If your health insurance is subsidized or subsidizes your own health insurance plan, you might consider buying Medicaid or Medicare Supplement Insurance. Medigap policies provide copays, coinsurance and deductibles that would normally be incurred when Medicare provides the coverage.

Medigap plans are standardized, but they are sold through a private firm whose premium is determined. The price of a home may differ depending upon the location of the home, gender of the person, tobacco consumption, medical history of the person, insurance company. How Do People Get Medicare Supplement Coverage?

The total cost will depend on how many people purchase their health coverage plan from, the company they purchased their plan from, their income and sometimes their age. Therefore, it is essential to consider your coverage needs when choosing your Medicare policies. In 2023 Medicare Part B costs are now lower than normal at $66.20.

How much is the typical premium for Medicare Supplement plans? Unfortunately, it's not possible to answer this question as Medicare Supplemental Plan Fees vary. How do I find my Medicare plan? So the cost of Medigap coverage is a lot of uncertainty.

The exact amount can vary by individual policy. Insurance companies can set monthly premiums for their policies in three different ways: Community rated. Everyone that buys the policy pays the same monthly premium regardless of age. Issue-age rated. Monthly premiums are tied to the age at which you first purchase a policy, with younger buyers having lower premiums. Premiums don't increase as you get older.

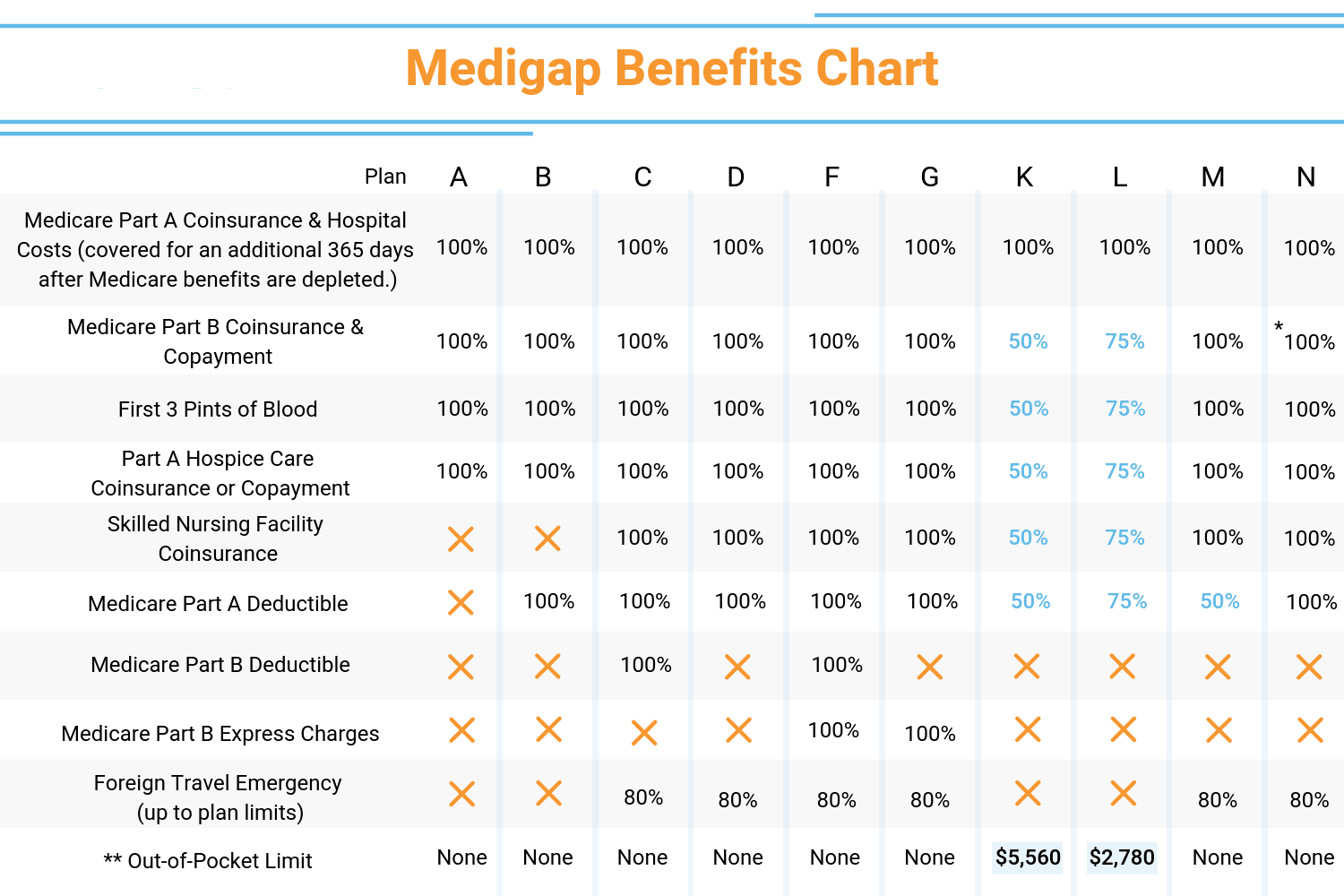

Below is a list of MedigaP plans available to 65-year-old non-smokers from North Carolina, with average prices from most of the states. Medigap Plan types: Monthly premiums - prices - Medigap Plans A — all basic benefits of a Medigap plan with no additional costs. - $185-462. Medicare plan B includes a basic Medicare Part A deductible. 133$-300$. Medigap Plan A - an inexpensive option to cover the majority of Medigap benefits. 105 – 330 dollars. Medicare Plans G are the most covered plans available for new Medicare users. Available in many countries with standard or premium plans. $97-341. High-deductible Medigacy Plan. $20 to $76.79.

