Medicare covers health care for older persons. The package includes the alphabet soup of parts offering different kinds of cover for each benefit. Medicare faces a lot of challenges, including gaps which are not covered at all. You should consider the option of enrolling in Medicare Advantage. To assist with making the right decision and weighing the advantages and disadvantages, the following information has been analyzed, providing unbiased expert insights.

The products we recommend are evaluated independently. Advertising does not influence the decision of any product. We may earn a commission from visiting a company that we recommend. See Advertiser Disclosure. All people interested in joining Medicare have many choices to choose from. I think a single thing is crucial: Should I opt for Medicare Advantage?

Medicare Advantage plans cover hospitals and doctors and often include prescription drug coverage and some services not covered by Medicare, too. In 2021, 42% of Medicare beneficiaries choose one of these plans. 5 Most Medicare Advantage plans operate as a health maintenance organization (HMO) or preferred provider organization (PPO) insurance. HMOs limit members to using the doctors and hospitals in their networks.

The plans usually provide coverage for things like vision, dental, disability services, home health, and other health care needs not covered by original Medicare. “Medicare Advantage plans offer the convenience of providing all of these services in one plan,” Erin Nance, MD, a New York City-based orthopedic surgeon, tells WebMD Connect to Care.

You cannot apply for either insurance plan, so you should understand how it operates. Medicare Advantage offers the most flexible options for seeing an independent physician with Medicare. Give me the important information for the future.

Medigap plans, are not connected with or endorsed by the U.S. government or the federal Medicare program. While this may be the more expensive option, it has a few advantages. Both Medicare and Medigap insurance plans cover you for any hospital or doctor in the U.S. that accepts Medicare , and the great majority do. There is no need for prior authorization or a referral from a primary care doctor.

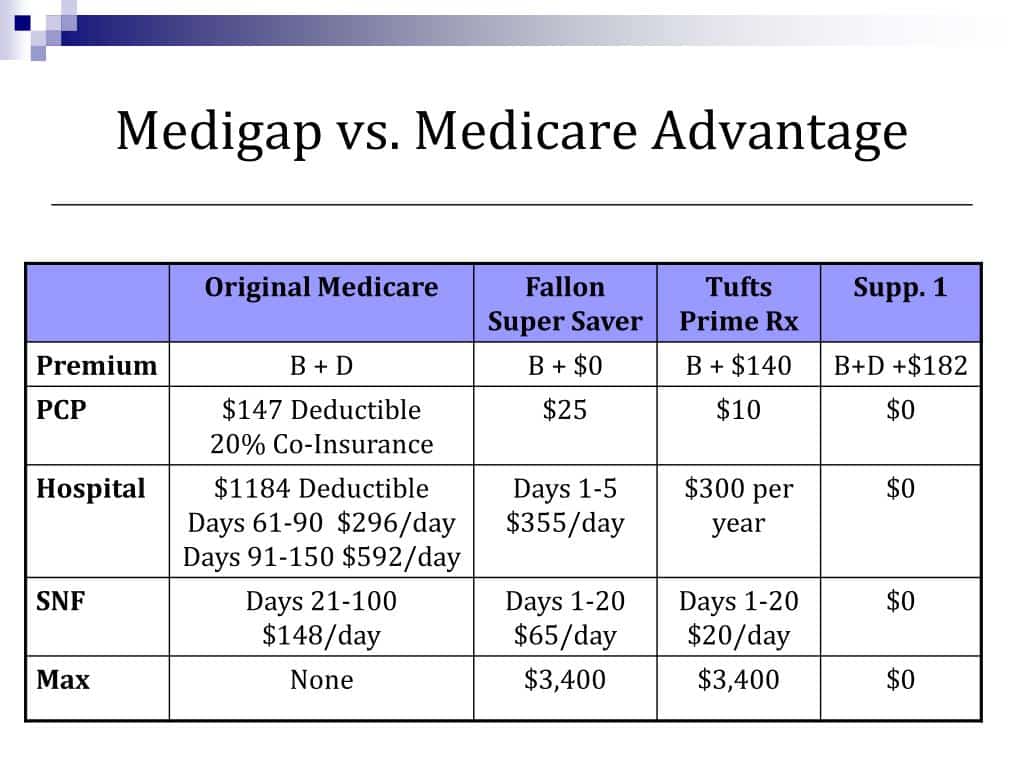

Once you decide if you need more coverage than original Medicare alone, you must determine which private plan best meets your needs.

You also may have to pay a monthly premium to the Medicare Advantage insurer. The average premium for Medicare Advantage enrollees is $19 in 2022, but more than half the plans charge no premium. You can compare the premiums, copayments and coverage for Medicare Advantage plans in your area, including copays for your drugs, by using the Medicare's Plan Finder.

Keep in mind If you enroll in a Medicare Advantage plan, you cannot use a Medigap policy to cover your out-of-pocket expenses. So you'll have to pay any deductible, copays or coinsurance yourself. It's illegal for an insurance company to sell you a Medigap policy if you're enrolled in a Medicare Advantage plan. Updated June 7, 2022 More on Medicare Medicare Advantage plans increasingly popular Understanding Medicare's options.

