Medicare provides a range of coverage choices to the public. Although Medicare pays for all of its costs, some items are not covered. Medigap offers coverage for a number of medical expenses which Medicare can't cover. About 44%Trusted Sources in Part A and Part B Medicare can enroll in Medicare. Medigap offers several different types of supplementary coverage. One of the plans in this series is Plan G. Many people chose Medigap G since that's one of the only Medigap Plans covering the Part B extra charges.

Once you meet the Medicare Part B deductible, you will not have to worry about additional copayments or unexpected medical bills. Further, because the federal government standardized Medicare Supplement plans, Medigap Plan G provides the same benefits regardless of the carrier.

Medicap Supplement Plans G are one of the largest Medicare supplement plans that can be purchased by Medicare seniors. During the past few decades, the coverage has gained traction. Find the best Medicare plans in 3 simple steps – Let’s find the perfect plan right now. The Medigap Plan G covers both the cost of your Medicare and its costs. This program is available in most States to Medicare recipients.

Medigap Plan G prices can vary within the same geographical area by as much as $100/month with different insurance companies, although the coverage is completely identical. With Medicare Supplement plans, the companies are allowed to determine what they charge for their plans, although the coverage is Federally-standardized.

Medigap Plan G prices vary widely depending on many variables. Do I have a plan in place? Plans are generally priced at $90-110/month. There is one state less than the other and one more. This list contains some examples of current Plan G prices for all regions of the country. Important note: The following prices are only examples and were provided in an illustration form.

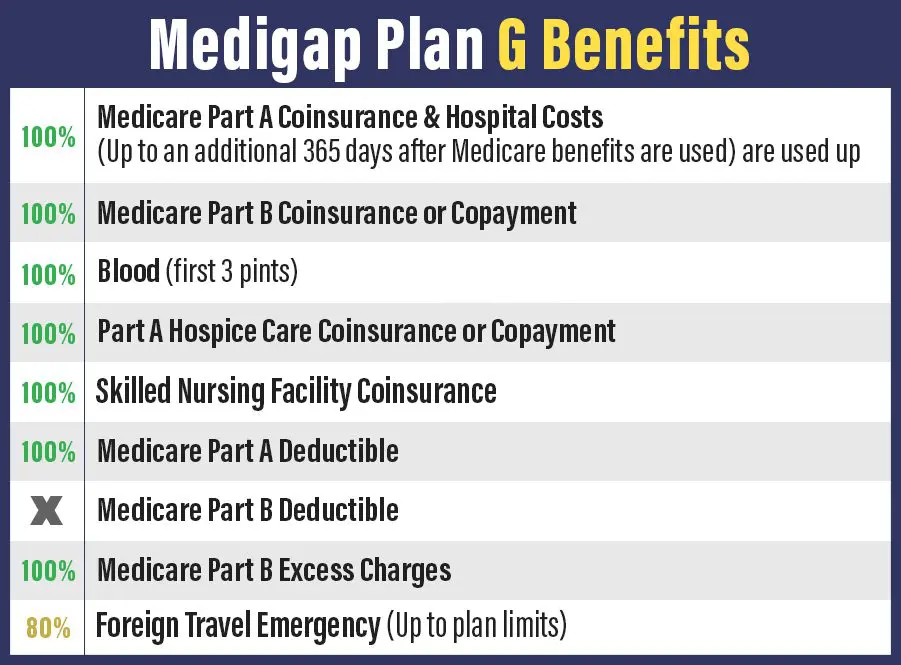

Plan G is an additional 10 Medicare Supplemental coverage plan that fills coverage gaps in Medicare Parts A and B. Many seniors now opt for plan G to save money when a health care provider enrolls in Medicare. Plan G is a very comprehensive policy, but it has a deductible that is not included in Medicare Part B.

The Medicare supplemental insurance program "G" is a group of 10 Medicare supplemental insurance policies. Medigap plans include copayments, coinsurance, and deductibles that may not be covered by Medicare Part B. Plan G offers the largest Medigap plan for Medicare members.

Plan G has supplemental coverage and does not have your primary coverage but it provides some benefits that Medicare does not provide. Part b or Part d insurance provides coverage for health care needs you might require. Until Medicare covers the remainder, Plan G will cover most of the rest costs.

Plans A and B also help you pay some costs associated with Medicare policies. Medicare Part A is currently offering a $1600 deductible for 2020. In the event there's no plan, your remuneration is deductible from your taxable income. However, a Plan G plan will cover all your insurance premiums for you. Those deemed eligible can apply for Part A or Part B plans through Medicare.

Medigap Plan A will help reduce your outsourced expenses. Benefits of Medicare Supplement Plan G include: Medicare Supplement Plan G does not include any additional costs for deductibles. Once a patient has met the Medicare Part B deductible, there will not be need for additional copays or unexpected medical expenses. Because Medicare Supplements are universal, Medigap Plan G provides all of its coverage, regardless of the carrier. Nevertheless, monthly premium rates differ between states and carriers. Get Medicare plans in three simple ways.

