Medicare Supplement plan N reduces what a Medicare beneficiary pays in cash for medical services. In the past, Planned Parentage has paid 100% of copayments for hospitalizations and medical expenses. Plan N, a Medicare Supplement or Medigap policy, offers more protection than many other plans on the market. Plans A, D, K, and M are included, though it isn't the most comprehensive one. Despite these shortcomings, Plan N is an attractive option for people wishing to cover medical costs with the most affordable policy.

Medicare Supplement plans, also called Medigap plans, are policies sold by private insurance companies to help pay for the expenses Medicare does not cover.

Find the cheapest Medicare Supplements plans. Medicare Supplement Plan N is among many standardized Medicaid plans available to most states. Like other health insurance plans, this program helps you pay for health care expenses that Original Medicare cannot cover. Plan N offers standardized benefits as well as Medigap coverage. You can enjoy exactly the same basic benefit for your plan, regardless of whichever insurer you purchased the policy from. Plan N offers ten advantages.

Medicare Supplement Plan N is expected to serve as a major beneficiary by 2022. Medigap plans can help those who prefer lower monthly payments and aren't willing to forfeit important benefits.

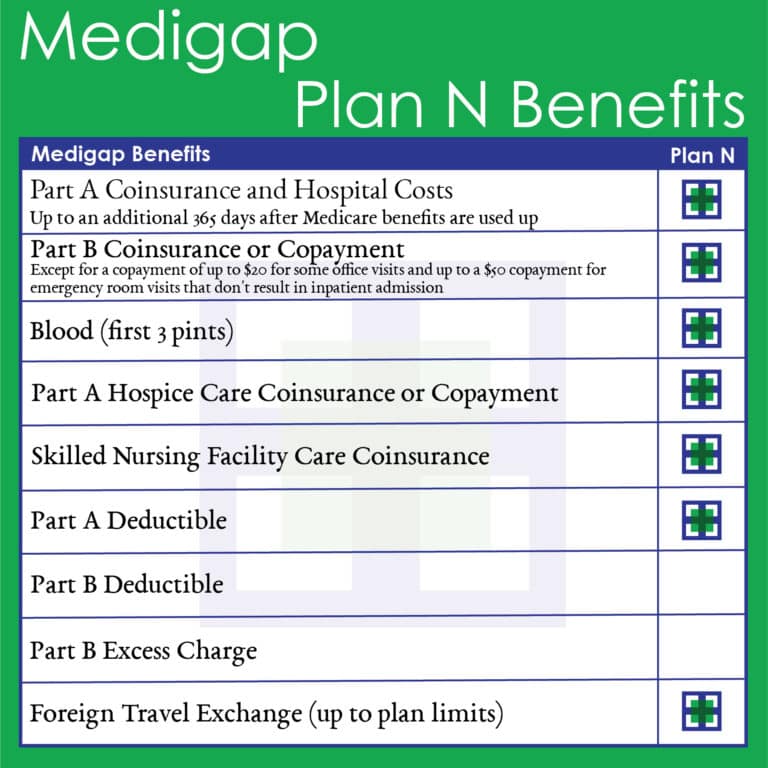

The plan covers the Medicare Part A deductible of $256, coinsurance of Part A and B, and covers 90% of the cost of medical travel abroad. Plan N does not offer deductibles in Medicare Part B ($232 in 2020). In addition, its copay does not qualify as a Part B deductible. Some Plan N policies do not have separate taxable incomes other than Part B deductibles. Plan N does NOT cover Medicare Part B excess costs. These costs are extra for a company to pay a premium on a new service that has already had a premium for its services. The costs of the plan n can't be covered without a limit of Category Plan n coverage.

Premiums in Medicare Supplement plans vary depending on where you are. The 62-year-old woman who lives without cigarettes in Florida will pay monthly premiums of around $118 for supplemental Medicare supplement plan N in 2021. What is the process to set the price for an individual product? They have three price ratings for premiums. Costs vary considerably between companies. Differences may arise from whether or not insurers selling policies offer discounted policies. When buying supplementary health insurance you should always compare apples with apples.

