Does the plan provide adequate cover to cover your expenses? Currently: December 17 2022 8pm. Many Medigap plans do not offer a deductible. Do you think Medigap will cause you financial hardship? It is incredibly unlikely. Tell me the possibility of having insurance coverage for a medical condition requiring medical care that costs a little less than $300 on average per year. Medicare Part B coverage covers only Medicare Part B cost gaps. If Medicare does not cover certain services or devices, then Medigap will probably not.

The Medicare Outside-of-pocket maximum is the highest rate that one should be liable for. Some areas of Medicare include maximums, while the rest do not. Cost outside-of-the box varies by the plan you choose When looking for a Medicare Advantage plan, there are several considerations. Medicare is designed to reduce medical expenses for patients by providing financial assistance to reduce costs for medical expenses and to protect patients from financial strain.

Senior65 is not endorsed by the Centers for Medicare & Medicaid Services (CMS), the Department of Health and Human Services (DHHS) or any other government agency. Please visit our Privacy Policy to learn more about how we protect your information. We do not offer every plan available in your area.

Original Medicare insurance can reduce health expenses for you. Nevertheless this does not encompass every aspect. The first step in enrolling in Original Medicare is to examine your spending limitations to determine which insurance plan is suitable for your budget. Some people may wonder why Medicare Part A and Part B does not include deductible caps on the outs. How can I locate the right health insurance plan in three simple steps?

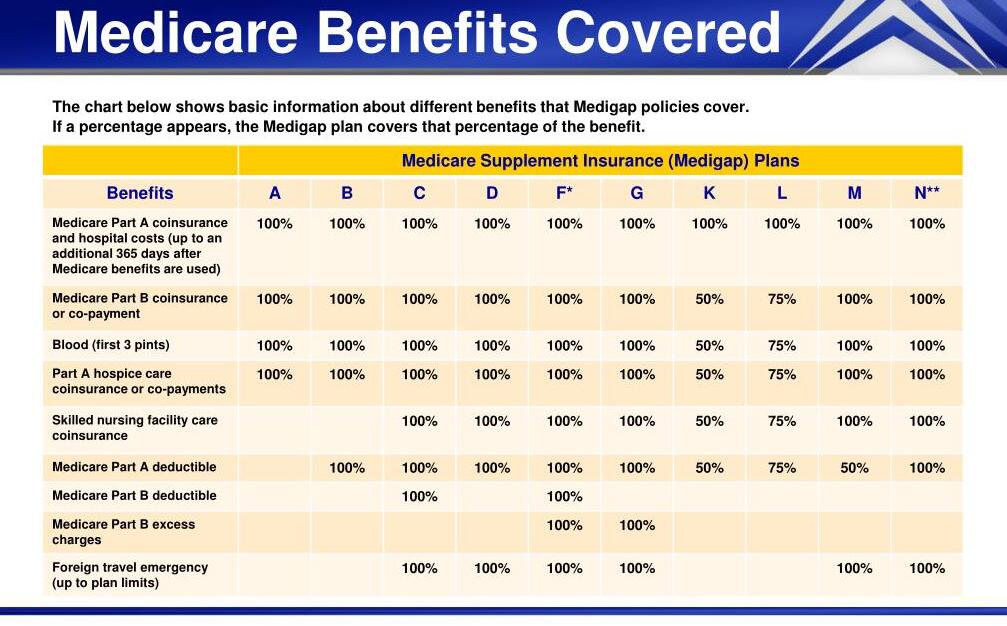

It's from very poorly communicated benefits directly from Medicare publications. Medicare Supplement Benefit Table Benefits Medicare Supplement Insurance (Medigap) Plans A B C D F* G* K L M N Part A coinsurance and hospital costs (up to an additional 365 days after Medicare benefits are used).

If you have an urgent matter or need enrollment assistance, call us at 800-930-7956. By submitting your question here, you agree that a licensed sales representative may respond to you about Medicare Advantage, Prescription Drug, and Medicare Supplement Insurance plans. Note: We cannot answer specific medicare claim information.

At day 101 your Medicare coverage is depleted. You are on your own unless you have Long-Term Care Insurance. That is where your Long-Term Care insurance policy will begin. Does 100% Mean Everything? Second, and this is key, the maximum out-of-pocket limit is only referencing what the Medicare supplement covers.

