According to the majority, Medicare Advantage and Medicare Medigap are two completely separate types of insurance. Find the most suitable insurance that suits your requirements. Get your plans for the region immediately! If your health insurance is not covered at the time, you will most definitely feel relieved as you get older. Although Part A (hospital and hospital insurance) covers most health care expenses, it does not cover all costs.

Medicare is billed to older people for their medical needs free. There is an alphabetical array of parts that offer different kinds of protection or benefit options. Medicare has some difficulties. Some holes in Medicare are completely ignored. For these gaps, consider transferring your Medicare Advantage and Medicaid plans. We found the most comprehensive coverage available for the most affordable price, and the benefits are discussed.

Our recommendations are based on our own reviews and advertising does not impact on our choice. We may receive compensation for visiting a partner we recommend. See the advertisement disclosure page to learn about the advertising services offered. All Medicare enrollees have several choices on hand. What is a better alternative option if Medicare is the best option?

When you decide to buy supplemental coverage over Original Medicare, then it's time to figure out what private policy will meet your budget.

How will the Inflation Reduction Act affect Medicare enrollees? Under the new law, Medicare beneficiaries will see a series of prescription drug-pricing provisions phased in – mostly over the next several years Nearly three-quarters of readers feel overwhelmed by Part D options We asked how confident our readers were with comparison shopping for a Medicare Part D plan during the 2022 Medicare Annual.

Medicare's supplemental health coverage is the same as a private plan. Most service visits, labwork, surgery, etc. can be paid for with only one small copayment. Some plans provide HMO or PPO networks and each plan has a limit for total billed expenses each year. The plan varies in terms of advantages and conditions. Most insurance companies offer prescription drugs. Some require the consultation with a medical doctor and some don't. Several may offer out-of-network medical services while others can cover only medical providers that belong to HMO or PPO networks or hospitals. Some of them also offer an alternative Medicare plan. It is important that you find an affordable monthly plan if the premiums are not as high as expected.

Medicare Advantage plan provides a substitute for original Medicare. These private insurance programs cover the entirety covered by Original Medicare but offer additional advantages over things Medicare does not cover. Additional benefits include medical insurance and prescription drugs as well as dental and vision care. If you are eligible to enroll in Medicare Part B hospital coverage and Medicare Part C medical coverage, the Medicare Advantage plans are available. When a person enrolls in Medicare, their Medicare Advantage plan replace Part A and Part B coverage.

Choosing a Medicare Advantage Plan Medicare Advantage Health Plans are similar to private health insurance. Most services, such as office visits, lab work, surgery, and many others, are covered after a small co-pay. Plans might offer an HMO or PPO network and all plans place a yearly limit on total out-of-pocket expenses. Each plan has different benefits and rules.

After enrolling in Medicare, you must decide whether to get Part D prescription drugs or not. If Part D insurance is not available when the patient gets Medicare or tries to purchase drugs, you may face penalties for late enrollment or late enrollment. But you can avoid the penalties if the prescription drug coverage that you have is creditable. The coverage is essentially prescription drug coverage that is paid in a manner comparable to the Medicare standard prescription drug coverage. If a person is receiving Medicare drug protection, they usually get it back.

Medicare Advantage is a replacement plan for original Medicare Medicare. The products have been made available through insurance companies. A MA Plan gives you the parts A, B, and C, but you can usually get Part D as an additional benefit. The Medicare Benefits plan covers all kinds of healthcare — including hospital visits, doctor appointments and laboratory testing, for instance. But you may have to be within the network or seek referrals to make sure the program covers the cost. Original health care will be available from any physician that accepts the plan.

The Medicare Advantage program is available from private, approved insurance companies to consumers. They could not pay any premiums or be lower when compared with high premiums on Medicare and Medicaid. Typically Medicare Advantage coverage covers hospitals or physicians, and may provide prescription drug coverage as well as a variety of other services that aren’t covered by Medicare. During this period, 82 million people will have been enrolled in this program. Most Medicare Advantage programs offer health-related insurance in HMO or PPO form.

Medicare Advantage plans offer most of what Original Medicare provides, but also cover items and services which aren't covered by Original Medicare. These include certain vision, dentistry, audio and wellness services such as gym memberships. Some plans also offer transportation to doctors and adult day-care providers. The company said its benefit packages could be tailored to the needs and conditions of chronic illnesses and their families. Cigna has offered its Medicare Advantage subscribers free vaccinated vehicles.

