Generally the Medicare Supplement insurance is designed as a way of assisting people with a medical condition to reduce their cost of medical care. There are ten standardized plans in nearly every state that offer different benefits based on their characteristics. You'll find plans immediately in any region! Medicare Supplement Plan K can be accessed in many states. Plan K provides assistance with various Medicare expenses out-of-pocket. In 2021, Medigap plan K provides a maximum annual cost of $620 for Medicare-covered services.

Plans K and L offer the same basic benefits as other Medicare Supplement insurance plans, all with a lower monthly premium. In exchange for a lower premium, these cost-sharing plans cover less of the coinsurance and copayments than other Medicare Supplement insurance plans, but you'll have the added security of a maximum out-of-pocket cost every year.

Medicare Supplement Plan K is a standardized Medicare Supplement plan offered for Medicare beneficiaries. Medigap plan K provides numerous advantages and cost reductions for the policyholder. Get Medicare Supplement Plans in three straightforward steps. Comparable to the Medicare Supplement plans, MEDGAP Plan KA is not comprehensive. The plan offers additional insurance for less than the normal cost.

Medicare Supplement Plan K is one of 10 Medicap Plans. Medigap plan can be used in most states to help with healthcare costs not covered under Medicare. MediGap policies have slightly different letters depending on your state. For Medigap plans, you have to participate in Medicare's initial program. Can I find out if the Medicare Supplement Program K covers, does not cover & is there any option?

Medicare plan K consists of an affordable Medicare supplement that will cover the gaps in traditional Medicare coverage. Plan K assists in assisting with covering certain Medicare Parts A-B and other medical expenses. Medicare K plan costs about $177 per month.

Medicare Supplement plans, including Plan K, are available for purchase at all times and do not limit the open enrollment period yearly. Even though you can purchase the Medicare supplemental plan anytime, such adjustments are ideal during your guarantee period and ensure you get the most affordable coverage. Plan K provides specialized insurance coverage through the government-sponsored UnitedHealthCares. Insurance firms offering Plank policies vary by state. This will help you compare rates between several providers and determine what plan is best to meet the needs of your organization and get the best price.

Medicare Supplement Plan K is a Medicare Supplement plan available across 48 states. These are federally approved plans. Thus all the benefits offered in Medicare Supplement Plans K vary depending on which company you are enrolling with. The only significant differences are between carrier premium prices. Medicare Supplement Plan K is a great option for reducing the costs for beneficiaries. As with other Medicare Supplements, the Supplement K plan is primarily funded through a small portion of the costs that Original Medicare left to pay.

Medicare Supplement Plans K vary by location, age, or other factor. But it is estimated to be about $40 to $120 per month. Get a list of available Medicare Supplement plans by visiting this website. It's called maximum out-pocket. Medicare Supplement Plan K will cost $6940 in 2023. After you have paid the Medicare premium, Medicare Supplement plan K will be responsible for 100% of the remaining expenses. Currently, MOOPs for the Medicare Supplement Plan K may vary year after year.

Medicare Plan K aims to cover gaps in traditional Medicare coverage. Supplemental insurance helps people pay medical expenses. Medicare Plan K does not reimburse all services for up to 50% of costs. When the beneficiary meets this requirement, the plan pays 100% of the medical costs for the remainder of the calendar year. It should be noted that Medicare excise charges do not count against the annual cost limit, however the maximum of $226 is included in this cap.

Medicare plan K is occasionally compared to Medicare plan L and shares a few similar features. Both the plans primarily cover certain services, and they both carry annual costs. Plan K L also excludes Medicare Part B deductibles from traveling to foreign countries unless there are unforeseen health problems. Generally speaking plans are based on the cost and coverage of their contents in relation to the plan and its contents. Medicare Supplement Program. X Plans.

Some Plan K plans can even provide support for SilverSneaks, which encourage older adults to participate in activities to improve their health. Your insurer pays you to join a gym from a SilverSneaker network. Coverage for the SilverSneakers program is dependent upon whether an insurer provides SilverSneakers under Plan K. Depending upon the area in which you purchased Plan K and where you live. Check your eligibility on the SilverSneaters website.

As with most Medigap policies, health-related costs are included in the Plan K premium and they are tax deductible. If your adjusted gross income exceeds 10%, itemizing can help you make an informed saving decision.

