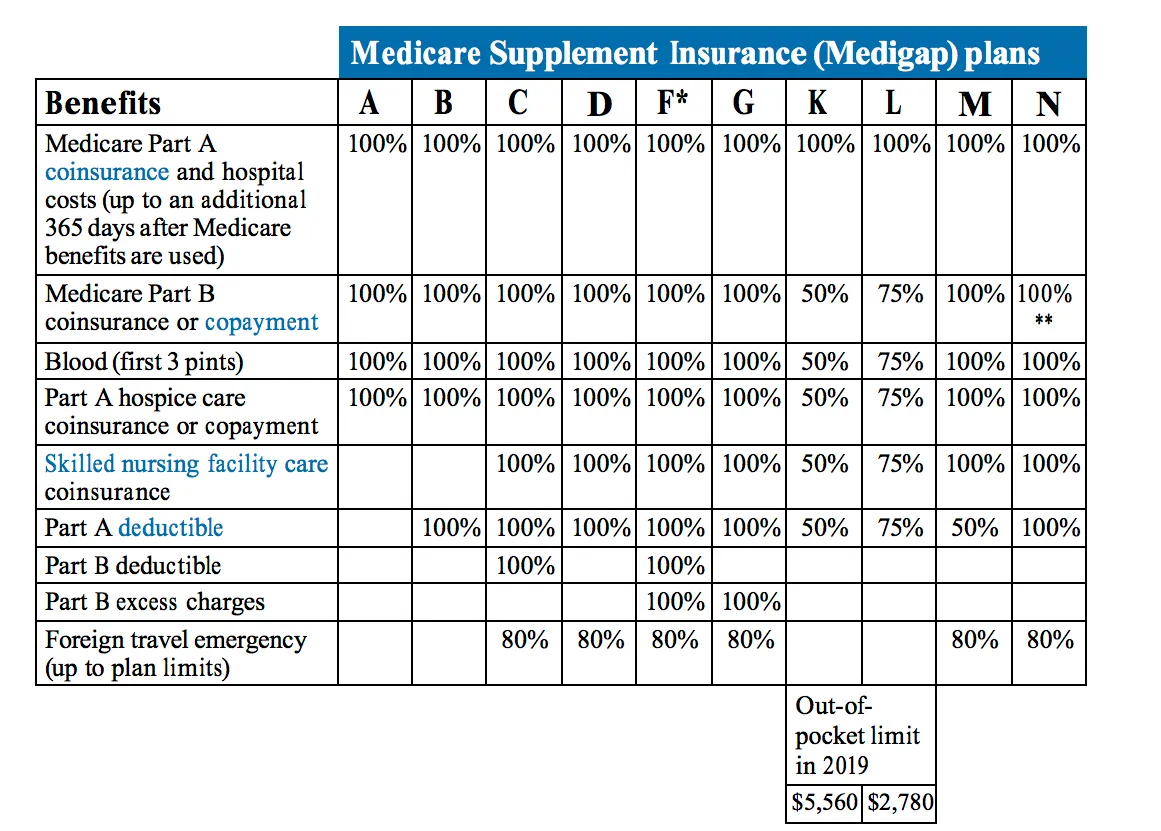

Medicare Supplements will have 12 different plans in 2022. We provide the most intuitive comparisons of Medigap plans so you can quickly review these plans and compare their costs. Find the most affordable Medicare plan in the region This chart shows all 12 Medigap plans and the coverage after the original Medicare payment is complete.

Medigap Benefits Plan A Plan B Plan C Plan D Plan F Plan G Plan K Plan L Plan M Plan N Part A coinsurance and hospital costs up to an additional 365 days after Medicare benefits are used up. If your health care service or medical device is covered by Medicare, your Medigap plan would cover any additional out of pocket costs so that you don't pay anything for your services (depending on your Medigap plan coverage and whether or not you've reached certain Medicare deductibles).

Medigap does not offer the best solution. A Medigap plan may be good for the customer based upon its coverage and its premiums that match your spending goals. Medigap Plans F offer the most common insurance coverage for Medicare Supplements. The Medicare program is funded by United Way and provides health insurance coverage for a number of eligible Medicare beneficiaries. The eligibility age for Medicare is 65.

Plan F covers Medicare costs bundled with Medicare payments compared to any other Medigap Plan. Plan F covers most standard Medigap benefits. Plan F's premium average will reach 176,725 a month in 2020. Medigap Plans G are the second most popular Medigap Plans which have rapidly become more popular. Plan G enrollments rose 39 per cent between 2010-2013.