Managing health care expenses at retirement is tough because most people don't know how much money they will spend each year. While traditional Medicare provides largely basic coverage, it only pays around 80-80% of the fees approved for hospital, physician or medical procedures. The remaining 20% is the individual's responsibility and unlike coverage under the ACA, it does not contain any limits to how much a person can pay in a year. Tell me a case where a heart bypass operation is needed.

About 62% of older adults who qualify for Medicare choose Part 1 and Part 2 of Medicare, which covers doctors and hospitals. 5. The 81 percent who participate in Medicare Supplemental coverage pay for the same coverage and the 48 million pay for supplemental Medicare Part D prescription drugs. Medicare Supplement insurance and Medicare Supplement insurance policies are not affiliated with or endorsed by any government agency. Despite being cheaper than the others, they do have advantages.

Medigap is designed to cover some gaps that are not covered by Medicare. Coinsurance, copay and deductible are examples. Medicare covers covered medical and other medical expenses in the form of doctor's services and medical equipment. A Medigap program may help you cover 20% of the money gap you are currently paying. Medigap does not reimburse the cost of Medicare Part A or Part B coverage. This means you wont be covered under Medigap for medical care.

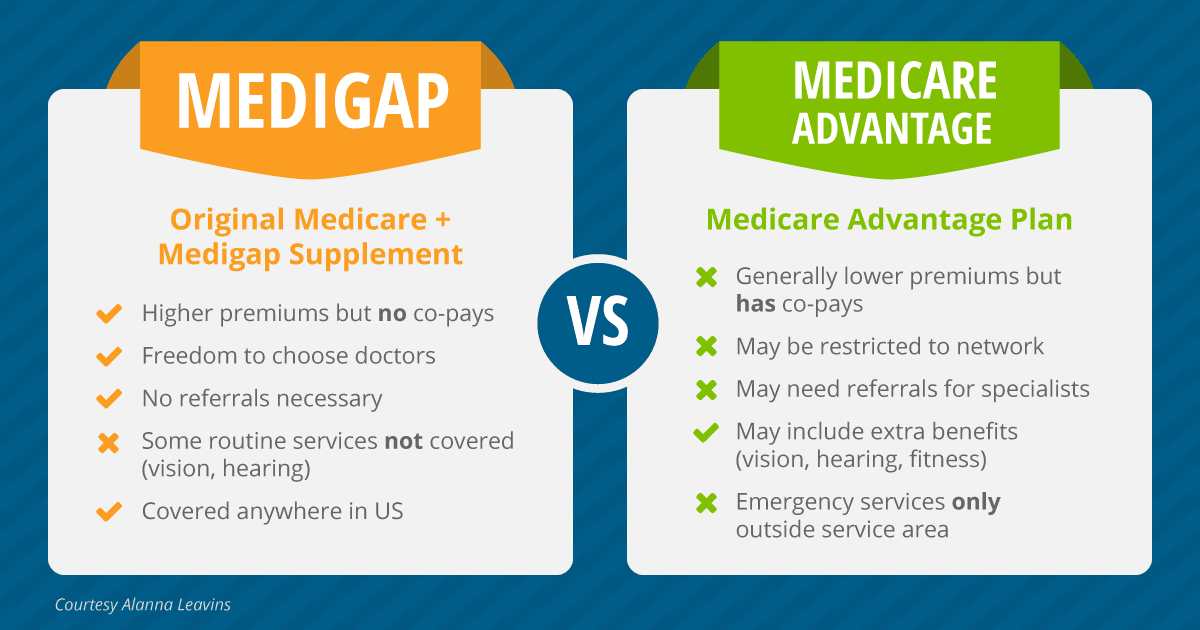

If you're well-being with no medical expenses, Medicare Advantage could be a useful money saving option. Medigap is generally safer for people with serious medical conditions. Consult an experienced insurance agent who knows your medical situation and will guide you through the options available. Because it's impossible to combine Medicare Advantage vs Medigap in one place, you must decide carefully to ensure you're receiving the appropriate coverage.

The Medicare Supplement program provides a cost-effective solution to your monthly expenses. Jacobson says many customers like it because it does not require that they worry a lot when they are rushed home. “You could visit any doctor you wanted in any place”. In Arizona, you could travel to Minneapolis to visit the Mayo Clinic for example. Unfortunately, Jacobson said this is more useful in sick situations than when sick.