Once you decide if you need more coverage than original Medicare alone, you must determine which private plan best meets your needs.

Medicare Advantage plans have similarities with private healthcare. Almost all services are provided with a small copayment. Some plans offer a HMO/ PPO network and all plans have annual maximum deductibles. All of these plans have different features and rules. Many of these prescription drugs are available. Some need an evaluation by an expert and the rest don't. Some may cover the out-of-network expenses while others only cover doctors or clinics that belong to HMOs or PPOs. Some Medicare Advantage Plans are also available. Choosing plans that offer no annual premium is crucial.

Medicare Advantage plans are a replacement for the Medicare Originals. They can be bought by private insurance companies and covers all the benefits provided under original Medicare. However, some plans have additional benefits based upon something that does not come under Medicare. Other benefits can include prescription drug coverage as well as eye care. The Medicare Advantage program is offered to individuals who enroll in Medicare Part A medical coverage and Medicare Part B medical coverage. When you enroll, Medicare Advantage plans will replace Medicare Part B coverage.

After enrolling in Medicare Part D prescription drug plans, you should know that this program is important. Unless you get a Medicare Part D plan in advance, you can permanently be revoked for late signing. But if you have creditable prescription drug coverage, this means that prescription drug coverage (provided by employers or unions) is likely to pay at least as much as Medicare's normal prescription drug protection. If your drug coverage is available after a Medicare benefit period, you can usually get it.

Some Medicare Advantage programs offer no premiums, so look for alternatives before you sign up. According to Baethke, the cost to enroll in a Medicare Part B insurance plan can vary according to the individual and their earnings. Medicare Part B's coinsurance and the deductible is $226, according to Medicare.gov, and once they are met, your copay under Medicare Advantage is typically 20% of the Medicare-approved amount for most services and products, such as durable medical equipment (DME), like glucose

I would recommend considering a Medicare Advantage program while you are fairly healthy, then switching over to normal Medicare if you are experiencing problems that need medical treatment at another hospital. Currently it is possible to switch between both Medicare Advantage and Medicare Part B plans during the open enrollment period. The election year runs October 15 - December 7. I have an important problem. If your Medicare benefits are withdrawn, you can no longer get Medicare coverage.

Medicare Advantage plans are marketed to consumers under the names Medicare Advantage, Aetna, Humana, and Kaiser Foundation. They can have no or lower rates than other prescription drugs insurance plans. Medicare Advantage Plans provide health care services as well as some services not covered by Medicare. By 2020, 82 percent of the Medicare beneficiaries will be choosing a plan. 4. Medicare Advantage plan primarily offers health maintenance organizations and preferred providers.

The cost of a retirement plan is challenging, and you can usually not tell how many dollars you spend each year on health care expenses. While Medicare provides basic basic health insurance, the company pays only a small fraction of its approved cost for hospitals and doctors. Another 20% will be borne from individual responsibility – unlike ACA-covered coverage — the person cannot exceed $200,000 per insurance claim in annual terms. Tell me about your heart bypass procedure?

About 58 percent of all Medicare beneficiaries are 65 or older. 58% choose Original Medicare Part AB, Part C, and Part D. This coverage covers hospital visits and surgical procedures. Almost 91% of these individuals pay a premium for Medicare Supplemental insurance through a single Medicare prescription drug policy.7. Medicare Supplement Insurance - or Medigap plans do not have affiliations or support with Medicare. Despite its costs, it offers many advantages.

Medicare Supplement programs can help you save money on health care bills by making it easier for you to budget. Jacobsons said that the cost-sharing approach is good because people have no concern over the amounts owed when they are admitted or are hospitalized. You may go see a doctor wherever you want in America. Similarly in AZ there can be flights from Minnesota to Mayo Clinic. However, Jacobson says the benefits are much higher in the event of sickness.

The CommonWealth Fund recently reported that Medigas is an innovative health-insurance program providing nontraditional services for people who do not receive original Medicare[4]. The study showed that relatively few insurance plans offer such benefits—only 7%. “Somebody is not consciously aware that these plans have similar benefits if they were billed as Medicare-assisted.”. There is a tradeoff between federal and state government policies to encourage or dissuade this benefit.

Medigap has essentially been aimed at filling gaps in Medicare coverage. Original Medicare only covers 80% of your medical expenses including outpatient medical care. Medigap plans may help to fill that 20% gap. Medigap is unable to cover any medical expense covered under Medicare Part C and Part B. This means you cannot take Medigap for hearing, vision services or other medical care Original Medicare cannot offer.

Medicare Advantage generally offers the following benefits. With the Medicare Advantage plan, you must also be covered under Medicare Part A (hospital insurance) and Part B. Enrollment happens a few days before a new policy is issued, but you will have no coverage because you have re-established a pre-existing condition. You can join Medicare's Advantage program with or without insurance in all 3 windows:

Medicare Advantage is an effective option if the patient has little medical expenses. In most cases, Medigap is the best option for serious health problems without expensive treatment. Asking an agent about a medical condition will help you decide on what to do. Because you cannot have Medicare Advantage or Medigap at once, you must make a very careful choice to ensure that you have appropriate coverage.