In some cases an individual can apply for a Medicare Supplement to cover a specific medical care expenditure that is not covered under Medicare Part A or Part B (Medicaid). Among the “gaps" Medicare covers are coinsurance, co-payments and deductible fees.

This article provides information about the benefits of the Medicare Supplement Plan. See plans for you immediately! In the majority of state Medicaid programs, 10 Medicare Supplement plans have private insurers that offer coverage for all of them under the Medicare Supplement. All standard plans have different coverage levels.

A Medigap policy is different from a Medicare Advantage Plan. Those plans are ways to get Medicare benefits, while a Medigap policy only supplements your Original Medicare benefits. You pay the private insurance company a monthly premium The periodic payment to Medicare, an insurance company, or a health care plan for health or prescription drug coverage.

Our recommendations are vetted by independent reviewers, and advertisers have no control over their choices. We may earn compensation for any visiting partner recommendation we provide. See the advertising disclosures below and please click on 'Advertised'. Everyone interested in obtaining Medicare needs to decide what to do with it. Is Medigap an alternative to Medicare Advantage?

Medigap Plan A provides an insurance policy that helps pay the cost of Medicare Part A and Part B beneficiaries. Medigap Plan A contains the “essential” elements to all Medigap plans. Plan A has lower premiums than other Medigap options. This plan does not include coverage provided for other plans. How do I get a good quote from Medicare Supplements Insurance?

Medigap is the Medicare supplement insurance system that helps to fill gaps and is offered by private firms. Medicare reimburses much, if not all, of health insurance costs. Some Medigap policies cover other services that Medicare does not cover such as medical care if you're visiting a foreign country, for example:

Available by a private Medicare-accredited insurance company, Medicare Advantage policies are marketed to the consumers as Aetna Humana Medicare Plan or Kaiser Foundation Medicare. These insurance companies could have no premium or a lower premium than those offered under Medicare and prescription insurance coverages.

Medicare Advantage covers hospitals and physicians and often includes prescription drugs and some services not provided by Medicare. 42% of the population in 2020 has chosen this coverage option. The largest Medicare Advantage program operates as an organization to maintain a medical care system for its employees and patients.

Medicare's health care benefit plan is the same as private health insurance. Many services are covered by small co-payment. All plans have limits on the total cost. Several plans offer various benefits. Some offer prescription drug coverage. Many doctors will recommend seeing an expert, while others won't. Some may cover outright hospital care whereas other providers may cover only hospitals and facilities within HOMOs or PO. Other Medicare Advantage programs exist. Selecting plans with annual premiums may be important.

What is Medigap A Benefit? Part A is not deductible. Part B excess charges if the patient must pay Medicare's recommended amount. Skillful healthcare co-insurance. Emergency care while traveling outside the United States. Furthermore, all Medigap plans sold to new Medicare members don't cover the following: Part B deductible (since 2020, new Medicare members can't buy any plan that covers the Part B deductible or deductible). Long-term care is similar to the nursing care provided at the nursing home. Licensed nurse.

Managing health expenses is difficult as you often don't realize how much you are spending every year, at least in the short and long term. Although Medicare provides adequate basic coverage (Part C and Part B), it does not pay about 80% of its approved medical services and hospital costs. The other 20 percent of the bill is individual responsibility and unlike the insurance coverage provided under the ACA (ACA), it is not limited by capped annual fees. Tell us about the case of heart bypass surgery.

If you happen to be ill or are in a serious state it is logical to switch over from Medicare if you develop a medical condition that requires treatment in a nonhospital. In fact, switching between Medicare Advantage or the other Medicare-related plans can be a possibility for everyone at open enrollment. The elections are held annually from October 15 to December 7. This is a catch. If you switch to Medicare Part A or Part B, it is possible that you will no longer qualify for Medicare Part B.

66% of Medicare beneficiaries have Medicare Parts B or Part A.5 They are Medicare's only Medicare for adults 65 or over. The majority of these beneficiaries pay Medicare prescription drug coverage and Medicare Supplement insurance for the same health care plan as Medicare. Medicare Supplement Insurance or Medicare Supplements is neither sponsored nor supported by the federal government or the Medicare plan. Despite being a cheaper alternative, there's many advantages to it.

