How should you learn plan G covers every aspect of Medicare's A deductible. Premium prices vary largely by place of residence. In several states, the cost differs as much as the gender and whether the person smokes or vapes.

Depending on eligibility you can enroll for an Original Medicare plan E. The Medicare Supplement Plans G or Medigap Plan G have become increasingly common since their first release several years back. In 2021 Plan G has remained the top priority of many people because of the gradual removal of the Medigap plan.

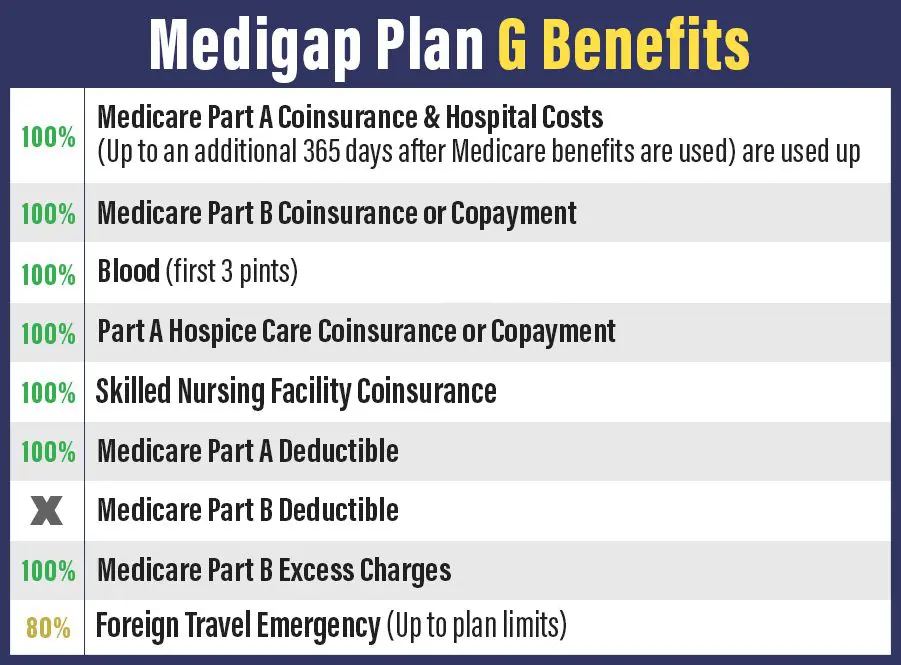

Plan G is a 10-part Medicare Supplement policy that addresses the gap in Original Medicare Part A and B. Many people purchase plan G in order to reduce costs for health care while in Medicare. Although Plan G is an extremely comprehensive policy, its plans are not eligible for Medicare Part B deductible coverage.

Medicare Supplement Plan G is the newest Medicare Supplement plan. The coverage has gained popularity recently. How do I locate my Medicare plan? Medigap plan G covers the gap in Medicare costs with the cost you pay. It can be used to meet many Medicare benefits nationwide.

Plans G are supplementary policies that don't provide primary coverage and fill many gaps in Medicare policy. Part B benefits cover health care needs. After Medicare pays its part the remainder will be covered by Plang. Plan G provides a portion of the costs of your Medicare coverage. Medicare deductibles for 2022 include $600 and $800 a year.

You can still claim a deductible from your paychecks in case your plan has not changed. Whether or not your plan covers all the deductibles of your health care provider. Plan G can be used by individuals who have disabilities under age 60 and who currently participate in Part A or Part B of Medicare.

Which Medicare plans are covered by insurance? Medicare plans G will not provide deductibles for Medicare Part B in 2022, which will be $226.95. Your medical expenses may increase until you exceed your deductible. If so, Medicare can cover the cost.

Plan F has been described as an excellent Medigap plan. This is a total replacement for the Medicare gap. Plans G are pretty much equally effective, with one exception: Plan G does not cover a Part C deduction, which will be $233 in 2020.

