The majority aging population will be offered twelve types of Medicare supplement in 2023. We provide a comprehensive guide to all of the options available from MediGap for your healthcare. Find your Medicare Plan Today!

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable. This means it is automatically renewed each year.

When selecting MEDIGAP policies prices will most likely dominate your mind. The plans have monthly premiums. Your premium is dependent on a variety of variables, such as your age, your smoking history, and your ZIP code. It's crucial that you remember that Medigap's most important element determines your Medigap premium letter.

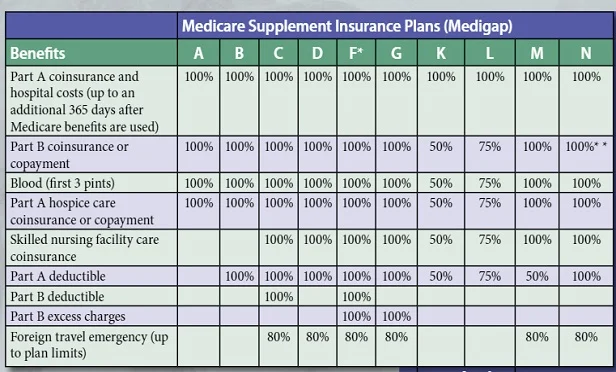

These letters show the coverage you receive from the coverage plan. Interestingly, Medigap plans offer higher premium coverage and more expensive options. Below is a comparison sample Medigap monthly premium for the demographic below: Non Smokers living in Tampa FL (33634 ZIP code):

It shows all the 12 medical plans that Medicare covers after Original Medicare contributions are paid. Do not confuse Medicare Part A or Part B with Medicare Part B. Original Medicare includes the Medicare Part B, which provides inpatient hospitals and the Medicare Part C, which provides outpatient medical care. Medicare Supplement Plan A and Plan B provide additional coverage to cover Medicare's costs. Whatever Medigap plan you use is covered by any physician nationwide accepting Original Medicare. An insurance acceptance physician cannot refuse you the Medigap plan you chose.

Insurance companies can only sell you a “standardized” Medigap policy. Medigap policies must follow Federal and state laws. These laws protect you. The front of a Medigap policy must clearly identify it as “Medicare Supplement Insurance.” It's important to compare Medigap policies, because costs can vary. The standardized Medigap policies that insurance companies offer must provide the same benefits. Generally, the only difference between Medigap policies sold by different insurance companies is the cost.

Medigap offers enrollment throughout the year. Nonetheless, you should consider your Medicare Supplement opening enrollment window if you want to join a Medigap plan. When an applicant applies for these opportunities, carriers cannot deny coverage. You may apply for medication if you choose. Those who have not taken part in a Medigap program during that time can still participate in Medigap plans. However, health insurance claims can be answered in many states. Therefore, you can be denied access and pay premiums for a number of reasons.

When you look into each Medigap plan, you may observe that the monthly averages and the expenses vary. You'll still have responsibility to pay these costs if you are covered by Medicare. Costs for a Medigap policy may vary. Typically the plan requires copayment or deductibles while some plans such as the Supplemental Medicare Supplement Plan F do not require seniors to pay the premiums. Examples of plans include MediGap F and a plan where the first-time coverage – which is the deductible – is not available to patients new to Medicare.

Each Medicare supplement is regulated by federal law to ensure you have the best protections. Most insurance companies sell policies with only the standard name. All policies offer basic benefits and some also offer extras to make it easy to pick one which best fits your needs. In Massachusetts, Minnesota, and Wisconsin, Medigap policy is different. Several insurance providers decide what insurance coverage they wish to sell, but some states may affect which. Insurers offering Medigap policies.

There are 12 Medigap plans available throughout the US lettering A through NE. This number also reflects two High Deductible Plans - Medigap High-deductible Plan E and Medigap high-deductible plan A or G.. The. When reviewing the Medigap plans, you can determine the coverage and how the plans will match you in terms of health care needs. Depending on your letter plan, your insurance may cover deductibles, copayments, coinsurance, and many more.

Medicare includes four sections, namely Part D and Part A. Part A covers inpatients and hospital coverage. Part B covers hospital services for patients in need. Part C provides another way you can get Medicare benefits. D covers drugs deemed to be illegal.

They are sold by private insurance companies. If you have a Medigap , it pays part or all of certain remaining costs after Original Medicare pays first. Medigaps may cover outstanding deductibles, coinsurance , and copayments.