A recent report by the CommonWealth Fund examines Medigap plans that offer nontraditional benefits such as vision, dental and hearing services that are not available under traditional Medicare(2]. The survey revealed that only 7 percent of these programs offer these benefits. Most Americans are unaware that they have Medicare-like benefits. There is some trade-off between federal policy encouraging or disabling this benefit being offered.

Some Medicare Advantage plans provide no premiums and are therefore worth exploring. The plan that charges premiums will be paid by the person who enrolls. Medicare Part B coinsurance and the deductible are $226, according to Medicare.gov. If these conditions are satisfied, your copayment under Medicare Advantage will generally be 20 % the Medicare-approved value for the most services and products.

Medicare supplement insurance, also known as Medicare Advantage, is available to you. This fund provides assistance for services Part B and Part E are unable to cover. It also helps cover your Part A deductible – $1556 for 2020 – along with 20% coinsurance for your Part B coverage, if necessary. I would recommend a Medigap program that can help with these costs,” she explains.

A Medicare Supplement plan can have up to $200 annual premiums, which can vary depending on the state you live in and the insurance company you choose. Just like Medicare Advantage plans you can look at if you are 65 and you are saving up for Medicare Advantage. We've been studying private plans to improve efficiency in our communities, Jacobson explains.

Medigap and Medicare Advantage offer a number of benefits that vary in their specific health needs. Medigp offers supplemental coverage to Medicare patients, but does not contain prescription drugs. Medicare Advantage Plans also include supplemental benefits including prescription medications, vision, dental, hearing and other services for the health and safety of the patient.

Medicare Supplements are sold by private insurance companies for the purpose of filling gaps in Medicare. In 2018, 34% of people who enrolled in Original Medicare were enrolled in Medicare Supplement coverage — that's almost 11 million people. Medigap offers standardized coverage that covers everything from deductibles to coinsurance and copays.

In this context Medicare includes Part AB (hospital and hospital coverage) and Part B (medical coverage). This coverage is available as part of Medicare Part d or supplemental Medicare Part d insurance. While Medicare will give you Part B coverage, you must buy a supplement.

Medicap plans are privately available plans, offered either through an insurance company or broker. Plans A, B, C, D, F, and G each have standardized coverages that differ. Plans GF and G also offer deductible plans for certain states. Several insurances provide medical assistance in the event of a medical emergency in the country. Because Medigap's cover is standard, they don't have ratings for it yet. Consumers may easily compare insurer pricing and simply pick the best offer. From January 1, 2020, new Medicare plans will be prohibited from paying Part B deductibles.

A Medicare Advantage program could be an excellent plan to get out of a larger bill. The regular Medicare and Medigap plans generally give you better options on where to get treatment.

Costs Monthly premium, deductible, coinsurance, and copayment Monthly premium Income-related premiums Yes Yes Prescription drug coverage Often included Not included Medigap and Medicare Advantage together It is not possible for a person to have both Medicare Advantage and Medigap. The two plans do not work together. An individual may use Medigap to help pay original Medicare's copayment, deductible, and coinsurance costs, but they may not use it to pay Medicare Advantage's out-of-pocket expenses.

The biggest disadvantages of Medicare Advantage are closed providers network that limit your choice of the medical provider. Medicare's health insurance costs largely depend upon the amount of care needed and make it difficult for a person to pay.

Medigap offers some downsides including: increased monthly fees. There are various kinds of plans. No prescription insurance (available through Plan D).

If you have a Medicare Advantage plan, you aren't allowed to enroll in a Medigap insurance plan unless you're also switching your Medicare Advantage plan back to Original Medicare. If you want to enroll in Original Medicare and buy a Medigap policy, you'll need to contact your Medicare Advantage plan and ask if you can disenroll from it. You may be able to do so only during certain times of the year, known as “enrollment periods.”

Medicare Supplements. Medicare Part C Advantage plans are designed as bundled options with lower annual premiums. Medicare Supplement plans provide supplemental coverage to Original Medicare at no cost to individuals.

Get the information you need today! Read More Do Medicare supplement plans include prescription drug coverage? Modern Medigap plans do not include prescription drug benefits. Instead, Medicare offers prescription drug coverage under Part D. Medicare enrollees can get prescription coverage either by switching to a Medicare Advantage plan or by purchasing a stand-alone Medicare Part D plan (PDP) to go along with Original Medicare.