The Medicare Supplement plan consists mainly in Medicare Supplement Plan L. Like Medicare Supplement Plan K, Medigap plans L cover 80% of the costs incurred by the Medicare Original Medicare program and have a minimum deductible to reduce the cost of obtaining the benefits. It is ultimately about cost. Where Medicare Supplement Plans K cover 80%, Medicare Supplement Plans L cover 75% - 85%. In addition the MOOP for supplemental Medicare is $3470.

The benefits of the supplement plan can also be supplemented with Medicare, but they do not substitute for Medicare. Medicare is provided for disabled persons in addition to those older. The original program was broken down in parts. Together they cover about 88% of health care expenses and create gaps in insurance provided through Medicare supplement policies. How are Medicare Plan K coverage deductibles calculated?

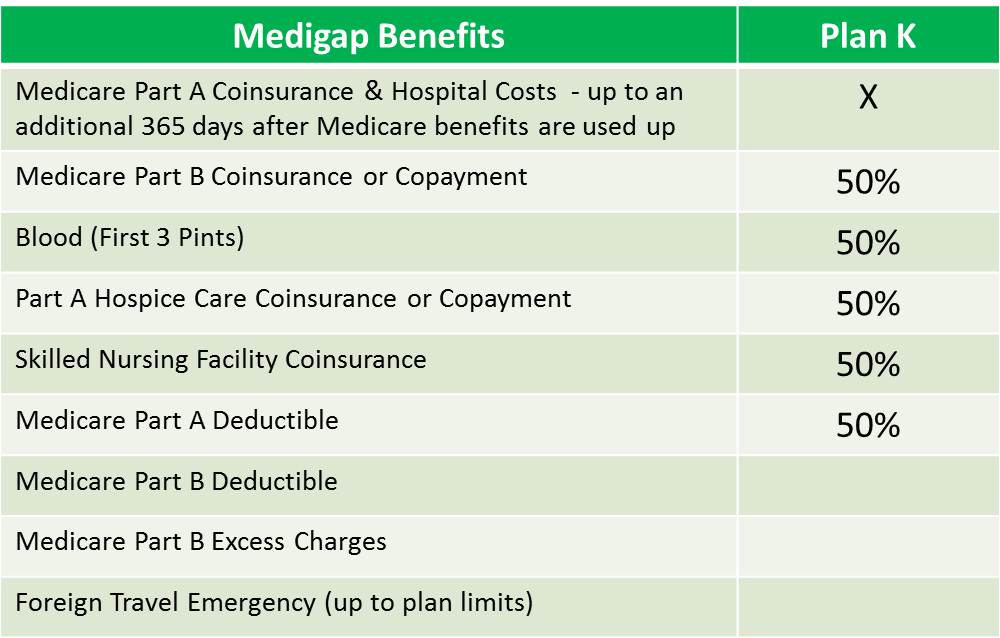

Medicare Part A coinsurance and hospital costs Medicare Part B coinsurance or copayment (50%) Blood – first 3 pints (50%) Part A hospice care coinsurance or copayment (50%) Skilled nursing f acility care coinsurance (50%) Medicare Part A deductible, which is $1,600 in 2023(50%)

Medicare Supplement Plan K reduces the cost you may be able to incur under Original Medicare, but does not cover the gaps completely. Plan K pays a minimum of 50 percent in most cases if you meet the minimum. Plans are limited to $662 by 2023. Once your limits have been met, Medigap plans will cover your remaining approved costs. This limit is renewed every month. K's coverage is:

Premiums on Medicare's K plans vary based on the location, health status, age or sexual orientation. Plans K monthly premium is lower than many other Medigap plans. Plan K is a budget-friendly solution because of the low monthly fees. Medicare Plan K provides less than 50 percent coverage in some areas. - Medicare plans K.

Medicare Part C does not cover the total cost of seniors. The beneficiary is entitled to a Medicare Supplement. Medicare Supplement Program K offers numerous benefits that help reduce Medicare cost. Benefits from the Medicare Supplement Plan K are:

100% coverage for Part A hospitalization coinsurance, plus coverage for 365 days after Medicare benefits end 75% hospice coverage for Part A coinsurance 75% of Medicare-eligible expenses for the first 3 pints of blood 75% Part B coinsurance, except for preventive care services, which are covered 100% In addition to the basic benefits.