Medicare Supplement Plans F, G and N may provide an alternative way to get Medicare coverage. If you've reached the age of 65 and are looking into Medicare or Medigap coverage, you can use these helpful tools to help you understand the options available.

What is your most important thing about Plan FF? It has an additional bonus than Plan G. Plan G generally has a higher premium than Plan N, because it offers greater coverage. You may be saving money by enrolling in plan N because out-of-pocket expenses with plan N may be greater, but Medicare supplement plan E, N may be a way to help address the gap in Medicare coverage.

Compare Medicare Supplement Plan F versus a Health Care Plan G versus Health Care Plan N and find which plan offers the greatest number of benefits in the United States. Most people are looking for supplemental insurance coverage that covers health care expenses at the least amount.

Those are the goals of the Medicare Supplement Plan (Medigap). Get the most accurate information about Medicare Supplement plans. Although most plans have standardized lettering for all Medicare Supplement plans, there are differences in their lettering. The following list of Medicare Supplement plans are available nationwide.

Medicare Supplement Plan N is widely considered the highest value Medicare supplement plan. For the value-oriented, this article provides a wealth of information about Medigap Plan N. Medicare Supplement Plan G is sometimes referred to as a “Peace of Mind” Medicare supplement plan because it offers the best benefits of Medicare Supplement Plan. This article aims to compare Supplement Plan G with Supplement Plan N to find out if they suit your situation best.

Medigap's plan N covers all medical care so you may have one year in an emergency room without paying any medical charges like in the Plan G. Similar to Plan G, your monthly deductible for Medicare Part B is billed at the first or second visit of your health professional.

Let's see the difference in plan N. The doctor may also charge a small fee for visits to the office. Only office visits will receive a small fee to receive treatment. Since 2020, Medicare defines office visits differently. A $50.00 co-payment will be applied if the hospital visit has not led to an overnight hospital visit.

But outside of open enrollment, insurers can use medical underwriting – things like your age, gender, area of the country, and previous health conditions – when deciding to sell a policy.

The Standard Medap insurance policy was developed to help Medicare beneficiaries maximize their Medicare benefits and reduce their out-of-pocket costs. Medigap has an additional role for Medicare. It's essentially Medicare paying first and your Medigap plan paying the rest. Medigap plans provide additional benefits to Original Medicare by paying the copayments, deductibles, and coinsurance that Medicare sees as your financial obligation. Standardised terms are important to many people. This means the benefits of Medicare Supplements Plans are the same, no matter which company you buy from.

IMPORTANT: Medigas policies are standard across the U.S. except in Minnesota, Massachusetts and Wisconsin. The list contains 11 plans, which contain an alphabet. The plan’s sale comes from private insurers.

Not all companies offer the same plan letter; Medigap plans differ from Medicare Advantage plans. Because Medicare Supplement Insurance is standard coverage, each policy type with similar letters must offer the same coverage regardless of age of beneficiaries. It simplifies comparison of policies. The benefits of a Cignal plan are identical to those provided by a Mutual of Omaha.

The Medicare Supplement Plan covers most of the costs you normally pay for Medicare Supplemental Insurance and the cost that the government imposes on Medicare. The coverage you get depends largely upon your Medicare Supplement Plan.

Medicare Supplement Plans are the most widely accepted health insurance plans nationally. It has a comprehensive cover that is popular with most of them. Watch this podcast today! Compare Medicare supplement insurance plans F and N and notice the similar coverage. Note the rates vary between states and carriers but the benefits remain the same.

