You can generally get best Medicare Supplemental Insurance when you enroll in Part A or Part B. Medicare Open Enrollment commences at the start the month before your 65th birthday. Insurance companies are unable if they are required to approve medical underwriting to make decisions about the price of a particular insurance plan at any given stage. Contact a Medigap insurance company to ensure you have completed the enrollment period. Make sure your application is completed by completing this form.

Plan G is prepaid by the customer at monthly rates. Typically, these premiums vary according to when the policy was purchased, the cost and state of residence. Medigap is offered via private insurance companies decide on their premium. The cost per month can increase depending upon age, inflation or other factors. If you opt for a high-deductible Plan G, your deductible will be covered for the entire amount up to the deductible amount. Plan G deductibles will increase to $2490 for 2021.

There is a penalty for not enrolling in prescription coverage when first eligible. You want to see specialists without needing a referral from your primary care physician. You want guaranteed renewability—as long as you pay your premium you won't lose your coverage. Compare Medicare Supplement Plans The chart below shows the different benefits covered by each specific plan.

For just $15 per month dental coverage can be added to your Medicare Supplement. The package is also offered to a number of Blue Cross members in the Health and Social Services divisions. Dental vision hearing package details are available on the website of a current Blue Cross member who has signed up for Medicare Supplement and Legacy Medigap. Please view this website's help pages for more information.

If you've ever had any health insurance before January 1, 2020 - if you are not - if it's not possible. Plans G also include supplemental high cost versions. Plan g offers coverage for over the counter charges as well as comprehensive coverage for any standard plan (except Plan F which cannot provide any new benefits to older recipients). This plan also provides travel expenses.

Freedom to Travel Medicare supplement plans are generally accepted at any doctor or facility in the US that accepts Medicare. No Referrals Needed See any Medicare specialist whenever you like without a referral from your primary doctor.

If you are enrolled with Medicare Part A or Part B, it is important to have coverage gaps. Medigap insurance plans are available from private insurers that help with out-of-pocket expenses. Medigap plans are common and can sometimes be unavailable in other regions.

Anyone with Medicare eligibility is eligible for a Medigap Plan G. If you missed your Open Enrollment period for Medigap, you may no longer buy the policy. You cannot use Medicare Advantage or Medigap policies.

Medicare Advantage might require you to use certain doctors and hospitals. Prescription drug coverage is available under Medicare Part D. Prescription drug benefits are included in some Medicare Advantage plans but otherwise must be purchased separately.

Find a Doctor Find out if your doctors accept Medicare assignment. Find a Doctor Medicare Supplement Plan Details Learn more about our Medicare Supplement plans. Please select the appropriate brochure based on where you live.

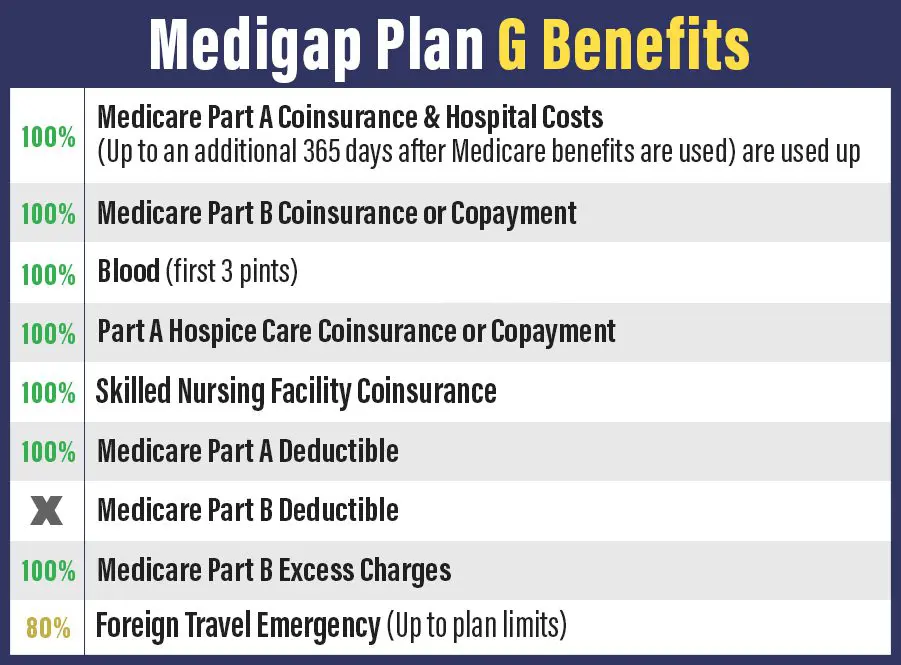

There are several different Medicare supplement plans, and each are identified by a letter. The type and amount of benefits covered by each plan determines how expensive it is. Here is a chart listing the various benefits provided by each plan: All insurance companies must offer the same benefits under a given plan.

Plan G will cover that expense, plus hospital costs up to an additional 365 days after your Medicare benefits are used up. Plan G pays for copays and coinsurance charges for Part B benefits. For instance, if you see your physician, Medicare pays for 80% of approved charges, and Plan G covers the rest.

When is the initial enrollment period? After you are enrolled in Medicare Part A and Part B, you can select other coverage options like a Medigap (Medicare Supplement) plan from approved private insurers. The best time to buy a Medigap policy is the six-month period that starts the first day of the month that you turn 65 or older and enrolled in Part B. After this period, your ability to buy a Medigap policy may be limited and it may be more costly.

You are responsible for the Part B annual deductible and the plan's deductible if you choose the high-deductible version. How Medigap Plan G works Plan G helps fill in “gaps” in Original Medicare and is issued by Medicare-approved private insurance companies.

Network This plan doesn't have a network. You can see any doctor nationwide who accepts Original Medicare. Out-of-pocket maximum This plan doesn't have an out-of-pocket maximum. Office visits After you meet your Medicare Part B deductible, this plan pays all your coinsurance and copays for office visits. Pharmacy This plan doesn't have Part D prescription drug coverage.