Is Medicare deductible limits too high? When talking to those people who call me as well as with others comparatively new to Medicare, I've seen great confusion. In the above paragraphs, I will cover the question of maximum deductible limits on Original Medicare Part B and Part C, Medicare Advantage plans and Medicare Supplements.

The maximum amount billed each year for medical insurance covers your entire cost. It is your protection. Medicare Part B is not deductible for any individual. Generally speaking, the costs for hospitalization could exceed $10,000. Find plans within minutes of your location!

Part B: This part of Medicare provides hospital and hospice services. Medicare does require a minimum in-pocket coverage amount for Medicare, but there is a minimum coverage amount. Part A has no premium and deducts payments and the other part has deductible payments. This section covers medically necessary services and preventive healthcare services. The minimum amount of MOP is not included in Part B, but it does limit how much coverage can be covered. Premiums are required, and deductibles are available. Part B (Medicare Advantage): This is a private insurance company plan that combines Part A and Part B with prescription medication protection.

When an eligible Medicare patient first gets into Medicare, their service typically starts with a Medicare Part A hospital visit. This part of Medicare can be purchased in the month or in the year following the Part B. But these are the parts which must be considered for Medicare supplementation and the Medicare Advantage plan. Medicare's annual maximum deductible is not unlimited. There is no standalone insurance option for senior citizens. You must purchase Medicare Supplemental plans and Medicare Advantage Plans for your financial security.

Does the Medicare Supplement plan have an annual limit that cannot be met? Yeah. The cost-per-person maximum for Plan G equals Medicare's deductible ($238 per 2021 plan). Planned premiums in this category are deductible under Part C along with office/hospital copayments and remuneration for the emergency. For high-deductible insurance plans, the out-of-pocket cost equals the premium ($2490 for 2020). This has always happened. In 2022 plan K max will be $6620, while plan L will be $3310 in total. There is considerable confusion about the maximum supplement cost due primarily to the poorly designed Medicare supplement benefits chart which we discussed above.

Most Medicare supplement plans offer full coverage of the major benefits. Generally, Part B coinsurance and deductibles are examples. This is 20% Medicare does not provide. All your insurance is guaranteed. Everything is paid up until the plan is completed. Medigap 'K plan covers only 50% of the premium. Medigap Plan l is only 55% covered. See section on Hospital coinsurance. Without supplements you get 60 days of coverage before paying a monthly copay. This copayment covers 80% of Medicare Supplemental coverage except plan K. Plans K only cover 45%. Plans cover 65%. A qualified nurse.

The Medigap Plan covers most or all Original Medicare coinsurance and deductibles. Inflation is hurting Medicare. Although inflation reduction legislation has helped reduce the amount of debt accumulated under Part D (Medicaid) Medicare, the Act does not affect Medicare's medical expenses or the cost to the taxpayer. Here, the Medigamap starts. Medigap plans provide a nice way to meet original Medicare costs that some are so rare that beneficiaries will need to pay out of their pocket. Tell me the significance of your situation?

All insurance programs have a monthly cost limit. This restriction can differ based on the plan and based on the year. There is an amount that is determined by the governments. In this case an individual could not set his maximum monthly payments at $7,000. But stumbling blocks are possible in some plans. - $3,000. Upon an annual increase in your coverage, your insurance company will cover all of their costs. If you are considering enrolling in an upcoming Medicare Advantage plan then you should inquire about its maximum costs.

In Part A or Part B of your Medicare, the cost of the Medicare Part B is billed as a cap or a deductible. The original Medicare plan doesn't limit your medical expenses. You typically pay 80% of the Medicare Part B charge regardless of its total cost. If a surgeon's cost exceeds 10,000, then you can usually pay 2,000. For hospital inpatient stays of up to 100 days, Medicare Part A will typically reimburse you $400 for days 61-90. It was more than $20k for one 100-day hospital admission alone.

Medigp plans offer many disadvantages: high monthly rates. There are several types of planning to be navigated. No prescription insurance.

In the 2020 Plan Year the cost per occurrence limit is not exceeding $8700 for an individual and $177400 for families.

Since 2011 the federal government has imposed an out-of-pocket limit for Medicare beneficiaries who receive services through Part A and B. The out-of-pocket limit for in-network services will not exceed $1,500 for in-network services until 2025.

In addition, you pay all costs for Part A or Part B covered services provided by network providers, including coinsurance. Part D costs will never be deductible as part of your plans.