You can join a Medigap plan anytime of your life. In some instances, the best time to enroll in Medicare Supplement plans is during your initial enrollment period. In the event of a successful application the carrier can no doubt refuse you the insurance. You are able to choose a Medigap plan that suits you. You may miss out on your first enrollment period or decide to take Medicare Supplement plans later. Medicare enrollment can take place year-round. All policies require that an applicant answers health insurance questions during the underwriting process within one state. Find a Medicare plan that fits you best.

Medigap policies must comply with federal and state legislation aimed at protecting you, and must be clearly defined in the name Medicare Supplement. Most insurance companies only offer a standardized policy with letters. All policies are similar, but some offer additional benefits. Medigap policy can also be standardized in other states, like Wisconsin, and Minnesota. Regardless of whether state or national laws determine which insurance companies are offering Medigap plans, a company's policy may vary. Insurers selling the Medigap policy:

The following chart provides a brief summary of the different Medigap policy benefits that are covered by the policy. The plan is 100% covered by it and does not include those benefits.

Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in inpatient admission.

Medicare premiums can also be sold by private insurance companies. The availability of plans may differ. In 2022, the premium cost will average $121.61 each month. The median costs for each Medicare Plan type are very different. Typically, every type of Medicare-Medicaid plan offers an individual variety of standardized benefits; that means fewer benefits will likely have fewer premiums. The average cost for Medigap plans in your locality are also affected by your age and gender.

Do not confuse Medicare Part A or Part B. Original Medicare also includes Medicare Part A inpatient hospital coverage and Medicare Part B inpatient physician visits. Plan B and plan A provide supplementary coverage to cover Medicare costs. Any health insurance company or doctor who accepts Original Medicare will offer you the coverage you need. Medical providers may not reject a person whose Medigap plan is approved by Medicare.

In Medicare, you must still go to your doctor. Medicare Supplement Insurance plans help to cover out-of-pocket medical expenses you do not receive from Original Medicare. The coverage of Medicare supplement coverage is dependent upon the state of residence. What Medicare Supplement plan should be chosen will depend on your personal circumstances. Tell me the most suitable Medicare Supplement plan for your needs.

Medicare Supplement insurance costs can vary based upon carrier or site. The standard benefits of Medigap are still applicable regardless of the location or the plan carrier (with exception of Massachusetts, Minnesota / Wisconsin where Medigap has varying standards). The Ohio Medigap plan A benefits are the same as Texas Medigap plan A. The nine standard Medicare benefits offered through this scheme include:

The Medigap plan offers 12 different types of benefits – including premium and other costs – and each has their unique annual fee. Cost for a Medigap Plan varies a lot depending on your plan choice. Some plans also require a co-payment and deductible whereas some have no deductibles for coverage until coverage is 100%. How does Medicare work and what's the right plan for me?

The Medigap plan carries 12 letter letters: N to A. Each letter plan provides statutory benefits at various levels (if additional). Get a free quote Find a health insurance plan that meets your budget and meets your needs. According to the plan plan, you can pay for medical costs including copayments, coinsurance or other expenses.

Medigap plans are very flexible and have no restrictions to network providers and services. With Medigap you can use health benefits as you want whenever it suits your circumstances. The benefits for travelling overseas during an emergency should be taken into consideration as a Medigap plan is based on a Medigap plan's benefits.

The plans are only available if the Medicare recipients became eligible before July 1, 2020 or later. If you've got Plan D you'd still qualify for a free year plan. If you were previously eligible for Medicare in 2015, you can still get the Medicare plan for your family a month after the date on which the plans are available.

Applicants who are enrolled in Medicare for a period beginning with 2020 must apply to get the plan. The check marks indicate the benefit is fully credited. Part B Coinsurance & hospital coverage (upto the maximum period of 365 days if a Medicare benefit is used).

The Medigap plan is a Medicare supplemental plan that covers the cost of some or all of Medicare's deductible, copayment and coinsurance or other expenses. Below is information on the Medicare Supplement Program.

This 2022 Medigap Plan Chart will compare the advantages of each plan type. Use the scrollbar to see all plan information.

This website is not connected with the federal government or the federal Medicare program. We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area. All policies offer the same basic benefits The health care items or services covered under a health insurance plan. Covered benefits and excluded services are defined in the health insurance plan's coverage documents.