All of these recommendations are based on an independent review process; advertising does not influence the choices. If we have a recommendation from you, we can get paid for it in some respects.

Please review the disclosures for advertising companies. Medicare Supplement Plans or Medicare Advantage are specialized health insurance plans that provide a supplement that consists of a variety of health care benefits and is marketed separately from Medicare.

Medicare Supplement Plans cover coverage that was previously unavailable through the Original Medicare program. Usually they include medication prescriptions, a doctor visit, eye-health, or other dental services. The best Medicare supplement providers offer competitive prices and a modern and user-friendly web interface.

All products are reviewed by independent reviewers; advertisers are not affected when making a selection. It's possible that we'll get compensated if a person visits a friend that we recommend to a friend of ours. Find information on the disclosure of this advertisement.

As health care costs increase the out-of-pocket costs for medical services that cannot be provided through Original Medicare. The cost is based upon the amount of time you have and what the cost of medical care is. Currently, Medicare spends about $5460 on healthcare costs per month.

When looking to buy Medicare Supplement policies in 2022 you will need to learn about the top 10 Medicare Supplement insurance companies. Our experts have compiled the most useful and accurate information on supplemental Medicare insurance to meet your needs. Get a free quote. How can I find the most cost effective Medicare Plan in San Diego? Among other things are customer reports, AM Best ratings, Standard and Poor ratings and the years of its presence on the global market.

It gives stars ratings for Medicare Advantage and Medicare Part D prescription medicines, but not Medicare Supplement Insurance plans for Medicare beneficiaries. For comparison of insurance companies in the Medicare Supplement Insurance industry, you can view independent financial reports.

When looking for Medicare Supplement Insurance (MEDIGAP), you will need to compare both your insurance and the plans offered by your insurer to determine if you are a suitable candidate.

Medicare offers an easy way to save money. People over 65 often refer Medicare as a great health plan. But this is not a complete solution. You might require Medicare Supplement or Medigap insurance for medical care while you are old.

Medicare supplement programs are standardized. So regardless of which carrier to enroll with, the benefits of your plan differ from carrier to carrier. The importance of finding reputable plans is also paramount when selecting your plan.

You want your insurer to know that their claims are paid back correctly, offer good service and reduce their rates in a timely fashion. Medicare Supplements have many advantages. Demographics like age, location and tobacco habits affect Medigap premium rates. Indeed, the carrier that offers the plans influences prices all across the board.

A dependable plan F may also be expensive depending on the Medigap plan's average premium. Plans F and C are not offered to Medicare beneficiaries whose eligibility begins at the end of January 1, 2020. The federal government will no longer cover Medicare Part B deductibles for Medicare beneficiaries after January 31, 2020. Medicare patients already able to enroll for Medicare after the deadline are eligible to apply for plans F or C if a plan is available for that location. If you have Plan CF or Plan CC prior to 2020, you can maintain the CF or Plan CC.

Researching on a suitable plan can be a crucial part of getting the coverage that you require. Each plan provides unique benefits depending upon your states, desired benefits, and prices. If you've reached your 65th Birthday and still don't receive Social Security benefits, you can qualify for Medicare. Buying Medicare Supplement insurance is recommended at your Medicare open enrollment period for your plan. This is one-time and six months of eligibility to purchase Medicare Supplement insurance from the Federal Government.

Depending on the company and their reputation they may offer you additional coverage that is the right fit for you. You should also think about things such as reputations and reviews of the insurer as well as the ease of navigation and application of insurance coverage on its websites. Additional factors should be considered like the type of plan offered, the cost of deductibles. Alternatively, you might choose an app that lets you manage your policy online.

Medicare Supplement Insurance Plan or Medigap is a private insurance policy that covers most costs associated with Original Medicare. They cover Medicare deductibility, co-insurance, copayments, and more. The 10 Medigap plans in most states have been standardized and the benefits will be identical no matter where you buy them. Medicare's 10 standard Medicare plans have a minimum amount of coverage for Part A insurance for hospital treatment.

Medicare Advantage is an alternative to Original Medicare. Medicare Advantage provides alternative Medicare coverage over Medicare. Medicare Advantage is a low to $0 monthly fee covering almost all medical treatments although fewer doctors have the choice. The Medicare Supplement program will not cover the cost of the Advantage plan and it's illegal for anyone to sell you the Medicare Supplement plan while your Advantage plan is on.

Comparisons between Medigap Insurance and Etna Insurance are made through examining independent ratings from independent companies. The rating agency has many branches and include the MMS. Rating services for insurance companies. Fitch Rating Agency Kroll Ratings. It is normally free online. Since different agencies are rated according to specific criteria you'll need to try to review one rating for every Medigap insurance company.

Medicare Supplement plans are intended to cover a portion of Medicare's gap. Medicare supplement policy is uniform across all government departments. The benefits of each policy therefore remain unchanged no matter what insurer you choose. What's the difference between pricing for each company and how do they determine rates of increase? It is ok to consult a physician if you have Medicare Supplement insurance.

