The Medicare Supplements Programs "fg" and " n " can assist in securing Medicare. When determining whether you should be enrolled in Medigap coverage or Medicare, you should consider the following questions. Lists some important things about Plan F.

It's the most comprehensive of all plans. Plan G offers more benefits, but Plan X has a higher premium rate than plan N because of the additional benefits provided. You'll be able to cut costs by using Plan N because your premiums could exceed Plan G's. Medicare supplement plans F, G, and N can help reduce gaps on Medicare.

Compare Medicare Supplement Plan F and Plan G with Medicare Supplement plan N. If you like many people, you're aiming for securing the maximum coverage possible without sacrificing your budget.

That's precisely what Medicare's Medicaid plan does. Find a suitable Medicare program today. The benefits of standardized Medicaid plans may vary significantly between the different types of plans. The following are comparisons between two of the best Medicare supplement programs in the nation: Medicare Supplement Plan F vs plan G.

You're here: Home / Medicaid Supplements Plans/Medicare Supplements. Plan G offers more comprehensive coverage, and plan N provides an excellent value with lower monthly premiums.

A comparison between Medicare Supplement G vs. Plan N will show Plan G offers more protection. Medicare supplementation will have a reduced monthly premium. The patient agrees to pay a small copay when he or she visits his doctor or the clinic.

The Medicare Supplemental Plan G can therefore be better for those with more income that will not incur any copay when you visit the doctor or hospital. Providing a lower premium with an additional payment option could be the most beneficial for you in reducing costs over time. You'll be able to change plans if you aren't registering outside of that window.

The Medicare Supplemental Plan F offers the highest coverage since it provides you with one dollar coverage that eliminates the extra expenses that come to you in the first year. If you feel low, then Medicare Supplemental Plan G is a better option for you.

It varies by the need for each of the questions. Additionally, you should be careful in determining which is the Medicare Supplement plan F versus Plan G and ensuring that you qualify for each. New Medicare patients cannot get coverage under plan F. Many people now enroll under the Supplemental Medicare Plan.

What does it mean when excess fees are calculated? Doctors or other providers that do not have an agreement on a Medicare Assignment are liable for an additional 15% of your Medicare payments. These fees are billed as supplementary to Medicare Part B excess fees. Medicare Assignments are generally an agreement that a physician and Medicare will make.

When you are accepted by the doctors, you agree to the payment terms of Medicare. If a medical doctor doesn't accept Medicare, Medicare allows the Medicare program to pay your premium at a maximum of 15%.

Medicare Supplement plan covers the premiums usually reserved by the beneficiary and is available to the beneficiary. This is dependent upon your Medicare Supplemental Plan. In the United States the most popular health insurance supplement plans are Plan B and Plan C. These plans are the most popular because they are comprehensive.

Listen to this podcast today! Comparison of Medicare Plan F versus Plan G versus Plan N demonstrates similar coverage. Note that the prices vary between states and carriers but the benefits remain unchanged.

IMPORTANT: MedigAP policy should be uniform across all of our states (except for Massachusetts and Wisconsin). The ten plan names have specific letters. These insurances are provided from private insurers. Most companies don't offer any coverage in their insurance plans.

Since Medicare Supplement insurance policies are standard policies, all type policies with a similar letter must be provided with the same benefits. That simplifies comparison of policy. The Cigna plans have similar benefits to the Aetna plans or Mutuals in Omaha.

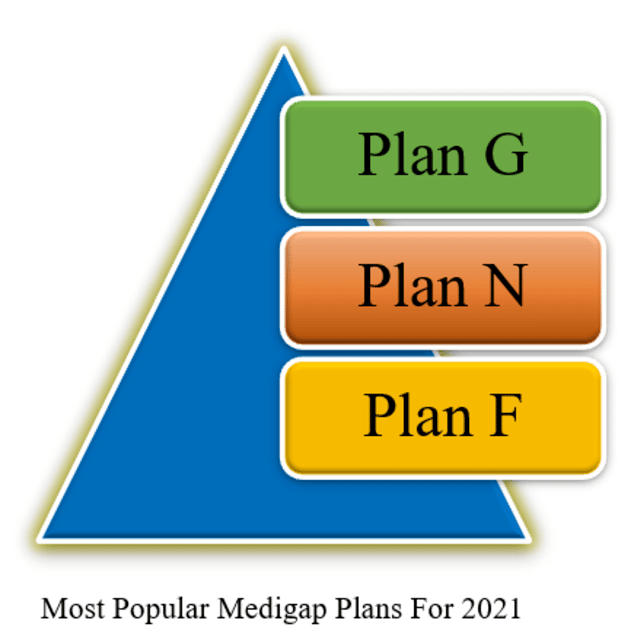

Do I need a Medicare Card? Are these plan options available? If so, want to know more? The decision to choose an appropriate plan for the individual may seem daunting. No one is alone. Plan G and Plan N are also popular plans (also called Medigap).

