The price is a variable. A good insurance program attracts seniors in Colorado because it is less expensive. List the 10 most popular Medigap Plan policies in Colorado based on our review (click to find more info).

many Medicare enrollees under 65 will enroll in a Medicare Advantage plan until they turn 65 and then switch to a Medicare Supplement plan.

Health insurance assistance program is aimed at ensuring the health insurance benefit and support available to Medicare beneficiaries and family members. The Colorado SHIP is funded through federal grants. They are accessible by telephone or via the Internet.

Medicare Advantage Plans Include dental, vision, and/or hearing coverage, and most also cover prescription drugs.

All standard Medigap plans are provided in Colorado although Plans F and G offer the most comprehensive coverage and are the most popular. The FS and G plan come in high-deductible versions. There are some differences between different plans, namely:

The best time for most people to buy a Medicare Supplement insurance plan in Colorado According to the Centers for Medicare & Medicaid Services, about 58% of Colorado's Medicare beneficiaries have Original Medicare.

Plans GF and G provide supplemental insurance in many states. With this option, you must pay Medicare coverage for coinsurance, copayments and deductible expenses until deductible amounts of $2490 are paid. Plans B and F may only be offered for people who are currently in Medicare. **For plans K and L, a premium is automatically credited annually for a deductible of up to 5% of the total amount of the deductible.

Medicare supplement insurance plans are not connected with or endorsed by the U.S. government or the federal Medicare program. We offer plans from a number of insurance companies.