Medicare Supplement Insurance is the Medicare supplement insurance that fills gaps and is sold privately. Medicare covers much, if not most, costs for health services or supplies. Generally, the health care costs of an individual are covered through Medicare Supplement Insurance (Medicare Supplements insurance or Medicare Supplemental policies).

Enrollment in Anthem Blue Cross Life and Health Insurance Company depends on contract renewal. Anthem Blue Cross Life and Health Insurance Company (Anthem) has contracted with the Centers for Medicare & Medicaid Services (CMS) to offer the Medicare Prescription Drug Plans (PDPs) noted above or herein. Anthem is the state-licensed, risk-bearing entity offering these plans.

You may want a completely different Medigap policy (not just your old Medigap policy without the prescription drug coverage). Or, you might decide to switch to a Medicare Advantage Plan that offers prescription drug coverage. If you decide to drop your entire Medigap policy, you need to be careful about the timing. When you join a new Medicare drug plan, you pay a late enrollment penalty if one of these applies.

Medigap has a number of advantages, including an increased monthly premium. There is need for different plans at different stages of life. No medication coverage available from Plan D.

Vision or dental services Hearing aids Eyeglasses Private-duty nursing Insurance plans that aren't Medigap Some types of insurance aren't Medigap plans, they include: Medicare Advantage Plans (like an HMO, PPO, or Private Fee-for-Service Plan) Medicare Prescription Drug Plans Medicaid A joint federal and state program that helps with medical costs for some people with limited income and resources.

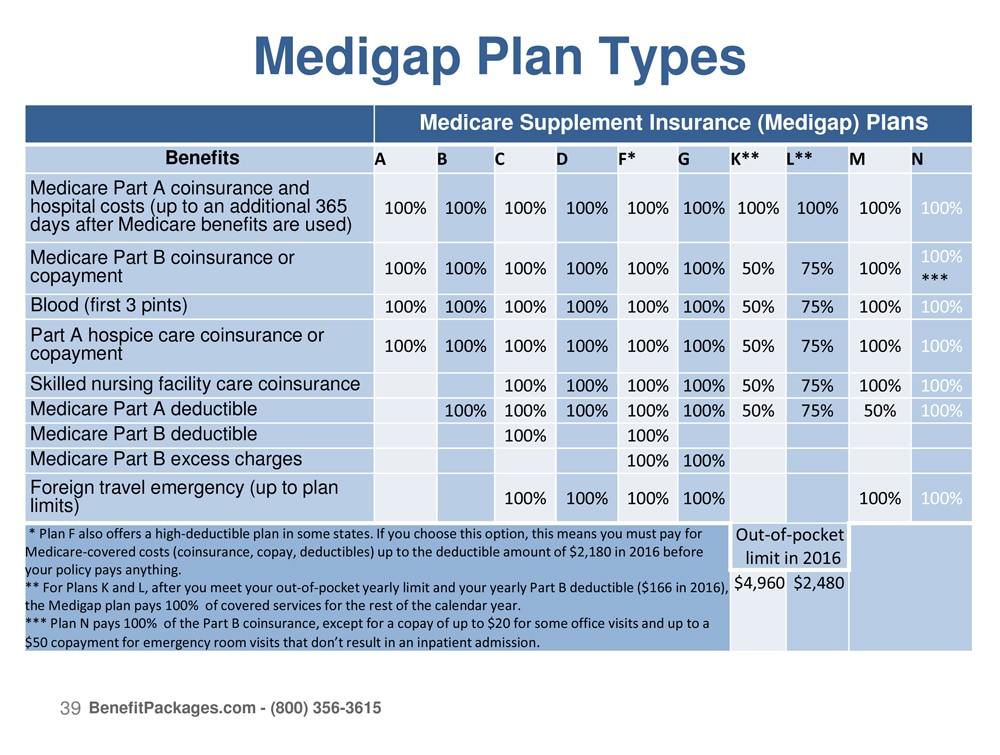

The majority of seniors can choose from 12 Medicare Supplement plan options by 2025. If comparing different Medigap plans is more difficult, our intuitive chart will simplify the review process for all your options. How do I locate a Medicare Plan?

Insurance companies will be able to provide up to 10 different Medigap policy categories A, B, C. Each letter of the policy is standardized. The same policy has the same advantages, regardless of the company providing them or their prices.

The Medicare Supplement program is available to individuals who already have Original Medicare Part B or a Part C plan. Your open registration period lasts six months beginning the day after your 65th birthday. Medicare supplements are currently closed to the public during its enrollment phase and you may no longer receive insurance for your current medical conditions or previous health problems. Not everyone is allowed for health underwriting. Some states have plans to cover people under age 65 who qualify under Medicare for medical insurance because of a different reason than age. Medicare supplements allow a person to see any hospital accepting Medicare-payable patients. Anthem offers several insurance policies — all covered by full part A and part B coinsurance.

