The data provided by you only pertains to plans that you can purchase at the local store. Please call 1-800-MEDICARE. Alternatively, you can use the telephone number at (847)577-8574 for all the necessary information. Certain health insurance plans cover medical expenses abroad and can even be accessed by private insurers. Upon entering the U.S., it is advisable to purchase Medicare Part A (hospital coverage) and Part B (medical insurance). International travel emergency coverage is limited to $50,000. Sources: Getty Images.

purchasing a travel insurance policy may be necessary when visiting other countries. Purchasing travel insurance while on Medicare will help cover emergency and non-emergency costs from situations that may arise overseas. Travel insurance benefits vary by policy and carrier. When you purchase travel insurance, your policy will help cover international costs that Medicare does not cover.

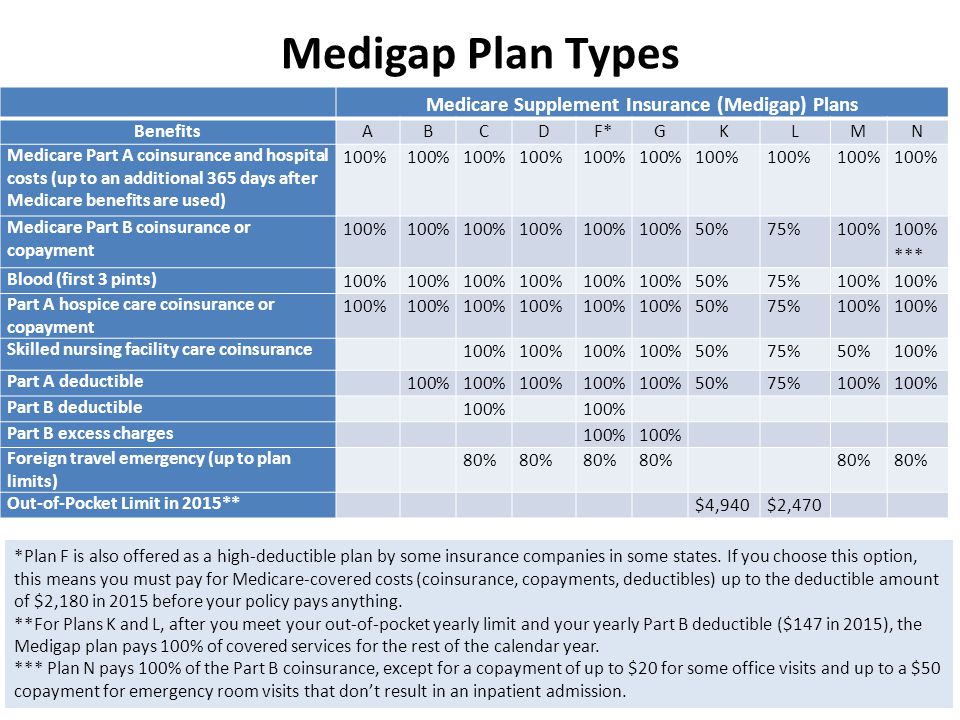

Your Medigap coverage will offer additional coverage in the event of an unexpected medical need. Medical insurance coverage for travelers who travel beyond the United States. Standard Medigap Plans C, D, F, G, M and N offer travel-related medical emergency care coverage when you visit other countries. All these plans offer emergency medical services to those traveling abroad.

When you travel outside of the United States or overseas, you need to understand your Medicare coverage to the maximum extent. What are the Best Medicare Plans? Medicare doesn't generally offer insurance outside the U.S. except during emergencies. This section lists the Medicare plans that offer emergency medical assistance.

These plans often combine additional benefits to create all-in-one healthcare plans available through private insurance companies. When you enroll in a Medicare Advantage plan, you must adhere to a network of doctors and hospitals to receive coverage. Medicare Advantage plans may provide foreign travel coverage outside the United States.

Sadly, it's not. Medicare does NOT pay for healthcare services abroad except: Medicare includes the entire 50 states and the District of Columbia and the U.S. territories of the United States.

Before traveling abroad, you need to understand the process for reimbursement by Medicare. Unfortunately, Medicare provides no coverage outside the United States for most situations.

Because Original Medicare has limited coverage outside the United States, purchasing an insurance policy may be necessary for traveling abroad. Travel coverage while on Medicare may help cover unforeseen expenses if the situation is abroad.

Benefits of travel insurance can vary from insurers to policies. Travel insurance covers the cost of international flights and other travel expenses not covered by Medicare. If you need medical care but can't return to the US, you don't have to pay for your own medical expenses like with the original medical plan. So suppose you've got original medical insurance, but want to go outside the US.

The Medicare Advantage plan can be a substitute for the original Medicare. Plans sometimes combine additional advantages to make a complete healthcare plan that can be purchased from a private insurer. The insurance plan requires the enrollment of an organization of doctors or hospitals to get the benefits. Medicare's Advantage plan allows you to travel abroad. Some Medicare Advantage plans limit certain medical care options. If you are traveling outside the country, the carrier must be informed about the planned travel.

Medicare will no longer be covered for medical treatments that can occur in other countries. It is thus wise to stop receiving Medicare in the case of a permanent resident living in another country. If the Medicare Part B coverage for you has no premium for you will be protected if you plan on returning to the United States. If you frequently travel to the United States you may be interested in continuing to pay the Medicare Part B monthly premiums. But you cannot get this coverage for one year.

Original Medicare is generally the most comprehensive medical insurance available for travelers traveling with an airline, but is only applicable in the case of a passenger ship that is still in U.S. waters. If you travel longer than 6 hours from the cruise port you won’t get coverage under Original Medicare. Physicians must obtain a statutory medical license for medical care on board ships.

Medicare provides insurance in many ways for emergency expenses abroad and is not available in the United States for those who need it. Medicare reimburses medical travel expenses for a medical visit to the United States. Generally you will have to pay the usual coinsurance. You may need to participate in Medicare Supplement plans for the expenses.

Overview of Medicare Supplement foreign travel emergency coverage: Carries a $250 deductible Coverage only lasts the first 60 days of your trip Your plan pays 80% of your medical bills while out of the country The lifetime coverage limit is $50,000. Your Medicare Supplement plan will provide foreign travel coverage if your health services are for emergencies.

If you have Medigap PPCs: Cover travel insurance if it occurs within 60 days of travel. Pay 80% of all billed medical costs after meeting the $250 annual fee. Travel policies for medical emergency situations can last an average of 50 years.

Medicare does not provide coverage for medical treatment outside the USA or other foreign countries. In some circumstances emergency treatment is excluded.

The eligibility age for Medicare is 65. However, some individuals may qualify for Medicare before the age of 65 due to certain disabilities or conditions.

Medicare may provide emergency travel coverage in some instances. This situation is among the following:

The amount you must pay for health care or prescriptions before Original Medicare, your Medicare Advantage Plan, your Medicare drug plan, or your other insurance begins to pay. for the year. Foreign travel emergency coverage with Medigap policies has a lifetime limit of $50,000.

With so many people on the move these days, this benefit is a priority for those who travel for work or leisure. Foreign travel emergency care is covered if it begins during the first 60 days of the excursion.

You can buy primary travel medical insurance when you purchase a Medicare supplement plan. Secondary travel medical insurance: Guarantees your foreign travel medical bills are paid after your Medicare supplement plan, or any other foreign travel coverage you have, pays its share. You can purchase this alongside your a Medicare supplement plan.