If you enroll in Medicare Part C or Medicare Part D then you will need a Medicare Supplement. You should be in the US at least 5 consecutive years and 65 years old. People diagnosed with a particular disability are considered eligible even when they were 65. When you apply for Medigap coverage during the Medigap Open enrollment period you will have the same premium for those who have health issues.

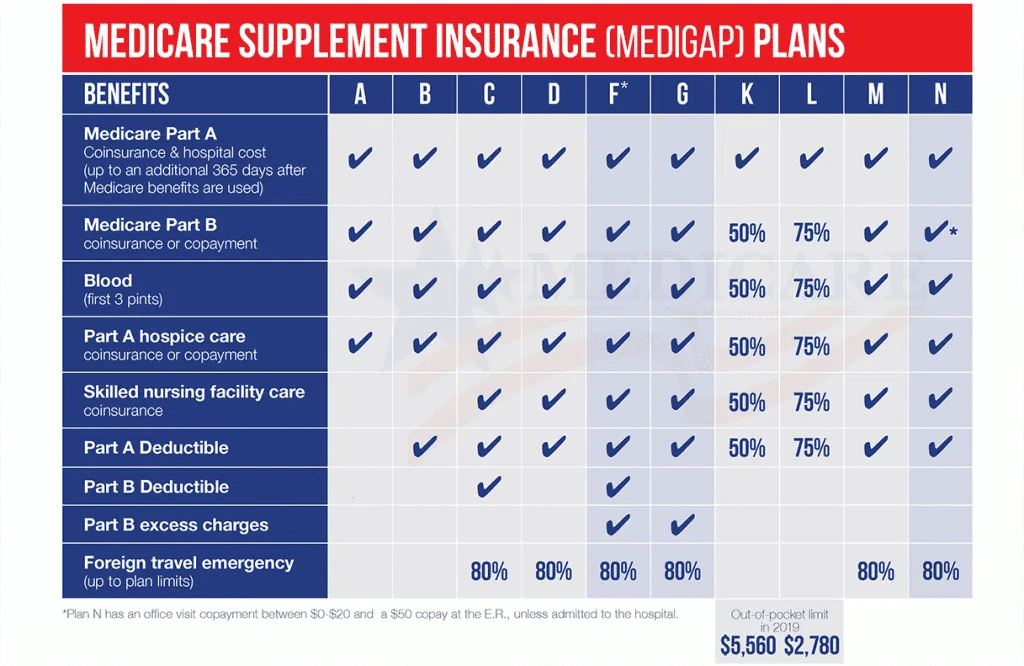

This chart shows contrasting Medigap plans with their respective types. Click here to read an updated chart scroll down to the left to read the graph Click to learn more Medicare Supplement Benefits Part B coinsurance / copayment Part A Hospice Care coinsurance / copayment First three pint of blood Skilled Nursing Facilities coinsurance. How do I get Medicare and other insurance coverage?

Tell me the best kind of medical insurance that will suit my needs best? Part-C plans cover all the benefits Medicare provides in a comprehensive plan. Several Medicare Advantage Plans cover medical and dental prescriptions, as well as hearing aid and other equipment. Medigap and Medicare benefits are different things. You can't get Medigap or Medicare Advantage plans simultaneously.

If you are eligible to qualify for Medicare Supplement coverage, you will have to pay the premium on the day you turn 65. In some cases a person who is under the age of 65 could qualify as long as they were permanently handicapped. You might also undergo medical underwriting testing, which includes the examination of your medical history.

Every Medicare Supplement plan must follow federal and state laws that are designed to protect you. In fact, all Medicare Supplement plans—no matter which company sells them—are standardized, and must offer the same basic benefits.

Almost all Medicare Supplements have limits on coverage or excluded coverages. Plan A & C covers most emergency medical care outside the USA, but these plans have additional provisions they do not cover. Medicare.gov provides details on the benefits of each plan. The main items that are not covered by Medicare Supplement programs:

The Medicare supplement's average monthly rate for 2022 was $178.11 a year. It's difficult to estimate the average cost of Medicare because of so many factors that affect the cost. The policy can be purchased in different forms depending on age, gender, and other variables such as whether the company provides insurance.

All Medigap Plans allow you to retain your physicians as long as they pay Medicare payments. It is possible you're seeing any Medicare-approved physician or visiting an authorized hospital or clinic. Medigap provides health insurance for foreign travelers in emergency situations (if traveling outside the U.S.

You can see any doctor or hospital that accepts Medicare. Medicare Supplement plans pay the specified share of your medical bills that Medicare doesn't pay, including deductibles and copays. No questions asked. While the basic benefits are the same for every Medicare Supplement policy, costs vary widely, and some companies offer additional benefits that might make choosing their plans