To get into Medigap Plan G you need Medicare Part C. Preventable health conditions can influence enrollment in the Medicare Supplement Plan G. Pre-existing conditions don't affect enrollment, unless one applies to the Medigap Plan G within your Medicare Supplement open enrollment period or is eligible. Guarantee issuance rights.

A carrier cannot revoke insurance coverage at the time of the claim. Once enrolled, you have medical questions answered. Depending upon state rules you may also enroll without completing any form of verification.

Besides the premium, several factors influence Medicare supplement rates. This includes your age when you are enrolled and your Medicare Supplement plan pricing method. Medicare supplementary plans generally increase rates annually - about 2% to 6.3%. Keep an eye on the percentage that will vary with the carrier. Understanding the rate increase history of a carrier that your enrolling in will prove crucial. Research before you enroll can help you decide which insurance provider will provide Medicare Supplements coverage.

All Medicare deductibles are paid by Medicare Part B as an additional expense. You will have to satisfy this deductibility before your Medigap benefit begins. Medicare Supplement Plan G also excludes dental, eye, hearing, and prescription drugs. Medigap Plans are not designed as replacement or replacement plans. This means that the bill will be paid once the Medicare originals are paid. Also, unless Original Medicare pays its share, it is not able to cover Medicare. You'd like additional coverage for these benefits?

In addition to providing more coverage than most plans, Medigap Plans G offer more coverage. In some ways, however, Medigap plans do not offer these benefits. Almost every Medigap plan sold to Medicare members does not include Part B Deductibles. From 2020, the new Medicare member will not be entitled to the Part B deductible unless the existing plan has been purchased. Longterm care is similar in scope to the care offered by an independent home for people who need it most. The nursing service in the public sector.

A Medicare Supplement policy will be offered to patients who are not a Medicare Advantage beneficiary. Nevertheless, not everyone provides G.D. plans. Therefore, the insurance provider that you've chosen should be researching what is best for you; it'll help you compare quotes for the best price. From the time you are 65, the Medicare and Plan G programs will take effect for a minimum of 7 months. You may also apply for Medicare coverage during open enrollment season from October 15 - December 7, each year.

Unfortunately many insurance companies now don't openly publish prices on the website without the need or requirement for a contact with a representative. Even though many health plans are listed online, some of those prices are aimed at one company and will not reflect your overall situation. You can use two ways to get Medicare Supplement plan rates: One, contact your state's insurance department if they offer any company offering supplemental coverage for your area – typically 30-35 companies.

Medicare Supplement plans are not required by any law in the United States. But in some states, the insurance industry requires Medigap plans to provide options for people under age 65. Some companies offer Medicare supplement coverage. The most common plan option for seniors under 65 is Medicare Supplement Plan A. Medigap plans A have only basic benefit. However some carriers understand the need and will allow people with disabilities to enroll in Medicare Supplement Plan E.

Here's how much Medigap Plan G is covered according to Medicare.gov. Deductibles are included in the policies in this section. Hospice care copay. Part B coinsurance / copayments. Part B excess charges (if providers are allowed to charge more than Medicare authorized amounts). Transfusions. licensed nursing home co-insurance. Medical emergency medical care is required during travels outside the USA. Deductibles and limitations apply.

In comparison with Medicare Supplement Plan N, Plan G offers more coverage. While Plan G provides coverage for Medicare Part C extra charges, Plan N cannot cover such expenses. You could easily get out of pocket if you were enrolled in Plan N. Plans N are cheaper in comparison with the G plan. For 2023, plan N costs an average of $111 monthly — 23% below plan G. Plan N is not included in Part A.

After Medicare reimburses the approved amount of your plan, Medicare plans G help reduce the remaining billed expenses. Medigap coverage will be paid in full monthly. Medicare Part B Medicare benefits are not offered. Medigap plans are standardized across the United States, but have separate requirements from California, Wisconsin and Massachusetts that have specific plans. They vary in coverage, deductibles, and premiums.

Healthline Media does not transact the business of insurance in any manner and is not licensed as an insurance company or producer in any U.S. jurisdiction. Healthline Media does not recommend or endorse any third parties that may transact the business of insurance.

In the US, the cost of Medicare Supplement Plang can vary based upon several different factors. Medigap plans are priced at around $300 a month. Find a Medicare Plan for you now in three simple steps. If you like Medicare Supplement Plan GG, but can't afford the premiums, you can take a new option. Medicare Supplement high-deductible G plans offer similar benefits with lower monthly premiums.

Medicare Plan G costs $165 a year on average for 65 year olds. The cost of Medicare Supplements policies can vary from one insurer to another because each company has their own pricing method. In addition, prices will also vary based on location, health, age and sexual identity. This will make comparing your Medicare rates important in determining the best Medicare rates for you.

Medicare Supplement Plan G represents one of the largest Medicare Supplement plans. If your health insurance plan G is the right fit, Medigap Plan G will meet all of your medical needs. Medigap Plan G provides 100% Medicare deductible coverage. You can easily see how much money you can make to get healthcare.

The major difference between Medigap Plan A and Plan F is a deductible covered under Medicare part B versus a non-deductible under Medicare part B. The plan was not offered to new Medicare beneficiaries until January 2020.