Although Medicare is paying a Part B deductible, a lot of Medicare enrollees consider Plan G cheaper to manage as a plan than Plan F. Plans G cover all Medicare Part A and B coverage except for deductibles for Part B. The deductible does not affect your insurance coverage or treatment. Similar to Medigap Plans E and C Plan G, plans also cover excessive expenses.

Original Medicare (Parts A and B) covers many different services, including hospital stays and doctor's visits. But the cost of deductibles, coinsurance, and copays can still be high. Medigap policies, also known as Medicare Supplement, help fill in these coverage gaps and sometimes offer additional services as well. Medigap Plan G offers a wider range of coverage than all Medigap plans except for Medigap Plan F.

You can use the next 60 days for free for the total cost of $742 per day. These are a reserve period which allows use across different benefit periods every time you're at hospital. There is a minimum of 60 days to reserve life-time days. The amount applies at the start of every benefit period that is at the time you come into a nursing home (SNF). The period ends if you have not had care in that setting for 60 days. Medicare generally does not cover Medicare Part B services outside of the US. Medicare covers medical inpatients primarily within the United States.

All costs paid by Medicare Supplement plan G are Medicare's deductible under Part B. You must pay this amount in advance of the start of the Medigap plan period. In addition, the Medicare Supplement Plans G does not provide coverage for routine dental, vision, hearing or prescribed medications.

Medicare Medigap plans only cover Medicare's original Medicare benefits programs. So the payments will continue even if Medicare hasn't paid out yet. If Medicare doesn't pay their portion, you can't claim Medicare supplemental coverage for it. Let's say you're considering this additional advantage.

To participate in Medigap Plan G, Medicare Part B must be available. Preexisting conditions can affect your coverage under Medicare Supplement Plan G, depending upon the time and location of your coverage application. Preexisting conditions do not impact the enrollment in Medigap Plan G in the open enrollment period for Medicare Supplements. During this period, an insurer can refuse to offer you insurance for any reason. If you sign up another time, you could face health questions. Some states allow you to register without having answers and so knowing the state's laws is important.

Medicare Supplement insurance is available to those age 65 and older enrolled in Medicare Parts A and B and in some states to those under age 65 eligible for Medicare due to disability or End Stage Renal disease. Medicare Supplement insurance plans are not connected with or endorsed by the U.S. government.

After the period ends, it never repeats, and you might pay more or get denied for coverage because of your health or medical history. In some states, insurance companies sell Medigap plans to those under 65 who are living with a disability and are eligible for Medicare. You can find more information at your local State Health Insurance Assistance Program , or SHIP.

Unlike Medigap, it is a substitute for Original Medicare, and covers Medicare Part A and Part B needs. People with a Medicare Advantage plan cannot buy Medigap insurance unless they switch to an Original Medicare plan. Get Started Now Interested in learning more about Medicare, Medigap, and Medicare Advantage plans? WebMD Connect to Care Advisors may be able to help.

Medicare supplement plan holders who are in disadvantaged circumstances cannot take a Medicare supplement. Nevertheless, certain states require insurers that offer Medigap plans to offer a minimum plan to those under age 65. Sometimes these carriers offer Medicare Supplement Plan G coverage. The most widely accepted plan option for older patients is the Medicare Supplement Plan. Medicare Plan A is the basic Medicare plan. Nevertheless many companies recognize the importance of a broad availability of the plan and can allow disabled people to join Medicare Supplement Plan G.

Medigap plan G allows for reducing out-of-pocket costs. The only cost that Medicare Supplement Plan G covers are deductibles. If a participant meets the Medicare Part B deductible they can't charge you deductibles or other costs if there's an unexpected cost to the treatment. Since the government standardizes Medicare Supplement Plan G, the benefits for Medigap Plan G will remain the same for all carriers regardless of which plan is purchased. However, premium prices vary between states and carriers each month. Find a suitable Medicare plan for your family.