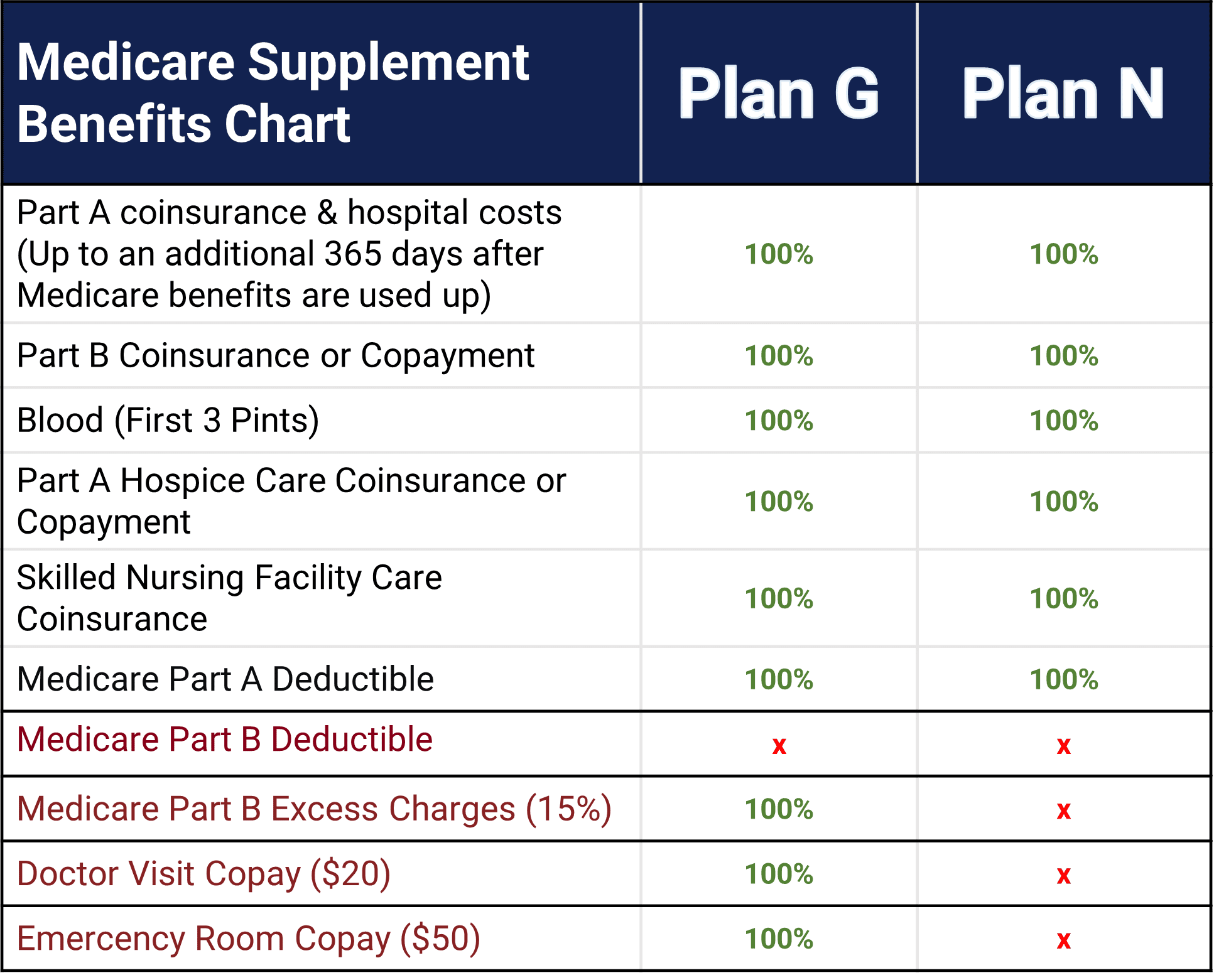

Medigap plans G and N look the same. The costs of these programs can vary depending on the plan, but the costs vary. The table below lists the Medicare Supplements cost. The biggest difference between Medicare supplement plans A and G is the co-payments in part B. Medigap plan G covers this cost to the fullest. Medicare Supplement Plans N require you to pay for your coverage in your own pocket. A good plan depends entirely on your needs. Taking medication can be helpful for patients who do not regularly visit doctors.

What is the coverage of the Medicare G plan? Previously Plan FR provided the highest levels of additional coverage until its elimination beginning in 2020. Since Plan F is not available to new beneficiaries, Medicare is now available to the maximum extent possible through Part G. Let me check what Medicare Plan N covers. List some health insurance options that Medicare offers in this program? How does Medicare G differ from the Medicare n? Check out the comparison table for Medicare supplement plans.

It is the third most popular plan. What's the Difference Between Medicare Plan F vs Plan G vs Plan N? Medicare Plan F used to be the most popular plan. However, it is no longer available to new Medicare beneficiaries who want Medigap. Now that Plan F is no longer available for new beneficiaries, the highest level of Medigap coverage that is currently available is offered by Plan G (followed by Plan N).

A comparison of Medicare Supplement Plans G & N shows that plan G offers higher coverage. Medicare supplement plans may require less premium payments. Nonetheless, you agree to pay small copayments if you go to a physician for treatment. Medicare Supplement Plan g could help you save a lot of money as a result, and also reduce the cost of the visit. Those who prefer a lower premium can use Medicare Supplement plan N for a lower monthly cost.

Medicare Supplement Quote You might wonder if Medicare Plan N versus G are costlier. The Medicare Part N plan is less expensive because it doesn't offer a similar level of coverage as Plan G. However, the costs differences are small. In most cases Medicare plan N costs between $15 and $30 more monthly than Plan G. For more information on the quoting software that we employ, click HERE for more information.

I have an excellent question that is: What Should Be Medicare Supplement Plans Rather Than Medicare Advantage? The reason is twofold. This is because the benefits have a common basis and the policy stays the same. This helps in saving on the upcoming cost of medical services. The second advantage of Medicare is the benefits of original Medicare. Please explain.

Benefits that are the same in both Plan G and Plan N Here are the Medicare benefits that both Plan G and Plan N cover, according to Medicare.gov Part A coinsurance and hospital stays up to an additional 365 days after Medicare benefits are used up. Part A deductible. Part A hospice care coinsurance or copayment. Skilled nursing facility care coinsurance. Blood transfusion (first three pints). Medically necessary emergency health care service for the first 60 days when traveling outside the U.S. Deductible and limitations apply.

Plan N will pay 100% of the Part B coinsurance, except for copays of up to $20 for certain office visits and up to $50 for emergency room visits when you're not admitted to the hospital. Medicare Supplement Plan F is the most comprehensive plan. Plan F covers one more benefit than Plan G, which is the Part B deductible. Plan G and Plan N premiums are lower to reflect that.

What is the purpose of a policy? Two plans cover the bulk of the large cost that is left over from Original Medicare Parts A or B. However no of these plans covers the Medicare Part B Deductibles. Part B covers the outpatient treatment of patients. This service covers visits to the doctor. When your policy deductible is met, your policy provides coverage.

Supplemental Medicare plans g and n are similar. Plans also provide in-country care, in addition to medical care for travelers to the United States. Plan g offers a higher premium and an average price increase. PlanN is an affordable plan to help people save money on Medicare. This list can assist in comparing Medicare Plans G and N.

Participating Providers According to Medicare, more than 98% of doctors choose what is called a Participating Provider contract. This is a fancy way of saying that they agree to accept Medicare assignment and only charge the Medicare approved amount. In return, they only bill Medicare. Medicare is their one-stop biller. Medicare then communicates electronically to the Medicare supplement plans and informs them how much to pay, and to whom.

Medicare has neither reviewed nor endorsed this information. Not connected with or endorsed by the United States government or the federal Medicare program. While we have done our best to ensure all rates shown are accurate, human error is possible. In the rare event of a pricing mistake, the carrier's rates will always supersede whatever price appears on our website.