Monthly rates in plan N range from $150 to $150 and climb from $200 to $150 in the States and fall from $100 to $300 in another. Rates depend on location, age, gender & current health conditions. The cost varies by month and includes all premiums for Medicare Part A. In 2018 Part C will cost a whopping $179.95. Plan N provides a copay for some medical services - $25 per doctor appointment, and $50 for any emergency room visit without admission.

Alongside factors that affect your monthly premium rates, your providers' pricing methods may also affect their premium. In the last three years, the premium for Medicare Supplement Plans X has increased by around 24%. These increases are lower in comparison to Medicare Supplement Plan F and Plan G. The benefits of Medicare Supplement Plan N are the same between carriers and the rates of increase should be considered when deciding whether or not your agent is a potential enrollment partner. In addition, research carriers review Medigap Plan N.

After Medicare pays the payment of the health care expenses, Medicare Plan A will supplement any gaps left in your coverage. Plan N will cover Part B coinsurance for a patient who has paid the Part B coinsurance minus cot payments for medical office or hospital visits. . Medigap Plan N reduces premium costs for certain benefits. Instead of covering your whole Part B copayment, the plan requires a minimum copayment of $20 per office visit. Emergency room visits can reach $50 for nonhospital admission.

Plan N pays 100% of the Part B coinsurance, except for a copayment of up to $20 for some office visits and up to a $50 copayment for emergency room visits that don't result in inpatient admission.

Medicare Rewards calls are legitimate. The program is run by the Centers for Medicare and Medicaid Services (CMS), which is part of the U.S. Department of Health and Human Services. The program rewards people who get preventive services such as vaccinations, check-ups, and screenings.

Medicare does not directly pay for services provided in assisted living facilities. However, Medicare may cover some of the costs associated with assisted living if the person receiving care is eligible for Medicare-covered skilled nursing care or home health care.

Medigap plan N is an extensive Medicare Supplemental Insurance program. There are other plans in which plan N does not cover Part A extra costs unless providers have been allowed to charge higher amounts than Medicare's approved amounts. In addition to Medicare Part D deductibles, Medicare's new plan does not offer deductibles. From now until 2020 Medicare beneficiaries will not be eligible for the Part A deduction. Long-term care or nursing care (as opposed to nursing services). Private nursing.

Plan G is a great plan for people who are at risk of going over their data limit. It is a cheaper plan as it offers less data than the other plans offered by the company. Plan G also has less features than other plans.

Medicare Supplement Plans are standard Medicare Supplement Insurance Plans that can be purchased from any state in the United States. It helps pay for the costs of transferring funds to other health plans and services. Enrollments in Medicare Supplemental Program N have increased annually since the start of the program. But the popularity of that proposal doesn't come as an unexpected surprise. Medicare Supplement plan N offers great coverage with minimal monthly payments.

the company offers a rewards program as part of its supplemental plan coverage, providing discounts on health and wellness programs and services, adding to the overall value of what you're getting if you sign up for Plan N.

During the Medicare Supplement Open Enrollment Period, you may enroll in any Medicare Supplement plan without asking a medical question. Approximately three weeks of your life span will be available. Until that time period is complete you can enroll in Medicare Supplement plans anytime by submitting an application. Underwriting a health question means that any airline will be allowed to decline your application citing the health condition.

Both plans are often compared. Plan N will provide a better solution for those seeking lower monthly costs. The Plan G, however, can provide a much more attractive option in the long run. Note: None have coverage for part B deductibles. Coverage differences. The standard Medicare Supplement Plan G is a more expensive plan compared to Plan N, which translates into a less expensive option.

Medigap Plan G provides a wide variety of benefits for people who are first enrolling for Medicare on April 20, 2022. Plan N and G follow Plan N. Plan C provides better coverage than both Plan NG and G but are not available to those beneficiaries who first joined Medicare. Plan G has two main benefits: one for its simplicity and another for reducing its cost. Plan N is also more accessible to budgets than Plan N can afford by making them deductible free, reducing the burden of a claim.

Similar to Medicare Supplement Plan G, Medicare Supplement Plan N provides large cost-sharing benefits for policyholders. If you live in states which permit excessive charges you are likely responsible. Most doctors accept Medicare assignation, therefore excess charges are rare.

Related Blogs: Medicare When Moving to Another State