If you have recently joined Medicare, you might have heard about Medigap. Medigram plans are designed to reduce your monthly Medicare costs. Medigap policies have many benefits. In this article we'll show more of what is a Medigap plan, why they work and the best way for enrollees to enroll. Medigap is an independent Medicare insurance supplement that provides coverage for deductibles, copayments or coinsurance.

Medicap plans are sold by private companies that provide insurance for certain types of health insurance costs, including coinsurance. Other Medicare plans also provide coverage for services that Original Medicare does not include like medical care while traveling to another country. Medicare will reimburse the Parts of Medicare-Approved amounts for medical care. So Medigap pays the rest of us.

The MediGap program is Medicare supplemental insurance which fills gaps and is marketed through the private sector. Medicare covers most or all health insurance coverage costs and supplies. Medicare Supplement Insurance (Medigap) policies are designed to help pay for health care costs including the following: Some insurance policies cover services that original Medicare doesn't cover.

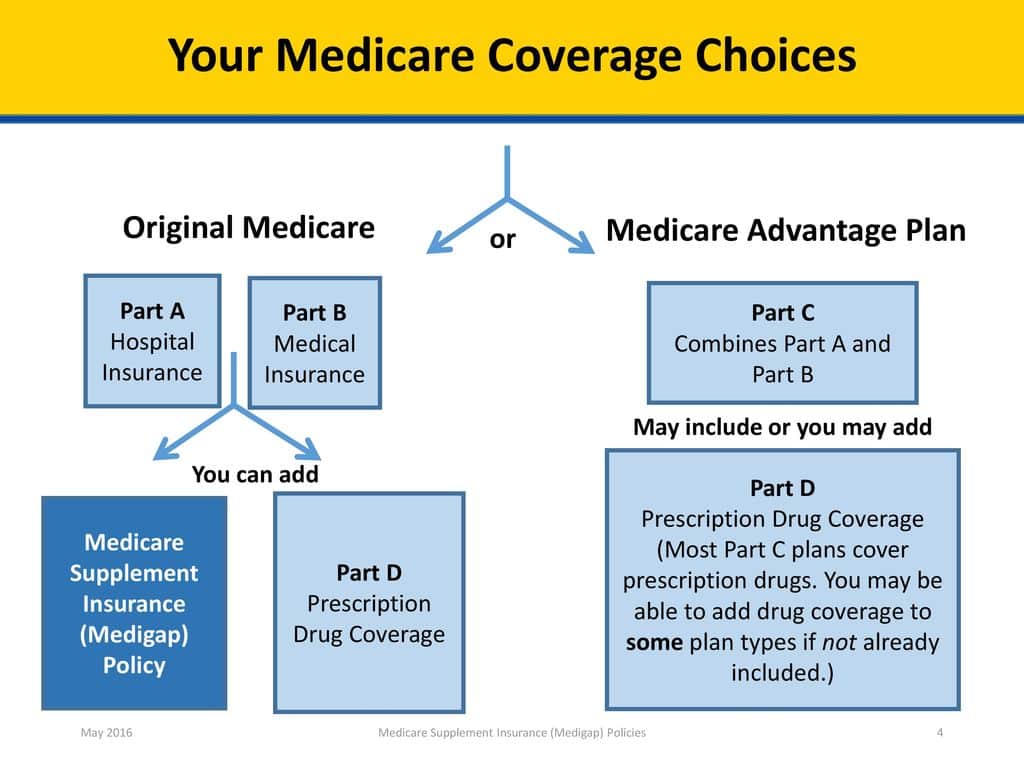

Medigap policies are only available to people who already have Medicare Part A , which helps pay for hospital services, and Medicare Part B , which covers the cost for doctor services. People who have a Medicare Advantage plan cannot get a Medigap plan. To learn about Medigap plans offered in your area, you can use the online Medicare Plan Finder or contact your state's department of insurance.

Minnesota and Wisconsin, Medigap policies may be standardized in a different way. Note: Types of coverage that are NOT Medigap plans are Medicare Advantage plans, Medicare prescription drug plans, employer or union plans, including Federal Employees Health Benefits Program (FEHBP), TRICARE, veterans benefits and long term care insurance.

If you are in the Original Medicare Plan and have a Medigap policy, then Medicare and your Medigap policy will each pay its share of covered health care costs. Generally, when you buy a Medigap policy you must have Medicare Part A and Part B. You will have to pay the monthly Medicare Part B premium. In addition, you will have to pay a premium to the Medigap insurance company.

Your options beyond Parts A and B These are your options offered by Private Insurance Companies An All-in-One option you can purchase to replace Part A and B Medicare Advantage This is called Part C.

Most plans do not cover prescription drugs . Find a Medicare Plan that Fits Your Needs Get a Free Medicare Plan Review Get Started You pay a monthly premium for a Medigap policy. A Medigap policy covers only one person. If you and your spouse both want a Medigap policy you will each need to buy one. Medigap policies are only available to people who already have Medicare Part A , which helps pay for hospital services, and Medicare Part B premium.