Once you join Medicare, the next step is to choose the Medicare coverage. If you do not receive Medicare Part D or have a drug plan later on that will cause you to lose your eligibility. 11. If you qualify for creditable prescription drugs coverage, you will usually get at least the same payment as the standard Medicare drug coverage you get for that drug coverage. When you get Medicare, you can usually maintain such stipulations, despite the fact they do not apply.

Plans A and B cover the most basic coverage of Medicare supplement plans and cover the lowest benefit. All ten standardized Medicare Supplement insurance plans offer 100% medical coinsurance. The newest plan covers the third category too (Medicare Part B copayment, 3 pints of blood and hospice coinsurance). However, Plan L covers these benefits for 75% while Plan K covers it for 50%. These nine plans, other than Part A, cover a benefit which Plan A does not include.

When you reach your 65th, it can be helpful for you to know when your eligibility deadlines are applicable. Make sure you have eligibility first. For more information about Medicare Parts A and B for Medicare patients and their doctors in the shortest time frame possible, the government recommends enrolling. You can enroll in Social Security automatically based on your Social Security status Alternatively, you must sign up in your local Social Security office.

If your employer has more than 20 employees and your age is over 65, you can still use your employer's coverage and stop taking part in Medicare Part B until your insurance has expired. Generally, if you are employed by an employer with less than 20 employees, you should be able to find the employer's decision on whether you should enroll into Medicare.

In the previous paragraph Original Medicare includes both Part A and Part B medical insurance. You may add supplementary health coverage to your Medicare Part D plan or Medigap. When enrolling for Medicare will allow Medicare beneficiaries to access Parts A and B, they need to make an individual claim to purchase supplemental policies.

You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year. Your coverage will continue year after year as long as you pay your premium.

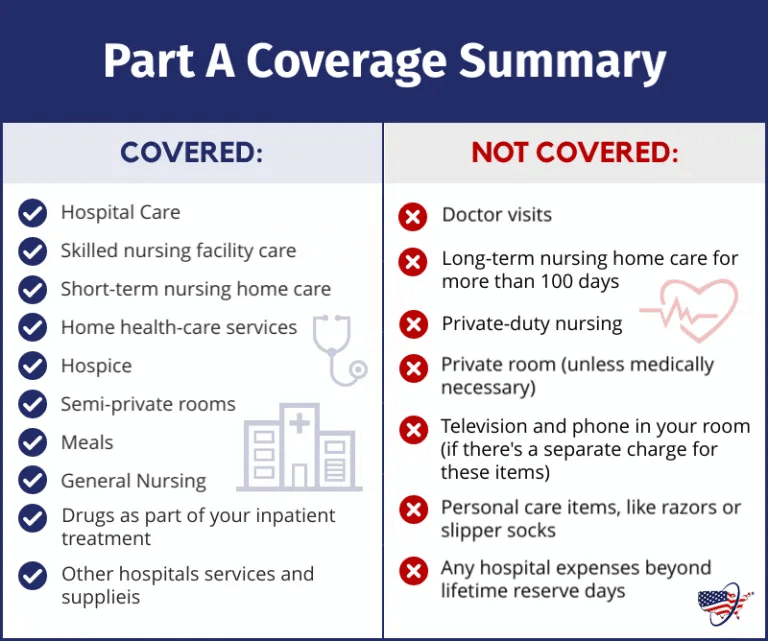

This is what Medicare plan A covers. The coinsurance and hospital costs can exceed 365 days after Medicare's use date. Part A Hospice insurance. Part B copayments / co-insurance. Transfusions. - Three pint.

The standardized Medicare Advantage program can be purchased anywhere in the United States excluding Massachusetts, Minnesota and Wisconsin. There are different plans that cover services in addition to premiums.

Continue Reading Below Continued Some Medigap plans used to cover prescription drugs . Since the introduction of the Medicare Prescription Drug Plan (Part D), you can no longer sign up for these plans. If you already have a Medigap plan that covers prescriptions, however, you can keep it.

Medicare Supplement Insurance, or Medigap plans, are not connected with or endorsed by the U.S. government or the federal Medicare program. While this may be the more expensive option, it has a few advantages. Both Medicare and Medigap insurance plans cover you for any hospital or doctor in the U.S. that accepts Medicare , and the great majority do.