Plan F covers Medicare deductables, copayments, and coinsurance. Currently, Plan F is not available until January 1, 2020. Select and Innovation F may be found in some states.

Plans N cover Medicare Part A or Part B coinsurance. In addition, you have to pay for your deductibles. Select and innovation N can be obtained from different states.

G covers any additional costs not covered by Original Medicare, except for deductibles in Part B. It is not guaranteed. The innovative G is offered to some states.

Plan A provides the most simplest Medigap plan with the lowest premium available. The Medicare Supplement plan covers only the Medicare deductible.

You may enroll in a Medigap plan anywhere in your calendar year. However, your Open Enrollment period for Medicare Supplement plans may be the best time. If an individual applies during a given opportunity the carrier will not be obligated to provide coverage. All Medigap Plans you choose are available to you. The Medigap program allows for Medigap members to continue enrolling until their last enrollment period. Answer health insurance questions in almost every state. You are also prone to being declined based on the preexisting situation and may be liable for additional charges if the situation persists.

During comparison of all the Medigap plans, the cost of the premium varies between the two plans. In addition, Medicare or Medi-gap plan participants are required to pay for the following expenses. Medigap insurance costs vary based on plan. Certain options require Copayments and Deductibles while other plans like Medicare Supplement Plan F require seniors to pay a deductible in advance. Some examples are Medicare Plan X and Medicare Plan B. But if the new Medicare enrollees have no deductible or premium coverage, they are not eligible unless they are eligible under certain circumstances.

The chart above shows each of the 12 Medigap plans covered by Original Medicare. Make sure to avoid confusion with Medicare Part C and Part B. Original Medicare covers inpatient hospital coverage and the Medicare Part B covers outpatient medical visits. Medicare A and C supplemental policies offer supplemental coverage that covers Medicare's cost. Whatever Medigap program you decide, it is available at any hospital or physician in the country who has Original Medicare. Medicare-approved doctors cannot turn you off because your insurance company has chosen you.

If you are considering Medigap policies prices should always be the focus of your mind. Several Medigap plans require monthly premiums. Your premiums vary according to many factors such as age, gender, smoking age, and ZIP code. It is critical to note that the largest element that determines Medigp premiums is the letter of the plan. It indicates that you plan covers a specific coverage level. Unlike other insurance plans, Medigap offers fewer premium costs. Below you can view sample monthly Medigap premiums for the below population groups.

Unlike traditional medical insurance, where policies vary across providers, Medicare supplement plans are uniform and the benefits of the plan letter are similar. The Medicare Supplement Plan G provided by UnitedHealthcare will provide the same coverage as the Plan G offered by Aetna. However prices vary by provider because every provider uses a different pricing structure. You should also consider provider financial stability and rate rise history. Often times the company offers cheaper rates but increases rates faster as we age.

For most of our readers Medigap plan G is recommended by AARP - United HealthCare. It costs approximately $131 a month, in case of an older person. Provides complete medical insurance from an experienced company. All Medicare Supplements have standardized benefit plans to help reduce the medical expenses you'd incur with Original Medicare.

Plan G is the second most common Medigap plan. Plan F is limited to individuals eligible for Medicare before 2020, but because of its comprehensive benefits, nearly 46% of Medicare Supplement participants choose this plan. Plan G is a popular option among those who recently got Medicare and has a 7% market share.

Medicare Supplements are best if they offer balanced cost and coverage. Insurance companies with greater medical coverage will generally have lower monthly fees. View other plans A plan B plan C plan D plan G plan G plans K plans L plans N. The average cost per woman is 55 and over. Rates are varied based on age of the applicant, gender or other factors. Plan G is good for people that need minimal medical costs that pay about $145 per month. It may provide you with some relief and you don't want surprises from unexpected expenses.

In 2021, Medicare supplement prices will be $119 monthly. Depending on what the cost is, the cost ranges between $50 and $400 each month. Selecting a Medicare Supplement policy can help provide the best medical benefits and fill the gaps where you want to spend the most. The costs are also covered under the plan G. However, with the Medigap plan K, there is only half coinsurance coverage. Medigap plan B does not have a provision for nursing coinsurance.

This Number consists of 2 high-deductible plan variants: Medigap high-deductible plan f and high-deductible plan g. Each letter-backed plan covers the primary policy benefit and varies in levels. When you compare health plans from Medigap, you need to consider how the different coverage is designed to fit your health goals. According to the letter program, the plan will cover your health expenses, including copayments and coinsurance.

Medicare Supplement plans are no longer available for prescription drugs, Alternatively you can buy Part D plans for more premiums. Medicare Supplement plans also do not include dental coverage, but it is also possible to buy Anthem dental insurance for an additional premium if you live outside of Colorado. Nevada and California offer innovative Medicare supplementation programs that provide eye and hearing benefits.

Related Blogs: Who Qualifies For Medicare Flex Card | What is The Best Medicare Plan