Similar to the cost per month, your insurance plan is governed by several variables, such as rate increases. Those variables include your age at time of enrollment and your Medicare Supplement plans pricing methods when you registered. In fact Medicare Supplement Plan G rates have risen from 3% annually. Keep in mind, this will vary according to the provider percentage. Knowing your carrier's rate increase history is vital. Researching the company reviews before enrolling can help you select the right Medicare Supplement coverage for you.

The Medigap plan is available from private insurance companies such as Aetna and UnitedHealthcare. However, not everyone provides Plan G insurance. Therefore it's important to know what insurance companies offer appropriate coverage and compare quotes to find the best possible rate. From 3 months until you reach 65 you are eligible for Medicare and plan G if you want. If your Medicare plan is not already available, you may have to change it during Open enrollment season, from October 1st to Dec. 7th.

Plan G offers premium Medicare coverage unless you are new to Medicare. Depending on your location, the premium for this plan ranges between $1188 and $5712 per year. In the case of premiums higher than those offered by Medigap, your policy has more extensive protection. Plan G pays almost all of your medical expenses when you receive a Medicare Part B $233 deductible. So there is little copayment. However, if you have fewer coverage options than you need you could have an alternative plan.

Part A of Medicare covers regular hospital visits and related care, including prescription drugs and additional needs during the patient's stay. These supplementary services offer better coverage for care at specialized nursing facilities. This coverage extends much more than original Medicare Part A. It covers expenses incurred from the traditional healthcare facilities that provide expert personnel and special equipment that can provide the high-end medical services that are required. Most of this facility offers skilled rehabilitation services critical to patient recovery.

This may be a valuable part of a MediGap Plan. Medicare Supplement Plan G covers 100% of the Medicare part B yearly deductible. Original Medicare coverage covers 80%. 20% will go to beneficiary. A copay of 20% is provided on arranged appointments. In the end, these expenses can be regarded as substantial enough to be paid to the beneficiary.

Plan G provides greater cover than Medicare Supplement Plan N. While Plan G provides for the cost of Medicare Part B excess expenses, Plan N doesn't. You'd pay the money out of pocket in the event you have Plan N. Plan N has better prices than Plan G. Plan N costs in 2022 averages $111 per month -- about 33% cheaper than Plan G. Both the plan and the G plan are not covered by Medicare. The background color of "eicecontents":" U003C/Pu003E 'u003Ch2 ID is "iff"U0003E.

Medicare plans are cost effective at about $145 a month for the elderly. The cost of Medicare supplements varies from one company to another as each company uses different pricing models. Apart from this, the cost of Plan G varies depending on your location, age, and gender. Therefore, comparing rates can help determine the optimal Medicare rates.

Medicare plan premiums are health care and are deductible by tax on your income tax return. The addition of itemization is helpful to saving a large percentage of your taxable gross earnings.

The premium for Plan G varies significantly based upon your home state. Cost varies depending on the age and the type of cigarettes and vaping you have. 2021 plans are priced between $475 a month or a monthly cost of $99 to $4776. Medicare 2021 pricing: 10 biggest markets in US. Health Insurance.gov. Access date: April 14, 2021.

Plan G is a Supplement Plan which does not provide the coverage you need. Parts A and Part B provide coverage for medical care you may require. Once Medicare pays, the Part G plan pays for the remainder. 28th Oct 2023.

Medigap Plans offer 365 additional days of hospital care after Medicare benefits have expired. Medicare, Coinsurance, and copayments.

What's covered under SSGP? G covers every benefit from a Medicare Supplement Plan except for the part B deductible. It is a good fit for those that have insurance for hospitalization but do not pay the Medicare Part B deductible alone. June 3rd, 2022.

$2,490. * In some cases plan F and GG have higher-deductible plans available. If the insurance company has not provided coverage in 2022 for the deductible amount of $2490, then you can claim for this policy for a deductible of $2490.