Medigap is an additional medical plan which a person buys to help cover health expenses not covered by Original Medicare. It covers copayments and deductible payments as a passenger. In other words, Medigap policies don't cover medical care. Typically, insurance does not provide coverage for prescription medications. You pay monthly premiums on medgap policies. Medigap insurance is designed for a limited number of individuals. You must buy whichever Medigap plan you want for yourself.

Medicare is Medicare’s primary policy. Because Medicare pays first, that's the most important. But Medicare does not always cover the cost of all services. Supplemental policies can be useful in protecting yourself against unexpected medical expenses. Find your best Medicare plan in 3 simple steps. It depends how well you can meet current and future needs. Our aim will be helping you understand Medigap as a secondary coverage.

In some cases, you may need health insurance that is billed by your employer. The coordination between benefits rules determine who is owed first. The Primary Payor repays the amount they owed on your invoices first, this amount going to a second payer for payment. Rarely do third parties have an alternative source of payment.

Monthly premiums on a Medigap policy can be paid directly to a licensed private insurer whose insurance provider is authorized. These are additional premiums to the Medicare Part B deductible. The policy does not cover any individual. If both parties wish to be covered by Medigap they must be covered separately by Medigap. Moreover, the shopping process for insurance is easy based on the comparison between cost and suitability. Once you buy Medigap policy you are able to continue using it regardless of your health condition. It is thus impossible to cancel the policy until the premium has been collected.

Employer-sponsored Medigap policies offer supplemental insurance for Medicare-eligible individuals.

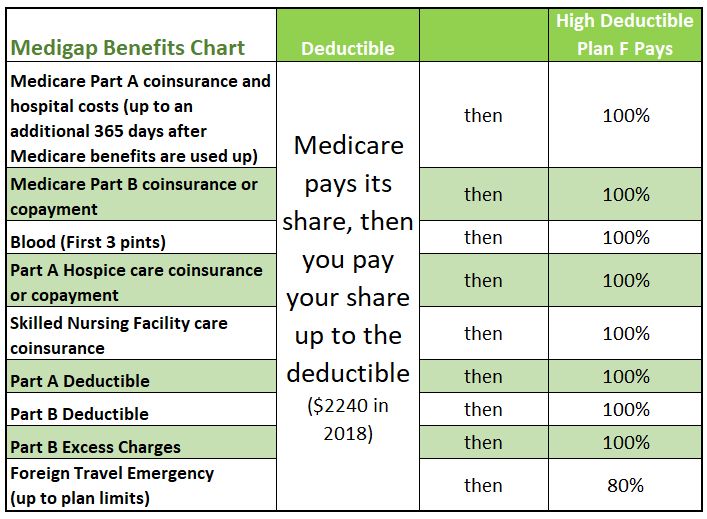

Medicare Part A and Part B are not designed for medical expenses. Medigap policies are usually able to cover the entire cost of this additional service, depending on what the insurance policy offers and do not include long-term care or private care. While private insurers provide Medigap protection, the government has a mandate on the companies to provide standardized policies. Your 12 options include plan A, B, C, D, F, F-High Deductible, G, G-High Deductible. However, if you're newly enrolled with Medicare in 2020 and after, plan C, F, G, and N are available.

Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company. As long as you pay your premium, your Medigap policy is guaranteed renewable.

Medicare supplement covers more health coverage than Medicare coverage. Your Medigap plan is then secondary to Medicare. There are additional benefits if you don't have the insurance. Generally Part D covers drug coverage as it carries supplementary insurance. Dental, Vision & Hearing policies can be purchased to supplement your current coverage. The policy stands alone and does not provide primary or secondary protection. It is possible that these phrases could make the language confusing, mainly as supplement is secondary rather than supplement.

Medicare is the largest benefit for Supplementals as it pays first. If you reach this limit, Medigap plans will automatically pay you. Secondary insurance often does not get refunded even though primary insurance does not. Medigap insurance is not the only alternative to Medicare. TRICARE For Life provides an additional benefit through TFL. Several rules called the coordinated payment determine the payment order in each case. Occasionally, although rare, the payoff is three. How do I find the best Medicare plan?

The CARES program will provide $23 billion to CARES recipients for medical care and economic assistance for cancer victims under the CARES Act. It will be effective in 2021. It will improve Medicare coverage for patients with coVID-19. The CARE Act also: The CARES Act provides a new definition of Medicaid for uninsured adult citizens who could have benefited from the Medicaid program despite being exempt. Others with low Medicaid coverage can also apply to the Medicaid plan through the state choice.

Medicare is a primary insurance plan for persons with Part A. Because Medicare doesn't cover all, this policy is offered to fill in gaps. It also reduces costs. The majority of states provide 13 different Medigap Plans that each have various amounts. Depending. Most plans carry the benefits of all carriers, according to federal regulations. Not all carriers offer all Medigap packages. Plans with greater benefits often cost more. When selecting the Medigagap plan, consider the coverage amount and price.

Medicare beneficiaries working today may also be eligible for large employers' group health programs. Obviously, Medicare is secondary to the employer plan. Part B can also be delayed after age 70, if a creditworthy insurance policy is obtained through an employer. The aforementioned penalties will apply to Part B recipients unable to enroll for Part B. A refunded portion will be assessed.

In case you have two different policy types which cover different risks, both policies are primary and second. If you have Medicare with Medicare Supplement Plans. Medicare is your primary insurance policy, whereas Medicare is your second policy. Plan G covers any remaining costs that you could otherwise pay.

Medigap is a private insurance plan from private providers whose objective is the payment for health care costs incurred under the original Medicare program. In addition, Original Medicare cannot cover any expenses such as travel abroad.

Remember: You can always choose not to take your employer's coverage and sign up for a Medicare Advantage Plan or a different Medigap, but you may not be able to get that retiree coverage back if you want it at a later date.

The insurance provider will pay the bill a few weeks later if the bill does not arrive. Medicare will make a condition of payment for payment of bills, but will also recover any other payments it was billed for.

Inform your doctor about the benefits of additional Medicare. They'll send your bill to the correct payer so that they're less susceptible of delays.

Tell me the cost of obtaining insurance for the first time? Inform your medical provider of changes when initiating treatment.

If no other insurance exists then Medicare can always serve you as the main insurance provider. If you have multiple forms or policies, Medicare remains your main insurance.

Since the introduction of the Medicare Prescription Drug Plan (Part D), you can no longer sign up for these plans. If you already have a Medigap plan that covers prescriptions, however, you can keep it. Find a Medicare Plan that Fits Your Needs Get a Free Medicare Plan Review