These programs are easily compared since their benefits have similar characteristics. We will describe some similarities and differences between this popular policy. You become a smarter Medigap buyer and can decide on a policy that suits your lifestyle.

What are some basic benefits for Medicare? Previously plans were offering high-quality supplement insurance until they began to phase out by the end of 2020. Since Plan F has become unavailable to Medicare beneficiaries, the highest Medicare Supplement cover is offered under Part G. What is the coverage for Medicare Plan N? Can I find out if Medicare has coverage for my health? How do Medicare plans differ from Plan N? See Medicare Supplemental Plan Comparison below.

Are there deductibles under the Medicare Supplemental Plan N? Unfortunately, the easy answer is no. Both Plans N and G pay Part Bdeductibles in excess of $225 each year. When you visit the physician the very first time in January, the $226 deductible is due from one of the two plans. Here the difference between plans G and N begins. Part B deductibles will cover 100% of your annual Medicare expenses. Medicare Plan N coverage does, however, have additional out-of-pocket costs.

It is the biggest coverage distinction among the two plans and could result in more expensive medical bills than you anticipated. Plan N does not provide any additional charge while Plan G covers. If you choose Plan N, medical providers will send you balances of payments for services they are providing if Medicare is not able to offer you the prescribed price. So the company could charge you a higher rate for Medicare. It is quite expensive to be cautious.

All medical visits covered under Plan G are 100% covered by Plan G. With Medicare Plan N benefits, however you have to cover a $20 copayment per doctor' s appointment. Ultimately, for those with regular doctor visits this could easily increase by a whole year.

You can contact your insurance company directly to cancel the Medigas plan. Then you must buy insurance of your choice. You can compare different Medigap plans for different cost and compare them. If you have a plan that meets your requirements you can modify it anytime. If you need more help you can switch to an alternative business for less. However, a change of plan can mean underwriting if you don't accept your new plan.

Medicare Supplements Quote You may wonder which Medicare plans are more expensive than the Medicare plans G. Because Medicare Part N does not provide as many coverages as Plan G, it is clear your premium for Medicare Part N can be lower. But the cost differences are modest. Medicare Plan N's cost will usually be around $30 per month less compared to Plan G. Click HERE for the video of the quote software.

an N doesn't cover is Part B Excess Charges . This is an amount up to 15% that a healthcare Provider can charge in addition to the amount of what Medicare approves for services. Doctors that accept Medicare Assignment or Medicare as “payment in full” are called Participating Providers.

There's the biggest difference between Medigap plan G and Medigap plan N, in that Plan N covers certain medical offices and emergency departments, while Plan G cannot. Medigap plan N would have less overall cost.

Plan N also pays the full Part B coinsurance for other types of visits covered by Medicare Part B. » MORE: Compare Medicare Supplement Insurance plans What's the cost comparison between Plan G and Plan N? Medigap Plan G covers more than most other Medigap plans, and its premiums tend to be higher, too.

We follow strict editorial standards to give you the most accurate and unbiased information. Medicare Supplement Plans F, G, and N can help bridge the gaps in Medicare coverage. If you're approaching age 65 and wondering about your choices in Medicare and a Medigap policy, we're here to help break down some important information for you.

Are Medicare covered? Plan N covers 100% of your Medicare Part B copayments, excluding a $25 copayment for office visits and a $50 copayment for emergency rooms.

The same coverage is maintained throughout the period following your Medigap anniversary. For example, it is possible to change plan G to plan G without guarantee.

Medicare plans are not all covered by Medigap. Medicare Plan N generally excludes medical and prescription medications and medical equipment. Medications are available to Medicare patients with prescriptions for drug coverage (Part D).