Part C is an alternative form of Medicare. Medicare is an insurance option for most people. Currently, available plans cost an average of $20 per month until 2024. The Part C program carries pure public insurance meaning the cost and coverage cannot be uniformly distributed among companies.

All policies have separate premium and deductible limits. So it's important for Medicare users to search the web for the most affordable Medicare Advantage plans. Medicare beneficiaries usually find plans as low as $0.30 a year, and fewer, more expensive plans as low as $900 a month. The price of a particular package reflects different coverages.

Medicare Supplements may have several costs: community ratings and community rates. Insurance rates do NOT vary by age but all members are entitled to the exact same monthly fee. This pricing is also known as age rating. Ages. The premiums vary depending on your age.

The average age for a premium for a single parent is about 18 years. This price is sometimes also referred to as entry aged rating”. Age reported. Premium rates will be determined by your age, so your costs will grow with age. Some states require standardized pricing for Medicaid Supplement Insurance and there's no standard pricing system for each.

Medigap usually has a monthly premium, and you may also have to pay copays, coinsurance, and deductibles. Medicare supplement insurance (Medigap) policies are sold by private insurance companies. These plans help pay for some of the healthcare costs that aren't covered by original Medicare.

Medicare Supplement plan F offers the most comprehensive protection in any of the medical insurance plans and is so popular that many people qualify. Below, we show how much Medicare Supplement Plan F premium is compared to other plans and ranges between $251 and $524, for example.

Depending on the state, Medicare Supplement costs vary. The average woman's life expectancy is less in most states than the males. But not all states follow these principles at all. It might be worth noting that New York has none. New York has a guaranteed issue, and the plan is mostly community rated.

The benefits of Medicare Supplements Plans are uniform, meaning there can be identical benefits among different providers for different types of plans. However, the cost of Medicare Supplement is different from person to person. Factors influencing the Medicare premium include your age or gender. For example, the Medicare Supplement rates quoted in three ZIP codes across the U.S. can vary according to individual health and disability status. This example is intended to be aimed at non-tobacco customers only. Please see below if you have any questions about the above.

In some instances, the costs in Medicare Supplement plans are the monthly premiums. The premiums can vary depending on various factors, namely. These are identified in a letter. The state of Massachusetts, Minnesota is also the smallest of these three and several states are also using standard plans. Medicare is marketed by private insurers, meaning the premium costs of these policies are often different. Plan g can therefore be cheaper if bought from one insurer versus another, even when the basic benefits of that plan remain the same.

Medicare Part D cost may vary by the plan that was selected and the amount of the household's income. By 2023, a Medicare Part D plan will cost an average $49 monthly. In addition, deductibles vary depending on plan with an average of $300 for drugs. Applicants who earn more than $77,000 are also charged an additional fee. Just under half of all enrollable people receive this Medicare Adjustment, automatically taken from Social Security for those who qualify. Individual Income Additional Monthly Costs For Part A.

In 2022 Medicare supplement coverage is expected to average around $150 a month, or about $1800 per year. Many variables affect the cost of Medigap, including age and location. Rachel Christian Rachel Christian is a Financial Writer and Certified Education Specialist and a writer and researcher for RetirementGuide. She focuses on annuities and life insurance. She is an affiliate with the American Financial Counseling Association and Planning Institute. Read More by Matt Mauney. Matt Mauney Financial Editors.

Almost 90% of Medicare beneficiaries receive the program free of charge. Those that don't qualify can expect a monthly payment of $28 - $506 depending how much the person pays for a pension. The total amount is based upon how much the person's spouse paid Medicare tax. The cost of Medicare is zero for the majority who have previously been active in the workforce. You may qualify for Medicare if you have work experience of at least 10 years, or if you worked in Social Security and Medicare.

Costs of Medicare Part B 2023 will average $166.90 per month. These rates vary with income; if the income is above $77,000, the premium is increased. The cost of Part B of Medicare is determined by your adjusted gross income (AGI) of your last tax year. Only about 7% of the millennials are eligible to receive these rates. If you file joint tax, you can double the income level for a monthly premium. SSA releases this statistic each year on an annual basis. Income a person earns monthly.

Currently, if you want health coverage you need to pay about $300 a month. This supplemental insurance plan helps cover the gaps between Medicare and its original coverage. Medigap will help pay your expenses, including deductibles, copays and coinsurance. Medigap Supplement Insurance policies offer partial or full coverage. This results in high price fluctuations. Two companies may offer very different rates to the same insurer. The larger the coverage the greater the price might get.

How an insurer decides on prices may directly affect how much you will spend now on Medigap coverage. Depending on what your age is, insurance companies don't know if your premium will rise. Other insurance firms will usually increase their policies every year or set the premiums according to the year of purchase of their policies. The cost of Medigap is dependent upon the ages of the people.

The Medicare Supplement Plan N premium is less costly than the other two top three plans in this segment. The plan covers all the coverage for Medicare Supplement Plan G including co-payments, but is not specifically for a single plan. Nonetheless, this is no disadvantage for those who live within an area with no excessive taxes.

For newly enrolled Medicare users a most common plan is Medicare Supplements Plan. The newcomer cannot participate in Supplements Plans A or B. Medicare is an insurance company whose premiums are higher. Medicare supplement plans have the lowest average cost. Medicare premiums are calculated as a percentage of the coverage paid by Medicare.